Irish tourism: Trump, tariffs and transatlantic travel

13 NOVEMBER 2025

INTRODUCTION

Irish tourism's dependence on the US market is becoming increasingly pronounced. The country's largest indigenous industry – employing 228,300 people – has had a challenging year but thankfully business from the key US market has remained healthy, up 4% year-to-date. This bulletin from the Irish Tourism Industry Confederation (ITIC) looks at the importance of US visitation to Ireland, how transatlantic business must be defended and deepened, but crucially how Irish tourism must diversify its portfolio of markets. In a world of such macroeconomic and geopolitical uncertainty there is significant risk for any industry to be too dependent on a single source market.

The US has been the star performer of Irish tourism with 32% of all annual revenue coming courtesy of American expenditure. It has grown significantly in recent times and as welcome as this is, it does pose a challenge of over-concentration. A modest dip In US visitor numbers would have a painful impact on Irish tourism and would require significant growth elsewhere to compensate.

ITIC calls for the US market to be strengthened but also calls for a sensible and prudent market diversification strategy. Funding is required to stimulate demand from European and long haul markets, air access must be incentivised, and capacity blockages on the ground must be alleviated.

The importance of the US market to Irish tourism

Last year Ireland welcomed more than 1.2 million American visitors who spent 10.5 million nights in the country and contributed €1.9 billion (excluding airfares) to the Irish economy. Signs are pointing to further growth in 2025, with latest CSO statistics indicating a 4% year-on-year uptick in visits from the USA for the first nine months of the year.

The US is clearly the best performing market for Irish tourism and has been in recent years. It represents a sizeable chunk of the Irish visitor economy in absolute terms as well as in relative terms too.

From the chart below it is evident that in 2024 roughly one-fifth of inbound visits and visitor nights came courtesy of those from the USA, but thanks to their above-average spend profile, the market was responsible for nearly one-third of all visitor expenditure (excluding fares).

