The Competitiveness of Irish Tourism

Review & Outlook

28 June 2023

The Competitiveness of Irish Tourism

Review & Outlook

28 June 2023

Introduction

Irish tourism is at a key juncture with demand strong but supply significantly compromised and sustainability at the heart of all considerations. In that context this timely report from the Irish Tourism Industry Confederation (ITIC) looks at the competitiveness of the sector and how worrying signs of erosion need to be addressed. Crucially the report outlines 10 strategic recommendations as to how Irish tourism’s competitiveness can be improved.

Ireland’s tourism recovery continues apace in 2023, with a positive outlook for the peak summer months. Consumers continue to prioritise travel despite increased costs of living and the ongoing war in Ukraine. Demand for travel has been facilitated by the rapid reinstatement of international airline and ferry services post COVID.

However, the rapid recovery has not been without its challenges. Ireland, despite full restoration of international connectivity, is pushing hard against labour and tourist accommodation constraints. The latter, due to Ireland’s over-reliance on tourist accommodation for providing shelter to refugees, not only reduces capacity but also inflates what the tourist pays for accommodation. Recent price comparison analysis of leisure travel to competitor European destinations shows the cost of certain elements of the tourism package in Ireland to be significant.

Competitiveness is critical to the continued recovery and sustained growth of Ireland’s tourism industry. Pre-pandemic tourism generated close to €10 billion in revenue, supported 260,000 jobs in 20,000 businesses, mostly SMEs, thereby sustaining regional economies and rural communities across the country.

High inflation, in an already high cost economy, coupled with supply side issues runs the risk of threatening the competitiveness of the Ireland tourism offering. The current competitive dynamic presents a set of new challenges for businesses in the sector. While price is not the sole defining factor of Ireland’s competitiveness, value for money is undoubtedly a major determinant of competitiveness. With steep price cost rises feeding through to higher prices Ireland’s competitiveness is at risk of losing its the value for money positioning in the international marketplace.

Ireland’s Recovery on Track, Connectivity Restored

Ireland’s tourism recovery – an industry perspective

Close to 7 million international tourists visited Ireland in 2022, 27% below 2019 numbers. Domestic trips totalled 13.3 million, spending an estimated €2.9 billion, with holiday volume and expenditure up 14% and 39% respectively on pre-pandemic levels, according to the latest data from Fáilte Ireland and the CSO.

Macroeconomic and geopolitical volatility has dominated the business environment for tourism since the re-opening of international travel post COVID. Currently energy prices are off their peak but inflation, while slowing, is still ‘sticky’.

Fáilte Ireland’s most recent Barometer reports that more than half of businesses (53%) are experiencing an upswing in demand. Almost two thirds of tourism operators predict an increase in overseas visitors this year compared to Covid impacted 2022, with demand from North America reported to be particularly buoyant, with almost just over three out of five respondents predicting an increase in US and Canadian visitors. Demand from mainland Europe is mixed, while recovery of demand from Britain is reported to be more subdued, with only 35% expecting a year on year increase.

The upswing in international visitors is despite increased airfares and rising prices, as businesses struggle with input cost increases. For almost three of out every four businesses rising costs – energy and other inputs, including food – are the primary supply side concern set against a decrease in disposable incomes on the part of the consumer.

Industry’s outlook on prospects for 2023 vs 2022

| Volume 2023 vs 2022 | Domestic + International | International Visitors |

|---|---|---|

| Up | 56% | 61% |

| Same | 26% | 23% |

| Down | 18% | 16% |

Source: Fáilte Ireland Barometer, May 2023

Despite a projected increase in visitor levels this is not reflected in the overall profitability of the sector, as businesses struggle to make ends meet due of soaring input costs, with food and drink businesses hardest hit. The current economic market environment makes rising price difficult with growing concern about the value for money proposition and the longer term impact on the country’s reputation.

Research continues to show that Ireland’s reputation and appeal remains strong amongst the target segments across its top source markets. The recovery drive, supported by Government funded connectivity supports and destination marketing, is based on continuing investment by businesses across the sector in innovation, productivity, marketing and delivering quality experiences. However, it is evident that the pandemic has resulted in accelerated changes in travel demand trends, including sustainability and climate change concerns. In addition, post pandemic demand is expected to show some shifts in the composition and profiles of international tourists to Ireland as consumer travel trends evolve.

Global tourism this year is expected to recover close to pre-COVID levels, according to the UN World Tourism Organisation. International air passenger traffic worldwide remains resilient, reaching 84.6% of pre-pandemic levels in April, with North American carriers reporting full recovery. Industry wide airline passenger traffic is predicted to reach close to 88% of the 2019 levels, with European traffic reaching 98%. Traffic between Europe and North America is currently running at 2% ahead of 2019, based on latest data from IATA. Airlines are achieving improved yields on the higher average load factors and higher fares, which have remained elevated despite a drop in fuel costs.

