Of the total estimated 3.9 million holiday visitors that came to Ireland in 2015, Continental Europe continued to be the largest source with an estimated 1.6 million trips accounting for 41% of the total by volume. Britain is the next largest source of holiday visitors with an estimated 1.2 million trip accounting for 30% of the total. North America at close to 900,000 holiday visits was the source of 23% of the total, while the rest of the world with 6% share resulted in close to a quarter of a million trips.

Germany is the top mainland European source market, accounting for 11% of all holiday visits, followed by France the source of 8% of the demand.

The absolute and relative importance of the source markets for holidays in Ireland has changed significantly over recent years as demand from Britain declined. Over the past 7 years the shift has occurred as demand grew from markets beyond Britain. Continental Europe, North America and the rest of the world have each grown in importance, in absolute and relative terms, as sources of holiday visitors. Back in 2008 Britain was the top source of holiday visitors accounting for 45% of demand compared to 30% last year. Continental Europeans now top the table of holiday visitors accounting for 41% of demand in 2015 compared to 34% seven years ago. The relative importance of North American holiday visitors has grown from 17% to 23% share over the same period.

Holiday Visitors x Source Market 2008, 2014 & 2015 |

| |

2008 |

2014 |

2015 |

% change

v 2014 |

% change

v 2008 |

| Britain |

1,572,000 |

978,000 |

1,172,000 |

+20% |

-25% |

| Continental Europe |

1,196,000 |

1,304,000 |

1,600,000 |

+23% |

+34% |

| North America |

596,000 |

783,000 |

900,000 |

+15% |

+51% |

| Rest of World |

161,000 |

196,000 |

235,000 |

+20% |

+46% |

VFR DEMAND

Almost 3 out of every five VFR visitors come from Britain – an estimated 1.3 million in 2015 or 58% of all visits for this purpose. Mainland Europe has been an increasing as a source of VFR demand in over the past decade, reflecting migration patterns, and is now the source of 26% of VFR visits, or almost 600,000 visits. An estimated 360,000 visits to friends and relative originated from long haul source markets last year. The composition of demand by source market showed little change on the previous year with a volume increase of close to 4% across all markets.

BUSINESS VISITORS

An estimated 1.25 million business visitors last year was an increase of 12% on the previous year. Business visitors from Britain account for almost half of all such visits, increased by approximately 15% in 2015 to an estimated 600,000. Business trips from mainland Europe were up in the region of 10% to an estimated 450,000, while demand from long haul markets rose by close to 30% to approximately 200,000.

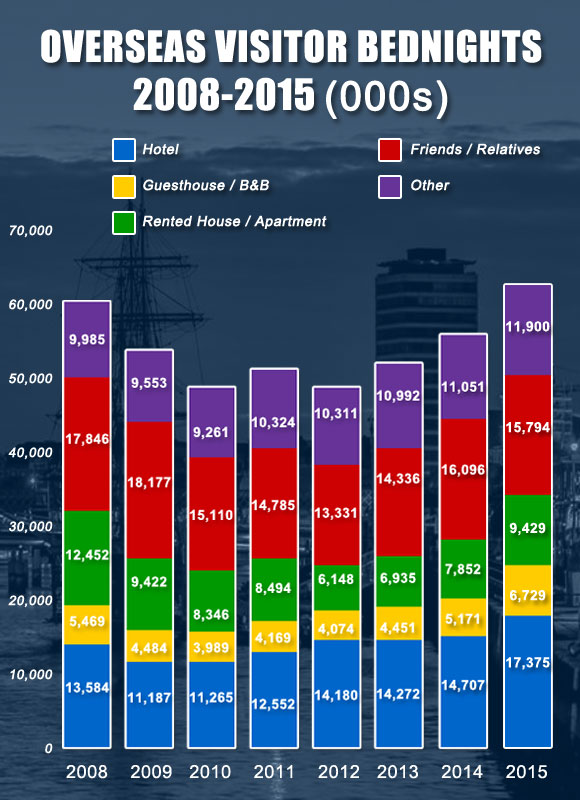

Overseas visitors spent a total of 61 million nights in Ireland in 2015, up 12% resulting in 6 million more nights than the previous year.

Mainland European visitors generated 44% of total bednight demand, with almost 27 million nights, followed by British visitors accounting for 25% at 15 million nights. North American visitors generated 11.7 million bednights with visitors from other long-haul markets spending 7.5 million nights in the country, accounting for 19% and 12% share of demand respectively.

Source: CSO

Holiday visitors accounted for an increasing share of bednights in 2015, up two percentage points to 42%, with VFR accounting for 28%, business 13% and those visiting for ‘other reasons’ 17%.

Bednights from holiday visits increased by 19% year on year, with demand from business visitors up 7% while VFR bednight demand increased by only 2%.

Where did they stay?

It would appear that all accommodation categories, other than ‘staying with friends and relatives’ enjoyed healthy growth in demand from overseas visitors in 2015.

Paid serviced accommodations (Hotels, Guesthouses, and B&Bs) catered to 39% of the demand, while 26% of bednights were spent with friends and relatives. Rented accommodation commanded a 15% share of bednights, with a further 19% spent in other forms of accommodation.

Source: CSO

Hotels sold 2.7 million more bednights to overseas visitors in 2015 than in the previous year, an 18% increase in demand to a total of 17.4 million bed nights. The hotel sector increased its share of total bednight demand by one percentage point to 28%. The growth in demand came primarily from holiday visitors generating 2 million more bednights for hotels, while demand from business and VRF visitors also increased.

Bednight demand for hotels was buoyant across all source markets with demand up close to 20% from most markets.

Source of Hotel Bednight Demand 2013 & 2014 |

| |

2008 |

2015 |

| Mainland Europe |

37% |

38% |

| North America |

23% |

29% |

| Britain |

35% |

25% |

| Rest of World |

5% |

8% |

Guesthouses and B&Bs experienced a 30% increase in demand in 2015 to an estimated 6.7 million bednights, 1.5 million more than the previous year. The sector enjoyed a 35% fillip in demand from holiday visitors to 4.6 million. The sector experienced consistent growth in demand across all source markets, resulting in its share of total bednights increasing from 9% to 11%.

Rented accommodation experienced a 20% increase in the number of bednights from overseas visitors, to reach 9.4 million, representing a 15% share. Demand from holiday visits increased by 23%, with demand from those visiting for ‘other reasons’, which accounts for almost 50% of demand for the sector, was up 22%. Mainland Europe continues to be largest market for the sector, accounting for just over half of bednight demand, while the rate of growth in demand from long haul markets outpaced the increases from Britain and mainland Europe last year.

Unfortunately the CSO does not provide any analysis of visitation patterns across the regions or distribution of bednights by region. However, based on other data sources and anecdotal evidence it is safe to assume that the pattern of demand for categories of accommodation varies between Dublin, other major tourism hubs, and the rest of the country. Hence the aggregate national picture provided above will not necessarily reflect the experience in every part of the country.

|