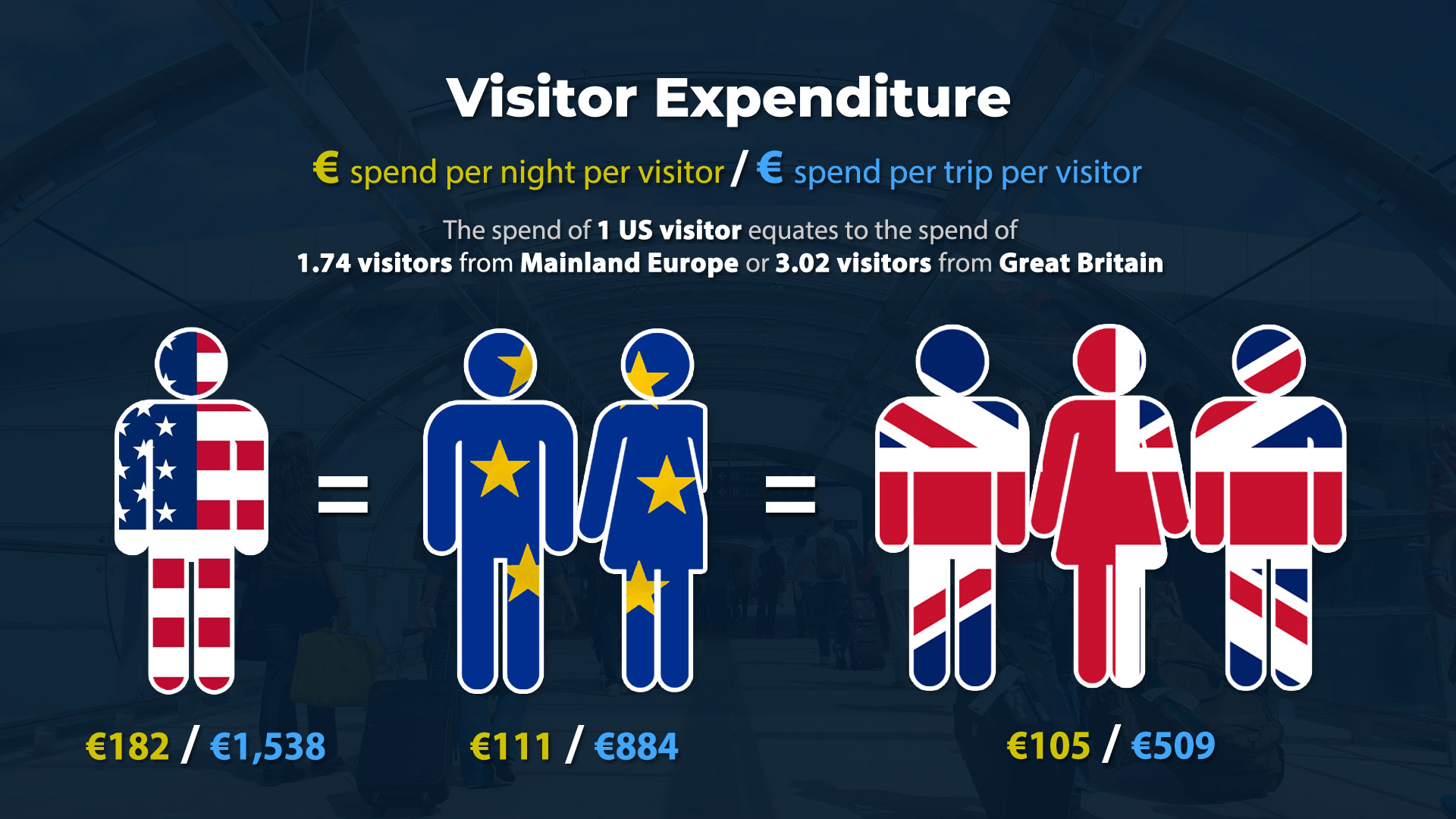

Meanwhile visitors to Ireland from Great Britain spend on average €105 per night and €509 per visit, and those from Europe typically spend €111 per night and €884 per visit. Contrast these figures with the equivalent metrics for the US market, with Americans spending an average of €182 per night and €1,538 per visit. Put another way, an American visitor stepping foot in Ireland is worth the same as 1.74 European visitors or 3.02 visitors from Great Britain.

As a result of changes in the way that CSO capture data on inbound tourism, making comparisons with the pre-pandemic era is a challenge. Saying this one can compare share of market metrics and it is evident that North America has grown in importance to the Irish tourism economy. Back in 2019 it is estimated that the USA and Canada combined represented 33% of inbound visitor expenditure in Ireland, whereas by last year this had climbed to a 37% share.

A vulnerable dollar?

There are many reasons why so many Americans opt to spend their leisure time, and their dollars, in Ireland. US Census Bureau analysis suggests that in 2020 38.6 million Americans claimed Irish ancestry, but destination choice is influenced by many factors. International research by VisitBritain has explored the degree to which international travellers said different factors were important when choosing a country for a holiday or short-break. The top five factors cited as "Extremely important" by Americans were "Is a welcoming place to visit", "It's easy to get around once there", "Is a place where I can enjoy history and heritage", "There is beautiful coast and countryside to explore" and "Offers good value for money".

Ireland ticks many of these boxes.

Undoubtedly Ireland is now seen as a Northern European destination in terms of costs however research shows that an Irish holiday continues to represent good value for money for US visitors. This has been helped up to recently by favourable exchange rates. It is true that there are cheaper destinations in Europe that Americans can opt to visit, but when it comes to value for money international travel is influenced not just by price but by exchange rates.

Since its inception almost two dozen years ago the most expensive period for Americans to buy goods and services priced in euros was the summer of 2008 when €1 cost about $1.55. While there were fluctuations over the course of the next decade the general trend was for Ireland (and anywhere else that uses the euro) to become cheaper for US visitors, with the typical exchange rate in summer 2019 being $1.12 to the euro.

The first couple of post-pandemic years brought about an exchange rate even more favourable for American visitors, often around $1.08, helping perhaps to explain the healthy visitor expenditure statistics.

