Introduction

The impact of Covid-19 on Ireland’s tourism industry – so heavily dependent on international visitation – has been nothing short of cataclysmic. The pandemic put an all but complete halt to air and sea travel and the unfettered movement of people. It has recommenced somewhat since mid-July with the European Digital Covid Certificate but most of the traffic at airports has been Irish people in search of the sun. Inbound tourism numbers have been modest and are likely to remain so into 2021 due to a lack of connectivity with key source markets overseas.

The Irish Tourism Industry Confederation (ITIC) publishes this updated strategic plan as to how to rescue the country’s largest indigenous industry and biggest regional employer. Following ITIC plans of June 2020 and February 2021 this update includes an analysis of the cost of Covid to the industry; the size of the recovery prize in terms of revenue, jobs and tax receipts; and scenarios for revival over the coming years.

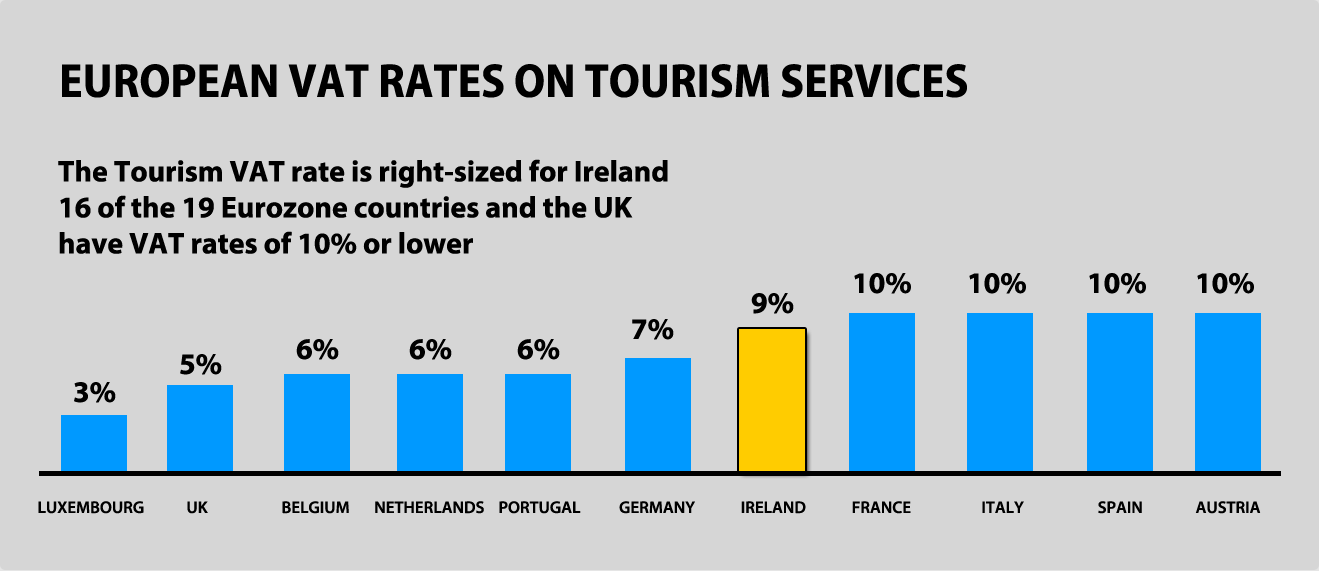

ITIC, on behalf of Ireland’s tourism and hospitality industry, argue that a fully-supported recovery could see a return to 2019 levels of tourism activity by 2024/5. This is predicated on pro-tourism and pro-aviation policies and decisions in next month’s budget are critical in this regard. To that end ITIC advocate that Government must; introduce a substantial stimulus package to kickstart connectivity; continue EWSS for tourism enterprises right through to June 2021; deliver a step-change in tourism investment; provide certainty on the tourism Vat rate; and support employers to create and sustain jobs.

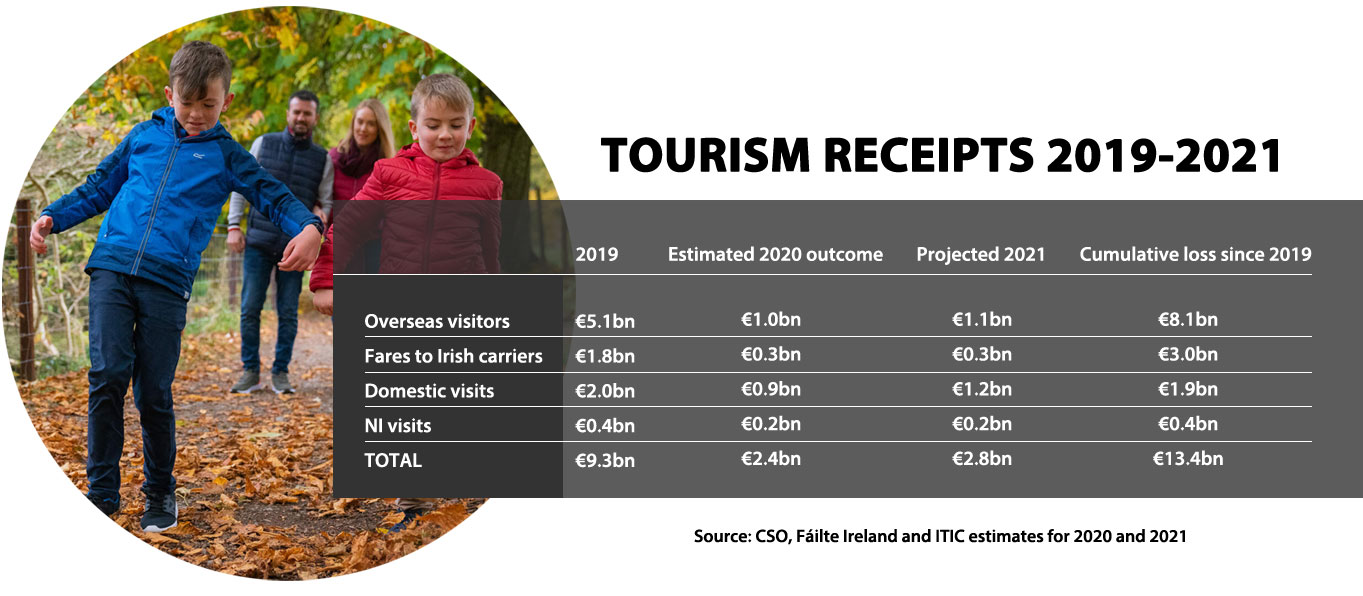

The cost of Covid-19 to the tourism and hospitality businesses since 2019 is estimated at a staggering €13.4 billion. Government supports to date principally EWSS, CRSS and business continuity grants have been vital but they pale in comparison to the scale of the damage.

