|

|

|||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

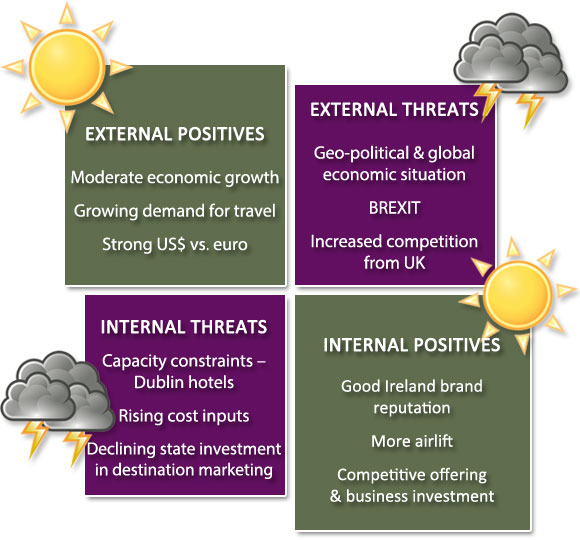

| 2017 – Continued growth achievable but challenging

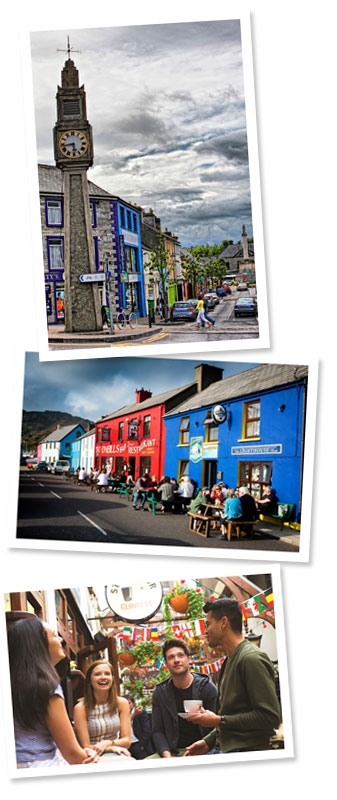

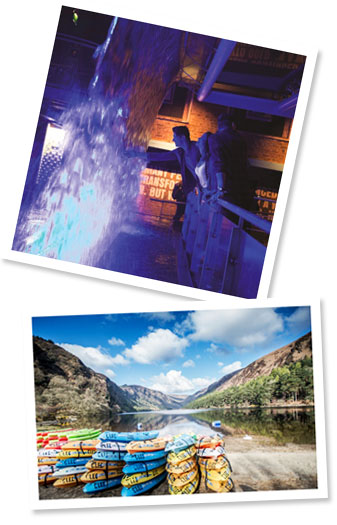

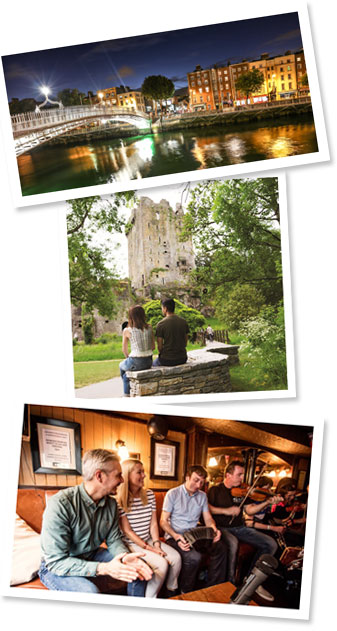

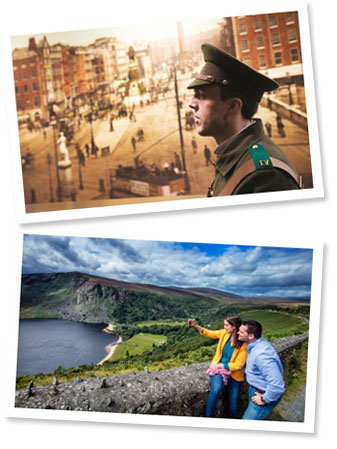

After two years of above average growth in inbound tourism, Ireland is poised to continue to grow this important indigenous industry. However, continued growth is not without its challenges. Ireland is well positioned in the international marketplace to continue to attract growing numbers of visitors thanks to its strong brand positioning and its success in delivering a highly rated satisfying visitor experience.