2025 has seen a change primarily due to economic uncertainty caused by the current administration. The euro has been getting pricier for American visitors, reaching $1.16 by this summer. Should such a trend continue it could well impact on booking patterns for European (and Ireland) vacations next year.

President Trump's 'America First' policy explicitly aims to see the US importing less and exporting more. As well as discouraging imports by imposing tariffs it is possible to shift the balance of trade by influencing the value of a country's currency – if it loses value then its exports become cheaper in relative terms while imports get more expensive. Some commentators believe that President Trump's eagerness to see the Federal Reserve lower base rates is in part due to the fact that this would put downward pressure on the dollar.

Perceived political interference has traditionally led to economic instability. The risk of nudging the value of the US dollar down risks causing a much steeper loss in value – not just bad for the US economy but for the wider global economy too including Irish tourism.

Troublesome tariffs

The US-EU trade agreement signed in July means that the majority of European goods face a 15% tariff on entry to the States. It raises the question as to whether tariffs really impact outbound tourism from the US? Perhaps their immediate effect is negligible, but it should be kept in mind that airlines make a significantly higher profit per business passenger than they do per leisure passenger. Last year nearly 1 in 10 visits to Ireland from North America were for business reasons. If tariffs reduce the amount of trade (as economists predict) it could lead to less business travel. Less business travel result in airlines finding it tougher to make money potentially leading to trimmed route networks, flight frequencies, or opting to offer fewer seats at a discounted price to leisure travellers.

Changes to US import rules also extend to vacationing Americans as there is now a need to pay a tariff on items purchased while engaged in personal travel valued at more than $200 when returning to the US.

Uncertainty has been the watchword ever since President Trump returned to the White House, but this has become especially true in relation to his reciprocal tariffs, with these recently having been deemed illegal. For the time being the tariffs stay in place, as although the US Supreme Court has heard arguments put forward by both sides, deliberations on its ruling are expected to take months as opposed to weeks.

Resilient US economy

With economic uncertainty prevailing, the price of gold has climbed to a record high of $4,000 an ounce as investors seek safe havens. A barrage of economic forecasts have been released and the International Monetary Fund's latest prognosis is that there will be US economic growth this year and next of about 2%. A resilient US economy still has stronger growth projections than the IMF suggest are likely for many of Europe's biggest countries.

America of course is a vast country of significant wealth. Data from Knight Frank indicated that in 2024 there were no fewer than 905,413 Americans with wealth exceeding $10 million. US consumer confidence as measured by the OECD has steadied in recent months although latest September figures signals that sentiment remains at a lower ebb than at any time since the autumn of 2022.

An estimated 62% of Americans are active in the stock market and it will be hoped that the tech / AI bubble that many commentators refer to doesn't burst. A shaky stock market would leave consumers feeling much less wealthy, thereby denting their appetite for discretionary purchases, including foreign vacations.

Connectivity

Economics certainly matters when it comes to the propensity of people to travel from one country to another, whether for business or leisure, but so too does how easy it is to get there. Ireland enjoys exceptionally strong connectivity from the USA.

Fáilte Ireland analysis suggests that seat capacity from North America to Ireland has been one of the fastest growing segments in recent times, increasing by 11% in the past year, and this summer it accounts for 13% of all air seats to/from Ireland (the bulk of which are from the USA as opposed to Canada). There are five airlines operating a remarkable 25 routes between North America and Ireland.

Looking at peak summer and July seat capacity from the USA, back in 2019 the tally stood at 239,137, whereas in July this year it was 283,043, an increase of 18%. By comparison seat capacity from all other markets has risen by just 9% over the past six years.

Dublin and Shannon's air connectivity from the US (and to an extent Canada) is worth celebrating, but it's connectivity from emerging source markets for international tourism across Asia is far more limited. It is true that potential visitors from Asia can connect via Dubai, Doha, London or other European hubs for flights to Dublin, but direct flights from China are currently only available with Hainan Airlines from Beijing and there are no nonstop flights from India to Ireland, whereas monthly seat capacity on flights between India and Britain is just shy of 200,000, with additional routes or increased frequencies on existing routes in the pipeline over the coming months.

