|

Another buoyant year for the Irish tourism industry thanks to continued growth in demand from North America and mainland Europe, while demand from Britain was static and the rate of growth from new emerging markets appears to have slowed.

The Irish tourism industry is now worth an estimated €9.2 billion annually – a new record, delivering further growth in employment with the sector now supporting upwards of 270,000 jobs.

|

|

Ireland earned close to €7 billion from overseas tourism in 2018. Spending by international visitors in Ireland grew by up to 7% to reach €5.2 billion while Irish air and sea carriers earned an estimated €1.7 billion in fares paid by visitors to Ireland. |

|

Domestic tourism revenue is expected to reach an estimated €1.9 billion, with a further €350 million earned from Northern Ireland visitors. |

|

Up to 25,000 new jobs were created in the Irish tourism industry over the past twelve months, with the tourism and hospitality sector now sustaining an estimated 270,000 people in employment throughout the country. Latest CSO employment data in Accommodation and Food Services is up 10% on the same period a year earlier. |

|

In volume terms, 2018 was another record year for the number of international visitors to Ireland, with an estimated 9.6 million tourists, up almost 7% on 2017. |

|

Holiday visitors grew by an estimated 10% to just over 5.2 million, while the numbers coming to visit friends and relatives (VFR) were up almost 7%, with business trips down by at least 6%.

Tourism benefitted from double digit growth from North America (+13%) and from Germany (+20%), with aggregate volume growth from mainland Europe up 10%. Current estimates suggest that the British market showed no growth in tourist arrivals, while visitors from new emerging markets increased by 5%.

|

|

The additional earnings from overseas tourists for the year is estimated at a net €280 million compared to a year earlier – yielding more than €100 million extra to the Exchequer in direct tourism related taxes. Spending by North American visitors accounted for almost 70% of the incremental increase in tourism receipts. |

|

Indicators from businesses across the country suggest that most areas enjoyed increased demand over the past 12 months. Dublin and key tourism destinations, including Galway, Killarney, and the western seaboard reporting particularly strong demand. |

|

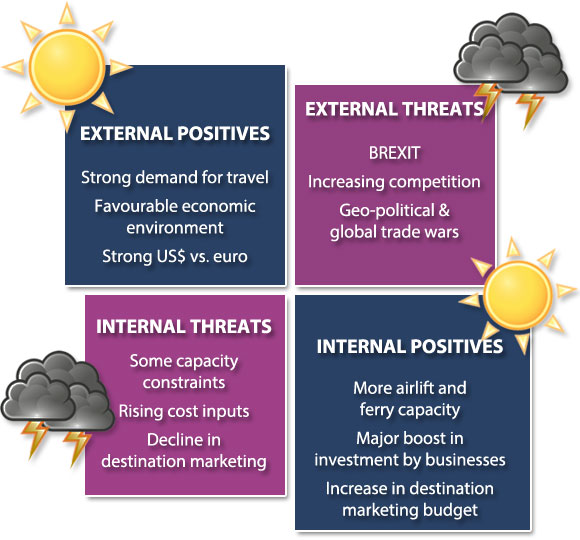

The industry is confident of continued growth in 2019, despite a number of challenges. ITIC estimates that the sector can increase by 5% to 7% in volume and 6% to 8% in value. Solid, albeit slower global economic growth (+3.1%) and lower oil prices augur well for increasing travel demand with IATA forecasting growth in airline passengers. There are good prospects from the North American and European markets which should deliver the eighth consecutive year of growth in tourism volume, expenditure and employment. Many businesses though, may see profits squeezed due to rising costs. |

|

Maintaining competitiveness is a significant challenge facing the tourism sector as it heads into more difficult trading conditions in 2019. The Government decision to increase VAT from 9% to 13.5% has severely dented the sector's competitiveness. In addition, the industry is facing increased labour costs and constraints in accommodation supply. |

|

Brexit related impacts on exchange rates and consumer confidence dented Ireland’s attractiveness to British and Northern Ireland residents reflected in no growth from these markets. At the same time Britain became a more attractive value destination for euro and dollar spending tourists putting increasing competitive pressure on attracting visitors to Ireland. Tourism businesses impacted by Brexit fair unfavourably compared to other export sectors which are in receipt of a range of state funded professional and financial supports for market diversification. |

|

|

|

Ireland earned an estimated €5.2 billion from overseas visitors this year, up 7% on the previous year. Based on the latest CSO data for the first 9 months of the year, the net increase in earnings resulted primarily from spending by visitors from North America up 13% to an estimated €1.7 billion. Earnings from mainland European visitors grew by 5% to almost €1.9 billion, with receipts from new emerging long haul markets up 5% to almost €600 million. Earnings from the British market were down marginally to just under €1 billion on little or no increase in volume.

