Introduction

With prices rising, there is understandably a significant focus on Irish tourism’s competitiveness and value for money. This bulletin by the Irish Tourism Industry Confederation (ITIC) looks at the sector’s international context, the unique cost pressure points on Irish businesses, the importance of retaining our value proposition, and outlines 9 key policy areas that Government can assist industry in maintaining competitiveness.

Blinking – bruised and battered – from the pandemic, the 20,000 businesses that make up Ireland’s tourism industry had been kept alive thanks to Government financial assistance and demand from the domestic market. Covid-19 had cost Irish tourism in excess of €12 billion over a 2-year period as international visitors, the mainstay of the industry, were prevented from coming to our shores.

Since March though, when restrictions were finally lifted, business has bounced back at a much quicker pace than had been expected. Pent-up demand, deferred bookings, and accumulated savings have all meant that travel and tourism around the world has surged.

However, recovery has not been without its challenges, while the current geopolitical and economic outlook suggests that the rate of recovery may not be sustainable. Recent increases in global energy, food and transport costs, together with a tight labour market and supply chain disruptions, threaten Irish tourism’s fragile recovery.

The sector is now facing a challenging trading environment against the background of the ongoing war in Ukraine, a softening of consumer sentiment due to rising inflation and interest rates, and increasing costs of doing business in Ireland at a time of economic uncertainty.

In recent weeks the increasing price of scarce hotel rooms and rental cars has attracted much media interest, at home and abroad, with some examples of excessive price hikes undoubtedly denting Ireland’s reputation.

Competitiveness is critical to the recovery of Ireland’s tourism industry. A sector which pre-pandemic generated close to €10 billion revenue, supported 260,000 jobs in over 20,000 businesses, mostly SMEs, and sustaining regional economies and rural communities across the country.