Do US visitors matter more to Ireland than other countries?

As has been noted before one-in-three euros spent in Ireland by visitors from overseas comes from US arrivals. While having a market that generates large numbers of high value visits is a positive it also poses a risk of over-concentration.

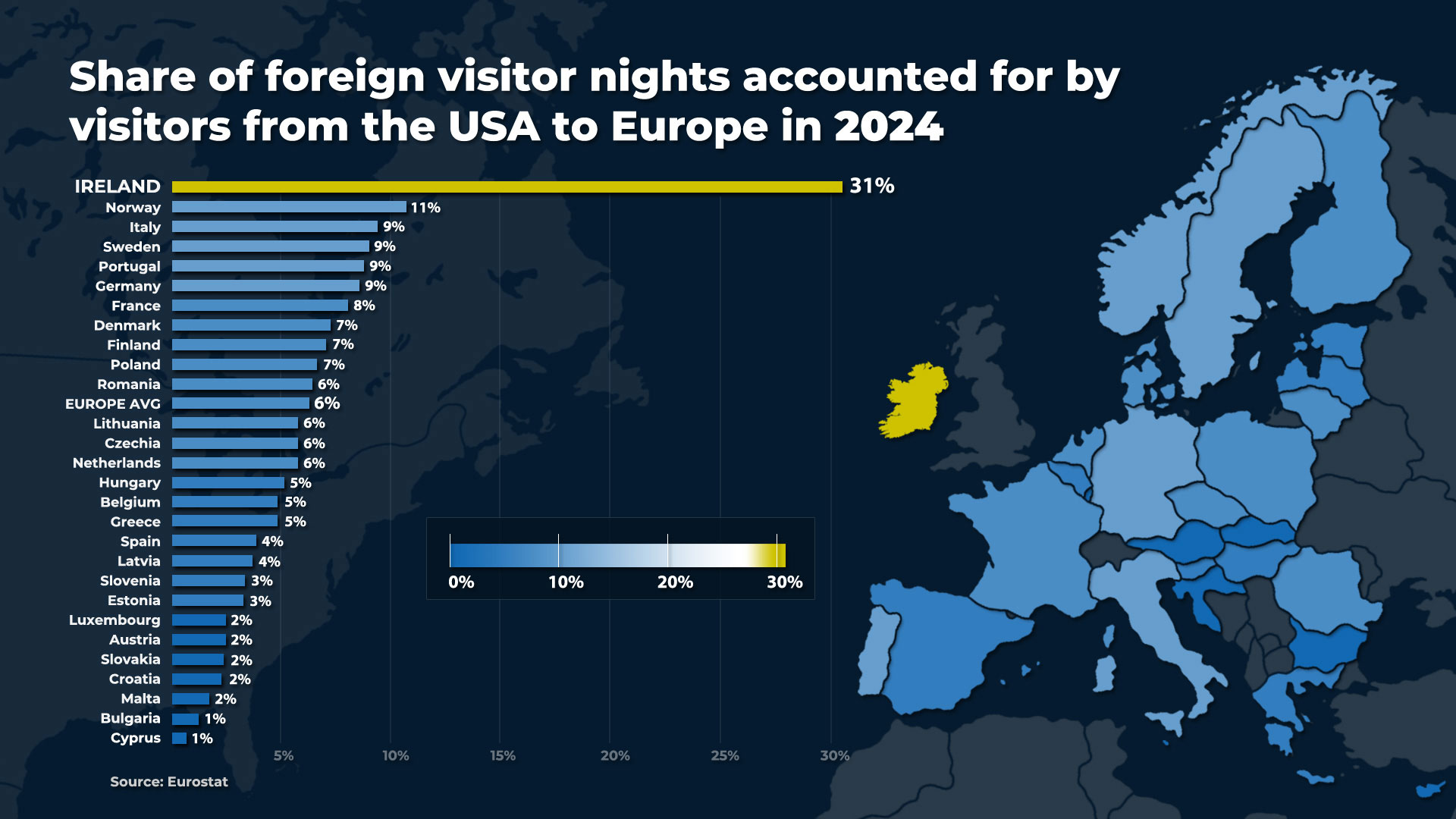

But is Ireland more dependent on the US market than other destinations in Europe? Data published by Eurostat is revealing in this regard as it shows the share of foreign visitor nights spent in all forms of tourist accommodation accounted for by US visitors in various European countries.