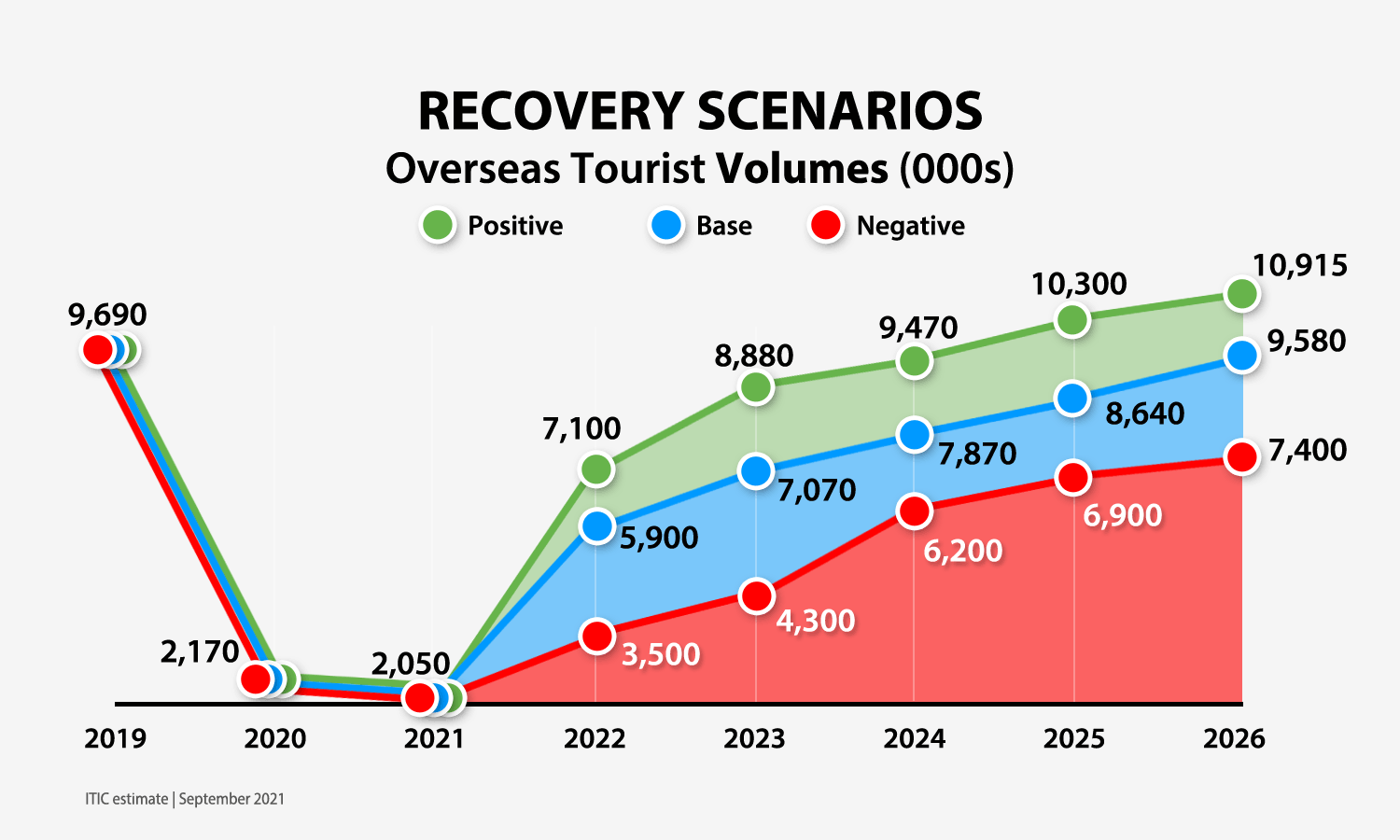

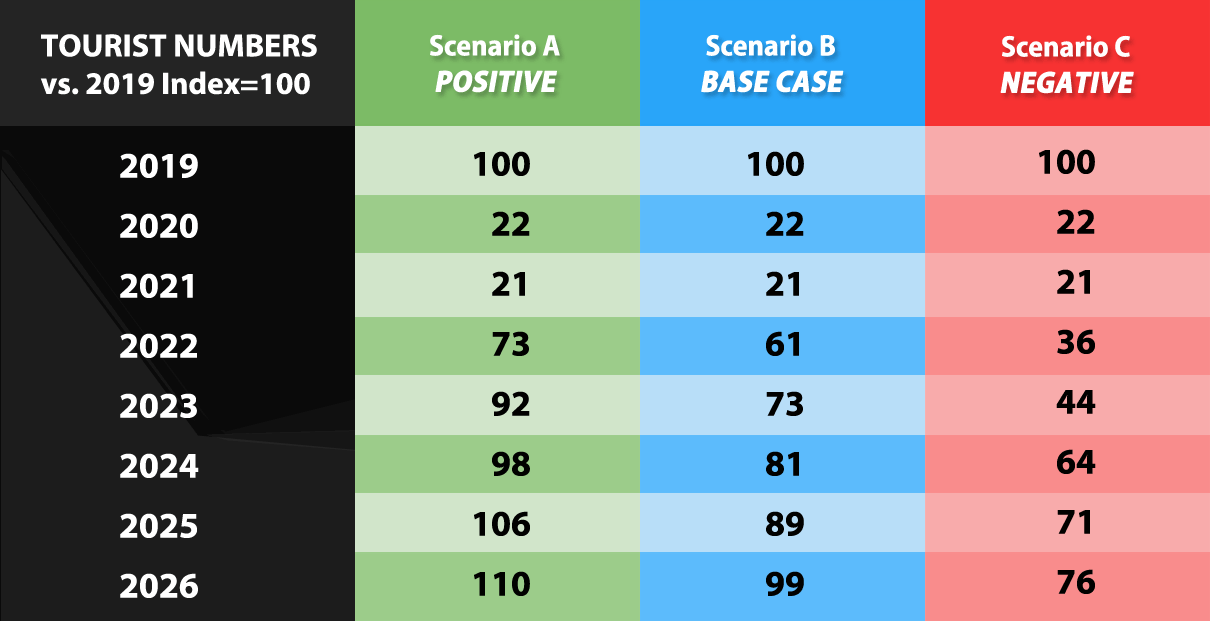

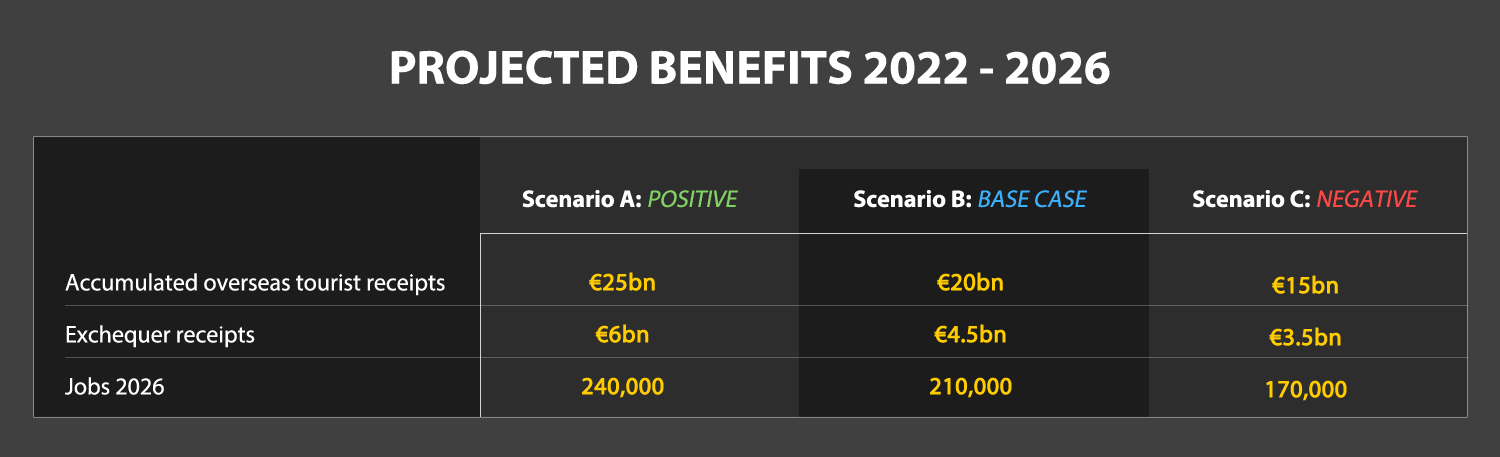

Over 100,000 jobs have been lost and the road back to health will be long, steep and uneven. However, despite the trauma and mauling of Covid, industry is of the view that recovery is achievable given a fair wind and crucially pro-tourism and pro-aviation policies. This updated strategic plan – Irish Tourism: From Survival to Revival – outlines a number of recovery scenarios, the more positive of which points to a return to 2019 levels of inbound tourism by 2025. That would mean 240,000 annual jobs in the sector and €6 billion in terms of exchequer receipts over the next 4 years.

The size of the prize in terms of tourism recovery is significant.

Let’s grasp it.

Chairperson

CEO

SCALE OF DAMAGE vs SIZE OF PRIZE

ITIC estimate that Covid-19 and associated restrictions have cost the Irish tourism industry €13.4 billion over a 2 year period. Overseas visitors and their associated expenditure have fallen dramatically for obvious reasons and the domestic market has been hamstrung by repeated lockdowns and various trading limitations even when open. Last month’s announcement on the final reopening of the economy has been broadly welcomed by tourism and hospitality enterprises but ITIC estimate that 2021 receipts will only be marginally above 2020 levels. Like last year this is a year of survival.

However a fully-supported recovery can see the tourism industry recover lost ground as soon as 2025. That would mean that overseas tourists would be spending €5.4 billion in the country with 240,000 people employed in the sector by 2025. Fáilte Ireland, the state agency for tourism development, estimate that 23c of every euro spent by a tourist is returned to the exchequer in direct tourism-related taxes.

BUDGET 2022 SUBMISSION

This represents a key juncture for Ireland’s tourism industry. Stabilisation is in reach with revival possible given the right supports and Government policy. Budget 2022 is critical in this context and likely to determine the Irish tourism industry’s future. Pro-tourism policies will help the industry on the road to full recovery by 2025. Failure to support the industry risks delaying the recovery costing jobs, exchequer returns and export earnings.

To that end ITIC, on behalf of the broad tourism and hospitality industry, are proposing a number of key polices be delivered by Government as part of Budget 2022 on October 12th:

The above 5 budget asks are critical to the recovery of Ireland’s tourism industry. In parallel to them Government needs to improve competitiveness which would benefit a number of tourism sectors from hospitality to car rental to tax return shopping and others. A staycation stimulus should also be put in place for autumn/winter months to maximise the domestic market and the waiver on rates should be extended for businesses in continued distress.

