|

More people than ever took an international trip worldwide in 2017, as tourism continues on an upward trajectory with year on year growth.

The Irish tourism industry is now worth an estimated €8.7 billion annually – a new record. |

|

Ireland earned an estimated €6.5 billion from overseas tourism in 2017. Spending by international visitors in Ireland grew by up to 6% to reach €4.9 billion while Irish air and sea carriers earned an estimated €1.6 billion in fares paid by visitors to Ireland. |

|

Domestic tourism revenue is expected to generate €1.9 billion, with a further €300 million earned from Northern Ireland visitors. |

|

Up to 25,000 new jobs were created in the Irish tourism industry since 2015. The tourism and hospitality sector now sustains 230,000 people in employment throughout the country. Employment alone in Accommodation and Food Services reached 153,000 in Q2 2017, up 5% on the same period a year earlier.

|

|

ITIC estimates that earnings from tourism for the year accrued €2 billion to the exchequer in direct tourism related taxes. |

|

In volume terms, 2017 was another record year for the number of visitors, although the rate of growth slowed significantly, with an estimated 8.9 million staying visitors, up almost 3% on 2016. |

|

Holiday visitors grew by an estimated 5% to just over 4.6 million, while the numbers coming to visit friends and relatives (VFR) was almost unchanged, with business trips down 3%.

Growth in visits from long haul markets of North America and Rest of the World once again was buoyant with double digit growth, while visits from mainland Europe grew by up to 4% as visits Britain fell by 7%. Ireland’s share of outbound traffic in several key short haul markets slipped in 2017 although market share looks to have increased in North America.

|

|

The additional earnings from overseas tourists for the year is estimated at €250 million compared to a year earlier. |

|

Indicators from businesses across the country suggest that most areas enjoyed increased demand over the past 12 months. Dublin and key tourism destinations, including Galway, Killarney, and the western seaboard reporting particularly strong demand. |

|

Brexit related impacts on exchange rates and consumer confidence dented Ireland’s attractiveness in 2017, with a fall in visitors from Britain, while at the same time Britain became a more attractive value destination for mainland Europeans. Thankfully expanded air lift on the North Atlantic coupled with strong economic conditions and the relative strength of the US dollar continued to boost demand from higher spending tourists, thereby compensating for the drop in earnings from short haul markets. |

|

The Government decision to maintain the 9% VAT rate on tourism services, and the suspension of the Air Travel Tax, continue to help Ireland remain competitive in the international marketplace on the back of efficiencies and better value offerings from tourism businesses. |

|

|

|

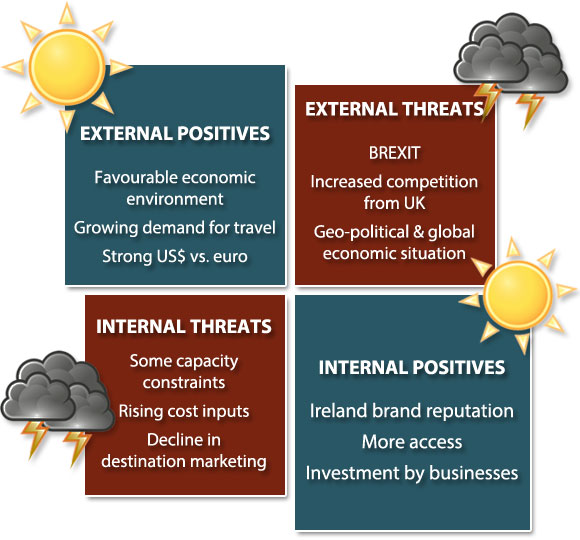

| Positive Outlook but challenging

Following a slowdown in 2017, after two years of above average growth in inbound tourism, Ireland is facing into a year of positive growth potential but not without its challenges. The lessons of 2017 point to a struggle to halt the decline of demand from Britain, to boost the rate of growth from mainland Europe while capitalising on the strong growth from high spending tourists from North America and further afield.

Ireland is well positioned in the international marketplace to continue to attract growing numbers of visitors thanks to its strong brand positioning and its success in delivering a highly rated satisfying visitor experience. However, the steady decline in destination marketing budgets over recent years is now showing signs of a lessening of destination awareness in several key source markets..