Mainland Europe – Ireland’s largest source market for holiday visitors - has proven to be a continuous source of increased demand, with the potential from several countries still far from realised. Demand is expected to remain buoyant in the year ahead as airlift expands and the unique experiences of an Ireland holiday is increasingly valued by our target market segments. North America - a highly valuable source of high spending holiday visitors - will be helped in no small way by continued expansion of direct air services coupled with a dollar riding at a 13 year high against the euro. While competition from the UK for a share of this valuable market is expected to intensify, Ireland on the back of increased marketing investment by the industry and tourism agency should see further growth of up to 10% in 2017. Britain - historically Ireland’s largest volume market - is exposed to currency volatility in the short term and an uncertain economic and consumer confidence environment as the UK commence Brexit negotiations in Spring 2017. Prospects for this market, especially important as a source of short breaks, are difficult to predict, although growth prospects are low. New developing long haul markets, continue to grow although still relatively small in volume but with a high value to volume ratio. Investment in market development and the expansion of new intercontinental air services via the Middle East and London should see continue growth in the year ahead. Aggregate growth of 3% - 5% in volume and 5% - 7% in value could be expected for 2017 although as ever tourism is extremely vulnerable to external factors beyond its control. Domestic demand is expected to continue to improve, particularly the incidence of short leisure breaks, as the economy and consumer feel good factors improve. The domestic market demand underwrites the year round sustainability of many tourism businesses, particularly outside of Dublin. Key challenges facing tourism in 2017 Competitiveness will be a key challenge for the industry in 2017, with the prospect of currency shifts making the UK a more affordable destination, as businesses in Ireland cope with increasing cost pressures and a diminished state investment in destination marketing. In recent years tourism businesses have been increasing their investment in marketing while the real term spend by Government has significantly reduced. Capacity constraints are beginning to impact the ability to cope with demand, in specific locations and times of the year. The shortage of hotel accommodation in Dublin, as the top gateway and urban destination, is limiting the ability to fulfil demand. The challenge will be to manage demand over the next 2 to 3 years until more accommodation comes on stream. If Ireland is to continue to grow its tourism significant investment is required in infrastructure and new visitor experiences. Uncertainty governed by geo-political and economic factors will undoubtedly impact on demand over the coming year, not least in relation to Brexit and the British market. The industry will need to be nimble in ensuring an optimisation of a revenue centric approach to exploiting market opportunities including investment in market diversification.

|

|

|||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

Ireland earned an estimated €4.7 billion from overseas visitors this year, up 9% on the previous year. Based on the latest CSO data for the first 9 months of the year, earnings increased across all source markets and within each purpose of visit category. Visitor volumes reached another record level in 2016, with an estimated 8.5 million visitors from overseas staying visitors arriving into Irish air and sea ports, excluding day trips and transfer passengers - a 10% increase on the previous year. Earnings growth almost keeping pace with volume increases is especially welcome despite a further decline in the average length of stay but helped by the strength of sterling (pre Brexit) and dollar. Growth in holiday visitors at 10% represents another year of above average growth pattern, helped in part by increased air lift and favourable exchange rates.

Ireland has seen overseas arrivals increase by nearly 50% in the past 5 years, with significantly above average growth in each of the past 2 years.

Staying visitors have increased by almost one third in the past 3 years, with double digit growth in 2015 and in 2016.

Close to 10% annual increases in volume were achieved from the major source market groupings. Mainland Europe and North America had been trending in recent years as the fastest expanding markets for Ireland, each market recording close to 40% growth over the past 3 to 4 years. In the USA Ireland continues to win market share of outbound travel to Europe. The 10% growth from Britain in 2016, boosted by the strength of sterling (pre Brexit), has pushed annual volume to close to where it was 10 year ago.

Continental Europe continues to be the top earner for Irish tourism reaching an estimated €1.75 billion in 2016, followed by North America, a market worth €1.3 billion. British visitors spent almost €1.1 billion, while new developing markets in the rest of the world contributed just over half a billion euro.

Long haul visitors, from around the globe including North America are the most valuable in terms of spend per visit, exceeding €970 for visitors from Austral Asia/Pacific region and €790 from North America. The average expenditure by visitors from continental Europe tends to be close to €500 per visit, with Germans spending the most. British visitors on average spent €272, reflecting the relatively high incidence of short stay visits.

Irish tourism earned €400m more in 2016 compared to the previous year. This increase in earnings created more jobs – an estimated 20,000, of which 153,000 were in the accommodation and food sector. The increase in earnings also contributed to the Exchequer by way of taxation.