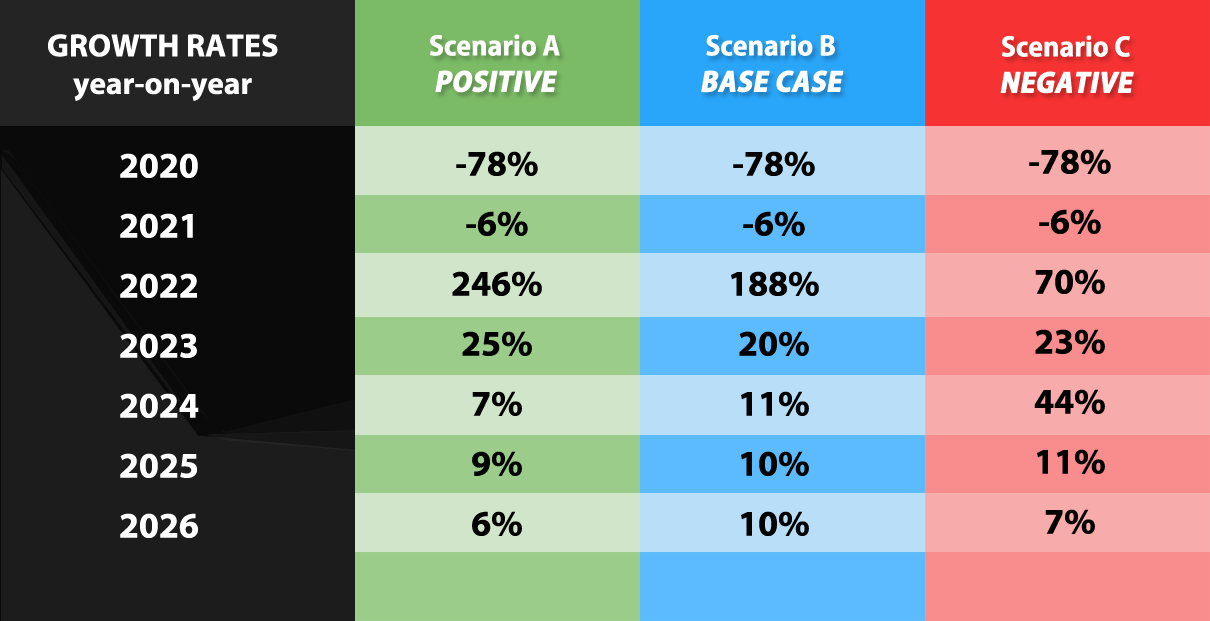

RECOVERY SCENARIOS FOR INBOUND TOURISM FROM OVERSEAS MARKETS

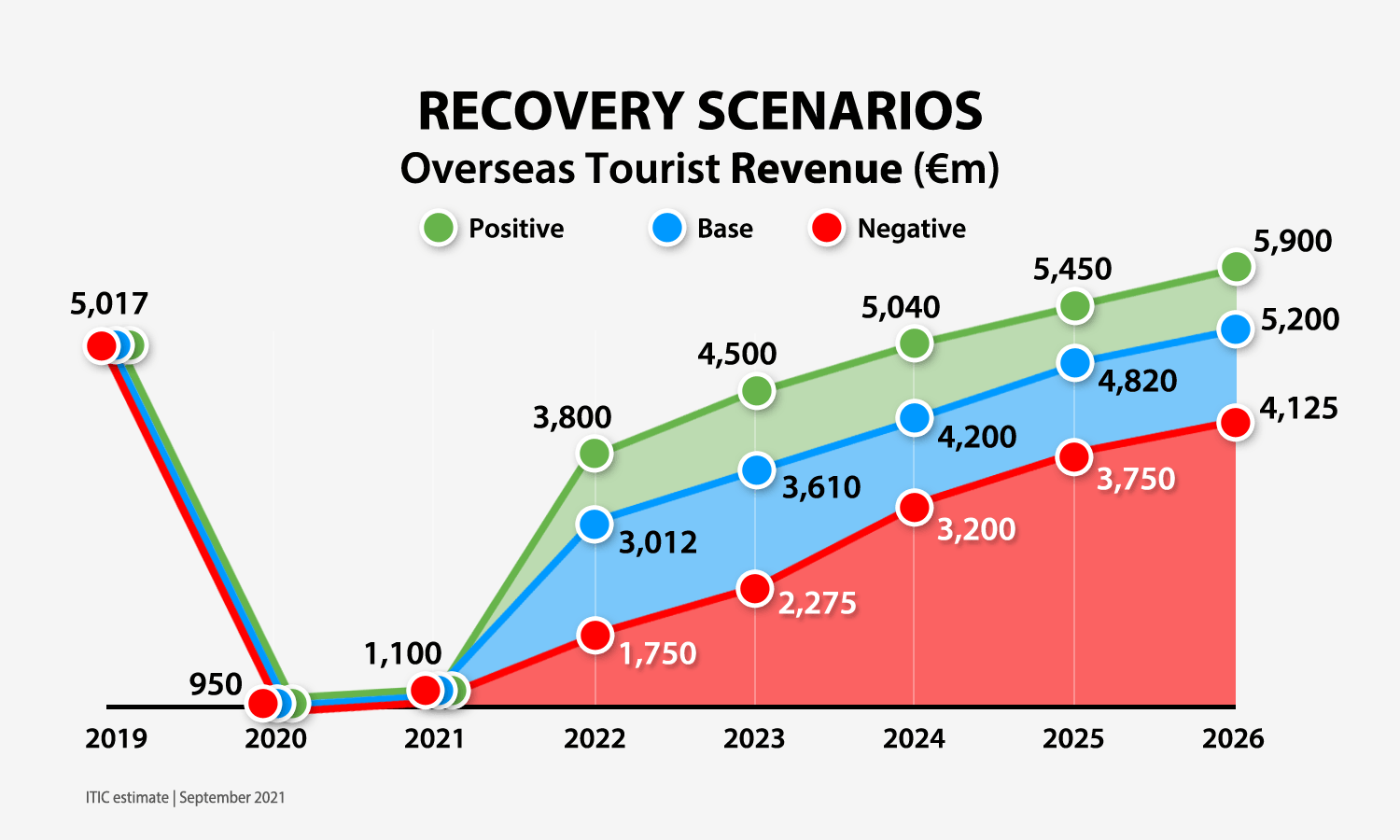

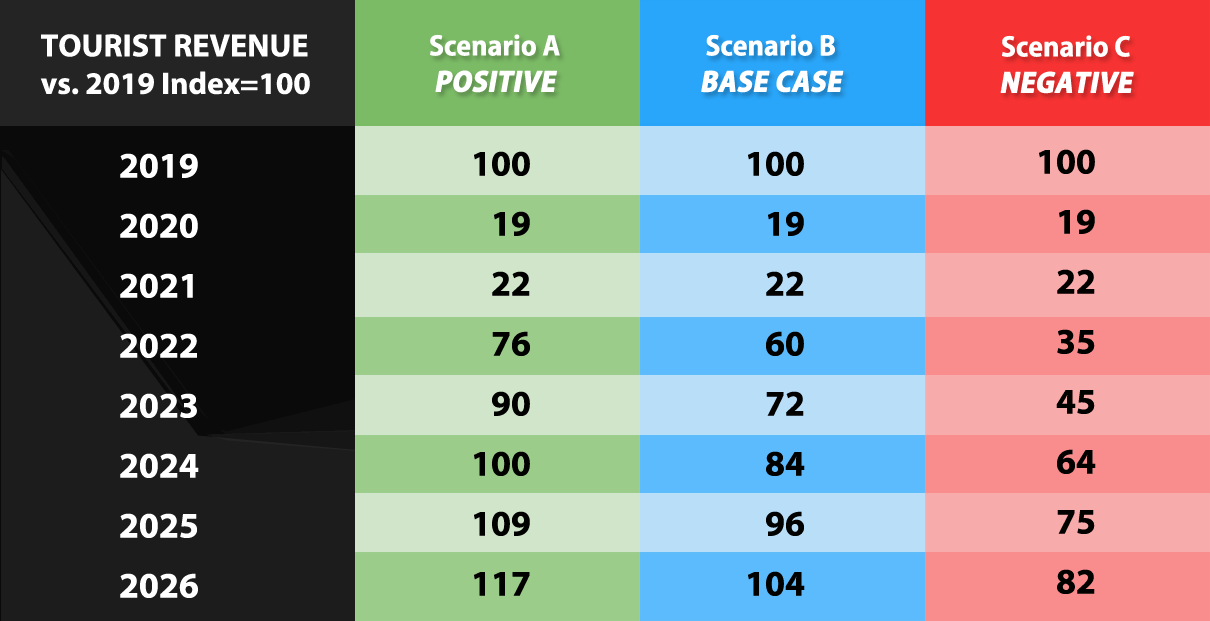

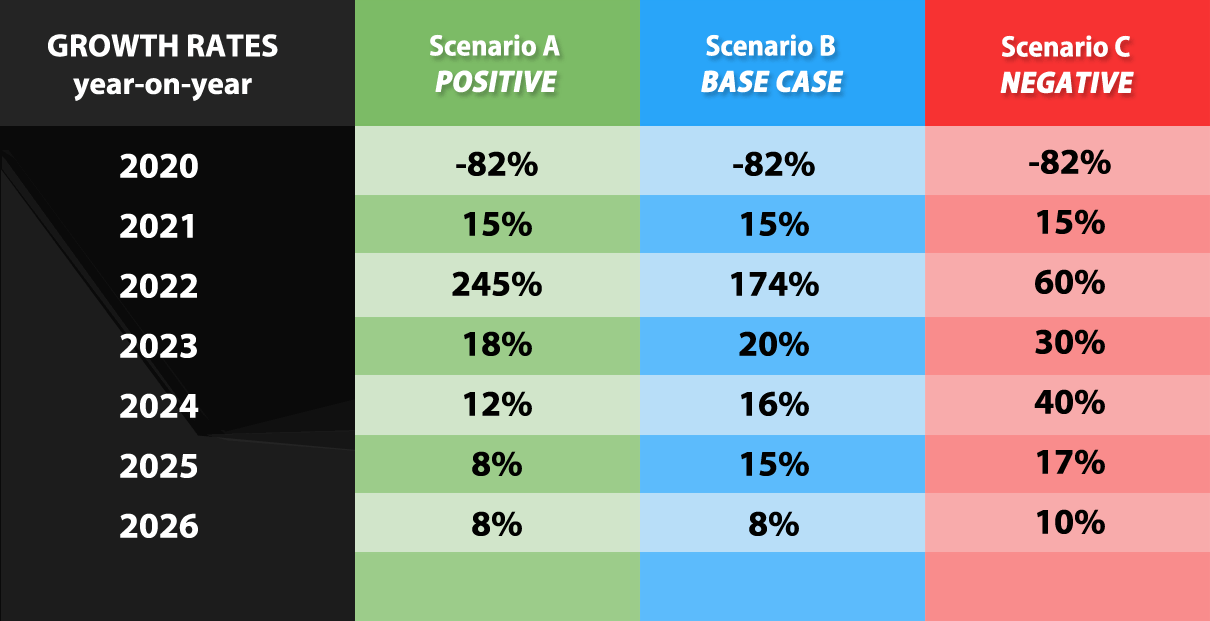

Back in June 2020 and again in February 2021 ITIC outlined a number of scenarios for in bound tourism from overseas markets for the years ahead. Based on more recent insights and developments these have been revised and are outlined below. The scenarios range from positive to baseline to negative and have been broken down by volume and value, clearly showing that a positive and fully-supported recovery could see growth return to 2019 levels by circa 2025 delivering enormous benefits to Ireland’s economy including accumulated overseas tourist receipts of €26 billion and 240,000 people working in the sector.

Data has been gathered on behalf of ITIC by TTC from travel and tourism stakeholders here in Ireland as well as a number of international sources. In a highly volatile world a number of assumptions have been made and these are outlined below.

Reference sources: IATA; EuroControl; ACI; McKinsey; UNWTO;WTTC; Tourism Economics; OAG; Expedia; DAA; IAG.

NOTE: As the situation remains very fluid and unpredictable, the scenario projections are apt to change as the pandemic, vaccinations and travel protocols evolve.

