Irish Tourism Review 2025

& Outlook 2026

30 DECEMBER 2025

INTRODUCTION

As we reach the end of another calendar year, there is somewhat of a sigh of relief from Ireland's tourism and hospitality industry that the serious concerns in the early part of the year largely didn't come to pass. Back in Q1 talk of tariffs and a transatlantic trade war dominated discussion but thankfully as the year progressed these fears abated.

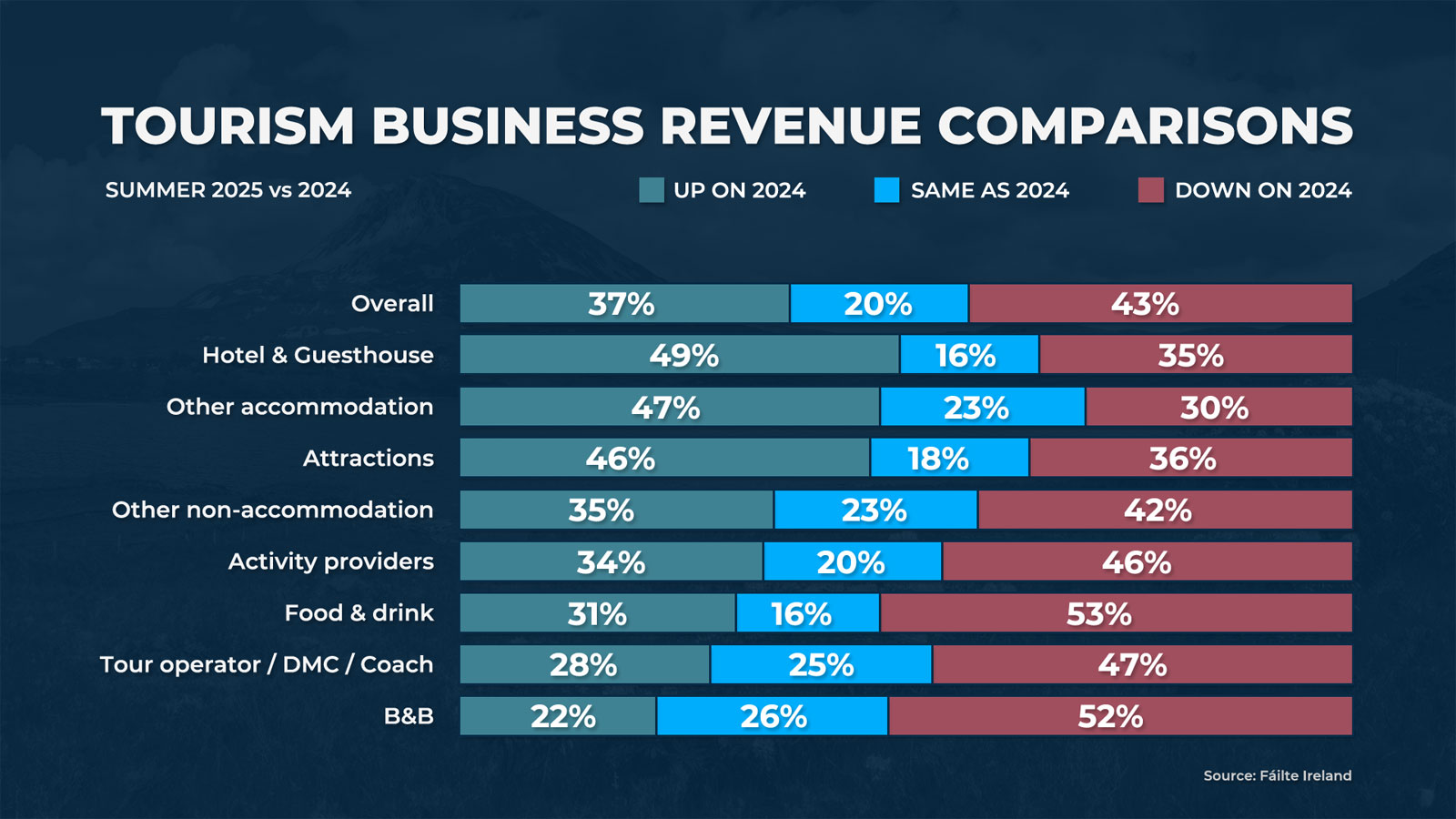

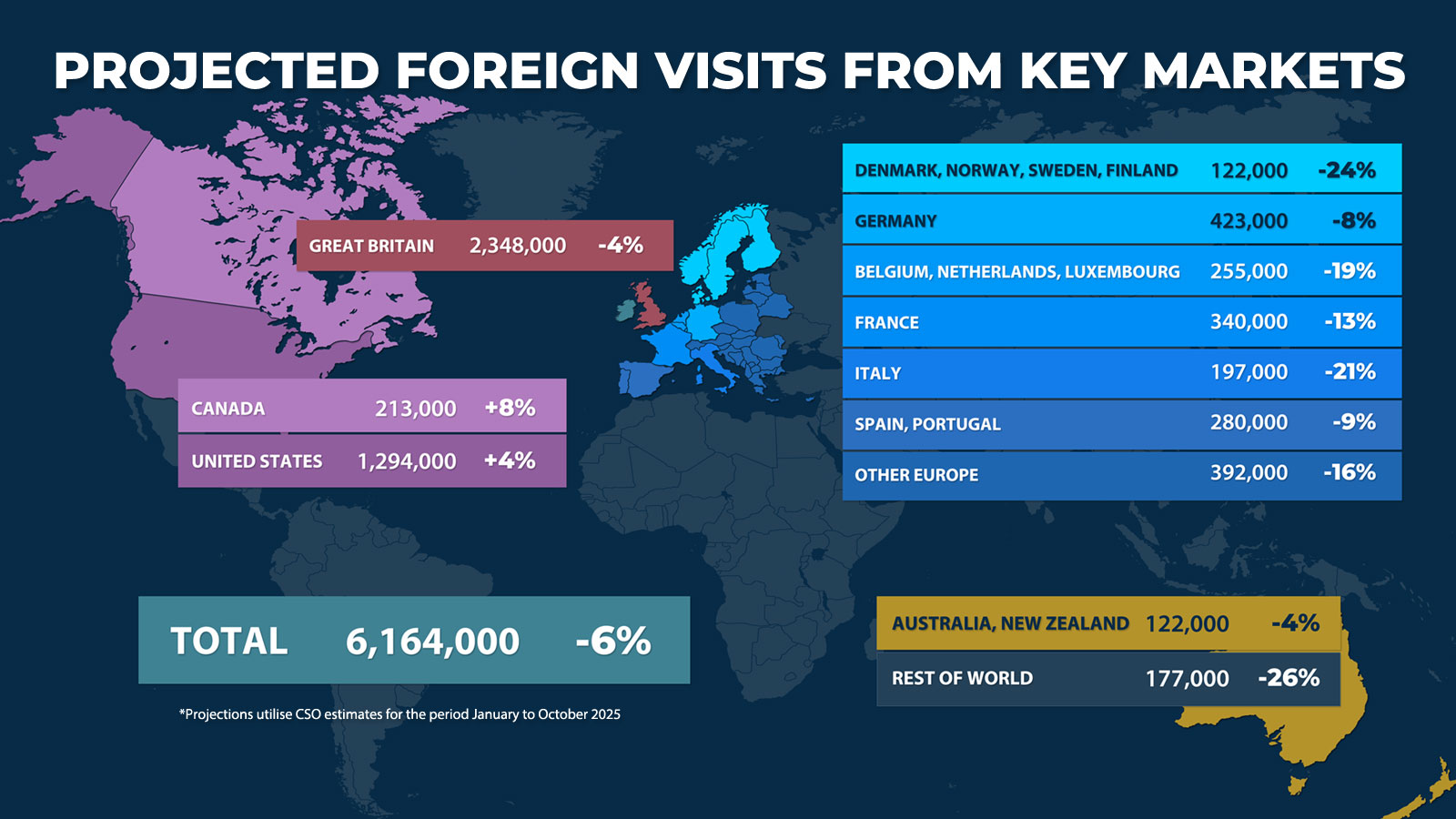

In this year-end bulletin, the Irish Tourism Industry Confederation (ITIC) project that the sector will be worth €8.89 billion to the national economy in 2025 when accounting for overseas visits and domestic tourism. Based on CSO data for the first ten months of the year ITIC is estimating that visitor numbers from overseas markets will reach 6.16 million, down 6% on 2024 levels with their expenditure amounting to €5.27 billion, down 13%. Meanwhile domestic tourism is valued at €3.62 billion for the year. As has been the case for much of the year, there remains a misalignment between the CSO and industry intelligence with tourism business data pointing to a flat year or one marginally-down rather than the sharp decline suggested by CSO surveys. This is supported by Fáilte Ireland tourism business surveys conducted through the year.

Demand proved strong from North America but other major markets most notably Britain and Continental Europe were weaker while the domestic market was relatively static. Costs of business remained the primary concern of tourism and hospitality businesses and Eurostat data in 2025 confirmed Ireland as the 2nd most expensive country in the EU. Higher input costs across labour, food, energy, and insurance naturally found their way to consumer prices whilst also squeezing profit margins.