The outlook for 2018 is positive:

Mainland Europe: The economic conditions and consumer confidence indicators suggest that 2018 will be a good year for continued growth in demand for travel. However, Ireland’s faces a challenge to maintain its market share in the top continental source markets. Germany will see an expansion of airlift as Ryanair launches new services to Ireland which provides an opportunity for a well focused tactical marketing campaign to drive growth in 2018. In France the almost doubling of ferry capacity together with modest increases in airlift provides an opportunity to further deepen Ireland’s market penetration. Across mainland Europe demand is expected to remain buoyant as economies remain in positive territory and the unique experiences of an Ireland holiday is increasingly valued by our target market segments.

North America: the market which continues to drive Ireland’s tourism revenues thanks to an expanding economy, the relative strength of the US dollar, and unprecedented growth in airlift, offers an exceptional opportunity for continued growth over the short to medium term. Aer Lingus’ planned increase in services and gateways – which will see its transatlantic fleet expand from 15 aircraft in 2017 to 25 in 2021, provides for the first time an opportunity to develop a multi-year marketing investment programme to capitalise on the potential of this critically valuable source market. The profile of North American visitors is valuable due to its average spend per trip, its propensity to tour the country and length of stay. Building on the success of recent years and based on the planned increase in air services double digit growth can be achieved in 2018.

Britain: the biggest challenge facing Irish tourism is to stem Ireland’s absolute and share decline of outbound travel as the British consumer faces into a period of belt tightening. The economic conditions in the market are forecast to deteriorate as consumer disposable incomes decline in the face of rising inflation, lowering consumer confidence and a weakened pound sterling. Ireland is in danger of being perceived as a poor value experience when compared to other destinations. Past experiences suggest that Ireland is particularly vulnerable in periods of economic downturn, due to its visitor profile and the high incidence of short breaks and secondary holidays. Uncertainty surrounding Brexit is also likely to continue to impact business and conference travel.

New developing long haul markets: continue to grow although still relatively small in volume but with a high value to volume ratio. Investment in market development and the expansion of new intercontinental air services via the Middle East, Hong Kong and European hubs should facilitate Ireland gaining a stronger foothold in these markets.

Aggregate growth of upwards of 5% in volume and 7% in value in 2018 could be achieved, with a caveat on the performance of the British market.

Domestic demand is expected to continue to improve, particularly the incidence of short leisure breaks, as the economy and consumer feel good factors improve. The domestic market demand underwrites the year round sustainability of many tourism businesses, particularly outside of Dublin.

Key challenges facing tourism in 2018

Competitiveness and ability to continue to deliver value for money will be a key challenge for the industry in 2018, as currency volatility is likely to prevail. Ireland will face stiffer competition in the marketplace from the UK which is presenting better value to much of Ireland’s target market. Businesses are facing increasing cost pressures, including state induced costs of doing business, utilities and labour, which further threatens the competitiveness of the tourist offering. The continuation of the 9% VAT rate on tourism services is critical in safeguarding Ireland’s competitiveness.

Capacity constraints are impacting the ability to cope with increasing demand, in specific locations and times of the year. The shortage of hotel accommodation in Dublin, as the top gateway and urban destination, continues to be a limiting factor, although new rooms coming on stream in 2018 will help alleviate the pressure. While airlines continue to add service there is an urgent need to ensure that airport infrastructure at Dublin keeps pace with airlines’ growth plans. On the ground specific strategies are required to boost demand outside of the peak season from selected markets if medium to longer term sustained growth is to be achieved.

Investment in destination marketing by the state over the past number of years has diminished the awareness of the destination in many markets and will continue to do so unless adequate resources are made available for marketing Ireland internationally. While the industry continues to invest increasing resources in marketing, the level of investment by the state has been in decline.

Innovation in the visitor experience will be required over the medium term to cater for new and developing markets as well as diversifying the visitor experiences for traditional and new market segments from established markets. It is hoped that the government's 10 year capital plan, due to be published shortly, will signal increased investment in new tourism products.

Uncertainty governed by geo-political and economic factors always present a threat to demand for travel, not least in relation to Brexit and the British market. The industry will need to be nimble in ensuring an optimisation of a revenue centric approach to exploiting market opportunities including investment in market diversification.

|

|

|

Ireland earned an estimated €4.9 billion from overseas visitors this year, up 6% on the previous year. Based on the latest available CSO data for the first 9 months of the year, the net increase in earnings resulted from spending by visitors from North America and new and developing long haul markets, as earnings from Britain declined and receipts from mainland European visitors showed only a marginal increase.