2021 – A YEAR OF FURTHER SLUMP IN TOURISM

Delayed restart

From a tourism perspective the year has failed to live up to expectations due to the continued devastating impact of the COVID-19 pandemic. The emergence of the Delta variant resulted in a further lock-down in Ireland and a regime of stringent travel restrictions. Despite the successful roll-out of vaccinations, Ireland has

had in place the most severe travel restrictions compared to other European destinations, including for the first time the introduction of mandatory hotel quarantine. The impact has had severe negative impacts on the tourism, hospitality and entertainment sectors, cutting off for a time both domestic and international visitor demand. In short, Ireland has been closed for tourism for the first half of 2021.

The successful roll-out of vaccines across most of the western world over recent months and the introduction of the EU Digital Covid Certificate, introduced on July 01, has facilitated the restart of international travel. While Ireland delayed the start until July 19 there is evidence that it has provided a re-start of demand for travel to and from Ireland. This together with Ireland and the UK aligning their travel regimes with the rest of Europe, including the acceptance of fully vaccinated European and US tourists without any quarantine requirements, has led to travel demand beginning to gain momentum for the first time this year.

First half 2021 downward spiral

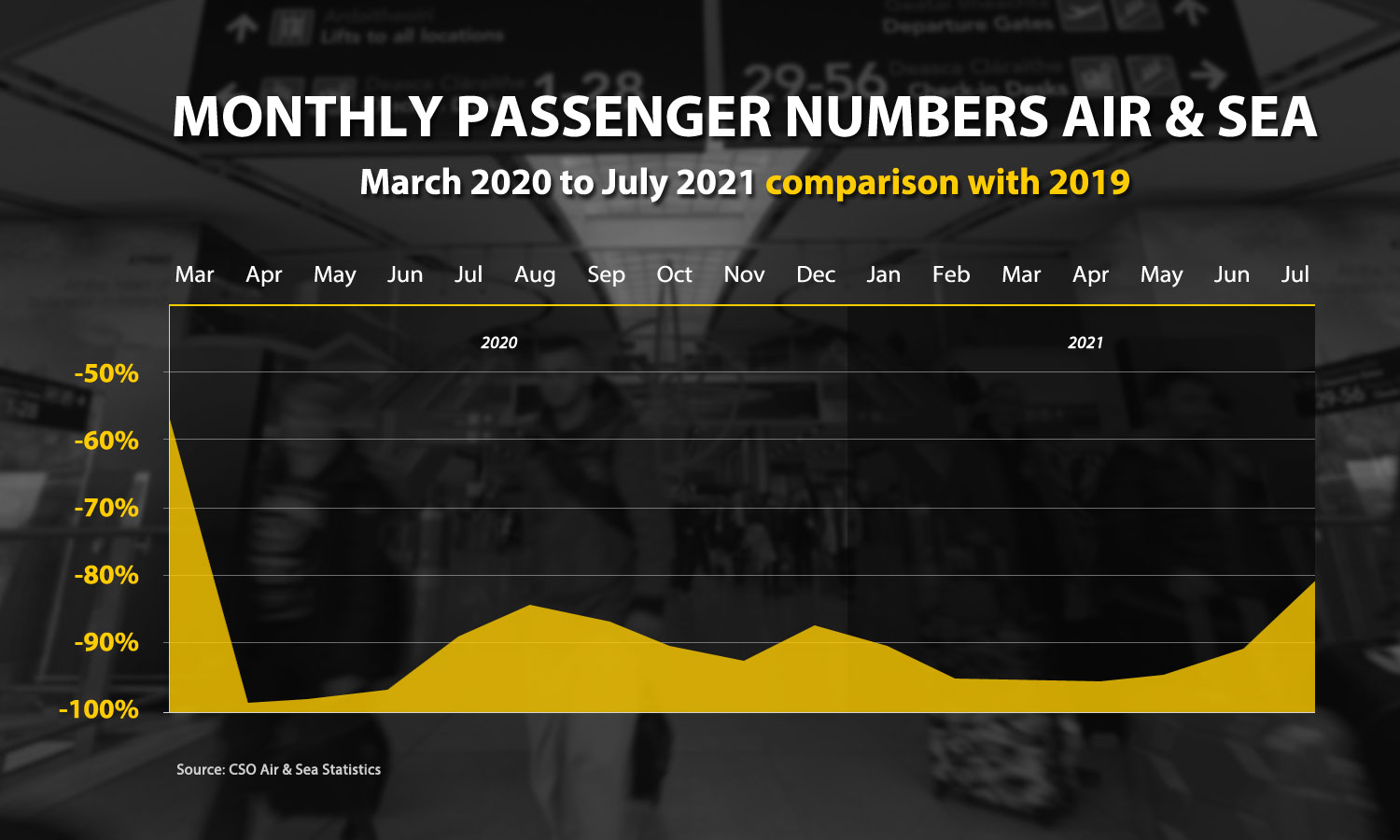

Ireland, due to its restrictive travel regime, has experienced a sharper fall-off in passenger traffic over the first half of the year compared to other European countries, and as a result is currently lagging the start of recovery apparent in some other countries. The first half of 2021 data shows travel into and out of Ireland was markedly worse than last year as traffic fell by 82%. Total passenger traffic into and out of the country from January to June fell to 1.15m journeys, a drop of 94% on the same period in 2019 (Source: CSO Air and sea statistics), with DAA reporting traffic down by 95% to just over 1 million passengers.

Passenger traffic decreased by 76.9% across the European airports network during the first half of the year compared to the pre-pandemic reference period (H1 2019), while airports in Ireland saw their traffic drop by 93.5% (Source: ACI Europe).