Context

International travel has bounced back

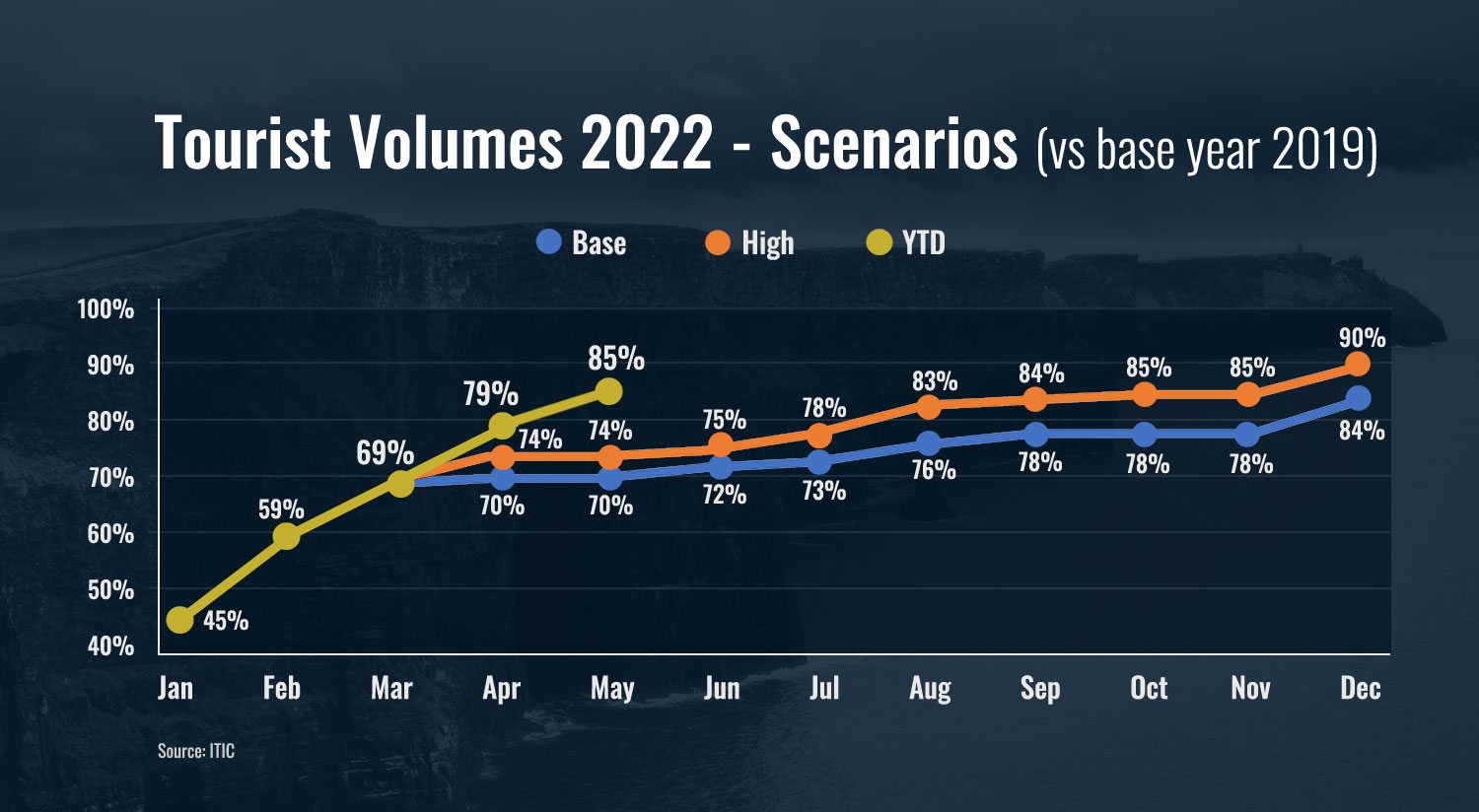

Demand for international travel has been on an upward trajectory with the progressive lifting of Covid travel restrictions over the past six months. The resurgence of demand has been most evident within Europe and North America, while recovery in Asia-Pacific source markets is lagging the rest of the world.

The number of intra-European flights in June reached 90% of 2019 levels, ahead of Eurocontrol’s optimistic forecast, bringing year to date traffic to close to 80% of pre-pandemic levels. Within the market LCCs (Low Cost Carriers) have been especially aggressive in restoring capacity. Ryanair, the market leader, reported its best month ever in June carrying 15.9 million passengers, 12% ahead of the same month in 2019, achieving a load factor of 95% across its network. Airline capacity between North America and Europe is currently at 85% of 2019 summer levels.

Ireland’s connectivity speedily restored

A rapid reinstatement of airline routes and capacities has been a major driver of recovery of travel into and out of Ireland in 2022. The competitive positioning of Ireland is considerably enhanced by the presence of two home based airlines – Aer Lingus and Ryanair – together with the services of all the major European, North American and Middle Eastern network carriers. Capacity on offer during the peak months this year is close to 90% of 2019 levels. Dublin Airport’s direct worldwide connectivity has been restored to 93% of pre-pandemic levels thanks to the incentives provided by Government, with Ireland’s main gateway improving its connectivity ranking within Europe from 20th to 14th.

Inbound visitor numbers increasing by month

ITIC estimates that visitor arrivals to Ireland over the first five months of the year have reached close to 2.8m, or almost 70% of the level over the same period in 2019. Visitor arrivals have been increasing each month relative to the same month in 2019, with arrivals in May estimated to be within 15% of the same month pre-pandemic. The January to May period traditionally accounts for approximately 40% of the annual visitor arrivals.

The buoyancy of inbound visitor demand is due to not only the release of pent up demand but also a large number of bookings deferred because of the pandemic – the latter is especially evident in group travel, coach tour and business events.

Challenges presented by rapid resumption of travel

The speed of recovery, which has exceeded most expectations, has resulted in a number of challenges for facility and services providers on the ground in Ireland. Ireland’s capacity to cater for the demand at an acceptable level of service has been found wanting on occasion due to labour shortages, reduced availability of hotel accommodation, and a 50% cut in car rental fleets.

While many of the labour and capacity constraints are not unique to Ireland, many visitors will have had a poorer experience and the destination risks suffering reputational damage and value erosion.

Full recovery may be up to 4 years away

ITIC estimate that visitor arrivals are projected to reach around two thirds of 2019 levels – close to 6m visitors in this very untypical year of demand. Unfortunately, the level of tourism earnings for the year is difficult to project at this point in the absence of CSO surveys.

While demand is proving to be buoyant so far this year, the unique post Covid circumstances and the composition of demand, the performance to date is unlikely to form the basis of a linear progression of growth into 2023 and beyond. The worsening economic conditions and the threat of a new Covid variant threaten future recovery, with ITIC not expecting to see full recovery to 2019 visitor volumes until at least 2025/6.