Ireland’s connectivity fully restored to 2019 levels

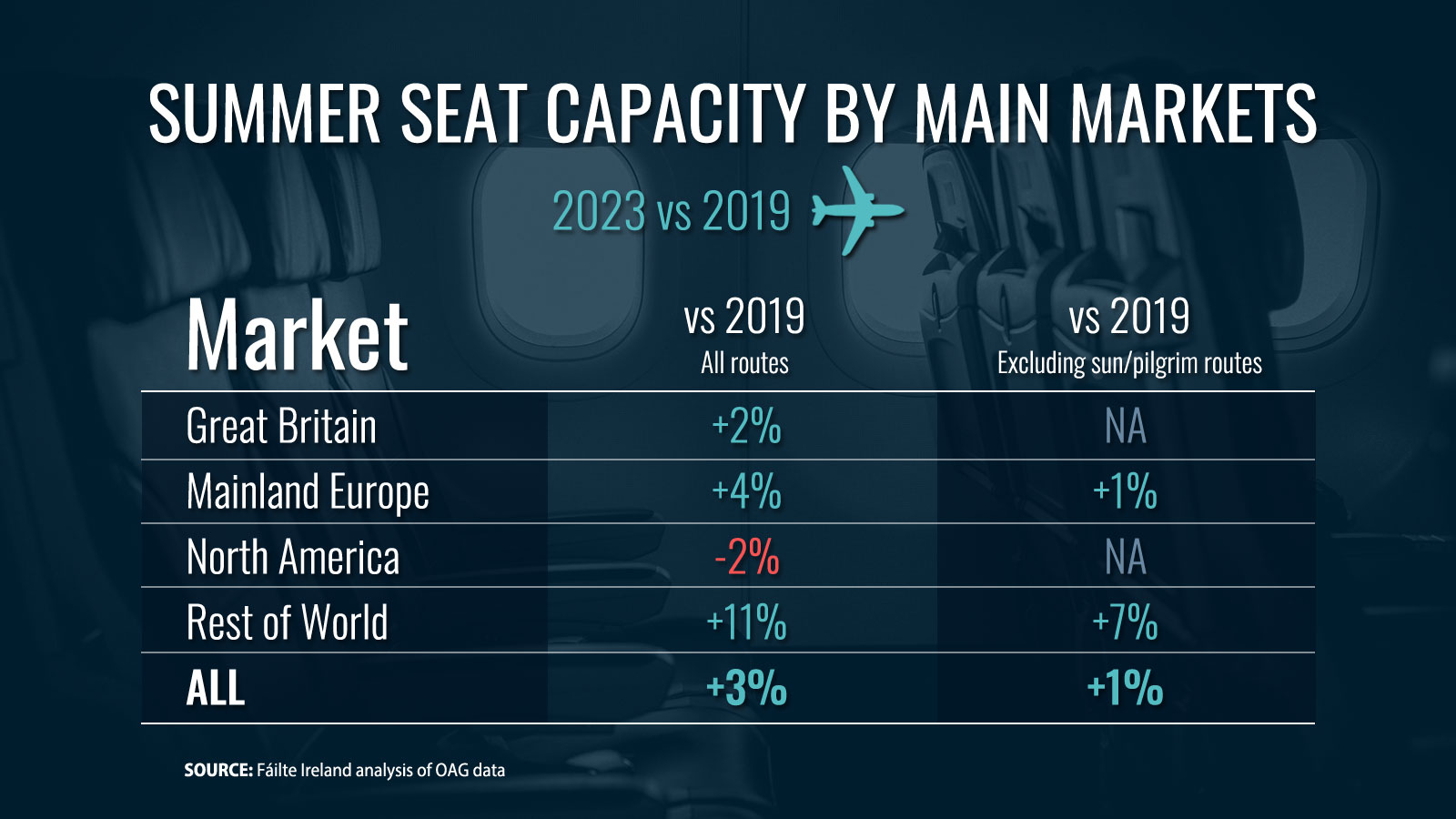

Airline and ferry connectivity has been critical to Ireland’s tourism growth over many years in not only facilitating, but also driving, demand. Summer 2023 sees total seat capacity on air services to/from Ireland up marginally (+3%) on 2019. Stripping out the increased capacity on offer exclusively to outbound sun and pilgrimage destinations, capacity on offer from an inbound tourist opportunity is back to 2019 levels. Ferry capacity is up on pre-pandemic levels, with a significant expansion of travel options and capacity on routes to/from mainland Europe.

Ireland continues to enjoy an efficient and competitive airline connectedness which is critical to the success of tourism. Aer Lingus and Ryanair, two home based airlines, rapidly reinstated service post COVID. In addition, all other network carriers have restored service to/from Ireland, with some adding capacity.

Summer access recovery from the four main markets mirrors the full-year schedule recovery with Mainland Europe (104%) and Great Britain (102%) above their 2019 summer capacity while North America is very close to a full recovery (98%) and Rest of World (111%).

While the airlift situation for the summer season is positive overall, capacity on offer from Germany, Ireland’s top European tourist market, is down 23% this summer on pre-pandemic levels, significantly weakening of Ireland’s competitive positioning in this important source market.

Ryanair is the dominant carrier on short haul routes having increased its share of capacity and extended the number of routes served. Ireland is the carrier’s 4th largest market with almost 1,300 weekly departures this summer, uniquely serving all 5 airports.

Aer Lingus, in addition to maintaining an extensive network of services from key British and mainland European gateways, has led the recovery on transatlantic services. This summer the airline will operate its largest ever summer transatlantic schedule, on 16 routes from Ireland with up to 128 weekly departures. Dublin is now the 5th largest hub for travel between North America and Europe, thanks to investment at the airport and the Aer Lingus’ strategy. This summer sees Hartford service reinstated as well as the addition of Cleveland as a new gateway.

Ireland benefits from a highly competitive fare regime from most markets. Ryanair, as price leader across Europe, ensures that airfares to Ireland are highly competitive from Britain and mainland Europe. Aer Lingus with its value fare strategy on transatlantic routes, including its hub strategy to/from Europe offering a stopover in Ireland, delivers a highly competitive price for travel to Ireland from USA and Canada.

Government incentives have been instrumental in securing a rapid reinstatement of air services, recognition of the critical importance of connectivity for tourism, trade and FDI.