Visitor volumes reached another record level in 2018 with an estimated 9.6 million tourists or staying visitors from overseas, a 7% increase on the previous year.

Growth in aggregate earnings kept pace with the rate of volume increase due largely to strong performance from high spending North Americans and a robust increase in holiday visitors. The growth in receipts is encouraging despite further slippage in the average length of stay and tourism price inflation.

Growth in holiday visitors, estimated at 11%, was a positive outcome, underwritten by the strong demand from North America and Germany – markets which benefitted from double digit increase in airlift and intensive promotion and marketing campaigns.

Some key insights into overseas tourism in 2018

Sustained growth in international travel globally

Worldwide demand for travel continued to grow in 2018, reflecting benign economic conditions, positive consumer confidence, and increased airline capacities across most regions of the world. The growth rate of outbound travel continues to be highest in the emerging source markets of Asia, most notably China, while sustained growth is evident from the more mature source markets in Europe and North America.

- The number of people making international trips during the first nine months of 2018 rose by 5% year-on-year, with every region in the world enjoying "robust growth" ,with Asia and the Pacific leading the way (+7%) and Europe (+6%). The United Nations World Tourism Organization (UNWTO).

- Airline passenger traffic, measured in RPKs, is expected to show a 6.5% growth in 2018. International Air Transport Association (IATA)

- Passenger throughput at European airports grew by 8.9% in Q1, 6% in Q2 and 5% in Q3 with a bounce of 6.5% in October. Airport Council International (ACI)

Ireland keeping pace with growth in international travel

2015 and 2016 were years of exceptional growth , followed by more modest growth in 2017, while the past year has rebounded with a 7% increase in volume and value in 2018.

Ireland welcomed close to an additional 600,000 visitors in 2018, a 7% year on year increase, well ahead of the increment of 200,000 additional visitors, or 3% increase, in 2017.

Over 300,000 additional visits from mainland Europe, coupled with almost 250,000 more from North America, contrasted sharply with the absence of growth in demand from Britain. The rate of increase in demand from North America suggests that Ireland is continuing to win share of the market for travel to Europe, thanks for the continuing expansion of air links from the USA and Canada. A 20% increase in arrivals from Germany mirrors a significant increase in airlift in 2018, largely due to Ryanair adding services.

Ireland welcomed more visitors from mainland Europe than from Britain for the first time in 2018.

Holiday visits grew by an estimated 11% to reach an estimated 5.2 million in 2018. Over the peak months, July through September, holiday visitors accounted for 60% of all overseas tourists. 42% of holiday visitors in Q3 were from mainland Europe, 31% from North Americans, and 21% from Britain, as the European and North American source markets increased in volume and relative importance, while holiday demand from British declined in absolute and share terms.

Tourism earnings up 7%

Ireland earned €280 million more from overseas visitors in 2018 compared to the previous year.

Mainland Europe continues to be the top earner for Irish tourism reaching an estimated €1.9 billion in 2018 (+5%), followed closely by North America, a market now worth upwards of €1.7 billion (+13%). British visitors spent just short of €1 billion (-1%), while visitors from new and developing long haul markets were a source of almost €600 million (+3%).

The estimated 13% increase in earnings from the North American market, contributing an additional €200 million, was the main driver of the growth in overseas tourism receipts in 2018.

The average expenditure per visit showed little change year on year, broadly reflecting with a marginal drop in the average length of stay and the impact of price inflation of the tourism product. Tourists from long haul markets are higher spending compared to tourists from short haul markets, reflecting longer average length of stay in the country and spending patterns.