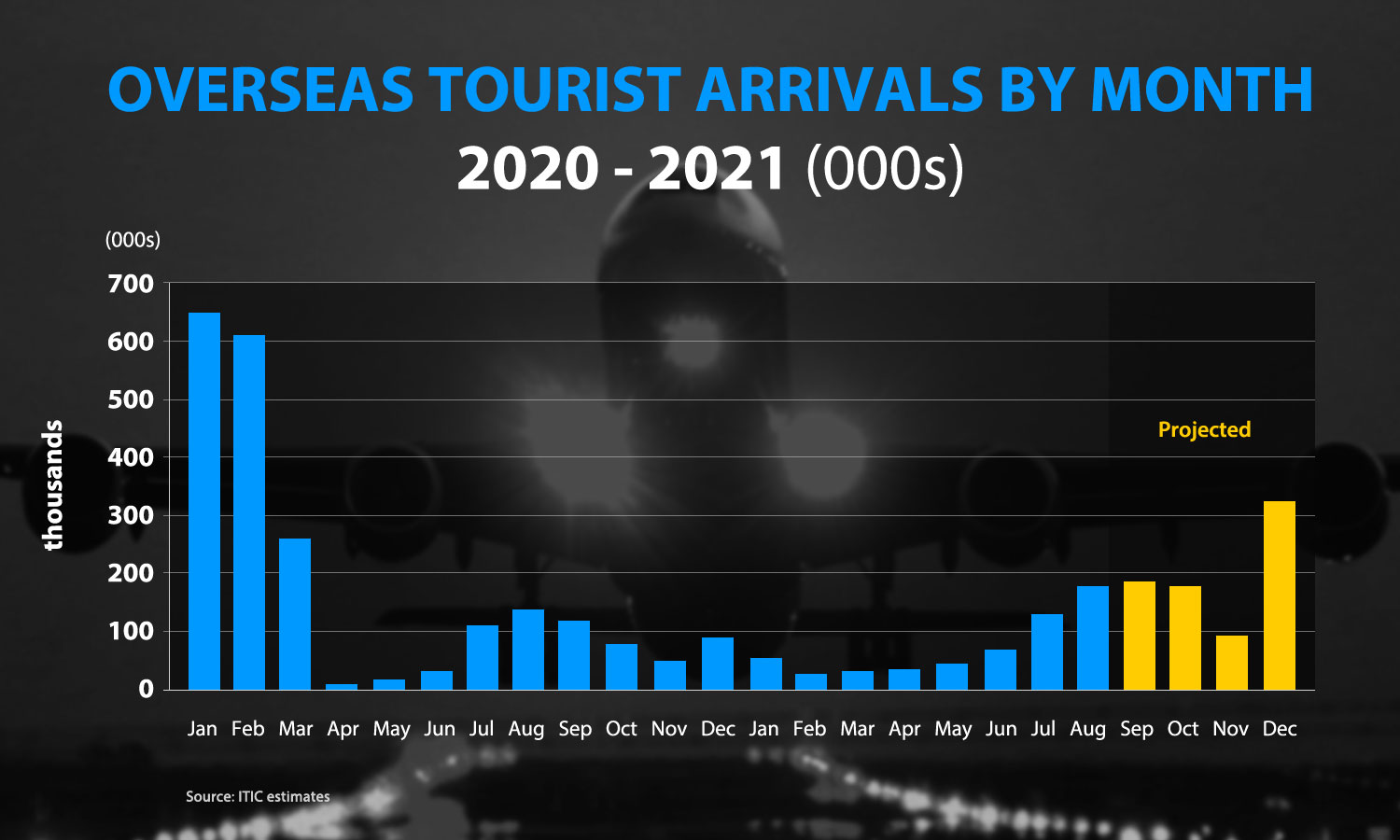

Visitor arrivals in the first half of the year, restricted to essential travel only, fell way short of expectation and below ITIC’s pessimistic or downside scenario (published in early 2021). Arrivals by non-Irish residents is now estimated at close to 250,000 over the six month period, compared to just over 5m in 2019.

Inbound tourism momentum in H2 2021?

Preliminary international travel data for July and August point to increasing momentum, while the future remains volatile and uncertain.

Latest indications are that passenger traffic on air services in and out of Ireland increased in the latter part of July. The DAA report that up to 32,000 passengers a day have been going through Dublin Airport since restrictions on air travel were lifted on 19 July 2021, with load factors climbing to 57%. Whilst this was a substantial improvement over earlier months, it was way off the 100,000-plus that passed through two years earlier. Over the month of August 1.26m passengers passed through Dublin Airport – 63% below the numbers from August 2019 when the airport had a record 3.4 million passengers. Compared to 2019, passenger volumes to and from continental Europe was down 54%, UK traffic was 72% down (118,000 passengers), while transatlantic passengers decreased by 77%, and other international passenger traffic to the Middle East fell by 82%.

The past month has seen both Ryanair, currently by far the dominant carrier, offering ultra low fares on an expanded flight schedule to/from Ireland. At Dublin Airport Ryanair has been operating more than half of daily departures, catering to the majority of short haul passengers.

Analysis of air services operating over the peak summer months shows that the expansion of services and capacity on offer has been largely on services to Mediterranean resort destinations and to Central and Eastern European cities. The capacity on offer suggests a particular focus on serving pent up demand for outbound sun and VFR visits. At the same time carriers have been gradually adding capacity on North American and Middle Eastern routes; catering exclusively for inbound traffic, as the USA and many long haul destinations remain closed to visitors from Ireland.

Based on available airline schedules and traffic data it would appear that outbound Irish travellers significantly outnumber visitors into Ireland since the lifting of restrictions in mid-July.

Ireland’s connectivity recovery lags the rest of Europe

A rebound in global air travel continued in July and August, supported by a willingness to travel and easing of restrictions.

European airport passenger traffic recovery moved closer to the capacity curve in early August 2021. Available capacity (seats) on airlines within Europe are 33.7% below 2019 levels in the week commencing August 16, 2021 – the closest that capacity has been to 2019 levels since before the pandemic. Yet, the recovery is not consistent across Europe with southern Europe performing better than northern Europe. Preliminary data for July reveals a decrease in passenger traffic of -51% across the European airport network compared to the same month pre-pandemic (2019). (Source: ACI)

Notably Ireland’s air traffic recovery continues to lag the rest of Europe. Data for Wednesday August 11, 2021 shows that flights to/from Ireland were considerably below the level of the equivalent day in 2019 at -59%, only Finland had a deeper reduction, while across Europe the aggregate number of intra-European flights was down -30%.

Ryanair carried 11.1m passengers across its European network in August, down 25% compared to the same month two years ago, filling 82% of seats on offer. In contrast, the airline’s traffic on Ireland routes is estimated to have been down, at close to 50%. A characteristic of recovery on intra-European air services has been the growth in low cost carriers (LCC) share, led by Ryanair and Wizz Air.