Ireland’s Economy – High Cost, Rising Quickly

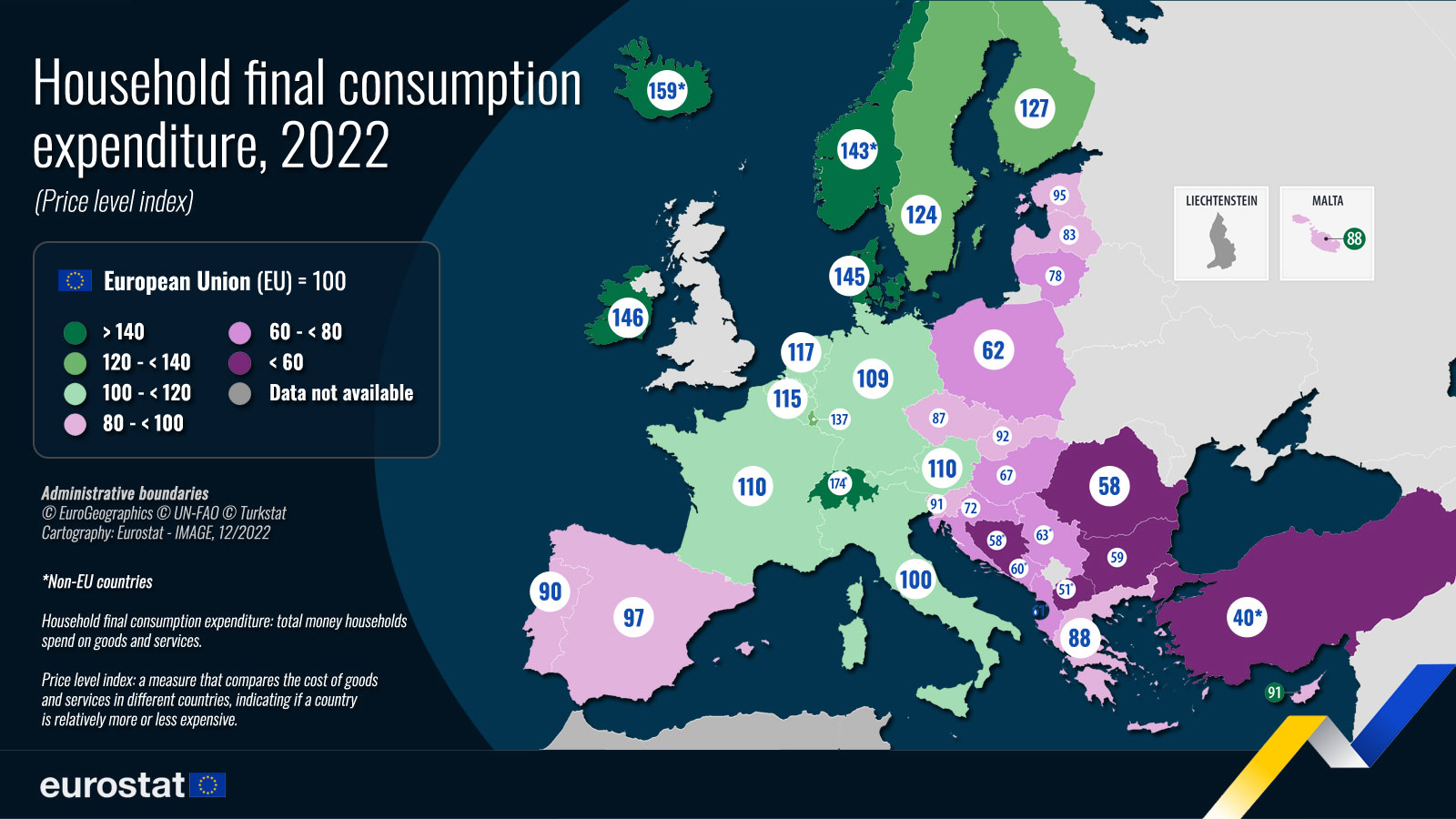

Ireland is a high cost economy, with the cost of doing business higher than in many of its European neighbours. As a tourist destination Ireland has positioned itself as a value experience rather than an inexpensive destination. Close to 60% of pre-pandemic holiday visitors consistently rated their experience as ‘good or very good’ value for money.

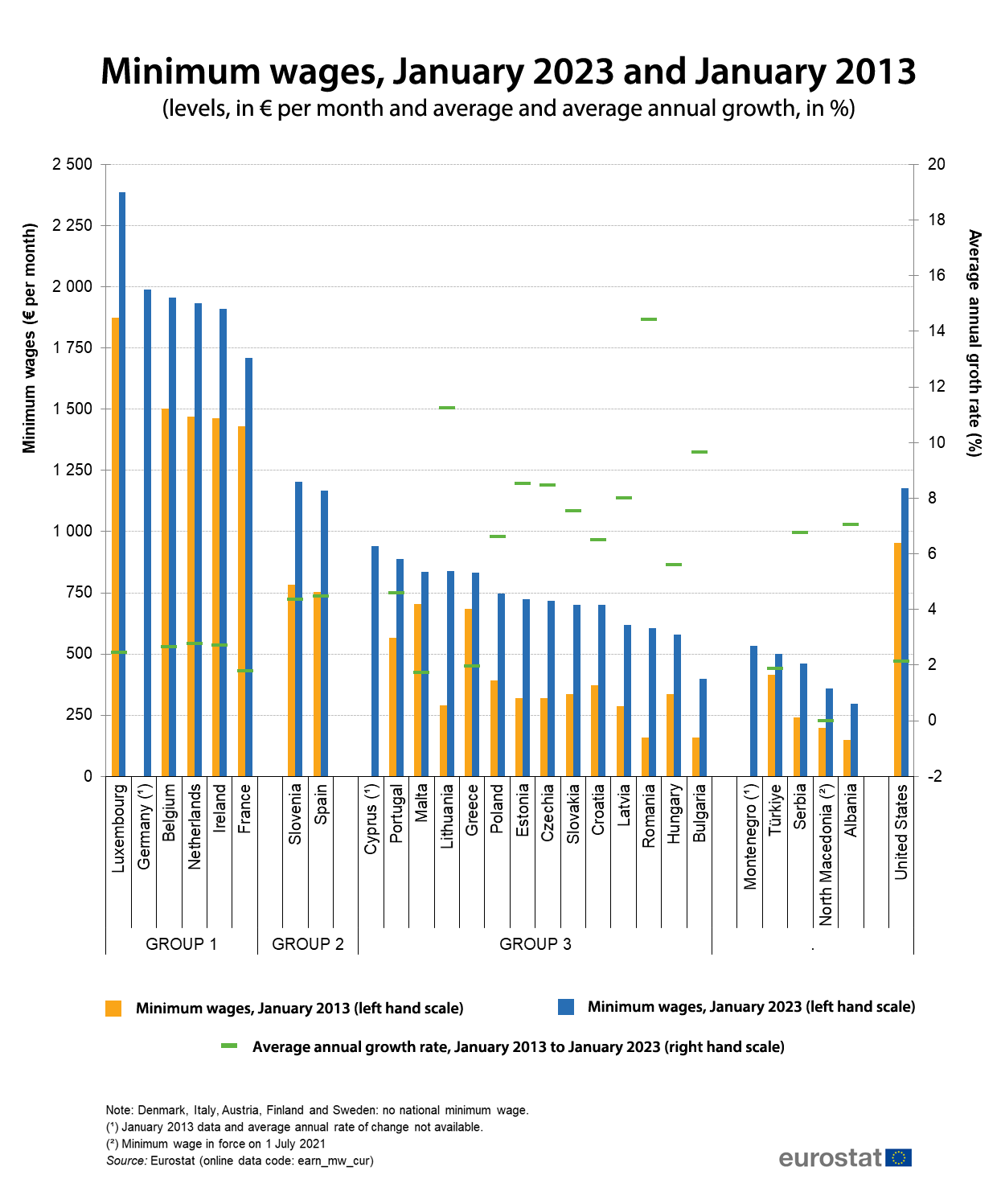

Business costs in Ireland are relatively high in a European context. For example, Ireland’s minimum wage is more than 70% above the EU average, while electricity (+14%) and cost of credit (+50%) have historically been well above the European norm.

Tourism as a labour, energy and capital intensive industry – these high cost inputs feed directly into higher prices for the visitor.

The already high input costs are currently under further pressure from rising inflation. Should the rate of inflation in Ireland exceed the rate in other European countries the competitiveness of Ireland’s tourism offering will be further eroded.

The price of a visit to Ireland reflects the cost of living within the country.

Ireland was the most expensive country to live in across the EU in 2022. Consumer costs in Ireland were 46% above the EU average. Only Switzerland, Iceland and Norway had a higher cost of living.

The highest price level for alcohol and tobacco was recorded in Ireland at more than twice (+116%) the EU average, due mainly to high taxation on these products.

