Urgent and immediate action to save Ireland’s tourism industry

19 March 2020

Tourism in business front line of Covid-19

As hotels, attractions, restaurants, venues, pubs and many more hospitality businesses close their doors it is evident to all that Ireland’s tourism industry is in the business front line of the Covid-19 crisis that grips the country.

A public health issue first and foremost, Covid-19 also has shattering economic implications and Irish tourism is facing catastrophic consequences. It is estimated that 140,000 people have already lost their jobs, many in the tourism and hospitality industry, and this is set to get worse in the coming weeks.

The Irish Tourism Industry Confederation (ITIC), representing the leading tourism stakeholders across the public and private sectors, last weekend set out a 3-point plan outlining the urgent and immediate measures needed by Government to protect Ireland’s largest indigenous industry and biggest regional employer during this unprecedented and immense challenge.

Put simply, minimising job losses and business closures requires aggressive Government intervention. With the cessation of flights between the US and Ireland, the closure of tourism sites, the cancellation of the St. Patrick’s Festival, and the ban on gatherings of 100 people indoors or 500 people outdoors, the impact of Covid-19 on Irish tourism has been devastating and immediate. There will be no quick bounce-back from this either with international visitors absent from our shores in 2020 even if the virus is under check.

Understandably public health issues, and the containment of the virus, has been the Government’s main focus and it has moved quickly to offer laid-off workers some supports. However Government has been far too slow to respond to the urgent and immediate needs of tourism employers who face the real and stark challenge of business survival.

Drastic and immediate action required to protect and preserve Irish tourism

ITIC’s 3-point plan for the tourism industry is based around business survival, liquidity measures, and demand stimulation. In this context ITIC welcomes yesterday’s news that the 5 main banks – AIB, Bank of Ireland, KBC, Ulster Bank and Permanent TSB – have agreed a 3-month deferment of commercial loan repayments by business. This is but a small first step. Not only will the 3-month duration need to be extended by the banks but Government must implement far more wide-ranging measures to keep cash in tourism business bank accounts. These measures must include vat and payroll tax forbearance, a waiving of local authority rates, and deferment of water charges.

With cancellations of existing business, and no new bookings, Ireland’s tourism and hospitality industry simply has no revenue stream to sustain itself. Cashflow is the oxygen of business during this crisis and Government must ensure that the state takes no additional money out of business. Keeping cash in businesses is the only way that enterprises can survive and job losses can be somewhat stemmed.

Liquidity measures are also fundamental for the Irish tourism and hospitality industry. Working capital and business continuity funding are vital as part of a multi-million rescue and recovery package. Once the crisis passes then massive market stimulation will be required including a tourism Vat rate of 0% and increased investment in both overseas marketing and domestic promotion by tourism state agencies.

All focus and efforts at this stage must be on ensuring that there is a tourism industry still in place once this crisis passes.

Learning from our neighbours

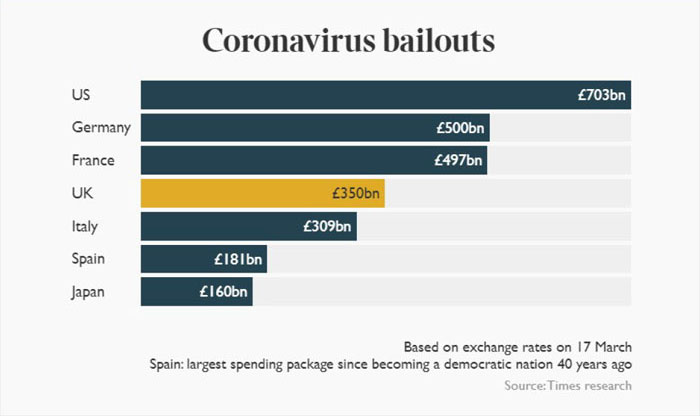

Although their public health approach has been at odds with our own, the UK Government has this week taken bold and brave steps to support business affected by Covid-19 with a £350 billion package of economic supports. This comprises £330 billion of government-backed loans for businesses and another £20 billion in direct cash support including business rates holidays for 12 months and £25,000 grants for small to medium sized companies.

Furthermore larger companies that were classed as safe investments before the crisis, but now risk running out of money, will be able to raise vital funds by issuing commercial paper, a form of debt, in the markets that the Bank of England will ultimately buy.

Such business-friendly measures must be adopted by the Irish Government if our tourism industry is to survive this harrowing challenge. The UK and other countries have committed to billions in support of business yet to date Ireland has only committed €3 billion, wholly inadequate to the scale of the challenge.

A challenge like no other

Tourism and hospitality businesses are facing an unprecedented challenge. Many recall Foot & Mouth, SARS, 9/11 and other external events that dramatically dampened demand. However, Coronavirus, in its few short weeks, has dwarfed all these other crises and undoubtedly will leave Irish tourism with casualties and deep scars. Nonetheless Irish tourism is resilient and innovative and businesses and stakeholders will come out the other side but only if Government commits to backing and supporting Ireland’s most important industry immediately and with urgency.