Industry leaders welcomed Government's renewed focus on tourism with responsibility now residing within an economic portfolio, the Department of Enterprise, Tourism and Employment. The Programme for Government at the start of the year held some positive tourism commitments including the publication of a new national tourism policy while the VAT rate for hospitality is due to be reduced next July.

Looking forward into 2026, despite macroeconomic and geopolitical uncertainty, Irish tourism leaders are cautiously optimistic about the year ahead. ITIC are predicting growth of 5%-7% in tourism revenue predicated on a stable global economy and increased air access into the country. The projection is also reliant on pro tourism and pro-enterprise policies from Government including the lifting of the Dublin Airport passenger cap, support for regional airports, cost mitigation measures, appropriate investment, and the alleviation of capacity blockages.

RENEWED GOVERNMENT FOCUS

A New Department

After significant industry case-making, tourism's responsibility was moved at the start of the year to an economic portfolio and now sits within the Department of Enterprise, Tourism and Employment. Tourism chiefs welcomed this, feeling that it is only right that Ireland's largest indigenous industry and biggest regional employer is treated like the economic engine that it is. Tourism's new economic focus has already begun to pay dividends for businesses. Minister Peter Burke secured the reduced VAT rate of 9% for hospitality in October's Budget despite significant public and political resistance. It gives food businesses a buffer from July 2026 onwards as costs of business continue to escalate elsewhere.

A New Policy