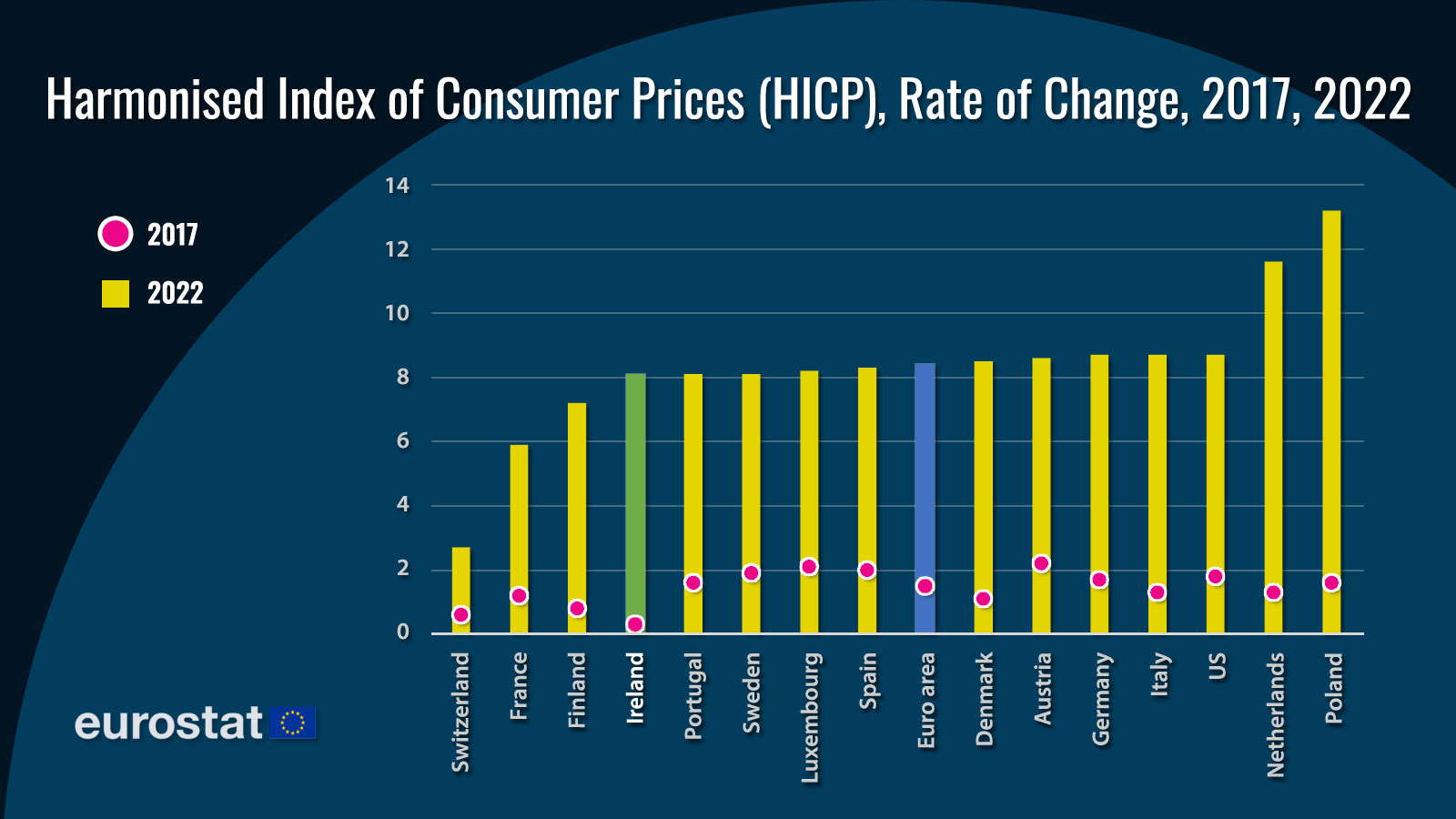

The EU Harmonized Index of Consumer Prices shows that over the past decade the national annual rate of inflation in Ireland has outpaced the rate of increase in most other EU states. Ten years ago prices in Ireland were 18% above the EU with the cost of living the fifth highest in the EU after Denmark, Finland, Luxembourg and Sweden.

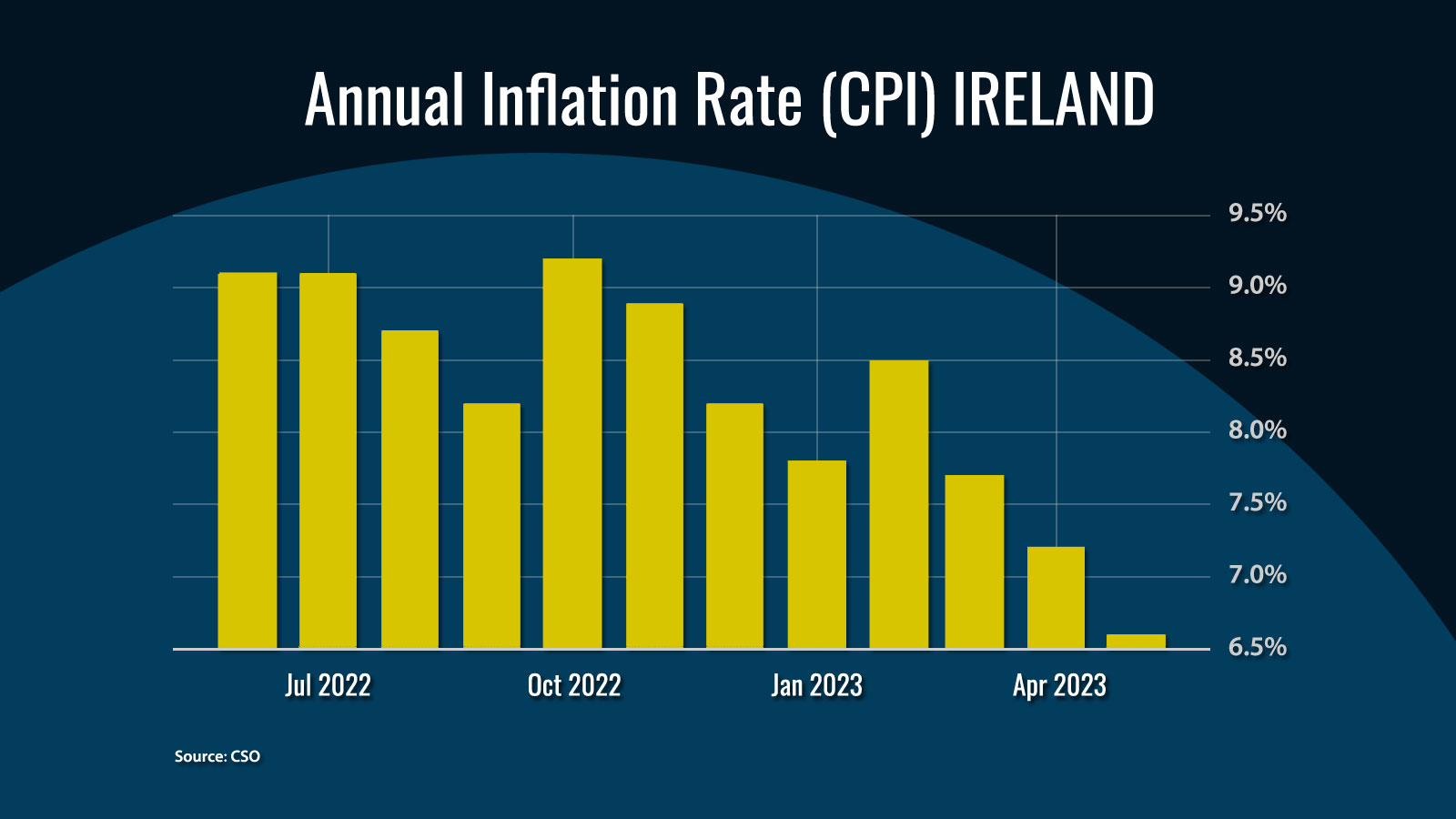

Rising costs and supply issues driving prices

The annual inflation rate in Ireland fell to 6.6% in May 2023 from 7.2% in April, the lowest since February 2022. Cost of energy increased, with electricity (+34.7%) and gas (+47.4%). Also, prices of food & non-alcoholic beverages rose by 12.7%, reflecting a rise in prices across a range of products such as sugar (+42.5%), frozen fish (+28.1%), fresh whole milk (+18.9%), and eggs (+18.8%). Prices in restaurants and hotels rose by over 8.1% over the twelve month period to May 2023.