Visitor volumes reached another record level in 2017 with an estimated 8.9 million visitors from overseas staying visitors arriving into Irish air and sea ports, excluding day trips and transfer passengers – almost a 3% increase on the previous year.

Growth in aggregate earnings outpaced the increase in volume due to increasing numbers of higher spending visitors from beyond Europe, despite a further decline in the average length of stay but helped by the relative strength of the US dollar.

Growth in holiday visitors, estimated at 5%, was a positive outcome, again underwritten by the strong demand from North America thanks to increased air services by carriers, a favourable exchange rate, and effective marketing.

Some key insights into overseas tourism in 2017

Sustained growth in international tourism

Global international arrivals surpassed 1.1 billion in the first 10 months of the year, setting a new worldwide travel record. The latest UN World Tourism Organisation (UNWTO) World Tourism Barometer shows a 7% increase in international travellers on last year between January and October – amounting to an additional 70 million arrivals, reflecting a global economic upswing. Europe led the growth in international arrivals by region with numbers up of 8% on 2016, driven by Southern and Mediterranean Europe (+13%), while UNWTO reports a 7% growth in visits to Western Europe and 6% growth in Northern Europe.

IATA reports a 7.5% rise in passenger numbers worldwide in 2017, with a forecast increase of 6% in 2018.

More modest growth in visits to Ireland

Following two years of exceptional growth, 2017 turned out to be a year of more modest growth with mixed results from across source markets.

Ireland welcomed close to an additional 200,000 visitors in 2017, the lowest incremental annual increase since 2012.

Over 200,000 additional visits from North America, coupled with almost 70,000 more from new and developing long haul source markets, and close to 100,000 more from mainland Europe more than compensated for a drop of over 200,000 British visitors. The rate of increase in demand from North America suggest that Ireland is continuing to win share in the market for travel to Europe, while the rate of increase from mainland Europe would suggest some slippage in market share.

The most challenging conditions were experienced in the British market where visits declined by 7%. It would appear that Ireland fared less well than the overall outbound demand for travel from Britian which grew by 3% in volume with a 5% in increase in expenditure (January-August), despite a weakened currency, tightening economic conditions and a fall in consumer confidence resulting from Brexit.

Holiday visits grew by an estimated 5% to reach just over 4.6 million in 2017. Over the peak months of July through September, 42% of holiday visits were from mainland Europe, while North Americans increased in importance accounting for almost 30% as British holiday visitors declined in absolute and share terms.

Tourism earnings up 6%

Continental Europe continues to be the top earner for Irish tourism reaching an estimated €1.7 billion in 2017, followed closely by North America, a market now worth upwards of €1.5 billion. British visitors spent just over €1 billion, while visitors from new and developing long haul markets were a source of almost €600 million.

Ireland earned €250 million more from overseas visitors in 2017 compared to the previous year. The increase in tourism in 2017 helped generate an additional 25,000 new jobs within tourism and hospitality during the year.

The estimated 16% increase in earnings from the North American market, contributing an additional €213m, was the main driver of the growth in overseas tourism receipts in 2017.

The average expenditure per visit showed little change over the first 9 months of the year, with a marginal drop as the average length of stay declines. Long haul visitors, from around the globe including North America are the most valuable in terms of spend per visit, exceeding €930 for visitors from Austral Asia/Pacific region and €730 from North America.

The average expenditure by visitors from continental Europe tends to be close to €500 per visit, with Germans the highest spenders.

British visitors on average spent €273, reflecting the relatively high incidence of short stay visits.

Domestic Tourism in 2017 – an overview

The domestic travel market is worth an estimated €1.9 billion with up to 9.3 million trips taken by Irish residents spending 25 million nights away from home. Holiday trips are estimated at close to 4.7 million generating expenditure of over €1.1 billion.

Latest CSO data for the first three quarters in 2017 shows:

- Expenditure on domestic trips up 5%, driven by more spending by those visiting friends and relatives (VFR) while expenditure on holiday trips showed only marginal change.

- The aggregate number of trips taken was static at 7.3m, while holiday trips decline by 2% to almost 3.9 million.

- Nights spent away from home declined by 3%.