The domestic travel market is worth an estimated €1.75 billion with up to 9.3 million trips taken by Irish residents spending 25 million nights away from home. Holiday trips are estimated at close to 4 million generating a spend of €1.1 billion. Latest CSO data for the first three quarters in 2016 shows:

|

|

|||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

Airlines continue to add capacity for 2017 The expansion of airline services has been a key driver of growth in Ireland’s tourism in recent years. The good news is that more seats will be available on air services in 2017, as airlines launch new routes and add frequency on existing services. Capacity on air services in the peak months of 2017 will be ahead of last summer. The principal additions to air services, compared to summer 2016, which will benefit inbound tourism include: From the US

From Canada

From the Middle East & Beyond

From Germany

From Scandinavia

From Finland

From The Netherlands

From Switzerland

From Greece

From Iceland

From Spain

In addition to the above, Ryanair and Aer Lingus are adding services on a number of established routes from Continental Europe catering to inbound tourism. From Britain

The External Environment Uncertainty surrounding the geo-political environment, economic conditions in source markets, currency volatility and the threat of terrorist activities on travel continue to hang over the outlook for the year ahead. External factors beyond the industry’s control, include Brexit, a potential shift in economic policy in the US and the uncertain nature of the political economy of the EU. The principal threat is the headwinds Ireland will face in the British market, with the currency advantage of recent years already reversed and the prospect of a dip in economic growth and consumer confidence in 2017 and 2018. Maintaining Cost Competitiveness The recovery over recent years has been driven by a marked improvement in competitiveness in terms of price and quality of the tourism offering. Ireland’s improving economy could pose a threat to the competitiveness should our costs rise faster than in competitor destinations. Pressure from increasing labour and utility costs, and high taxation, run the risk of making the tourism offering uncompetitive pricewise and deters business investment in the sector. A loss of competitiveness represents the single largest threat to the realisation of the sector’s sustainable growth potential. Enhancing competitiveness is the route to continued growth in tourism and the creation of more jobs. Capacity Constraints The most obvious constraint continues to be a shortage of hotel capacity in Dublin which limits the ability to attract increasing volumes of visitors to the capital. Dublin hotels are operating for much of the year at close to capacity due to the city’s popularity as a leisure and business destination. For the city to grow more accommodation will be required or a significant shift in the pattern of consumer choice of type of accommodation used. Market, Seasonal and Regional Diversification The future growth of inbound tourism to Ireland will increasingly depend on a broadening of its market base to protect against cyclical downturns in demand and a widening of the seasonality and regional dispersal of visits to optimise the economic viability of the sector. A revenue earning prioritisation, rather than one based on visitor numbers, of source market opportunities would best serve the industry in achieving sustained growth and in attracting much needed investment in infrastructure, facilities and services. As demand increases across the country continued sustained growth will become more dependent on the ability to attract greater number of visitors outside of the peak months when access, accommodation and other service providers have spare capacity, which if filled will in turn significantly boost profitability and sustain greater levels of year round employment. |

|

|||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

ITIC’s agenda includes the following key goals for the year ahead as part of its ongoing advocacy role on behalf of businesses and other stakeholders engaged in tourism.

While there are no ‘certainties’ in regard to Brexit other than negotiations are set to commence by March 2017, ITIC will actively push to ensure that the interests of tourism businesses are recognised by Government, its ministries and agencies in the upcoming EU negotiations. ITIC’s position, already communicated to Government, centres on four areas:

ITIC is proactively engaged in an information and advocacy campaign to ensure that the interests of the tourism sector feature on the agenda of the negotiators.

ITIC is publishing a new road map for tourism growth to 2025. This includes a 10 point plan to help the sector become worth €7 billion in overseas earnings by 2025, a 50% increase on the current export value. Although tourism is in a strong place at the moment ITIC is advocating that now is the time to chart a strategic future for Irish tourism that will be industry - led and government - enabled. This road map for tourism growth can be accessed by CLICKING HERE.

Future growth opportunities in tourism are being limited by infrastructure deficits. Continued growth is also dependent on continued investment in facilities, people and attractions. Currently there are several infrastructure deficits, including the availability of broadband, roads, water and sewerage, etc., which limit tourism development. The level of funding in the Government’s Capital Programme 2016-2021 allocated for tourism development is disappointing for an industry now generating upwards of €8 billion per annum in to the economy. ITIC is strongly of the view that Government should use the current upturn in economy and Exchequer receipts to invest in essential infrastructure as a basis for future growth. Failure to make adequate investment provision in tourism infrastructure and facilities is short sighted and will inevitably lead to lack of innovation, a loss of competitiveness, and a downturn in demand. Tourism uniquely has the potential to deliver economic and social development to many villages, towns and communities throughout the country.

ITIC is committed to continuing to work with the state agencies charged with facilitating the development of the sector to ensure that investment and marketing programmes are effective in delivering results in a cost efficient manner. ITIC representatives welcome the opportunity to engage in real dialogue and an exchange of views in working groups to ensure that key decisions by the agencies are informed by market research and a business perspective. A priority for 2017 will be to address identified pressure points limiting the future development of the sector while maintaining focused marketing campaigns in those markets offering the best potential in terms of income and economic benefits. Specifically the industry will work closely with the state agencies in the development and marketing of the Wild Atlantic Way, Dublin - A Breath of Fresh Air, and Ireland’s Ancient East, while developing a distinctive marketing identity for the Midlands and Shannon Waterway. |

|

|||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||