Ireland faces a major challenge in rebuilding connectivity. Access transport is an essential driver of Ireland’s economy, facilitating trade and FDI in addition to tourism.

The North Atlantic summer season is missed for this year

Despite strenuous attempts by airlines to reopen the very valuable North Atlantic market, President Biden has rejected calls to open the border to Europeans, while vaccinated Americans and Canadians are welcome in Europe. It is expected that North Atlantic services will reopen faster than other inter-continental connectivity with Europe, as airlines are currently denied half of their market during the usually bumper months for leisure travel. Where travel is possible, almost exclusively outbound from the US, economy yields are reported to be down by 22% on pre-pandemic levels. (Source: OAG)

Pre-pandemic North America has been the fastest growing vacation market for Irish tourism, accounting for 33% of foreign earnings in 2019. Expanding connectivity has been the key to growth in tourism from North America, with Aer Lingus central to the drive to grow the market.

285 flights per week over the peak months in 2019 operated on transatlantic routes connecting Ireland with the US and Canada. For most of the past 18 months this fell to less than 30 per week, increasing over the past 3 months. The pandemic has drastically reduced the number of North American gateways with services to Ireland.

The transatlantic market is critically important for Aer Lingus and Irish tourism. While US major airlines operating across the Atlantic typically generate more than three quarters of their revenue from ticket sales in the US, Aer Lingus is only one of two European carriers (along with Turkish Airlines) that traditionally earned more revenue from the US than its home market. Aer Lingus revenues in July-August 2019 is estimated at US$207m, of which just under two thirds was earned in the US. (Source: OAG Traffic Analysis)

Overseas tourists

Uncertainty and ongoing COVID transmission continues to cloud travel recovery, while the EU COVID Certificate has stimulated demand and reopened travel opportunities.

In the absence of official inbound travel data from the CSO, ITIC has been estimating visitor flows.

Estimated tourist arrivals in the first half of the year, extrapolated from total air and sea numbers, is estimated close to 260,000, falling far short of the ‘pessimistic/downside’ scenario published in early 2021. On the basis of traffic estimates for the year to date and the development of a range of short to medium term outlooks, it is now reasonable to assume that visitor traffic for the year is likely to reach close to 2 million visits, depending on a number of variables. The variables principally include the trajectory of the virus and its variant(s); the rate of further easing of travel restrictions; and the reinstatement of connectivity. A key variable for the tourism outcome is the opening up of the transatlantic travel market in both directions. It is anticipated that the remaining months of the year, especially December, will see a high level of demand for VFR visits from short haul markets. Demand from long haul markets, other than North America, is not expected to reopen before 2022 at the earliest.

Latest forecast from DAA suggests total Dublin Airport passenger traffic for 2021 at between 8 and 9 million.

International tourism to the United Kingdom was estimated to fall dramatically in 2020 by 73 percent, down to 11.1 million in 2020 from 40.9 million overseas visits in 2019. Forecasts for 2021 show that the number of overseas visits to the UK is expected to rise to 11.3 million, a two percent increase on 2020 visits, but still a significant decline over 2019. (Source: Statista Research Department, August 17, 2021)

Domestic Tourism

Domestic demand for holidays and day trips is an important component of the tourism economy. In 2019 Irish residents spent €2.15 billion on 11.6 million trips (excluding day excursions), while spending on holidays and leisure trips amounted to €1.3 billion.

Hospitality and tourism businesses were closed for most of the first half of the year. Since the re-opening of hospitality reports indicate a buoyant demand for holiday trips especially to coastal and traditional holiday destinations. It is apparent that domestic demand over the peak summer months, again this year, will enable many businesses to survive. However, the outlook for the autumn months is uncertain, particularly in the absence of events.

Key to recovery will be the early reinstatement of events – cultural, sporting and entertainment – which drive significant shoulder and off-season demand for short breaks and day trips. Full recovery will require a total removal of restrictions on the hospitality sector.

CURRENT OUTLOOK FOR INTERNATIONAL TRAVEL RECOVERY

Limited recovery of traffic is expected in 2021 overall due to travel restrictions in place during the first half of the year. Widespread vaccination and lifting of restrictions are expected throughout 2022 and 2023 which will facilitate a more rapid recovery in demand and flights from 2022 onwards. IATA’s latest scenario forecasts for Europe include a ‘baseline’ recovery to 98% of 2019 level by 2024, while the more optimistic scenario would see a full recovery a year earlier or a downside significantly longer recovery path. However, international travel is not expected to reach full recovery before 2025. (Source: Air Traffic Movement Outlook – Europe, August 12, 2021)

The latest scenarios suggest that the ‘most likely’ scenario would see flight traffic returning to close to 2019 volumes by 2025, while the previous more optimistic return by 2024 now appears to be unrealistic due to the delay in restarting of intercontinental traffic. The pessimistic scenario – persistent or recurring restrictions due to new and more transmissible coronavirus variants, lingering infection and low consumer confidence – could see full recovery take up to 2029. (Source: Eurocontrol: Policy Committee, June 25, 2021)

The situation is gradually improving for airports, but 2021 is not going to be the year of recovery, as Europe’s airports have already lost over 1 billion passengers this year– which is more than was lost last year to date. The outlook beyond the peak summer months remains uncertain, and is dependent on further progress with vaccination both in Europe and globally. Crucially, it is dependent on more Governments allowing and effectively facilitating travel on that basis, with a special focus on the US market, which remains closed to European travellers, increasing the level of frustration on both sides of the Atlantic. (Source: ACI Europe Release, August 10, 2021)

‘International travel largely on hold despite recent uptick, while recovery remains very fragile and uneven’. A return to 2019 levels in terms of international arrivals could take between two and four years. Findings from UNWTO ’s most recent survey of panel of experts found that almost half (49%) do not expect worldwide travel to recover before 2024 at the earliest, with just over one third (36%) more confident of recovery by 2023. The panel was marginally more optimistic of recovery of tourism in Europe by 2024. (Source: UNWTO Release, July 23, 2021)