Visitors from Australia/Asia/Pacific region are the highest spending tourist at an average of just over €900 per visit, followed by North American visitors spending an average of €730 per visit. The average expenditure by visitors from continental Europe tends to be close to €500 per visit, with Germans the higher spenders. British visitors on average spend €267, reflecting the relatively high incidence of short stay visits.

|

|

|

Tourism faces a challenging year ahead

Following a year of robust performance in 2018, the industry is facing into 2019 with a cautious confidence recognising the real challenges ahead. The overriding cloud on the horizon continues to be the uncertainty surrounding Brexit. The prospect of a ‘no deal’ outcome with the UK crashing out of the EU on March 29th would potentially have a catastrophic impact on the sector with the potential for disruption of air service, a fall in the value of sterling, together with supply cost increases, not to mention the value attractiveness of visits to Britain.

It has been estimated by ITIC and Fáilte Ireland that a hard deal Brexit could cost as much as €390 million in its immediate aftermath.

Tourism businesses in preparing for the challenges of Brexit do not have access to the range of professional and financial supports as other exporting businesses. Exporters in the agri-food, manufacturing and services sectors can benefit from financial assistance for market research, product innovation and market diversification from state agencies including Bord Bia, Enterprise Ireland and InterTrade Ireland. It is hoped that the Government increase in tourism budgets for 2019 will mean that tourism businesses can secure similar state supports. Many are heavily dependent on the British and Northern Ireland markets and equally exposed to the negative impacts of Brexit.

On the cost side the industry is facing increases in labour costs, insurance, services and utilities, while particular sectors have unique cost increases, for example, the car hire sector due to changes in taxation.

Outlook for demand in 2019

Ireland continues to enjoy a good positioning in the international marketplace thanks to its strong brand image and its success in delivering a highly rated satisfying visitor experience. Tourism Ireland’s marketing budget has been increased for 2019, the first meaningful increase in some time, which hopefully can reverse the steady decline of destination awareness in several key source markets. The awareness and appeal of Ireland as a place to visit will receive a boost with the launch of the new destination campaign and increased exposure on traditional and new media platforms.

- Mainland Europe: The economic conditions and consumer confidence indicators suggest that 2019 will be a good year for continued growth in demand for travel. However, Ireland’s faces a challenge to maintain its market share in the top continental source markets. The expanded range of very competitively priced air service links from Germany should help secure continued growth. Increased ferry capacity between France and Ireland, plus some additional air services, hopefully can boost demand after a lack lustre year in 2018. The deepening of connectivity, supported by more intensive marketing campaigns by the industry and state agencies, will combine to drive growth from across mainland Europe in 2019. Ireland’s reputational image is strong in the marketplace while price and value continue to be key components in the consumer’s choice of holiday destination. Current market indicators suggest that growth of the order of +5% to +10% is achievable in 2019.

- North America: the US market is expected to continue to deliver increased tourism revenues as the economy is growing at an annual rate of at least 3%, business and consumer confidence levels remain historically strong, coupled high consumer spending, low

unemployment and inflation well within the target rate of 2%. Tourism demand for Ireland continues to be driven by increased air lift with further new and exciting opportunities from both the US and Canada on the back of new air services in 2019. The industry are heavily committed to marketing campaigns in this market as the profile of North American visitors is valuable due to its high spend in Ireland and its propensity to tour the country thereby sustaining many businesses. Building on the success of recent years, and based on the planned increase in air services, double digit growth is again achievable in 2019.

- Britain: the market presents the biggest challenge facing Irish tourism. Continued uncertainty, falling consumer confidence and volatility of sterling present a particular challenge for many tourism businesses with a high dependence on visitors from Britain. Failure to agree a withdrawal agreement from the EU can be expected to further weaken sterling and severely dampen consumer demand as the UK economy takes a hit. Past experience shows that visitor trade to Ireland is particularly exposed to any downturn in the UK economy and that the British visitor is especially price and value sensitive. The prospect of tourism price inflation in Ireland exacerbated by exchange rate volatility represents a particular challenge. Until the Brexit issue is resolved any realistic prospect of growth in arrivals must be in doubt.

- New developing long haul markets, continue to grow although still relatively small in volume but with a high value to volume ratio. Investment in market development and the expansion of new intercontinental air services recently launched from Beijing and Hong Kong, together with access via hubs in the Middle East and Europe, provide a major boost to Ireland’s prospects of gaining a stronger foothold in these markets. An ongoing significant investment in market development, by the industry and state agencies, is required if Ireland is to capitalise on the latent potential in markets in the Asia/Pacific region. Liberalisation of the tourist visa regime, and improved processing facilities, would greatly facilitate growth from these markets. Aggregate growth of upwards of 5% in volume in 2019 should be achievable.