Displaying a sense of purpose, a new national tourism policy was unveiled by Minister Burke towards the end of the year. It aims for a 50% increase in overseas tourism revenue over the next 5 years and includes 71 policy recommendations. Industry welcomed the policy although business leaders were quick to point out that for the growth figures to be meaningful, tourism inflation – which averages 6% for the last 3 year – will need to be tamed. If cost inflation wipes out revenue growth, then tourism and hospitality businesses will be no better off. There was disappointment that no investment commitment was made by Government to enable industry achieve the growth targets.

Capacity problems also risk derailing the policy and these need to be tackled urgently. The Dublin Airport passenger cap is stubbornly in place, the pipeline of new hotel stock is slowing, and Government's impending short-term letting legislation risks denuding regional and coastal Ireland of tourist holiday homes and self-catering properties. How the policy is implemented is the key matter and tourism chiefs hope the policy oversight group will have strong industry representation.

Although light on detail, Government's new tourism policy certainly delivers a sense of purpose.

2025 REVIEW

Overseas Markets

2025 proved a challenging year for Irish tourism on a number of fronts with ITIC estimating that by year-end the value of the oversea markets will be approximately €5.27 billion (excluding fares). Based on CSO data, the US and Canadian visitor numbers performed strongly up 4% and 8% respectively buoyed by relatively strong exchange rates, excellent air access, and targeted marketing campaigns. However other overseas markets proved weaker with Britain (-4%), France (-13%) and Germany (-8%) in retreat. Overall ITIC project – based on 10 months of CSO data for overseas markets – that international visitor numbers for 2025 will be down 6% to 6.16 million, with international visitor spend down 13% on 2024.