- Demand for hotel accommodation increased by 1% to just over 5.5 million bednights.

|

|

|

Airlines continue to add capacity for 2018

The expansion of airline services continues to be a key driver of Ireland’s tourism performance. The good news is that more seats will be available on air services in 2018, as airlines launch new routes and add frequency on existing services. Capacity on air services in the peak months of 2018 will be ahead of last summer. The principal additions to air services, compared to summer 2017, which will benefit inbound tourism include:

From the US

- Aer Lingus continues its expansion having launched service from Miami in September, will add service from Philadelphia (effective March 26) and Seattle (eff. May 18). Seattle will be Aer Lingus’ 12th US gateway to Ireland, following the addition of 6 new direct transatlantic services since IAG’s acquisition in 2015.

- American is extending the season for its Philadelphia-Shannon service.

- Norwegian Air International is boosting frequency between Shannon and Stewart NY.

- United is extending the season for its Chicago-Dublin service, while adding capacity between Newark and Dublin with a change of aircraft.

From Canada

- Air Canada mainline replaces Air Canada Rouge, with new seasonal services from Montreal to Dublin and Toronto to Shannon, while increasing frequency from Vancouver and Toronto to Dublin.

- Air Transat is adding departures from Toronto to Dublin..

From Asia

- Cathay Pacific launches service from Hong Kong to Dublin on June 2nd, Ireland’s first non-stop flight to Asia..

From Germany

- Lufthansa is adding frequencies to Dublin.

- Ryanair has launched new services from Munich and Stuttgart to Dublin, and is adding frequency from Hamburg.

- Ryanair will operate from Berlin to Kerry, replacing service to Shannon.

From France

- Aer Lingus is adding departures from Paris, Bordeaux, Lyon, Toulouse, Marseille, Montpellier, and Nantes to Dublin.

From Italy

- Aer Lingus adding frequency from Rome to Dublin

- Ryanair launching service from Naples to Dublin.

From Scandinavia

- SAS is expected to add capacity on services from Copenhagen, Oslo and Stockholm to Dublin.

From Finland

- Finnair is increasing frequency from Helsinki to Dublin.

From Switzerland

- SWISS is adding departures from Zurich to Dublin and to Cork.

From Iceland

- Icelandair is launching service from Reykjavik Keflavik to Dublin, effective May 8th.

From Spain

- Aer Lingus is increasing frequency between Barcelona and Cork.

- Iberia Express will extend its summer season service from Madrid to Cork.

In addition to the above, Ryanair and Aer Lingus are adding services on a number of established routes from Continental Europe catering to inbound tourism.

From Britain

- Aer Lingus, BA, Flybe and Ryanair are adjusting frequencies on a number of routes.

- Flybe has reinstated service Southend to Dublin.

Irish Ferries launch daily sailings to/from France

Irish Ferries will double sailings between Ireland and France with daily departures in each direction from July to September 2018. The new €144 million 55,000 tonnes cruise ferry, W.B. Yeats, will operate between Dublin and Cherbourg running in parallel with the existing ferry Oscar Wilde sailing between Rosslare and Cherbourg or Roscoff. The new W.B.Yeats, the largest and most luxurious ferry on the Irish Sea, will have space on board for 1,885 passengers and crew, 1,200 cars in 4kms of vehicle deck space, and 441 cabins.

From mid-September next, W.B. Yeats will transfer to the busy Dublin-Holyhead route, adding capacity alongside the existing Irish Ferries vessel Ulysses. Given this additional investment in the route, the Dublin Swift fast ferry will operate a summer only schedule next year and will return to Irish Sea service in early April 2019.

|

|

|

ITIC’s agenda includes the following key goals for the year ahead as part of its ongoing advocacy role

on behalf of businesses and other stakeholders engaged in tourism.

A new industry-led, Government-enabled, strategic road map for tourism

ITIC is finalising an industry led comprehensive strategic road map for the future development of

tourism from 2018 to 2025, due for publication in March. A new vision and strategic plan for the

future development of the country’s largest indigenous industry is timely as businesses face

increasing competition in a fast changing marketplace. Tourism, unlike other indigenous sectors such as the agri-food sector, is unique in not having an inclusive strategic plan with its business

community. Over the past six months ITIC has led the industry in an in-depth strategic review of its

product offering, investment opportunities, marketing strategies, and selective opportunities to

deliver sustained growth over the coming years. The plan will set new ambitious targets and

recommend new strategic initiatives which will guide the State’s investment, destination marketing

programmes and industry support mechanism to enable businesses to realise the potential of an

expanding global travel demand.