On a monthly basis, consumer prices went up 0.3%. The divisions with the largest month on month growth in May were Restaurants & Hotels (+1.6%) and Alcoholic Beverages & Tobacco (+1.0%), while Transport, energy and communications showed a decline.

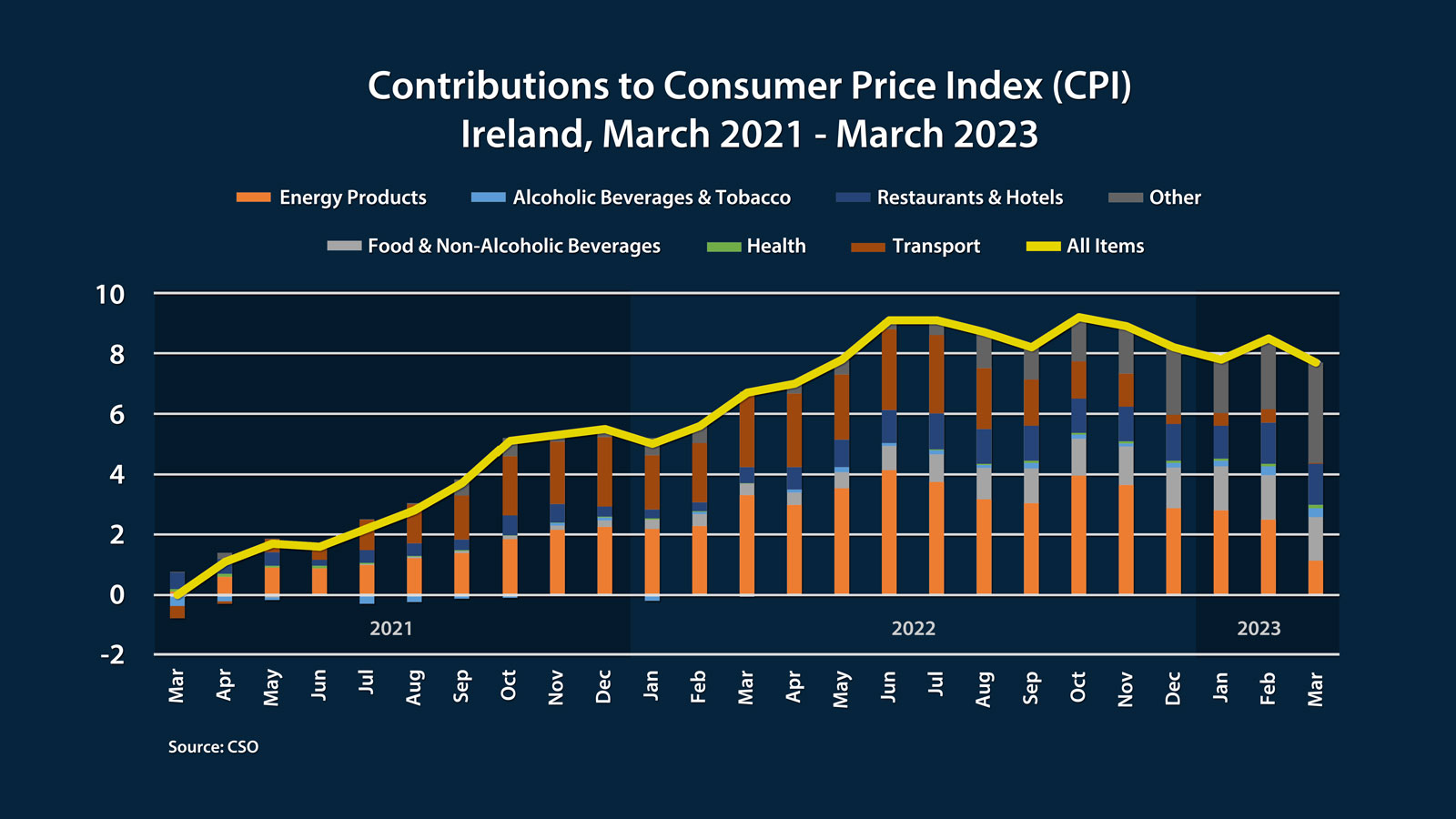

Most of the pick-up in inflation since mid-2021 has been driven by energy products and food. The contribution made by other components was also increasing as energy costs and supply chain disruption begin to feed through into core inflation (excluding energy).

Despite a fall in the rate of price increases, Ireland’s inflation rate is currently running ahead of the annual rate across the Eurozone at 6.1% in May. With global energy and food prices continuing to ease, domestic factors are beginning to play a more important role in the inflation outlook. Latest forecast from the Central Bank see annual inflation in 2023 falling to 5.3%, before dropping to 3.4% in 2024 and 2.5% in 2025.

Producer prices across Europe, an early indication of trends in consumer inflation, fell for a seventh consecutive month in April, almost entirely due to declining energy prices, according to the latest data from Eurostat.

Taking both the changes in prices (inflation) and the price level together, Ireland’s inflation rate has moved from being one of the lowest in the EU and below the Euro area average – moving Ireland into having a current price profile that may be described as ‘high cost, rising quickly’.

Rising prices in hotels and restaurants

Typically almost 80% of the expenditure by tourists in Ireland is on accommodation, food and drink, and internal transport. Pre-pandemic, Ireland was ranked in the top 5 most expensive destinations in Europe for the main items consumed by visitors.

With significant rises in the costs of business, prices in hotels and restaurants have been rising above the rate of overall inflation in Ireland.

Latest data from the CSO shows that the annual rate of inflation for accommodation services, predominantly hotels, was running at 14.7%, while the year on year price rise for restaurants and cafes was 6.8%.

While there are identifiable underlying costs and supply factors to explain the high rate of increase in prices in the accommodation sector, the concern is that the rate of price rise in Ireland has been higher than in many competitor European destinations. Price inflation in the restaurant sector is broadly in line with experience across the EU.