Saying this, industry data sources suggest a less alarming picture with airport numbers up, major visitor attractions performing solidly, and Dublin hotel occupancy up 1.5%. This picture is supported by Fáilte Ireland business surveys throughout the year.

Overseas Tourism Performance

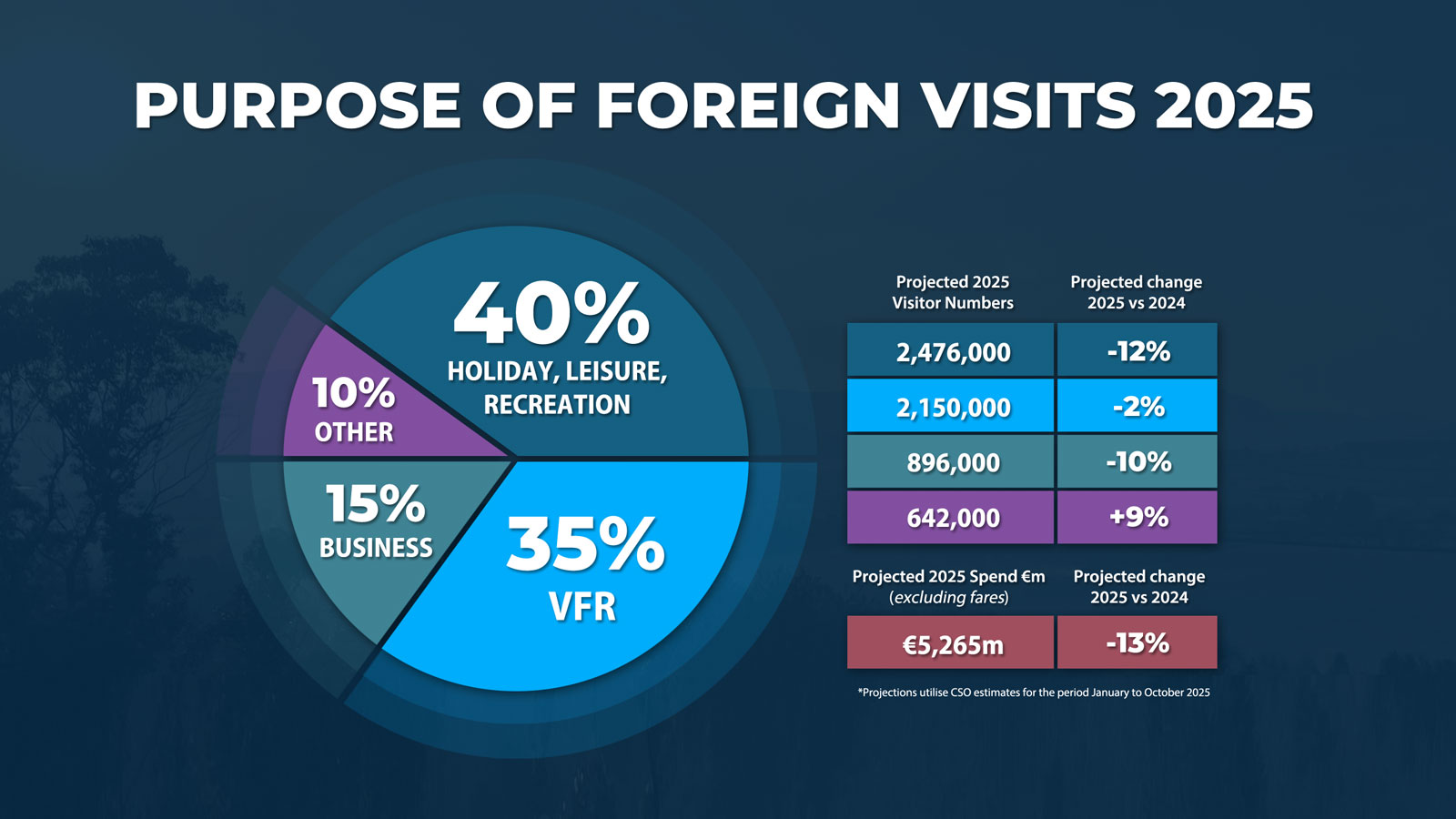

Overseas tourism numbers from the CSO show only the US and Canada in positive territory with 40% of all visits being for holiday, leisure or recreation.