Brexit preparedness

With Brexit less than 18 months away, there is still considerable uncertainty on its impact on the

tourism industry. While welcoming the recently announced agreement between the EU and the UK

which safeguards the common travel area between Ireland and Britain and recognises the need to

avoid a ‘hard border’ with Northern Ireland, the upcoming negotiations are likely to prove be

difficult and prolonged.

As yet there is no indication as to the terms covering aviation between the UK and the EU during the

transition period or beyond. Post-Brexit air service regime has yet to be agreed. It is essential that

this issue is addressed early in the negotiations in order to avoid any disruption of air services –

which would be detrimental to international travel and tourism.

The risk of regulatory divergence with Northern Ireland following the UK’s exit from the EU is a

serious concern, governing areas including employment, state aid, and transport. A break in

regulatory alignment would have serious market distortion implications for businesses south of the

border particularly in the context of continuance of an all-island marketing policy.

ITIC will continue to proactively engage in an information and advocacy campaign to ensure that the

interests of the tourism sector feature on the agenda of the negotiators as EU-UK negotiations enter

a critical stage.

Increased investment and funding for Ireland's largest indigenous sector

ITIC is committed to lobbying and securing additional funding from Government to support the ambitions of Ireland's tourism sector. Budgets for Tourism Ireland and Fáilte Ireland have been reduced by 40% in recent years and ITIC will be making the case for the restoration of these funds at this critical time. ITIC also expects that the forthcoming Government 10 year capital plan will signify significantly increased investment in new tourism product and infrastructure.

ITIC working with Fáilte Ireland & Tourism Ireland to deliver for the industry

ITIC is committed to continuing to work with the state agencies charged with facilitating the

development of the sector to ensure that investment and marketing programmes are effective in

delivering results in a cost efficient manner. ITIC looks forward to working in partnership with the

agencies to realise the potential envisioned in the industry led new strategic plan following its launch

in March.

Short term priorities will continue to focus on alleviating capacity bottle necks and pursuing

strategies to improve regional and seasonality spread of demand. Specifically the industry will work

closely with the state agencies in the development and marketing of the Wild Atlantic Way,

Dublin and Ireland’s Ancient East, and look forward to the launch of a new distinctive

marketing identity for the Midlands and Shannon Waterway.

ITIC will also work with the agencies and CSO to improve the quality and timeliness of metrics on the

industry’s performance with a particular focus on key economic data.

|

|

|

|

BREXIT BULLETIN - Irish Tourism's Brexit Challenge Continues

PUBLISHED: NOVEMBER 2017

VIEW THIS REPORT |

|

U.S. & CANADA - An Analysis of North American Tourism Growth to Ireland

PUBLISHED: OCTOBER 2017

VIEW THIS UPDATE |

|

9 REASONS WHY 9% MATTERS

PUBLISHED: JULY 2017

VIEW REPORT |

|

Tourism & Regionality – where overseas visitors spend their money when in Ireland

PUBLISHED: JULY 2017

VIEW ANALYSIS |

|

BREXIT BULLETIN

IMPACTING IRISH TOURISM

PUBLISHED: JULY 2017

VIEW REPORT |

|

GETTING BEHIND THE 2016 CSO

TOURISM DATA - DOMESTIC

PUBLISHED: APRIL 2017

VIEW REPORT |

|

GETTING BEHIND THE 2016 CSO

TOURISM DATA - INCOMING

PUBLISHED: MARCH 2017

VIEW REPORT |

|

IMPROVING TOURISM DATA FOR SUSTAINED GROWTH

PUBLISHED: MARCH 2016

VIEW REPORT

|

|

BREXIT & IRISH TOURISM

A Call For Action

PUBLISHED: MARCH 2017

VIEW REPORT |

|

TOURISM 2025 - An Industry Roadmap to Growth

PUBLISHED: JANUARY 2017

VIEW REPORT |

|

|

Directors:

Maurice Pratt (Chair), Ruth Andrews (Deputy Chair), Adrian Cummins, Paul Gallagher,

Declan Kearney, David McCoy, Nick Mottram,

Cormac O'Connell,

Con Quill,

Company Secretary: Eoghan O'Mara Walsh |

© ITIC | Irish

Tourism Industry Confederation | Registered in Dublin | Registered

No: 75658 | All Rights Reserved

Ground Floor, Unit 5, Sandyford Office Park, Dublin 18 | Registered in Dublin | Registered No: 75658 |

Tel: +353 (0)1 293 4950 | Email: info@itic.ie | Web: www.itic.ie |

|

|