Rising costs driving price increases

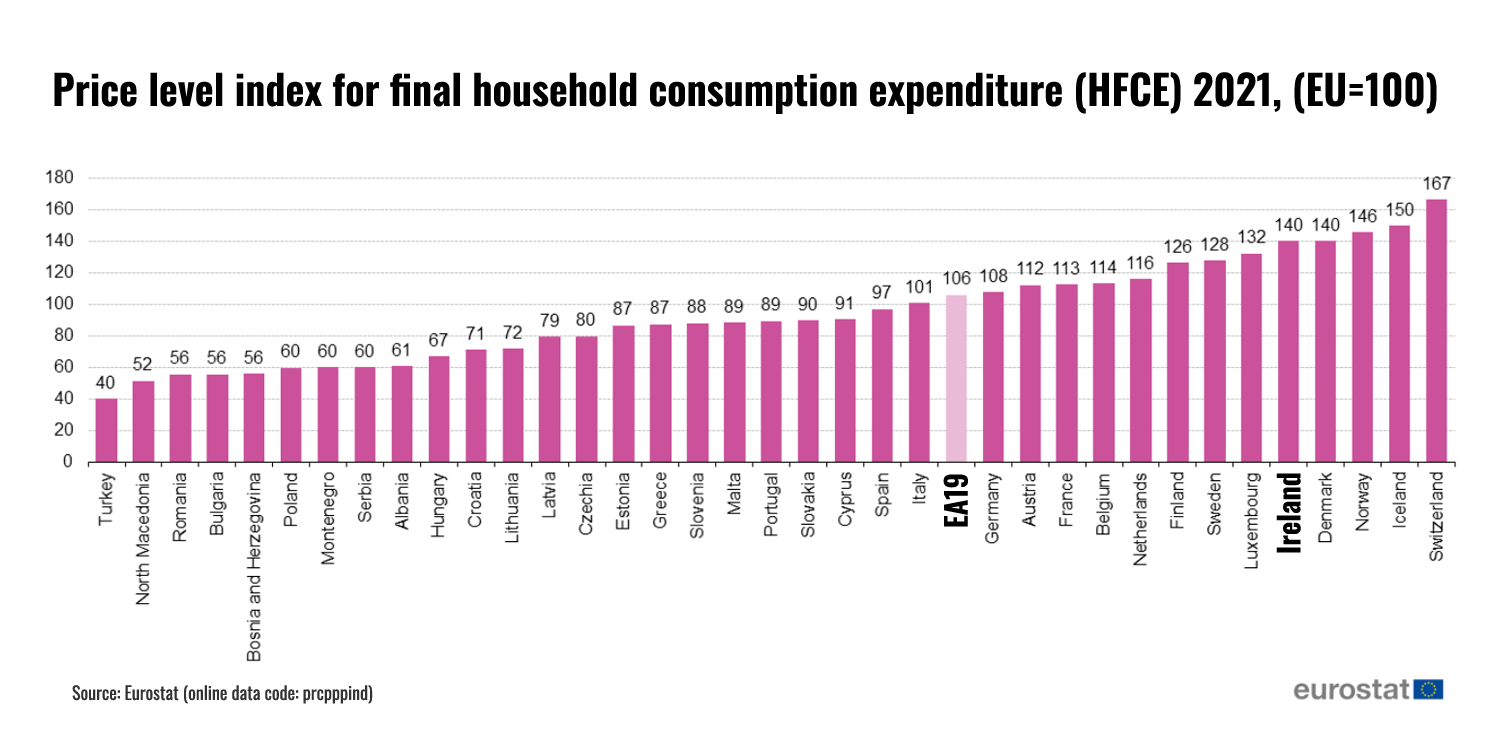

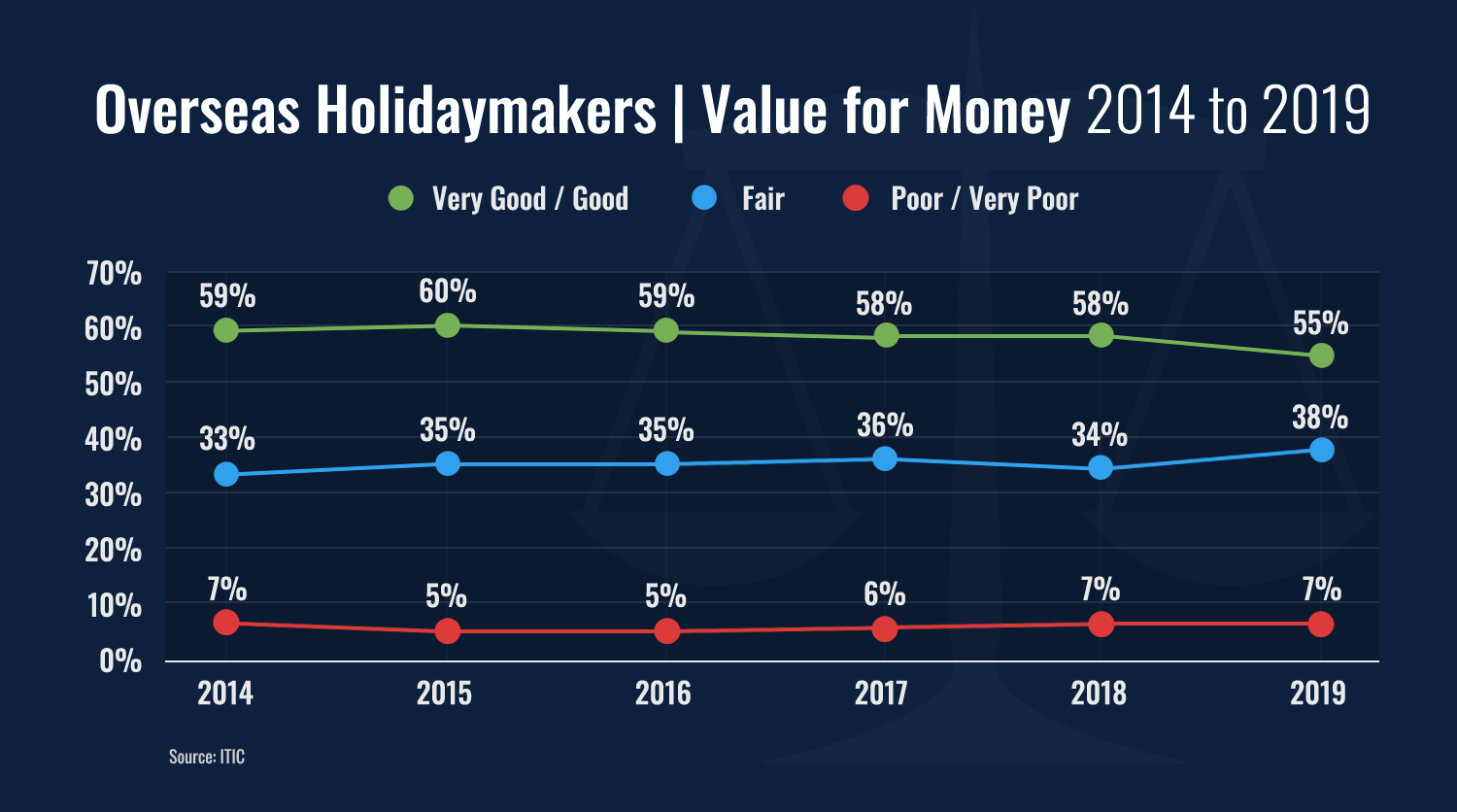

Ireland is a high cost economy, with the cost of doing business here higher than in many of our European neighbours. As a tourist destination Ireland has positioned itself as a value experience rather than an inexpensive destination with close to 60% of holiday visitors consistently rating their experience as ‘good or very good’ value for money in recent years.

The price of a visit to Ireland reflects the cost of living within the country

Ireland, along with Denmark, was the most expensive country to live in across the EU in 2021. Consumer costs in Ireland were 40% above the EU average. Only Switzerland, Iceland and Norway had a higher cost of living.

The EU Harmonized Index of Consumer Prices shows that the national annual rate of inflation in Ireland has outpaced the rate of increase in most other EU states. Ten years ago prices in Ireland were 18% above the EU with the cost of living the fifth highest in the EU after Denmark, Finland, Luxembourg and Sweden.

Latest estimate show that the annual rate of inflation in Ireland rose to 9.6% in June, higher than many forecasts and exceeding the 8.6% rise across the Eurozone. Energy cost inflation accelerated to 41.9% in June compared to 39.1% in May, the single greatest component in the rise in inflation, while food prices are estimated to have risen by 8.9%, up from 7.5% in May. (Eurostat 01 July 2022)