Annual inflation rate for hotels, motels, inns, and similar accommodation establishments in the European Union was 13.2% in April 2023. While the rate of price increase declined compared to the peak reported in June 2022, that figure still represented one of the highest rates recorded since December 2017.

A tight labour market, higher costs and skills shortages

Ireland is experiencing a tighter labour market than across the EU, as the number of people at work in the State reached a record high of 2.61m, having grown by 102,700 or 4.1% in the year to March 2023. Unemployment in Ireland hit a record low of 3.8% in May 2023, following a steady decrease in the rate since March 2021 and despite net immigration last year of 61,000. The seasonally adjusted number of unemployed people (15-74 years) was 103,300 in May, a decrease of 8,700 compared to a year earlier. An unemployment rate of 4% or less is commonly regarded as tantamount to full employment.

Unemployment across the EU has been stable at 6.0% in March and April 2023, down marginally in 6.1% a year ago.

The labour market in Ireland is forecast to remain tight in the immediate future, with The Central Bank projecting an annual unemployment rate of 4.1% in 2024 and 4.2% in 2025.

Tourism and hospitality is a labour intensive business, with the quality of personal service a key value. With effective full employment levels, the tourism and hospitality industry is facing an existential challenge, with upward pressure on wages inevitable and the risk of a further deterioration in the already depleted supply of critic skills.

Latest data from CSO shows that employment in the Accommodation and Food Services sector in Q1 2023 was 3.8% below the same period in 2019, in contrast to total employment in the State increasing by 12.6% over the same period. It is obvious that recovery in employment in the tourism sector is lagging behind the overall economy, with the hours worked in the sector down 10% on Q1 2019.

Labour costs in Ireland have tended to be higher than in many other European states. The minimum wage is the 5th highest in the EU after Luxembourg, Germany, Belgium and the Netherlands. However, the average wage within the Accommodation and Food Services is close to the average across the Eurozone, with workers in the sector in Luxembourg, France and Belgium more highly paid.

The recruitment situation in the hospitality and tourism sector has become more acute. Staffing shortages resulted in considerable stress on meeting demand in 2022 and continues in 2023. Despite businesses investing in recruitment and training, realignment of working hours, and increasing rates of pay, many operations have been forced to reduce trading – a cut in opening hours or a reduction in capacity on offer. In certain instances it has resulted in some business closures.

One in ten respondents to Fáilte Ireland’s most recent Barometer survey cited difficulty in recruiting staff as the reason for delayed opening for the 2023 season. Across the industry more than one in three (37%) highlighted the difficulty in recruiting staff – with 71% of restaurant and 63% of hotel respondents raising it as a significant concern. An ongoing shortage of chefs would appear to continue to plague the sector.

From a customer perspective the result has been a reduction in choice and/or the quality of the experience. This coupled with higher prices runs the risk of more serious longer term reputational damage and stalling growth.

A Snap Shot of Ireland’s Competitiveness as a Holiday Destination

Dublin, the gateway for the majority of visitors, is amongst the most expensive European cities to visit, according to two recent price comparison analyses. While the cost of getting to Dublin and aggregate cost for the usual city break sightseeing and dining experiences are shown to be competitive, the cost of hotel accommodation pushed Dublin into the higher price cohort.

Dublin was ranked as 4th most expensive destination for a city break amongst 35 European cities, with the 3rd highest hotel costs, only exceeded by Amsterdam and Venice, according to the respected UK Post Office Travel Money City Costs Barometer. An analysis shows that excluding the cost of accommodation Dublin prices are highly competitive within the range of cities, with 21 cities being more expensive for the typical weekend costs of food, drink, transport, and sightseeing. Dublin was cited as a good option for a cultural break with free entry to leading museums and galleries.

Post Office Travel Money City Costs Barometer, May 2023 for European City break 2-4 June 2023.

| CITY LEISURE BREAK COMPONENTS | LISBON Least expensive No. 1 |

DUBLIN 4th most expensive No. 32 |

AMSTERDAM Most expensive No. 35 |

|---|---|---|---|

| Cup of coffee (regular filter) – café/bar | £1.35 | £2.80 | £2.71 |

| Bottle of beer/lager (330ml local brand) – café/bar | £2.26 | £5.60 | £4.52 |

| Coca-Cola/Pepsi (330ml bottle/can) – café/bar | £2.08 | £2.71 | £3.34 |

| Glass of wine (175ml house) – café/bar | £3.07 | £6.28 | £4.33 |

| 3-course evening meal for 2 inc. house wine | £39.01 | £79.61 | £88.96 |

| Return airport bus or train transfer | £3.43 | £8.13 | £10.61 |

| 48-hour travel card | £11.92 | £14.45 | £12.19 |

| Sightseeing city bus tour | £18.06 | £26.19 | £22.58 |

| Top tourist heritage attraction | £9.03 | £7.22 | £14.45 |

| Top museum | £9.03 | £0.00 | £18.06 |

| Top art gallery | £4.52 | £0.00 | £20.32 |

| SUB TOTAL | £103.76 | £152.99 |

£202.07 |

| 2 nights’ 3* accommodation (weekend) for 2 | £121.00 | £448.00 | £525.00 |

| TOTAL COSTS | £224.76 | £600.99 |

£727.07 |

Source: Post Office City Costs Barometer 2023 prices were supplied by national or regional tourist offices of participating cities/countries, except for Amsterdam, Barcelona, Florence, Lille, London, Madrid, Nice, Paris, Rome and Venice (researched online). Accommodation prices were sourced from Hotels.com and Bookings.com and based on an average of the 10 cheapest available three-star city centre accommodation for two adults sharing a double/twin ensuite room between 2-4 June 2023. Sterling prices are based on Post Office exchange rate in early May 2023 for online transactions of between £500-£999