Which is the most valuable market?

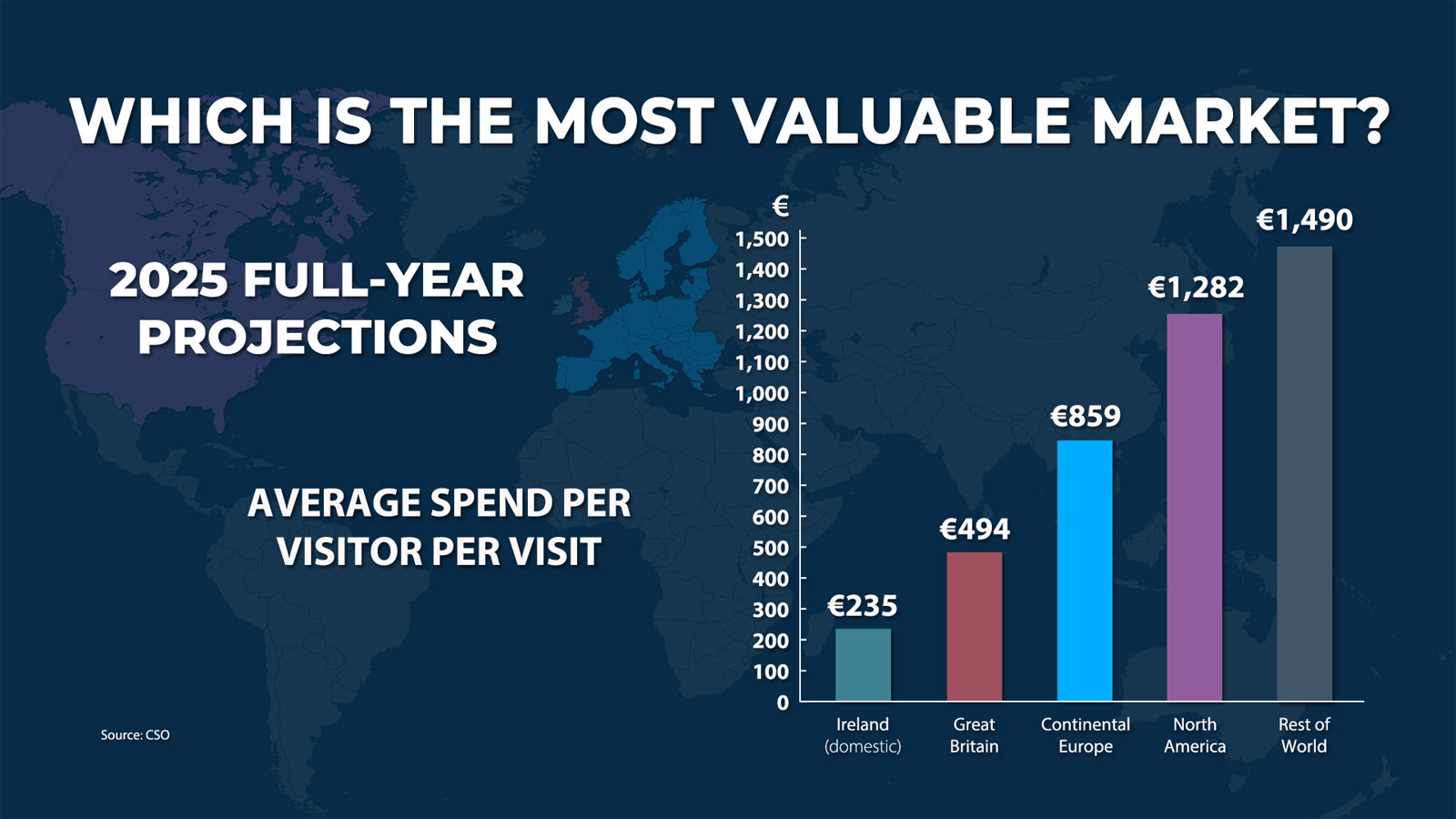

When looking at 2025 projections for volume and value, as well as spend per visit based on broad country group, some interesting insights are revealed. The North American market is the most valuable to the Irish tourism economy amounting to €1.933 billion in 2025 (excluding fares) with the individual North American tourist spending €1,282 per visit. Continental Europeans spent a total of €1.726 billion or €859 per visitor while the British market was valued at €1.61 billion with the average Briton spending €494 per visit. Meanwhile other markets contributed €445 million to the Irish tourism economy in 2025.

Spend for all market groupings was down on 2024 levels as the average number of nights across all markets declined.

Domestic Tourism Performance

While 2024 proved a bumper year for Irish residents holidaying at home, ITIC project that – based on Q1-Q3 data from the CSO – 2025 will see a 7% annual reduction in domestic trips although spend will be up 1%. The most popular domestic region for overnight trips by Irish residents in the busy summer months was the Southern region (Clare, Tipperary, Limerick, Waterford, Kilkenny, Carlow, Wexford, Cork, and Kerry) which accounted for 49% of all trips in Q3. ITIC estimate that in 2025 15.44 million domestic trips (-7%) will have been taken by Irish residents, spending 34.144 million nights (-7%) in the country, and accounting for €3.62 billion in expenditure. The average spend per domestic visitor in 2025 is projected to be €235 per person. The most popular reason for a domestic trip is for 'holiday' purposes followed by 'visiting friends and relatives'.

2026 OUTLOOK

Looking forward into 2026 despite macroeconomic and geopolitical uncertainty, Irish tourism leaders are cautiously optimistic about the year ahead. The Irish Tourism Industry Confederation (ITIC) are predicting growth of 5%-7% in tourism revenue for the coming 12 months. This is predicated on a stable global economy and increased air access into the country. It is also dependent on pro tourism and pro-enterprise policies from Government including the lifting of the Dublin Airport passenger cap, support for regional airports, cost mitigation measures, appropriate investment, and the alleviation of capacity blockages.