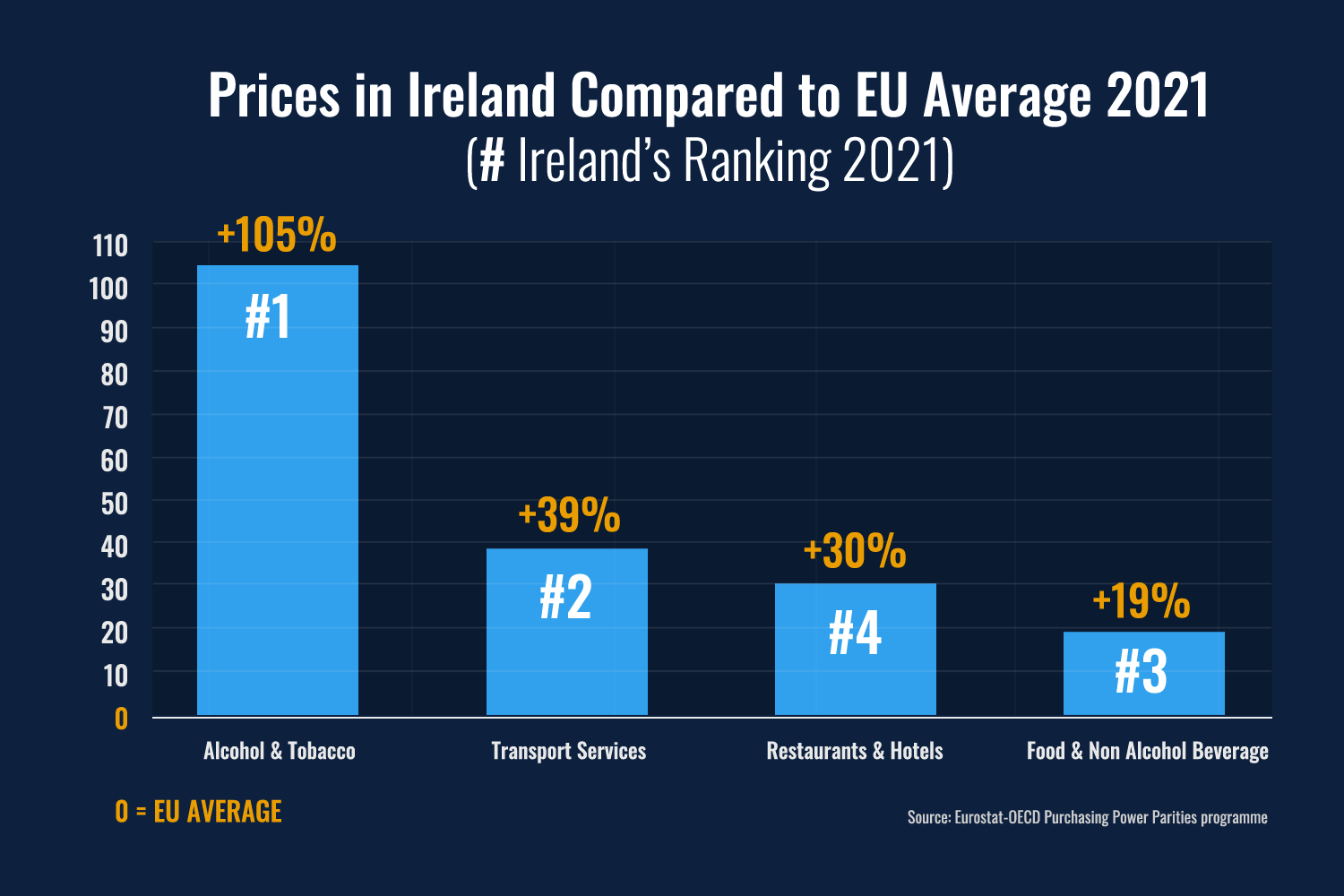

Typically almost 80% of the expenditure by tourists in Ireland is on accommodation, food and drink, and internal transport. Ireland is ranked in the top 5 most expensive destinations in Europe for the main items consumed by visitors.

Hotel and restaurant prices in Ireland were found to be 25% above the average across the Eurozone; alcoholic beverages and tobacco prices almost double; and transport services at third more expensive. Compared to the UK, Ireland’s main competitor in most source markets, prices of holiday components of accommodation, food and drink in Ireland were at between 23% and 30% higher.