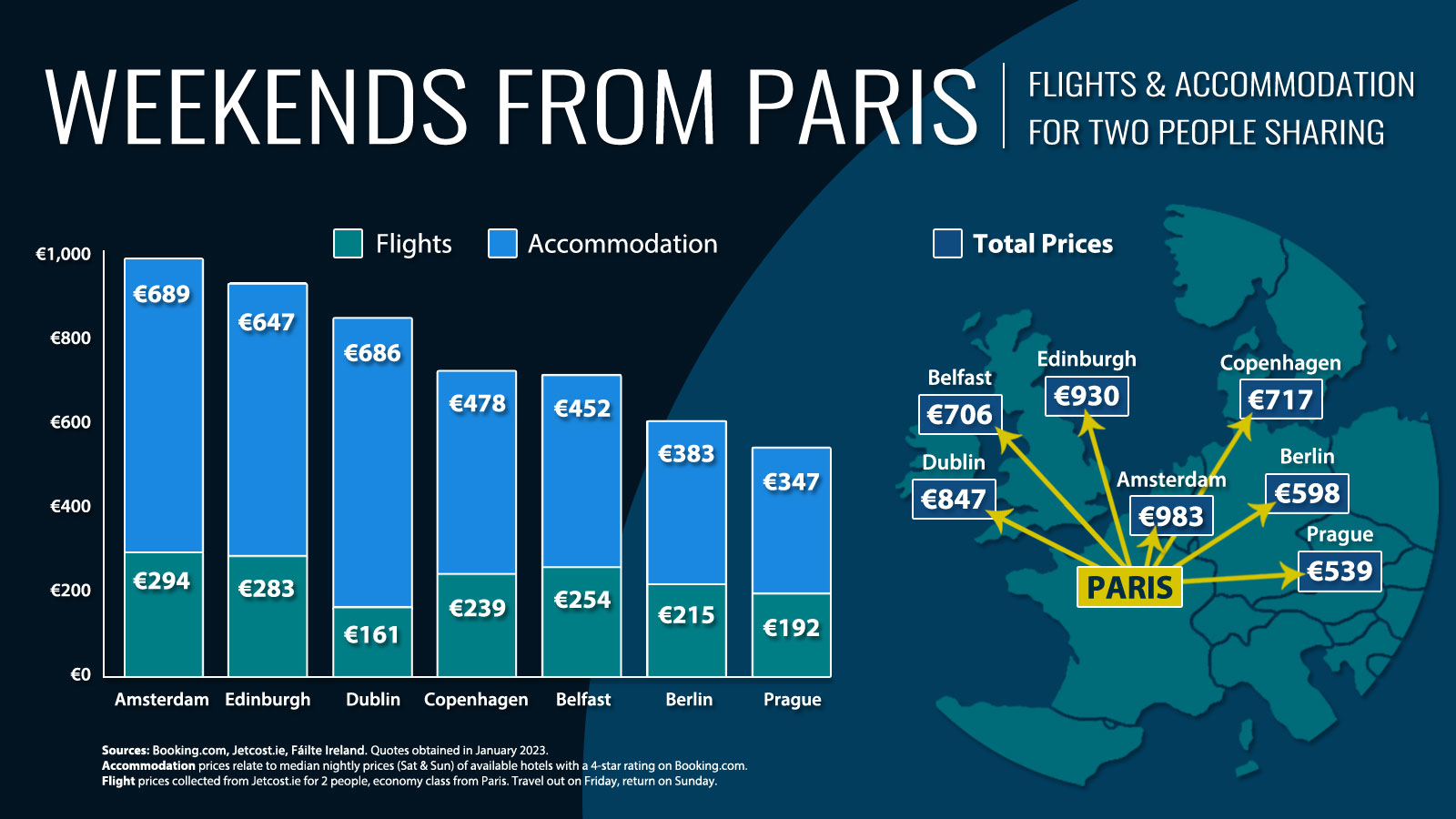

Despite low airfares, the cost of weekend break from Paris to Dublin, compared to six competitor destinations, was in the more expensive category due to hotel rates. The survey conducted by Fáilte Ireland found that airfares were extremely competitive, within the range €123 to €173 for 80% of weekends sampled, averaging almost one third less expensive than to competitor cities. Conversely weekend hotel rates in Dublin, together with Amsterdam, were found to be the most expensive, with median rates up to more than twice the rate available in Berlin or Prague. Average weekend hotel rates were consistently close to €360 throughout the period April to September, other than for a marginal decrease in the early weeks of August.

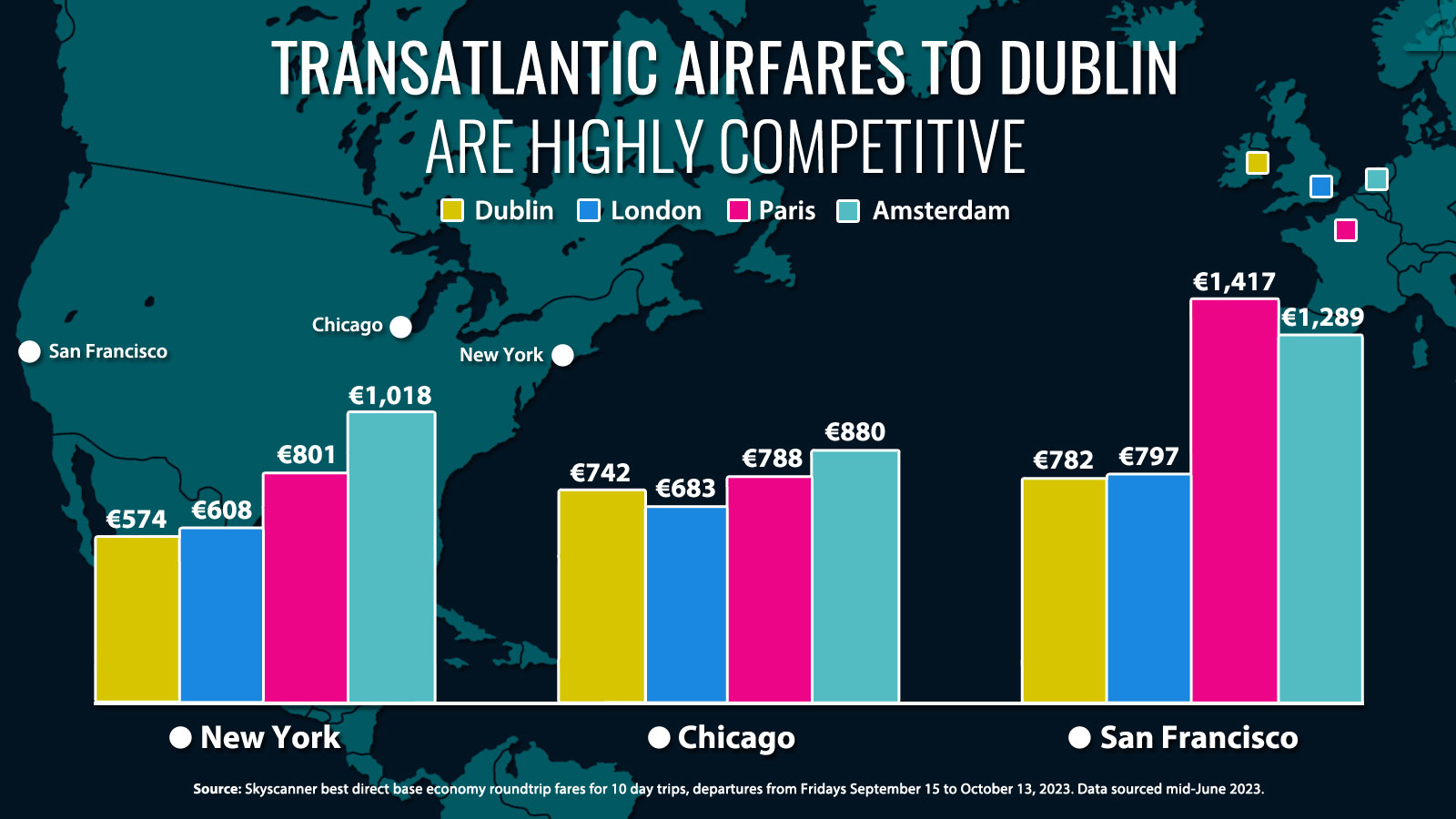

Transatlantic airfares to Ireland are highly attractive and competitively prices from key US gateways compared to other popular European destinations. Aer Lingus, the price leader in a highly competitive market, offers the most keenly priced fares to Ireland and, in many instances, transfer travel to other European points.