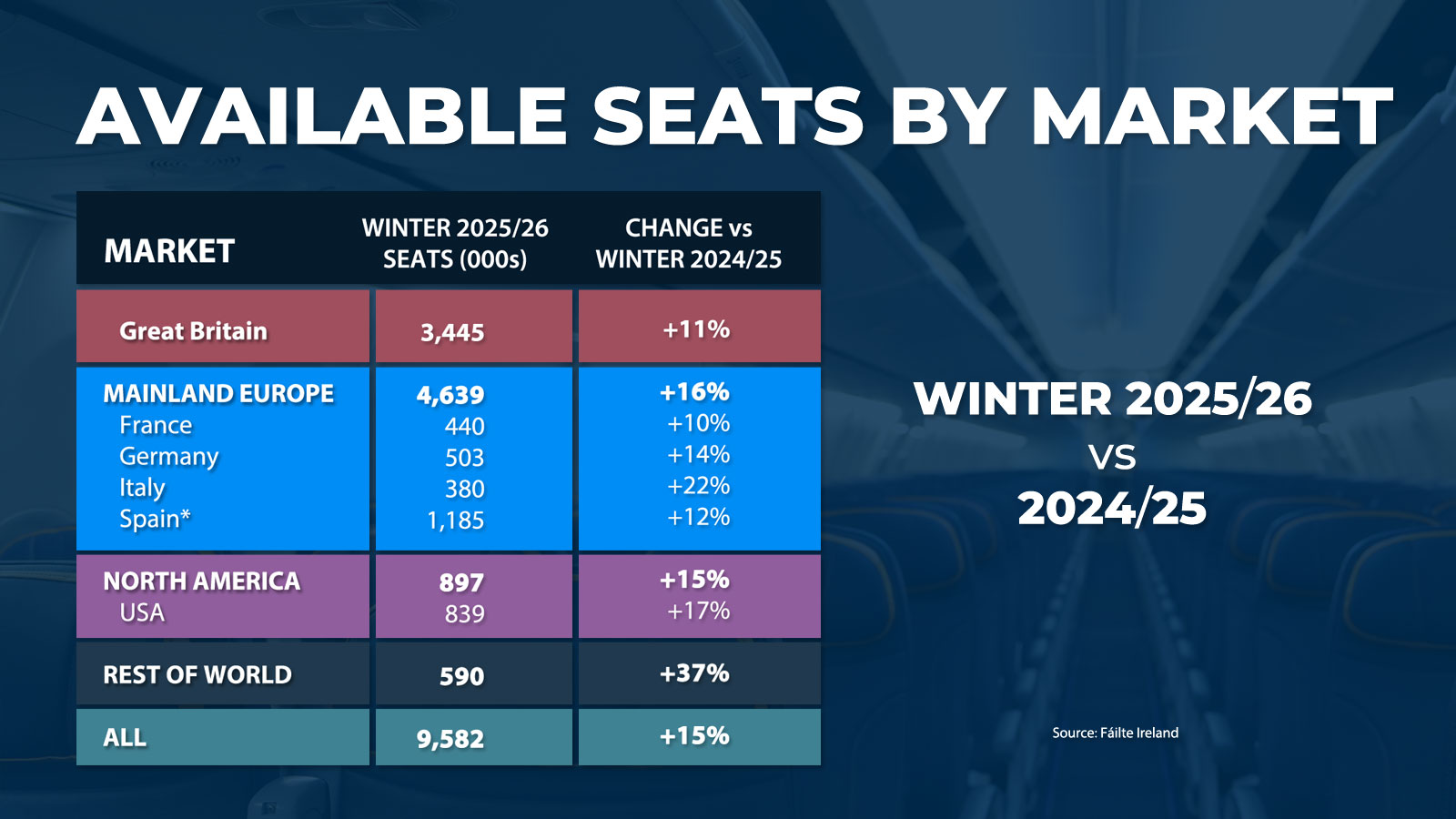

Air and sea access into the country looks positive for the early part of 2026 which is always a key indicator of tourism's performance.