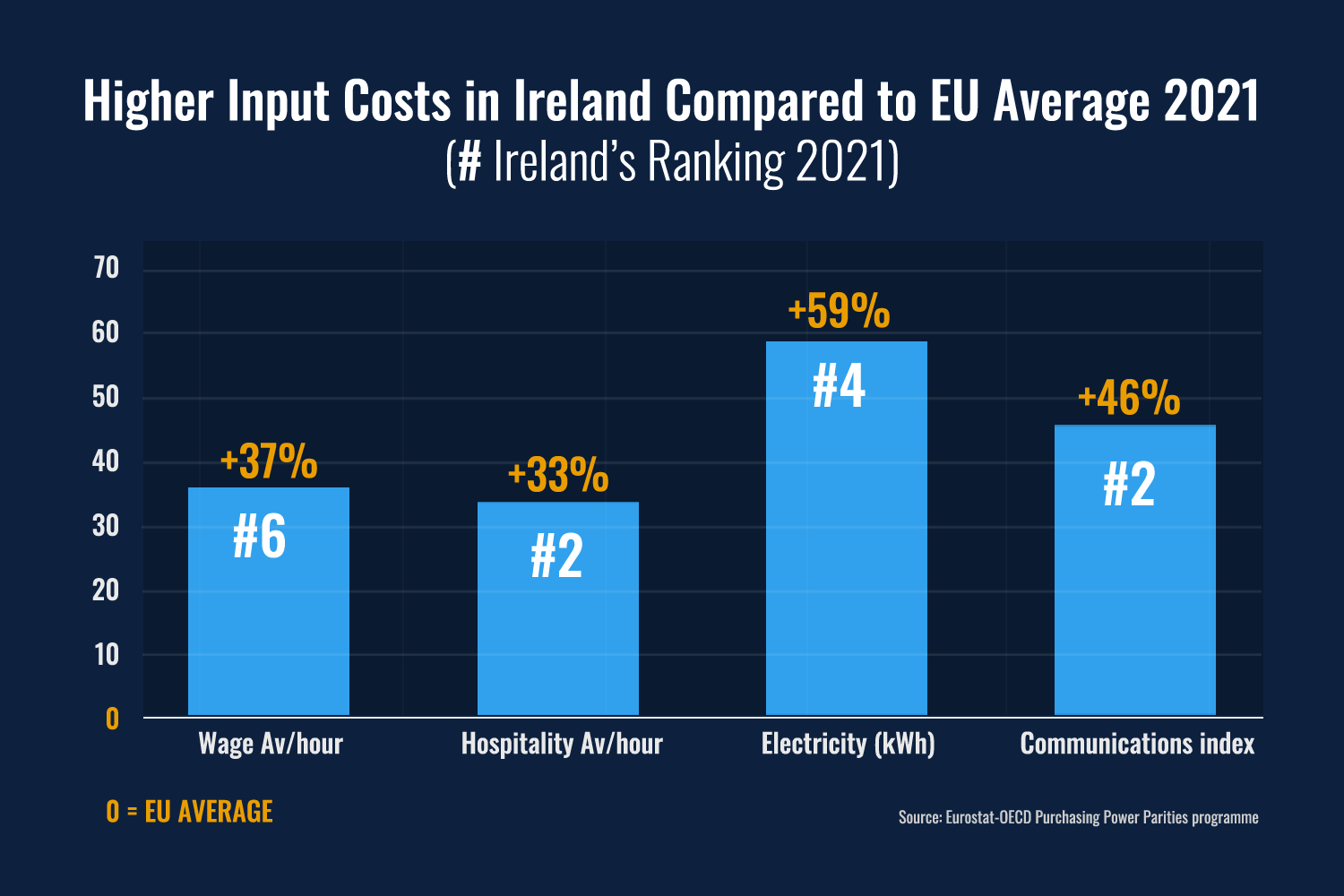

Business input costs determine the price to the visitor

Hospitality and tourism businesses face cost of inputs significantly above the EU average. These include labour, energy, food and drink supplies, insurance, and communications. The already high input costs are currently under further pressure from rising inflation. Should the rate of inflation in Ireland exceed the rate in other European countries the tourism offering here will become less competitive.

Higher costs in a tightening labour market

Tourism and hospitality is a labour intensive business, with the quality of personal service a key value.

Labour costs in Ireland have tended to be higher than in many other European states. The minimum wage at €10.50 per hour, 77% above the EU average, is the second highest in Europe. Within the accommodation and food service sector the average hourly wage at €17.60 per hour, is one third higher than the EU average.

The industry has lost large numbers of personnel following the enforced closure of businesses over the past two years. Over the period many moved to other sectors of the economy as well as international staff returning to their home countries. This exodus exacerbated the pre-pandemic skills shortage within the sector. The speed of the recovery of demand has highlighted the labour shortages. Even before full reopening 88% of businesses reported difficulty in recruiting new personnel, with just over two thirds experiencing difficulty in rehiring staff. (Source: Failte Ireland survey July 2021).

With employment in the country at an all time high, with 2.5 million people at work and just under 130,000 registered as unemployed, the recruitment situation has become more acute. Fáilte Ireland estimate that the number of job openings in the tourism and hospitality industry is at 40,000.

The staffing shortages have resulted in considerable stress on meeting demand in 2022. Despite businesses investing in recruitment and training, realignment of working hours, and increasing rates of pay, many operations have been forced to reduce trading – a cut in opening hours or a reduction in capacity on offer. In extreme instances it has resulted in some business closures. From a customer perspective the result has been a reduction in choice and/or the quality of the experience. This coupled with higher prices runs the risk of serious longer term reputational damage.

With unemployment expected to reduce further by year end to 4%, the industry is facing an enormous challenge, with upward pressure on wages inevitable and the risk of a further deterioration in the already critical skills levels.

Rising utilities, insurance, communication, and sustainability costs

Energy prices rose across the globe as the world bounced back from the pandemic have been exacerbated by supply issues following the invasion of Ukraine. Ireland has always been one of the costliest countries in Europe for energy. Electricity rates for businesses rose sharply in the latter part of 2021 to reach €1.23 per kWh, 60% above the EU average. Given Ireland’s reliance on natural gas for power – in the top three in Europe – it can be anticipated that prices may rise faster than in many other European countries. The rate of increases in energy costs, which have yet to fully reflect the impact of supply issues as a consequence of the conflict in Ukraine, have a significant bearing on the cost inputs for businesses in the tourism and hospitality sector. From a visitor perspective Ireland as a touring destination – with almost 50% of holiday visitors are mobile in cars and coaches – will see prices increase at the pump.

High cost of food and drink

Alcoholic beverages: High excise duty puts Ireland at the second highest priced country in Europe for beer and spirits, and the highest for wine.

Food costs: Producer prices have increased rapidly over the 12 months to May 2022, with a 37% increase across dairy products; while meat and fish increased by 17% and 8% respectively.

Visitors have consistently quoted the higher price of food and drink, compared to their home country, as impacting their evaluation of value for money spent on their holiday here.

VAT

With the reduced tourism VAT rate of 9% scheduled to revert to 13.5% in February 2023, Ireland will be amongst the top rate for visitors on accommodation and food across Europe. This would significantly damage Ireland competitiveness at a time when inflation on key visitor components would be further disadvantage.