- Domestic market demand is expected to continue to improve, albeit slowly, as the economy and consumer ‘feel good’ factors remain positive. However, short breaks in Britain and Northern Ireland will offer attractive competing options for Irish residents. Demand from Northern Ireland is expected to remain sluggish as Brexit and a weakened pound prevail. The domestic and Northern Ireland market demand underwrite the year round sustainability of many tourism businesses, particularly in the Border regions.

Key challenges facing tourism in 2019

- Competitiveness and ability to continue to deliver value for money will be key challenges for the industry in 2019, as higher VAT rate, increasing input costs, labour market tightness, and currency volatility impact tourism prices and value.

- Ireland will continue to face stiffer competition in the marketplace from the UK which is presenting better value to much of Ireland’s target market.

- Capacity constraints are expected to continue to impact the ability to cope with increasing demand, in specific locations and at specific times of the year. The shortage of hotel accommodation in Dublin, as the top gateway and urban destination, continues to be a limiting factor, although more rooms will be available in 2019 somewhat alleviating the pressure. New regulations governing short term rentals may also negatively impact demand from certain sections of the market with a preference for self-catering accommodation.

- Tourism congestion points – locations, critical infrastructure, venues and attractions – each require robust management strategies to alleviate any adverse environmental impacts or decline in the quality of the visitor’s experience.

- Uncertainty governed by geo-political and economic factors always present a threat to demand for travel, including the potential impact of trade wars and political upheavals. Such events challenge the industry to be nimble in ensuring an optimisation of a revenue centric approach to exploiting market opportunities including investment in market diversification.

Airlines continue to add capacity for 2019

The expansion of airline services continues to be a key driver of Ireland’s tourism performance. The good news is that more seats will be available on air services in 2019, as airlines launch new routes and add frequency on existing services. Capacity on air services in the peak months of 2019 will be ahead of last summer.

The principal additions to air services, compared to summer 2018, which will benefit inbound tourism include:

From the USA

- Aer Lingus continues its expansion, having launched services from Philadelphia and Seattle in 2018, with a new route from Minneapolis/St.Paul (eff. July 08, 2019), Aer Lingus’ 13th US gateway to Ireland.

- American Airlines will provide a new service from Dallas/Ft. Worth from June 06 to September 28, Ireland’s first direct service from Texas.

- Norwegian Air International is boosting frequency on services from Stewart NY to Shannon and from Providence to Dublin.

From Canada

- Aer Lingus will add service from Montreal (eff. August 08).

- Norwegian Air International will launch daily service from Hamilton to Dublin (eff. March 31).

- WestJet will launch a new service from Calgary to Dublin (eff. June 01) while switching its daily Dublin service from St.John’s to Halifax (eff. April 29).

From Asia

- Ireland will be served year round by services launched in mid 2018 - Cathay Pacific from Hong Kong and Hainan Airlines from Beijing.

From Russia

- Moscow will be linked daily with Dublin by Aeroflot’s new service.

From Germany

- Lufthansa is adding frequencies to Dublin from Frankfurt and Munich.

- Ryanair will service Frankfurt-Dublin twice daily, having launched new services from Munich and Stuttgart to Dublin last summer.

- New Cologne – Knock service by Ryanair (eff. June 01-Sept.28).

From France

- Aer Lingus is adding service between Nice and Cork.

- Ryanair is adding service from Bordeaux and Lourdes to Dublin.

From Luxembourg

- Ryanair has launched a new service while Luxair has added capacity on the route.

From Austria

- LaudaMotion, a Ryanair company, has added daily service from Vienna to Dublin.

From Italy

- Ryanair launching service from Naples to Cork.

From Sweden

- Ryanair is adding a seasonal service twice weekly from Gothenburg to Dublin

(eff. May 04-Oct.26).

From Ukraine

- Ryanair is launching service from Kiev to Dublin, (eff. May 02).

From Switzerland

- SWISS is adding capacity from Zurich to Cork.

From Portugal

- Aer Lingus will operate from Lisbon to Cork.

- TAP Air Portugal will launch double daily service from Lisbon to Dublin (eff. Mar 31).

From Spain

- Aer Lingus is increasing frequency between Barcelona and Cork

From Latvia

- airBaltic is launching 4 x weekly summer service from Riga to Dublin (eff. Mar 31).