The chart presents data for 2024 and it is readily apparent that Ireland is an outlier, with 31% of foreign visitor nights in tourist accommodation attributable to those from the US, far ahead of Norway in second spot on 11% and Italy in third place on 9%, with the EU average being 6%.

And the Eurostat data is part of a time series showing that Ireland has become increasing dependent on US visitation with the 31% figure for 2024 five percentage points up on the 26% share back in 2019.

This situation underscores the need to ensure that Ireland is alert to emerging opportunities from other source markets, not just those across Europe, but Asia too. While outbound travel to Europe from China remains considerably lower than before the pandemic the market from India has seen a far swifter rebound, with Britain welcoming more than 600,000 visits from India last year, versus 460,000 from China.

All hope of course that the US market will continue to grow, with Tourism Economics estimating that across the period 2024 to 2029 outbound travel destined for Northern Europe (Denmark, Finland, Iceland, Ireland, Norway, Sweden and the UK) will grow at an average annual rate of 1.5%.

Scenario planning

With the peak summer season now behind us many tourism businesses across Ireland will again have benefited from a strong US market, but with an uncertain economic outlook for the US what of the future?

It is useful to consider the implications of a decline in the market, and a plausible scenario could be for 2026 to bring a 10% drop in US visitor arrivals. It is worth considering what such an undesirable shift would mean. Keep in mind that 2026 is a special year in the US with it celebrating the 250th anniversary of the Declaration of Independence and hosting the FIFA World Cup from 11th June until 19th July. These events could both encourage Americans to vacation in their own country next year and impact transatlantic air fares (depending on which European nations qualify).

A 10% decline in visits from the US would equate to 124,000 fewer US visitors and a reduction in visitor expenditure of close to €191m.

If other markets were expected to compensate for such a decline how many additional visitors would Ireland need to be attracting? Well, if European markets excluding Great Britain are to replace 124,000 fewer American visitors no fewer than 216,000 more European visitors are needed, while if Ireland looks just to travel from Britain to make up the slack the requirement would be for an uplift of 375,000 arrivals.

Such growth in arrivals from Europe or Great Britain would be a stretch, which further underscores the importance of developing a broader range of long-haul source markets from the likes of Asia, with a tendency to stay longer and spend more per night than is true for short-haul source markets.

CONCLUSION

As this bulletin outlines, the US market is critically important to Irish tourism and has become more so in recent times. But such strength poses a potential weakness. With tariffs, a vulnerable dollar and economic uncertainty in the States, visitor flows from the US may be exposed into the future. Transatlantic air access may be stronger than ever and set to grow next year but it is only prudent for Irish tourism to develop new business channels as well as fortify old ones.

ITIC welcomes the market diversification strategy being developed by tourism agencies and urges the Government to properly fund it. Irish tourism is valued at over €12bn when accounting for domestic earnings, overseas tourism and fares paid to carriers. It is a significant contributor to the exchequer with Fáilte Ireland data showing that 29c of every €1 is returned to the exchequer in tourism-related taxes. Tourism and hospitality enterprises are navigating their way through a challenging period with elevated costs of business squeezing profit margins. The reduction in the food services VAT rate to 9% in Budget 2026 has been welcomed but investment in tourism was only modest and needs to be ramped up if the sector is to attract new markets, Equally capacity constraints need to be addressed including the passenger cap at Dublin Airport and the shortage of tourism accommodation.

Tourism is too important to Ireland to take for granted. ITIC hope that the new tourism policy from Government is ambitious whilst also dealing with demand and supply pressures to ensure that the sector can thrive in coming years.