Availability and cost of insurance a particular challenge for hospitality and tourism businesses

The Alliance for Insurance Reform has identified 20 business subsectors catering to tourists which struggle to get cover or are reduced to one underwriter with an effective monopolist’s hold over the sector. Despite recent reforms in the insurance sector, annual premium for liability coverage continue to increase by upwards of 16% per annum. Lack of competition in the market has been identified as the prime cause of higher premium costs compared to what is on offer in other European destinations. The situation in Ireland has forced the closure of several businesses and events over recent years.

Precarious financial health of the sector

Tourism businesses, together with arts and entertainment, were closed for longer than other sectors of the economy due to Covid restrictions on trading. Survival was possible only as a result of a heavy reliance on Government supports, use of cash reserves, and availing of loan repayment breaks. Most businesses emerged in 2022 from the brink of financial collapse with significantly weakened balance sheets. Businesses in the accommodation and food sector relied more heavily on Revenue’s tax warehousing scheme with almost two out of every three (63%) eligible enterprises deferring over €40m of taxes. Many of these businesses still have a debt overhang with over 60% unpaid, in part or in full, as of March 2022.

With borrowing costs in Ireland amongst the highest in EU, reflecting size of market, legal, regulatory and legacy issues, a situation that is unlikely to change as interest rates rise over the coming months. The above factors, together with a decline in recent years of new lending to the sector, puts the future of the sector at risk and has serious longer term implications for investment to deliver a quality experience to meet visitor expectations and to ensure that Ireland remains competitive.

Unique supply side pressures in 2022

Demand has exceeded expectation, including a high level of deferred bookings, with Dublin experiencing a period of exceptional post Covid demand as events resume at a time when hotel capacity is reduced due to the Ukraine crisis.

Hotel reduced capacity and higher prices

Price of available hotel accommodation in Ireland is impacted by inflation on cost inputs coupled with a shortage of hotel rooms to meet demand in selected locations and dates. Hotel stock is down by an estimated 15% on pre-pandemic levels as a result of rooms contracted by Government to accommodate people fleeing from Ukraine and asylum seekers. The impact on guest accommodation stock is most marked in Dublin and other selected tourist areas including counties Clare and Kerry.

Despite media headlines of sky high hotel prices, the average cost of Irish hotels has risen by 21.4% from €136.71 in May 2019 to €165.97 in May 2022. Irish hotels appear to have enjoyed the highest occupancy rate for the month at 84.9%, followed by the UK (77.4%) and Italy (72.9%), according to the latest data from the global hospitality analytics company STR.

Dalata- Ireland’s largest hotel operator – reported RevPAR in its Dublin and rest of the country properties for May-June expected to be 18% and 27%, respectively, ahead of the same period in 2019. Dalata reported that their Average Room Rate was €160 for Q2.

Car Hire

Limited availability of rental cars and inevitable increase hire costs as demand exceeds supply is not unique to Ireland. The cost of renting a car in European holiday destinations has almost doubled compared to 2019, with experts predicting that prices will remain high due to a global shortage of new vehicles which could continue for a number of years. It is estimated that the summer car hire fleet in Ireland is down by at least 50% below the 2019 level. The sector’s higher costs structure in Ireland, due to higher taxation on vehicles, exacerbates its competitive disadvantage in a time of recovery of demand.

As a consequence, the price of car rental in Ireland this summer is an outlier compared to competitor destinations across Europe. There is a real risk that Irish holiday bookings are not materialising due to the excessive cost of car rental. This will have a particularly negative impact on regional Ireland.

Ireland at risk of losing value proposition

Pre-pandemic over half of holiday visitors (55%) reported that the value for money was ‘good or very good’, with only 7% judging the experience ‘poor’ value for money.

The extent of the price hikes been sought by a minority of hoteliers and car rental firms in a tight demand versus supply situation in 2022, most particularly in Dublin, has generated significant adverse publicity abroad putting at risk Ireland’s reputation as a good value destination.

As cost inputs increase at a rate faster than those in competitor destinations Ireland’s price competitiveness disimproves. The industry needs to guard against the consequences of a repeat of the rapid price increases seen during the Celtic Tiger years, dubbed the ‘rip off republic’. Ireland’s value for money rating deteriorated sharply from 2000, with two out of five (41%) of holiday visitors rating their experience as ‘poor or very poor’ value for money in 2007. As a consequence, when the global financial crisis hit in 2008, seriously dampening demand for travel, Ireland’s tourism suffered from a deeper fall off in demand and a longer period of recovery – up to seven years – compared to other European destinations. Key Government action, including the introduction of the 9% VAT rate, contributed significantly to restoring Ireland’s competitiveness. By 2013 only 13% rated Ireland as poor value, which improved further averaging close to 7% annually over the five year up to 2019, the last available year for which there is data.