Car rental supply & prices

While overall transport costs have peaked, elevated car rental rates are holding in many countries due to supply and other regulatory factors, although availability appears to be improving. Car hire is an essential component of a trip to Ireland for one third of holiday visitors and a key facilitator of regional spread of visitors. Car rental fleet for summer 2023 is estimated to be approximately one third below the 2019 level.

The most recent analysis of car rental rates for 2023 from Failte Ireland conducted on prices available in January and April for a summer visit to Dublin, Belfast, Edinburgh, Amsterdam, Berlin, Copenhagen and Prague shows:

- Availability of ‘medium’ sized rental cars improved in April, across all destinations analysed, compared with searches in January. Conversely, the availability of ‘people carriers’ for summer 2023 fell over the same period.

- With the exception of Berlin, median weekly rental prices for ‘medium’ sized cars in the peak season were typically lower in April than in January.

Dublin, alongside Copenhagen, registered some of the sharpest falls in median weekly rental prices over this period. Consequently, more often than not, median weekly prices in Dublin for ‘medium’ sized rentals aligned more closely with those in the competitor set. - Median weekly rental prices for ‘people carriers’ in Dublin also moved notably lower for the summer months. Dublin was something of an outlier across the competitor set in this regard.

- As a result, ‘people carrier’ rentals from Dublin are now competitively priced for the peak season across the destinations analysed. Indeed, there are several periods across the summer where weekly median price points are on a par with the lowest available across the competitor set.

VAT on hospitality services

With the reduced VAT rate of 9% scheduled to revert to 13.5% from September 2023, Ireland will be amongst the top rate for visitors on accommodation and food at 3rd highest in Europe, and out of line with the majority of competitors. This will further add to Ireland’s loss of competitiveness at a time when inflation in key visitor components could continue to outstrip rising prices in competitor destinations.

Access to, and cost of, insurance

Despite recent reforms in the insurance sector, annual premium for liability coverage continue to rise. A lack of competition in the market has been identified as the prime cause of higher premium costs compared to what is on offer in other European destinations. Unfortunately the situation in Ireland has forced the closure of several businesses and events over recent years.

Reduced tourism accommodation stock

Tens of thousands of tourism bedrooms are currently being contracted by Government for the provision of accommodation for Ukrainian refugees and asylum seekers.

The housing of those seeking refuge is a moral imperative as Ireland plays its part in the ongoing humanitarian crisis. However, Ireland is an outlier in its dependence on tourist accommodation to provide shelter for refugees and asylum seekers.

The contraction in availability of accommodation for tourists has inevitably led to an increase in the price for the visitor, particularly at times of high demand exceeding available supply. It is estimated that 1 in 5 tourism bedrooms are no longer available to the tourism economy, a figure that continues to inch up. Fáilte Ireland has estimated that the impact of this reduced bed stock to the broader tourism economy could be as much as €1 billion over an annualised period.

The reduction in available tourist accommodation is most evident in a number of popular west coast counties, including Mayo and Clare.

The immediate impact on the tourism economy includes:

- Higher prices for accommodation where demand exceeds supply;

- Reduction in employment in the sector;

- Loss of visitor footfall in traditional tourism areas, less visitor spending in local economies, and a threat to the continues viability of downstream businesses catering to visitors;

- Loss of group and tour traffic due to sharp reduction in the supply of mid-market hotel accommodation.

As a result of Government policy summer Summer 2023 could see a level of frustration of demand together with significant reputational damage due to supply constraints and high prices.

Longer term the impact of the continued reliance on tourist accommodation to meet the State’s need to house refugees could result in a sharp drop in tourist accommodation as some properties may not revert to tourism use. The current situation weakens Ireland’s tourism ecosystem – a complex, highly interdependent and diverse key sector of the economy.

Maintaining healthy competitive market among hotels and other tourist accommodations is critical for consumers and operators. It ensures guests get the best value for their money and quality customer service, while providing an acceptable level of profit to sustain the business and grow the market.

Risks to Ireland’s Tourism Competitiveness

The economic and geopolitical environment presents several risks, industry profitability is fragile and Ireland’s competitiveness could be further eroded and recovery growth stalled by a number of factors.

Inflation fighting measures/possible recession: Central Banks are calibrating the best levels for interest rates to have a maximum cooling effect on inflation while avoiding tipping economies into recession. An end to rate rises and a decline in interest rates would stimulate demand across source markets. Equally, the risk of recession remains and would downgrade the outlook for the sector.

An escalation of the war in Ukraine: With little immediate hope for peace any further escalation of the conflict would heighten geopolitical tensions, have negative impact on global trade, including the travel and tourism, as well as impacting negatively on consumer confidence.

Energy price volatility: a key component of the cost of travel, the sector is exposed to the risk of price hikes. Despite a recent decrease in wholesale energy prices, businesses and consumers continue to struggle with elevated costs.

Ongoing dependence on tourism accommodation for refuge housing: The reliance on tourist accommodation to meet the needs of refugees is not a sustainable strategy and the delay in delivering alternative accommodation jeopardises Ireland’s tourism recovery. Any escalation of the conflict could see an increase in the number of displaced persons seeking refuge in Ireland.

Staffing and skills shortages: The ongoing struggle to recruit and retain staff in the sector, including a skills gap, continues to be a serious threat to the sector’s ability to deliver a level of service and experiences matching visitors’ expectations.

Climate action & Regulatory cost burdens represent an input cost increase for businesses. In particular, the industry potentially faces higher costs of compliance arising from climate related targets and environment initiatives.

The high cost of finance: With ECB interest rates at a 22 year high, and with the potential of further increases, many tourism businesses will struggle to recover from the impact of the pandemic. Borrowing costs in Ireland, already amongst the highest in EU, together with a decline in recent years of new lending to the sector, represents a risk. Continued investment in people, product innovation and sustainability, are critical to maintaining the competitiveness of the Ireland tourism experience.

Recommendations

“Overall, the Irish economy remains internationally competitive. However, there are still critical areas where Ireland currently falls behind our competitor countries, and improvements in these areas could see Ireland maintain or increase its competitiveness in the years ahead.”

ITIC has identified a number of recommendations as outlined below which could help underpin Irish tourism competitiveness. Three broad themes – infrastructure, energy and consumer/producer prices – were identified by NCPC as critical to improving Ireland’s competitiveness and sustainability of the economy and each of the themes is pertinent to the future competitiveness of the tourism sector.

Sustainable recovery and future growth of tourism will require a public-private partnership to realise Ireland’s tourism potential in a changing world. ITIC proposes the following 10 actions;