In addition to the above, Ryanair and Aer Lingus are adding services on a number of established routes from Continental Europe catering to inbound tourism.

Britain

- Ryanair will offer a twice daily service from Southend to Dublin (eff. March 31), and service Bournemouth to Dublin (4 days per week).

- Ryanair has launched a new Luton-Cork daily service.

- Ryanair will add East Midlands – Shannon (eff. April 05).

Irish Ferries expand services from France

Irish Ferries is expected to provide an increase in capacity with its new €144 million 55,000 tonnes cruise ferry, W.B. Yeats operating between Dublin and Cherbourg, with sailings every second day in each direction from mid-March to end September.

The Dublin Swift fast ferry will return to the busy Holyhead-Dublin route for the summer, operating alongside the Ulysses and Epsilon.

|

|

|

ITIC’s agenda includes the following key goals for the year ahead as part of its ongoing advocacy and case-making role on behalf of businesses and other stakeholders engaged in tourism.

Brexit preparedness

With less than 100 days to go before the Brexit deadline, and no clarity on what will prevail after March 29th, the industry needs to be prepared for all possible outcomes, including air service disruption, a hard border and regulatory divergence.

ITIC will continue to provide an information and advocacy campaign on behalf of the tourism business community to help alleviate any disruption and to protect trade in the sector. The industry will continue to call for access to financial and other professional supports funded by Government which are available to other export businesses.

ITIC's 8 Year Road Map:

Tourism - An Industry Strategy for Growth to 2025

In March 2018, ITIC published an 8 year roadmap for the tourism sector, the output of a 10-month long consultation period with tourism and hospitality businesses throughout Ireland. The strategy sets out ambitious goals for Irish tourism including a 65% growth in tourism earnings from overseas visitors and 80,000 more jobs nationwide. A number of key enabling factors have been identified along with 51 policy recommendations that need to be implemented in order for Ireland’s largest indigenous industry to realise its potential in the years ahead.

ITIC has committed to reporting progress updates on the implementation of the strategy every 6 months.

ITIC will continue to monitor the advancement of the strategy and the progress of the recommendations with the next update reports due in March and September 2019.

Strengthening Tourism Competitiveness

In the first half of 2019 ITIC will carry out analysis on the competitiveness of Irish tourism. With pressure on a number of fronts including taxation, labour and the cost of business, it is apparent that Ireland's competitiveness is weakening. As business efficiency is critical for tourism success ITIC's report will identify areas where this can be supported and improved.

ITIC working with Fáilte Ireland & Tourism Ireland to deliver for the industry

ITIC is committed to continuing to work with the state agencies charged with facilitating the development of the sector to ensure that investment and marketing programmes are effective in delivering results in a cost efficient manner and in line with the industry’s 2025 strategy.

ITIC will also work with the agencies and CSO to improve the quality and timeliness of metrics on the industry’s performance with a particular focus on key economic data, including the development of a Tourism Satellite Account.

|

|

|

|

TOURISM – An Industry Strategy for Growth to 2025 – Autumn 2018 Update

PUBLISHED: SEPTEMBER 2018

VIEW THIS REPORT |

|

Brexit Bulletin #5 - Deal or No Deal?

PUBLISHED: JULY 2018

VIEW REPORT |

|

DRIVING DEMAND: An analysis of overseas marketing by the Irish tourism industry

PUBLISHED: APRIL 2018

VIEW REPORT |

|

Getting Behind the Data – An ITIC analysis of CSO data

PUBLISHED: MARCH 2018

VIEW REPORT |

|

TOURISM – An Industry Strategy for Growth to 2025

PUBLISHED: MARCH 2018

VIEW REPORT

|

|

|

Directors:

Maurice Pratt (Chair), Ruth Andrews (Deputy Chair), Adrian Cummins, Paul Gallagher,

Declan Kearney, David McCoy, Nick Mottram,

Cormac O'Connell,

Con Quill,

Company Secretary: Eoghan O'Mara Walsh |

© ITIC | Irish

Tourism Industry Confederation | Registered in Dublin | Registered

No: 75658 | All Rights Reserved

Ground Floor, Unit 5, Sandyford Office Park, Dublin 18 | Registered in Dublin | Registered No: 75658 |

Tel: +353 (0)1 293 4950 | Email: info@itic.ie | Web: www.itic.ie |

|

|