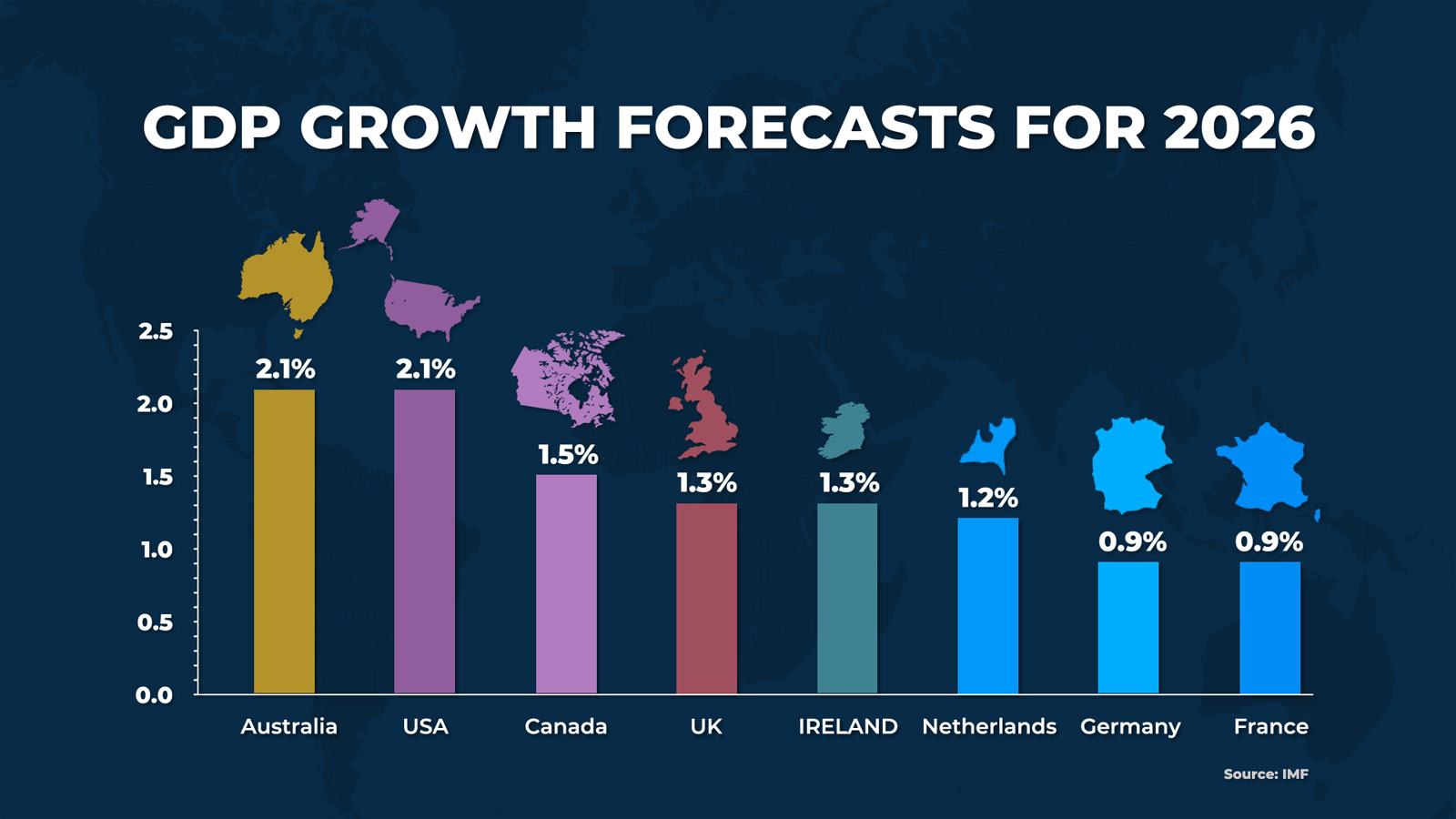

It should be noted that international forecasters, Tourism Economics, predict that inbound travel to Northern Europe (the region including Ireland) is set to grow 4.7% in 2026. As always the strength of source market economies is critical and the IMF's latest projections show modest growth.

The price of oil which largely determines air fares is forecast to fall to $56 a barrel in 2026 according to Goldman Sachs from circa $64 at present. It should also be noted that the key US market is likely to be influenced by the 250th celebrations of US independence alongside their hosting of the FIFA World Cup. This may distort usual travel patterns and transatlantic air fares.

As always when looking at the year ahead, the only certainty is uncertainty and tourism leaders in Ireland will nervously be keeping an eye on political, economic and societal shifts that may impact demand.

CONCLUDING COMMENTS

2025 has come and gone and the Irish tourism industry, as ever, showed its resilience and durability. The sector now employs 226,800 people right across the country and is by far the largest indigenous sectoral employer in regional Ireland. Industry chiefs remain concerned of a growing over-dependence on US visitors and, as welcome as the greenback is, there is an acceptance that Irish tourism needs to market diversify. Stronger European and Asian markets are important for Irish tourism in case of US economic volatility. Tourism agencies and industry partners are devising a market-diversification strategy and Government need to adequately fund it.

It is hoped that 2026 can see growth in tourism revenue, both domestic and international, and that some of the data gaps apparent in official statistics can be plugged with the State adopting new intelligence sources to bolster policy decisions. Costs of business will continue to put pressure on business but hopefully demand stays solid while the capacity constraints at home are addressed. New registered accommodation stock should be incentivised, a fair regulation of tourism short term rentals needs to be devised, infrastructural delivery from internal connectivity to EV charging points has to be expedited, and the passenger cap at Ireland's main gateway must be lifted to allow for capex development to commence without delay.

No matter the global uncertainty, Irish tourism can't be outsourced and offshored. It is here to stay and needs to be supported.