Tourism competitiveness is a complex concept for any destination. In essence, it is about Ireland’s ability to optimise its attractiveness and win market share by delivering a visitor experience which meets market expectations and provides good value for money while improving the sustainability of the destination and its people. The key fundamentals are quality of appeal and experience coupled with good visitor experience and value for money. The most obvious components from an economic and business perspective are the cost and efficiency of production of the experience and the visitor’s assessment of the price value equation.

The shortages in labour, and the reported significant price increases in some sectors of the industry, have the potential to impact the quality of the visitor experience and inflict longer term reputational damage, thereby threatening the sustainability of Ireland’s largest indigenous sector of the economy.

Competitiveness dynamics – the influences on competitiveness can change quickly – creating further challenges.

Short to Medium Term Outlook

While Covid related concerns amongst perspective tourists are diminishing, international tourism recovery is facing into a new set of challenges. These include the rising cost of living and the consequences of, what increasingly looks like, a prolonged conflict in the Ukraine.

Airlines continue to report strong demand for travel and are committing to increasing winter capacity compared to last year. However, the geopolitical and macro-economic situation will see fares increase as fuel prices remain high due to supply issues. The developing economic environment looks set to slow international travel recovery.

A global economic slowdown, stagflation or recession?

Latest forecasts point to the world economy facing higher inflation and weaker growth, with many economies at risk of recession while central banks tighten policy and raise interest rates.

Global economic growth has been revised downwards following the invasion of Ukraine. The OECD’s latest Economic Outlook projects global growth to decelerate sharply to around 3% this year and 2.8% in 2023, well below earlier projections and down from 5.7% in 2021. The economy of the EU is expected to grow by 2.7% this year.

It is estimated that Irish GDP will grow by 6.8% in 2022, with the equivalent measure rising by 4.8% next year, driven by strong export growth. The ESRI expects that modified domestic demand to increase at a slower pace than previously projected with growth of 4.4% in the current year and 3.7% in 2023.

As well as increased economic growth, the ESRI believes that the unemployment rate nationwide will continue to fall to around 4.3% by the end of the year. This trend is expected to continue and the estimation is that just 4% of people will be out of work by the end of 2023.

Soaring inflation also cast a shadow over the public finances, business and consumer sentiment. A wide range of economic indicators – market volatility, interest rates and inflation suggest a recession on the horizon or stagflation – stagnant growth coupled with inflation. Recession is not inevitable but rising interest rates in the face of inflation and supply chain disruption points to a contraction. 76% of 750 corporate executives in the US believe that a recession is looming or has already begun according to latest data from the US Conference Board.

Consumer sentiment – a current snapshot

The war in Ukraine and especially high inflation are weighing heavily on consumer sentiment. As a result of weak economic and income expectation, consumer propensity to spend is showing signs of being subdued. High energy and food costs coupled with increased interest rates, is resulting in less money available for discretionary purchases, including travel.

UK: Consumer confidence hit a new low in May 2022, surpassing the previous record low in July 2008 amid the global banking crisis. UK inflation surged to 30 year high of 9% in April. With the rise in prices outpacing wage increases, together with the threat of industrial strikes, the UK consumer confidence index decreased in June, the lowest since records began in 1974. (GfK)

USA: Consumer sentiment fell sharply to a record low in June, well below market expectation, as consumers’ assessment of their financial situation worsened, mostly attributed to inflation. (Michigan Consumer Sentiment Index).

Germany: While consumer climate improved slightly in May and expected to do so again in June, consumer sentiment is still at an all-time low. (GfK Consumer Climate Study).

France: Consumer confidence edged further downwards in May, the lowest reading since 2014 as consumers became more pessimistic regarding the standard of living for the next 12 months. (INSEE)

Domestic tourism: While Irish consumer sentiment improved slightly to 57.7 in June after a rare four months of decline but remained far short of the 2022 high of 81.9 in January, according to the KBC Bank of Ireland index. A tightening economic outlook is likely to depress demand for discretionary spending on domestic leisure trips.

Just over half (52%) of respondents across Ireland’s top source markets cited concern about cost of living increases were most likely to influence their decision on taking a holiday, with potential visitors from Britain and France being most sensitive about rising costs and diminishing disposable income which could prevent one in four from travelling. For Americans the greater influence is the conflict in the Ukraine, which could impede travel for one in five. A key finding from the research is that two in five holidaymakers agree that the rising cost of living could force them to defer trips. “The findings suggest that value for money will be really important for travel as the year progresses, with consumers keeping a tighter eye on their spending”. [Source: Tourism Ireland commissioned research amongst 1,000 outbound holidaymakers in Britain, the United States, Germany and France conducted in April 2022]

Building Back Better: 9 Recommendations

How Irish tourism can protect its value proposition

Sustainable recovery of tourism will depend on instituting additional policy measures to enable improved competitiveness and building resilience within the sector. ITIC proposed the following 9 actions: