Preface

Ireland’s tourism and hospitality industry has been disproportionately impacted by the Covid-19 pandemic in the last 12 months, with an estimated 90% drop in revenue and a staggering 160,000 job losses.

With the news of the vaccine roll-out, and the 11th hour Brexit deal, hopes rose that 2021 would see a recovery and revival of Ireland’s largest indigenous industry and biggest regional employer. However, as of February 2021, the third Covid wave and subsequent lockdown has meant that the first few months of the year for businesses are as fraught as ever with demand non-existent and businesses relying on state support for survival.

In these extraordinarily difficult and unprecedented times it is important to adopt a twin track approach, to implement urgent measures that will assist business survival, as well as put in place enabling policies for a longterm sustainable recovery.

In June 2020, the Irish Tourism Industry Confederation (ITIC) published its first Tourism Industry Revival Plan in response to the immediate and devastating impact of Covid-19, which helped set the policy agenda for the sector as the pandemic’s first wave ended. While many of the recommendations in that initial report are as valid as ever, the ever-changing landscape, bringing with it increasing uncertainty and restrictions, has prolonged the impact far beyond where we expected to be. Only one month into 2021 and we now understand the additional complexities of vaccine supply and roll-out as well as the impact of virulent new infectious strains of the virus resulting in ever-more restrictive public health measures.

Yet again tourism and travel will bear the greatest impact, recovery in overseas tourism now not expected until at least Q3, and financial measures already implemented by Government will now be required for far longer than could have been anticipated. ITIC, representing all the key tourism stakeholders in the country, publishes this report to provide a roadmap for recovery for the industry, based on the known impacts that the pandemic has already had on the sector. An extensive survey of our members was conducted and in-depth discussions took place with a variety of industry CEOs and leaders. ITIC engaged the services of TTC – Tourism & Transport Consult, to outline the impact of the pandemic on Irish and global tourism, consider projections on volume and revenue out to 2025, and detail a number of key policy recommendations that need to be implemented if Irish tourism is to recover to the fullest extent possible.

Despite the current challenges for businesses, there are certainties that bode favourably for recovery. The vaccine roll-out will happen this year at home as well as in source markets, treatments have improved and will continue to do so, and research shows that there is a growing pent-up demand for travel and tourism, therefore strengthening belief for a recovery when the time is right and public health restrictions can be significantly reduced. Thus, Irish tourism can look forward to future years with more positivity and security. Crucially at this time though, with the sector firmly shut and demand non-existent, the essential fabric of the Irish tourism industry must be preserved and ITIC is calling for immediate supports to protect tourism businesses who through no fault of theirs own have been disproportionately impacted. These include an enhanced CRSS scheme for the tourism sector, increased business continuity grants, the extension of the Employment Wage Subsidy Scheme at current levels in order to preserve jobs and livelihoods and the human capital of the sector, and a waiver on local authority rates for the full calendar year of 2021. With domestic tourism set to be an important market for Ireland’s tourism and hospitality industry this year, ITIC is also calling on the Government’s “Stay & Spend Scheme” to be redesigned and relaunched as a consumer-friendly upfront voucher to stimulate home holidays. More medium-term recommendations include a dedicated Minister for Tourism to reflect the importance of the sector to the Irish economy, the extension of the 9% Vat rate to 2025 to provide certainty for the sector, a doubling of tourism agencies’ budgets to support business survival and recovery, a Taoiseach-led Ireland global awareness campaign on St Patrick’s Day 2021 to maintain visibility of Irish Tourism, a digital strategy to support the rebuilding of tourism’s infrastructure that enables a stronger market presence, and an analytical transformation of tourism data.

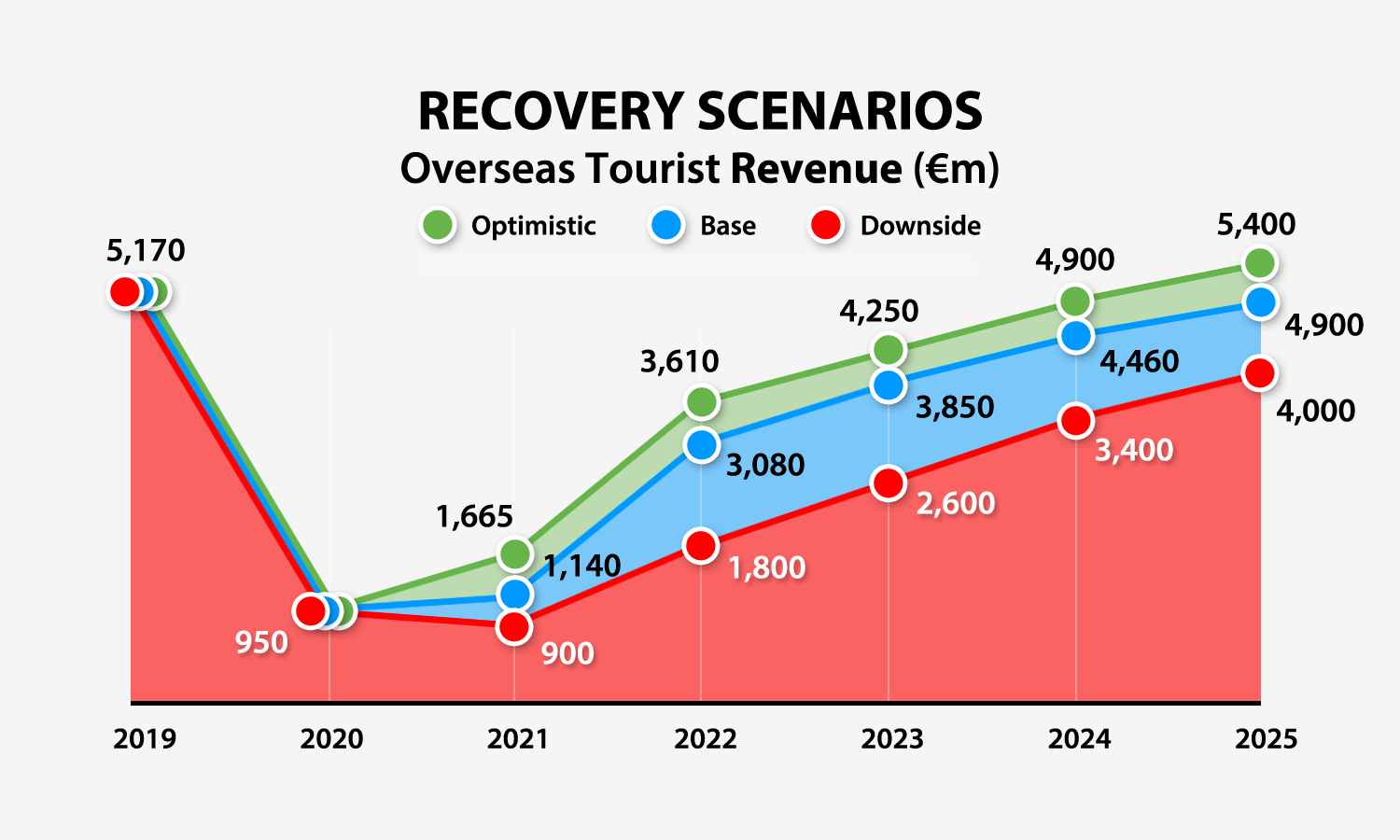

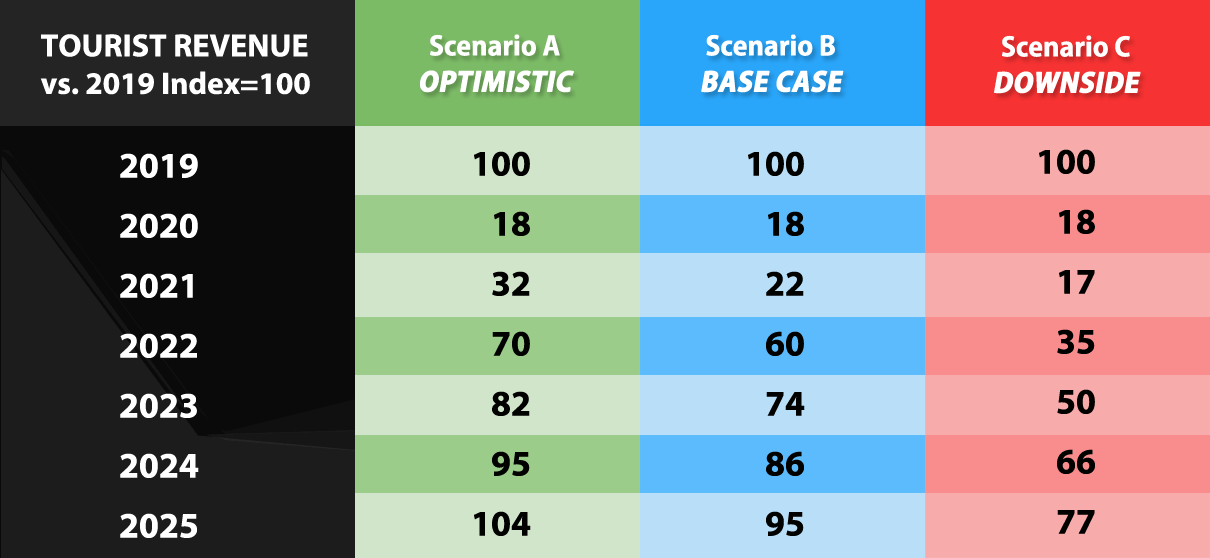

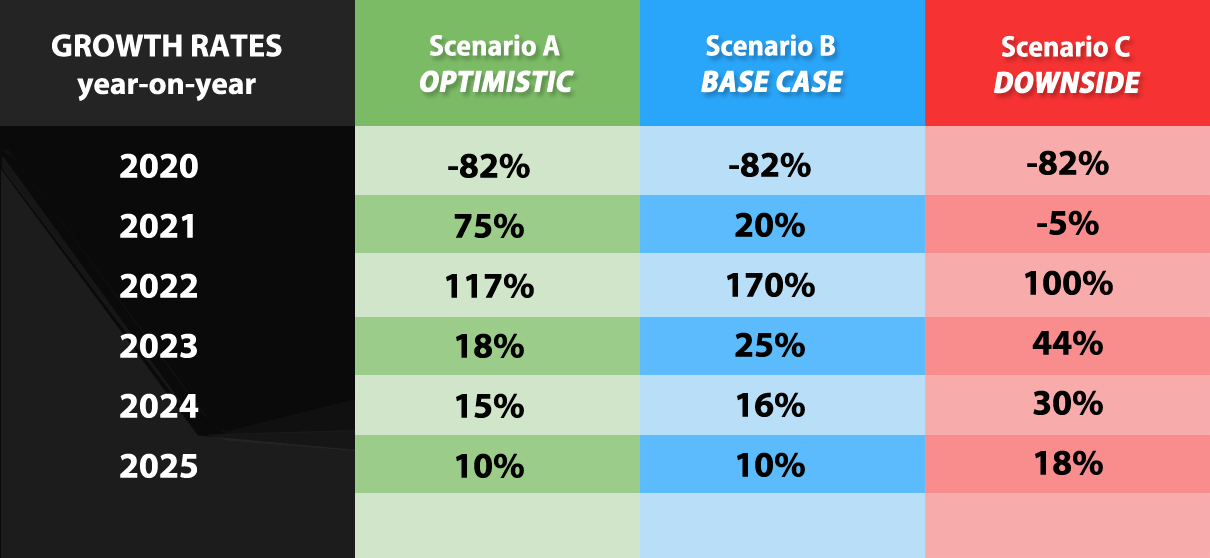

2020 was the year of the pandemic: 2021 will be the year of aftershock and stabilisation, while 2022 should be the year that real recovery commences in earnest. ITIC has outlined three possible scenarios for the years ahead and are confident that Ireland’s tourism industry can deliver the optimistic outcome – given the right enabling factors, and should the recommendations of this report be implemented in full. Should the optimistic scenario come to pass, then overseas tourism volume and value to Ireland, despite the greatest ever shock to global travel and tourism, can recover to 2019 levels by 2025. It is estimated that employment within the industry will see 280,000 people working in the sector, re-securing tourism’s position as the largest indigenous industry and biggest regional employer.

ITIC reaffirms the importance and value of the domestic tourism market but emphasises that it can never replace international inbound tourism that accounts for 75% of tourism revenue, or sustaining the 20,000 businesses within Ireland’s tourism and hospitality industry. The top two pre-requisites for recovery, as outlined in this report, are the rollout of the vaccine programme allied with a systematic rapid testing regime, and restoring connectivity to the island of Ireland. International connectivity by air and sea must be re-established this year in a safe and sustainable manner, supported with a comprehensive strategy as recommended by both the Tourism Recovery Taskforce and the Aviation Recovery Taskforce.

This report reflects and supports many of the issues outlined in the Tourism Recovery Taskforce (TRT) Plan issued in October 2020 and brought to Government by Minister Martin. It is therefore vital that the Recovery Oversight Group, established by Minister Martin to implement the TRT recommendations, consider this report and prioritise the key enabling actions in the short term to underpin the industry’s return to growth.

Ireland’s tourism industry has proven resilient in the past recovering from external crises, and we are confident that we can do so again. Despite the greatest ever global challenge to international travel, Ireland’s tourism industry will rise again and prosper. No other industry has the potential to create jobs quickly and to provide regional economic balance. As predominantly an export industry, bringing much needed foreign earnings to the country with 23% of expenditure going straight back to the Exchequer in direct tourism-related taxes, Irish tourism can and will once again contribute constructively to the country’s economic and social wellbeing.

Thank you for taking the time to read this report, and on behalf of the Board and Council of ITIC, thank you for supporting Ireland’s tourism industry.

ITIC acknowledges the valuable inputs from business leaders who gave willingly of their time and experience in the preparation of the report.

The analyst and conclusions in the report are based on ITIC’s interpretation of a range of external information from reputable sources available at time of writing (January 2021). The report, including projections, is presented as a guide only and should not be construed as a forecast of future performance or results.

Introduction

Tourism businesses have spent the last year scrambling to survive in extraordinary circumstances brought about by the Covid-19 pandemic. While the roll-out of vaccines has transformed the outlook for the travel and tourism industry, recovery is not without its challenges. At time of writing, border restrictions and quarantine measures have brought international travel to a halt, as infection rates have surged in most source markets, together with growing concerns about new variants of the virus. The path to a return of international travel and tourism will depend on the effectiveness of pandemic management and vaccination roll-outs, thus continuing to inhibit the ability of tourism businesses to plan with any certainty in the immediate future. Survival will therefore remain the priority of businesses in the industry.

The Covid-19 crisis differs from previous global downturns in tourism, not only in the magnitude of the collapse of travel, but in its underlying cause. In the past, tourism downturns were the result of the collapse of demand, most frequently due to economic factors. However, the current situation arises from supply side barriers due to public health concerns. Hence, harmonised, consistent travel protocols are essential for restoring confidence in international travel and getting tourism moving again, with the introduction of rapid Covid-19 testing of travellers and the removal of quarantine restrictions.

Over the past year, travel sentiment surveys consistently report a pent-up demand for travel. The experience of travel recovery in countries which have effectively controlled the spread of the virus is one of rapid recovery of both leisure and business travel segments, initially for domestic travel leading to the reopening of international travel on safe travel corridors.

The Irish Tourism Industry Confederation (ITIC), the umbrella organisation representing every sector of the tourism industry, provides a comprehensive and cohesive voice of the industry. It has been central in guiding and coordinating Irish tourism’s response to Covid-19 and informing the measures and tools for mitigating its impact on jobs and businesses. A joined-up approach is required to ensure tourism continues to receive financial supports and political commitment. While the immediate term outlook for recovery of Irish tourism is uncertain at this time, the prospects for the latter part of the year are more promising, provided appropriate procedures and enabling measures are in place. 2021 can be the year of transition from survival to recovery for Ireland’s tourism industry.

This report outlines the challenges and opportunities facing the sector, addresses the issues to be tackled, and presents scenarios for the path to recovery. Most importantly the report identifies a suite of policy recommendations and priority actions to achieve a safe and successful recovery. The recovery timeline may be uncertain, and the growth path volatile, but a return to international travel and tourism is inevitable and it is vital that Ireland is well-positioned to benefit from the upturn.

ITIC took a leading role in establishing the Tourism Recovery Taskforce, announced by Government in May 2020. This taskforce, the first established by Government for any of Ireland’s key industries in response to Covid, had a tripartite approach, combining industry, agencies and Department of Tourism and set out a three-year strategy for the tourism sector. ITIC argues that the TRT recommendations, allied to those within this industry report, need to be implemented in full and without delay.

Covid-19 pandemic has devastated travel & tourism

2.1 The collapse of international travel in 2020

2020 proved to be the most challenging year in the history of tourism, as the Covid-19 pandemic brought global tourism to a complete standstill. International tourism is a US$9 trillion industry annually accounting for 10% of global GDP.

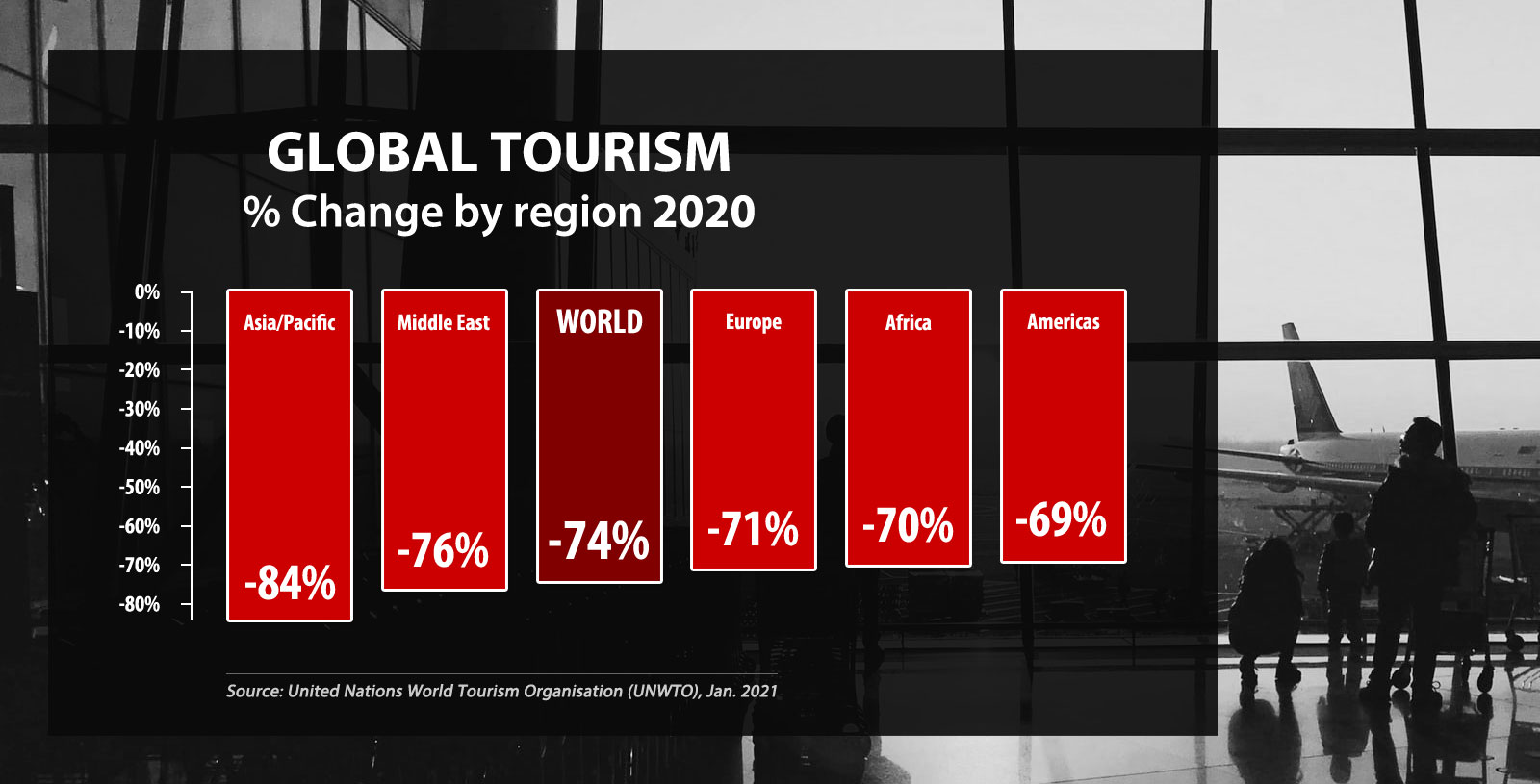

International tourist arrivals around the world are estimated to have decreased by 74% in 2020. Travel restrictions and other bans imposed to prevent the spread of the COVID-19 pandemic has resulted in one billion fewer tourists and an estimated loss of US$1.1 trillion in export revenues from international tourism. International arrivals in Europe are estimated to have fallen by 71%. (Source: World Tourism Organisation (UNWTO)

The economic cost of Covid-19 has been significant across almost every sector, but none more so than to travel and tourism. Of those employed worldwide, up to half have already lost, or are at imminent risk of losing, their jobs. The decrease in the global tourism industry due to the Covid-19 pandemic could result in a loss of US$2 trillion in world GDP, and the loss of 174 million jobs, if travel restrictions remain in place. (Source:World Travel & Tourism Council (WTTC)

Global aviation, the lifeline of international tourism, reported a loss of US$118bn in 2020 as passenger demand collapsed. Passenger traffic in Europe (measured in revenue passenger per kilometre), fell by at least 70% in 2020, the worst performance of any world region with the exceptions of Africa (-72%) and the Middle East (-73%). The latest forecasts suggest Europe will trail recovery rates in Asia Pacific and North America in 2021 as demand for air travel increases by just under 50%. (Source: The International Air Transport Association (IATA)

2.2 Tourism and hospitality hardest hit sector in the Irish economy

History will record 2020 as the industry’s worst financial year which continues to challenge the very survival of many businesses. Covid-19 prompted governments across Europe, including Ireland, to adopt a range of extraordinary measures from a public health perspective in an attempt to mitigate the spread of the virus. As a result, tourism businesses were forced to close or operate under commercially oppressive restrictions, including at times the almost total shut-down of international air service connectivity and the hospitality sector. This has effectively seen Ireland closed for international tourist business from early March 2020, when a Six Nations rugby fixture and St. Patrick’s Festival were cancelled. The impacts on the largest indigenous sector of the economy – comprised of over 20,000 SMEs (small and medium enterprises) supporting an estimated 260,000 direct jobs – have been devastating, forcing people out of jobs, and businesses struggling for survival. It is apparent that the travel, tourism and hospitality sector has been the hardest hit during the pandemic and urgent measures need to be taken to ensure it is not the last to reopen and recover.

“Apart from its overall economic importance, the importance of tourism to local and regional economies cannot be understated. In many rural areas, it is the only employer of note outside of agriculture. Analysis published by Ernst and Young (Potential impact of Covid-19 on Irish Tourism, April 2020) earlier this year indicated a significant proportion of jobs dependent on tourism in rural counties such as Kerry (18%), Donegal (13%) and Waterford (12%). In many such areas, there are no alternative sources of employment. It is also the case that the sector employs a higher proportion of young people. Almost one in two of those employed in the sector are aged less than 35, compared to less than one in three of the total workforce (CSO, Census 2016). It is also the case that the sector employs a higher proportion of young people on a part-time and seasonal basis providing them with their first experience of employment and valuable income to support further education.” (Source: Tourism Recovery Taskforce Plan, September 2020)

Demand from the domestic market for leisure trips and visits to friends and relatives (VFR) rebounded rapidly in Q3 2020 with the lifting of travel restrictions and the reopening of most hospitality businesses, other than non-food serving pubs. Irish residents taking home holidays, as well as visiting friends and relatives, provided valuable cash flow to accommodation and hospitality businesses, especially in coastal and rural areas outside of cities. However, it is evident from the official data that tourism-related businesses did not experience the level of recovery apparent in other sectors, despite the relaxation of restrictions over the summer. (Source: CSO retail sales & Central Bank credit card data)

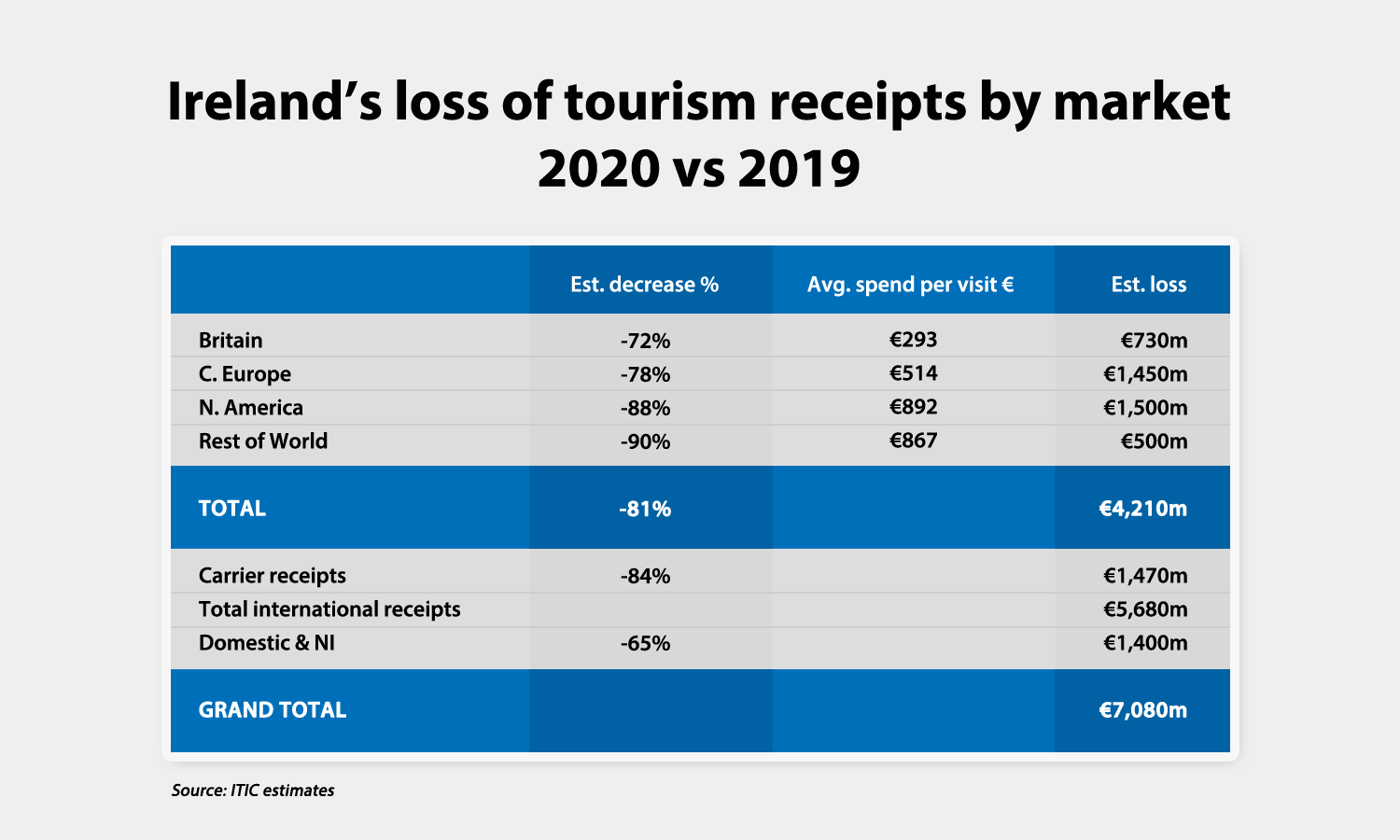

2.3 The catastrophic impact on businesses and employment

The introduction of Covid-19 financial support schemes by Government have staved off widespread business failures and bankruptcies in the tourism and hospitality sector. The Pandemic Unemployment Payment (PUP) and the Employers Wage Subsidy Scheme (EWSS), together with business continuity grants, guaranteed soft loans, rates remission, warehousing of business debt and some taxes, and a reduction in VAT, have proved critical to the survival of many enterprises. However, in the absence of a recovery in international tourism over the coming months, the withdrawal of the support policies before there is a significant upturn in international tourist arrivals will result in large scale unemployment, income losses, and business closures. In addition to the impact on those directly engaged in tourism, the absence of over €5 billion in export earnings spend in the country by international visitors in 2020 has seriously impacted a range of supply chain businesses. Subventions and subsidies can never replace lost demand.

Fight to sustain employment in the sector

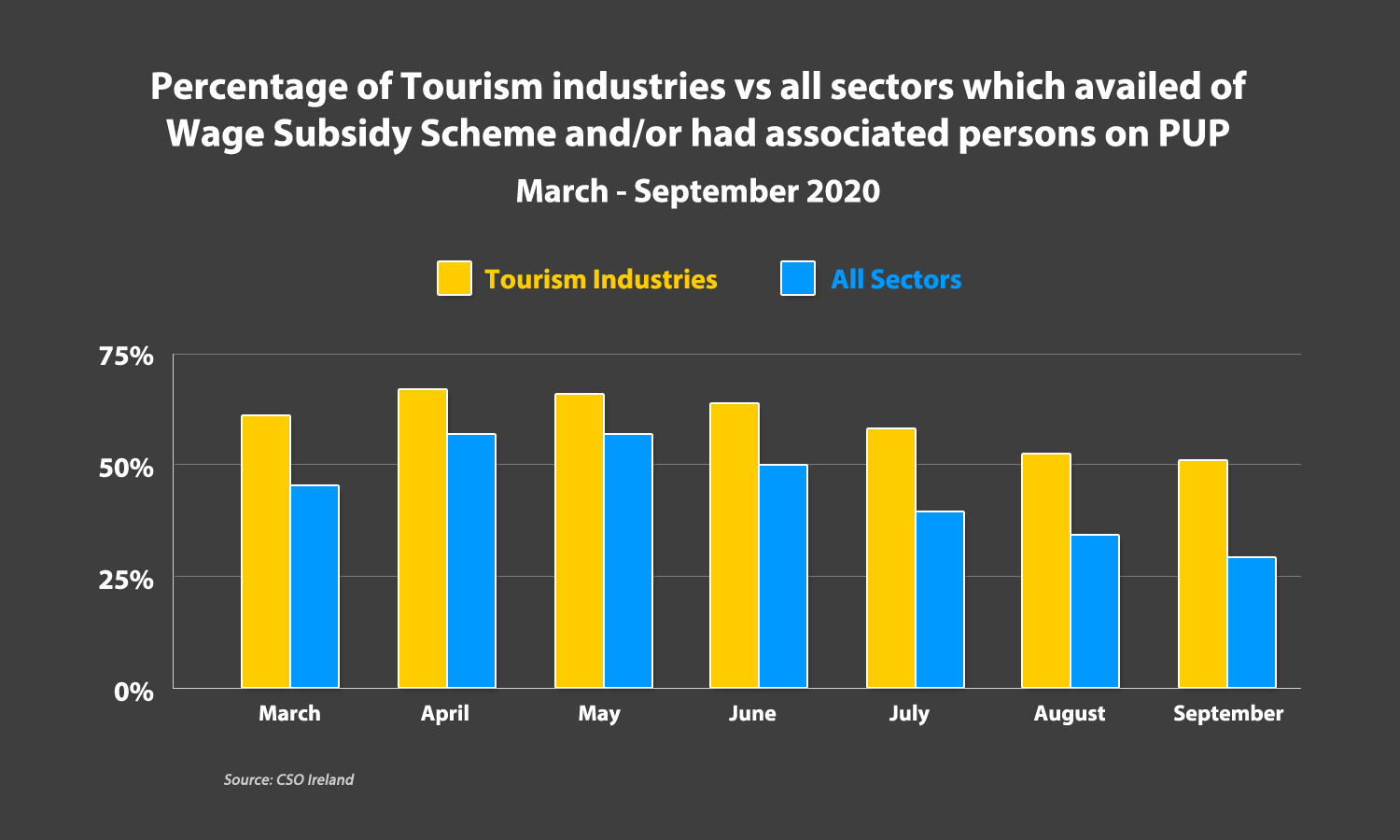

The starkest reality of the economic crisis in the sector has been the need to stand down thousands of people engaged in tourism. Official data shows that those working in the tourism, hospitality, arts and entertainment sectors have become most dependent on the PUP and EWSS supports to protect income, with more than two-thirds (68.9%) of tourism businesses availing of a state employment-related support at least once between March and September. Over two out of every three ‘Accommodation and Food Services’ businesses relied on state support to sustain employment, as did more than half (54.1%) of enterprises engaged in the Cultural and Creative sector. The loss of employment has been most severe in rural areas, especially along the western seaboard from Waterford to Donegal, and amongst the younger age cohorts. (Source: CSO: Business Signs of Life Series One: State Support, (Dec. 18, 2020)

With the sector currently under a closure order, a total of 111,872 employees engaged in Accommodation and Food services were in receipt of the Pandemic Unemployment Payment (PUP), far exceeding the number of wholesale and retail workers at 76,606. (Source: Dept. of Social Protection (release on February 8, 2021)

Based on official data, it is conservatively projected that over 160,000 people across the wider range of businesses dependent on tourism are currently in receipt of Government wage support, accounting for two out of every five PUP recipients, at an estimated cost to the State of almost €40m per week. The exposure to continued unemployment is evident in the tourism sector. While the total number of PUP recipients across the economy has fallen by a fifth from the peak in early May, dependency level in tourism and hospitality has remained intractably high due to continued restrictions on trading.

The importance of the Employment Wage Subsidy Scheme (EWSS) is vital for Irish tourism and hospitality businesses providing a much-needed mechanism to retain experienced human capital. With demand set to be so low for the rest of 2021 the EWSS needs to be extended for the full calendar year for tourism-related businesses.

The Tourism Recovery Taskforce clearly highlights the importance of employment retention:

“Retaining tourism jobs and skills will be vital to tourism’s recovery. Implementing an upskilling and reskilling programme for tourism, linked to Government support funding to businesses, can mitigate the significant damage the crisis has had on the sector. Retaining vital skills and intellectual capital within the tourism sector will be critical to a strong recovery. This is aligned with the European Skills Agenda. Investing in the delivery of lifelong learning programmes through digital platforms will increase the quality of jobs in tourism and sustain jobs regionally. Apprenticeships and traineeships will provide employees with a vital career pathway into work and a career while also providing the employer with the opportunity to build a future workforce and develop a strong talent pipeline.

One of the features of the dramatic economic slowdown witnessed so far this year is the huge impact on youth unemployment. A revitalised tourism sector can offer job opportunities to this young workforce. Almost one in two of those employed in the sector are aged less than 35, compared to less than one in three of the total workforce.

The TRT recommends the development of a National Tourism Education Gateway (one-stop shop) for every tourism employee to access education from Level 5 to Level 10, (facilitating RPL, CPD, single subject certification, special purpose awards through to full awards).

This recommendation proposes to create a continuing professional development (CPD) pathway for all Tourism industry employees.”

Tourism businesses in fight for survival

Businesses are currently in a state of suspended animation. It is unlikely that a true picture of the scale of commercial damage within the tourism sector will become apparent before the middle of 2021.

The industry of over 20,000 enterprises, predominantly composed of SMEs and micro-enterprises, with a limited number of larger scale or macro enterprises, is in a perilous situation due to Covid-19. Historically, the tourism and hospitality sector has been heavily leveraged. It is safe to assume that many tourism businesses were included in the €5bn of business loans on payment breaks from Irish banks as at end September 2020. While larger enterprises can avail of the €2bn Pandemic Stabilisation and Recovery Fund, part of the Ireland Strategic Investment Fund, smaller scale businesses can avail of guaranteed credit schemes, distributed through the top three commercial banks, 80 per cent guaranteed by the State, at attractive low interest rates. The scheme is due to end in June 2021. However, perhaps not surprisingly, the take-up has been low as businesses are reluctant to take on more debt in an uncertain environment with only €66m distributed by end November.

The relief on commercial rates and the warehousing of some taxes has provided a valuable reprieve for many tourism businesses. The survival of many will depend on an extension of the life of these reliefs.

It is expected that the number of claims under the Covid Restrictions Support Scheme (CRSS), which began in November operated by Revenue, will rise. A more graduated qualification criteria with proportionate levels of support would greatly benefit tourism businesses.

Current best estimates suggest that close to 400 tourism and hospitality SME businesses have already ceased trading since the start of the crisis, notably restaurants, B&Bs, visitor attractions and adventure holiday operators. All sectors project an immediate decline in the number of enterprises and/or capacity as a result of COVID-19 with pubs, restaurants, hotels, and B&Bs particularly hard hit, with more marginal declines across most other sectors including car and coach hire, incoming tour operators, and attractions. Regrettably, more businesses may not re-open, while many face an uncertain future with an increased debt burden threatening their viability and severely limiting their investment capacity. (Source: ITIC survey of member organisations (December, 2020)

2.4 Covid’s legacies for travel & tourism

Current consumer trends

Recent research amongst experienced international travellers across several source markets has identified a number of Covid-led or accelerated consumer trends. While survey results show that priorities and incidence levels differ by country and demographic, a number of underlying common trends emerge, each of which underscores issues that boost consumer confidence in travel in the current environment. (Source: Compendium of surveys, including IATA, Tourism Ireland, McKinsey, Phocuswright, Amadeus)

Heightened hygiene and health concerns

The top concern in most markets is the need for reassurance on the safety of the travel experience. Consumers prioritise highly visible and assured sanitisation, and hygiene and safety protocols throughout all aspects of the travel and tourism experience together with effective test, track and trace programmes. Consumer confidence is increased by processes which reduce queues and congestion in public spaces and which minimise physical touch points and face-to-face or physical contacts. A potential consequence appears to be a shift in demand for less crowded destinations and experiences, providing a boost for rural destinations outside of overcrowded cities.

Flexibility in travel arrangement

In the current uncertain environment, the consumer is seeking assurance in respect of travel commitments. Typically, the booking window is shortening. Airlines and other travel providers are offering more flexible and less onerous booking conditions and payment terms, including penalty-free change, cancellation and refund policies.

Increasing use of technology

Technology such as new mobile applications, biometrics, and contactless solutions, currently available, are enjoying a fillip in adoption. These include apps that provide on-trip notifications; contactless and mobile payment options; and biometric face or voice recognition. Preference is also emerging for a universal digital traveller identification on mobile devices which contains all necessary documentation and immunity status.

‘Long Covid’ legacy for the tourism sector

Despite the sector’s resilience to previous crises, the sheer depth and breadth of the pandemic’s impacts on tourism and the wider economy mean that a quick recovery is unlikely. However, while it remains unclear what long-standing or permanent changes the current crisis will inflict on the global tourism sector, growth is expected to return in the medium-term.

The pandemic is expected to effect some important changes in tourism. The crisis has accelerated shifts in demand and supply characteristics previously evident as well as causing new changes in consumer behaviour and business processes. Travel has been changed by past calamities. Safety measures instituted after the 9/11 attacks are now just part of the travel experience. It is unclear just which changes to the travel landscape will be in place a year from now, or 10 years on, but some answers have begun to come into focus.

Despite the significant negative impacts of COVID-19 on tourism, the crisis is providing an opportunity to rethink the future of Ireland’s tourism. Achieving a greener and more sustainable tourism recovery calls for a greater policy focus on the environmental and socio-cultural pillars of sustainability.

Sustainability

The pandemic has dramatically changed the policy context for tourism as well as a re-evaluation of the metrics used to assess tourism success. Looking beyond the immediate challenge to minimise the negative impacts of the crisis, fostering safe travel, and supporting a sustainable recovery are becoming into greater policy focus. Key policy considerations, identified by the OECD Tourism Papers No. 2021/01, recommends a greater emphasis on environmental and socio-cultural pillars of sustainability; the adoption of an integrated policy-industry-community approach; and the mainstreaming of sustainable policies and practices to develop and manage more sustainable tourism business models.

The immediate aftermath of the crisis provides an opportunity to better align recovery plans and investments with a transition that meets the objectives of health and safety, sustainability, climate action and biodiversity protection. Ireland could significantly improve its competitive positioning by a focus on transitioning to more environmentally friendly tourist transport, increased emphasis on outdoor activities, more hands-on heritage and cultural experiences, local food production, and slow tourism hubs. Government action including financial incentives to support tourism businesses should be considered.

The Covid-19 pandemic has heightened the focus on the resiliency, sustainability and interconnectedness of the tourism sector. Consumer and media focus on sustainability and the environment in the context of tourism has highlighted the considerable decrease in CO2 emissions and stalling the ‘over-tourism’ issue.

Digitalisation

The pandemic has undoubtedly accelerated the shift to digitalisation. Businesses have been creative in developing a range of innovative solutions which have helped to increase consumer confidence in the safety and security of all stages of the travel experience. Digitalisation in tourism services is expected to continue to accelerate, including an increasing use of automation, contact-less payments and services, virtual experiences, and real-time information provision. The next phase is also likely to see greater innovation and adaptation in the B2B business transactions within the travel and tourism sector.

Human capital

Employment in the tourism sector has been decimated by the impact of the pandemic. The sector’s skilled and experienced workforce has been depleted by redeployment to other sectors and migration. The reopening of tourism will present a challenge in delivering quality visitor experiences and services.

It is expected that the skills shortages in the industry will have been exacerbated by the crisis, while personnel returning to work after an absence of up to 12 months will require re-orientation and refresher training.

“Apart from its economic value, tourism also has other qualities which are difficult to measure. Tourism amenities within localities make them better places to live for local residents, whether by providing attractions and activities or offering good quality hospitality and events. In addition, tourism plays an important role in promoting Ireland’s image abroad, generating a positive impression of Irish people, landscape and culture for our visitors which can influence other aspects of our relationship with the world, whether in investment decisions or educational choices.” (Source: Tourism Recovery Taskforce)

Business productivity

The crisis has forced businesses to re-configure their operations, and in some instances provided an opportunity to transform their business model, resulting in increased productivity in the sector. The fall-out from the crisis can be expected to result in consolidation in some business sectors, as well as presenting opportunities for innovation and catering to new market segments.

Burgeoning national debt

The prime policy response to the need to meet extraordinary outgoings to mitigate the impact of the pandemic crisis has been to resort to modern monetary policy on an unprecedented level. The European Central Bank has facilitated increased deficit spending with new money by buying national debt securities. As a result, Ireland’s national deficit stands at a record high level. At some future date the debt burden will have to be reduced by increased taxation which may suppress demand and/or place a greater burden on businesses, perhaps at a time when interest rates and inflation are less benign.

Investment capacity

A prolonged period of recovery, coupled with the post pandemic debt, may severely burden the sector’s capacity to re-invest in the product. SMEs in the sector are particularly exposed to this risk. A lack of investment in the maintenance and upgrading of the product would inevitably result in a decline in the quality of the tourist experience and loss of competitiveness.

The pandemic is expected to at least stall a number of planned projects not currently under construction, including new hotels in Dublin, as developers and financiers reassess the new environment for tourism demand over the short to medium term.

Latest CBRE analysis for ITIC does point to continued expansion of the Dublin hotel product but many of these sites would have been under construction pre-Covid. Those that were only in planning stage may not see construction or completion.

Tourism Recovery – past experiences and current challenges

3.1 Evolution of Ireland’s tourism recovery from previous crises

The scale of disruption to international travel and tourism caused by the pandemic is unprecedented. However, it is perhaps informative to look at the recovery path of Ireland’s tourism following the most recent crises of 2001 (foot & mouth outbreak and terrorist attack of 9/11) and the global financial crisis of 2007-08.

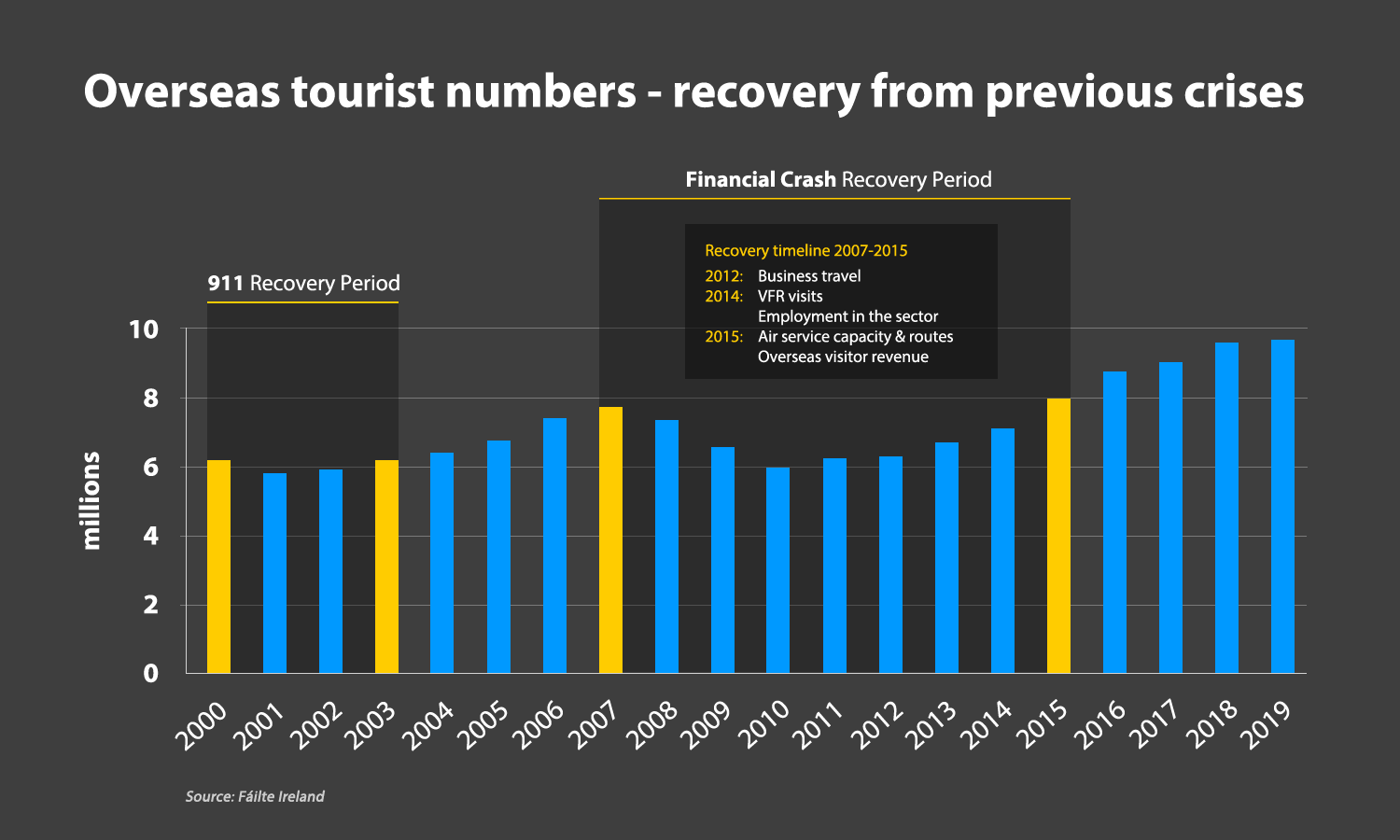

The impact of the events in 2001 was short lived. Foot & mouth disease in the early months of the year was confined in its market reach, while international travel from the USA returned relative speedily post 9/11 as security concerns were addressed. Ireland, in common with most other destinations, saw international arrivals recover to 2000 levels by 2003, with VFR rebounding within a year while holiday traffic recovered by 2004.

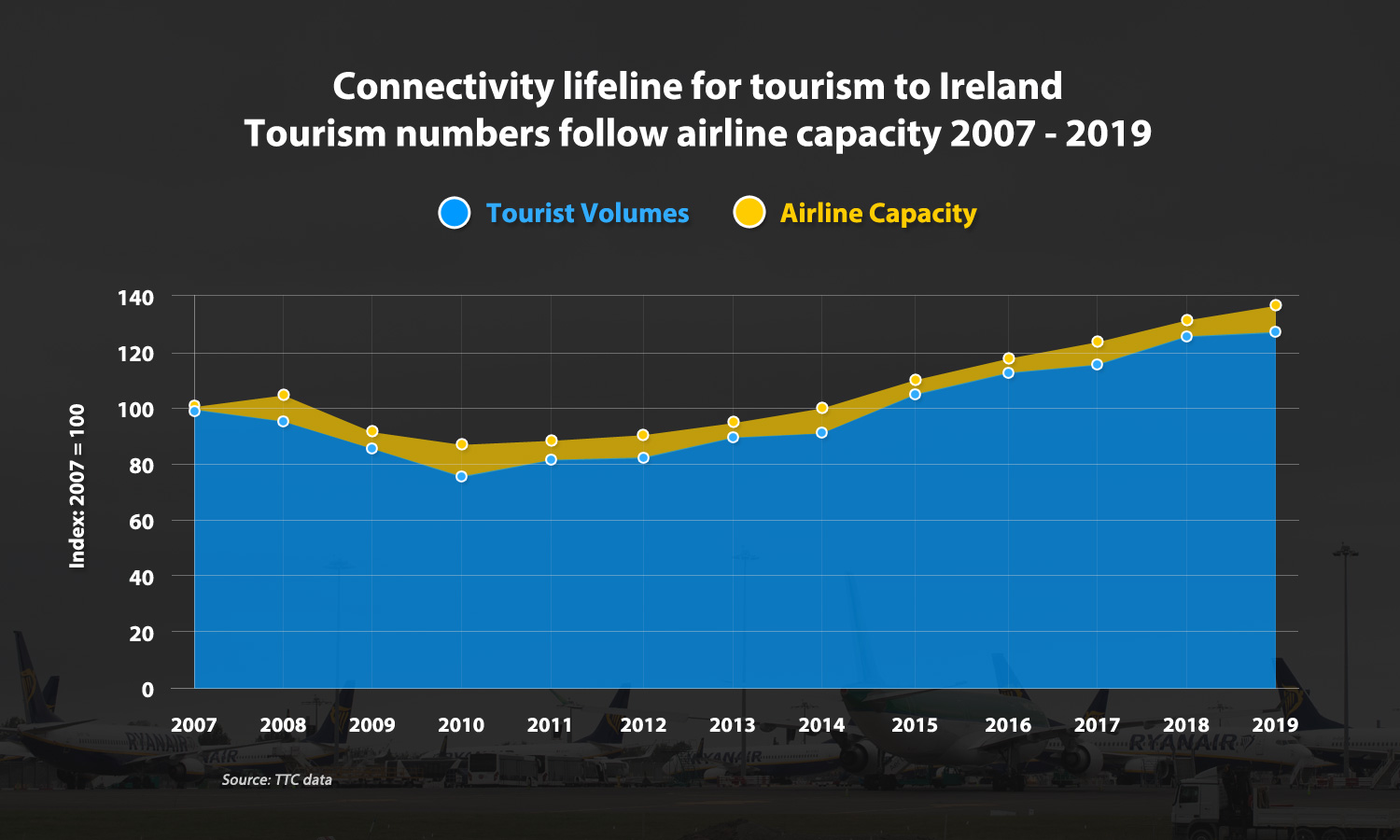

The global financial crisis had a far more reaching impact on tourism to Ireland with overseas visitor numbers and revenue only returning to pre-crisis level in 2015 – a 7 year recovery path, lagging global and European recovery achieved by 2011. Ireland’s recovery was challenged by a number of factors including the extent of economic downturn, lack of investment, but most especially by a loss of connectivity.

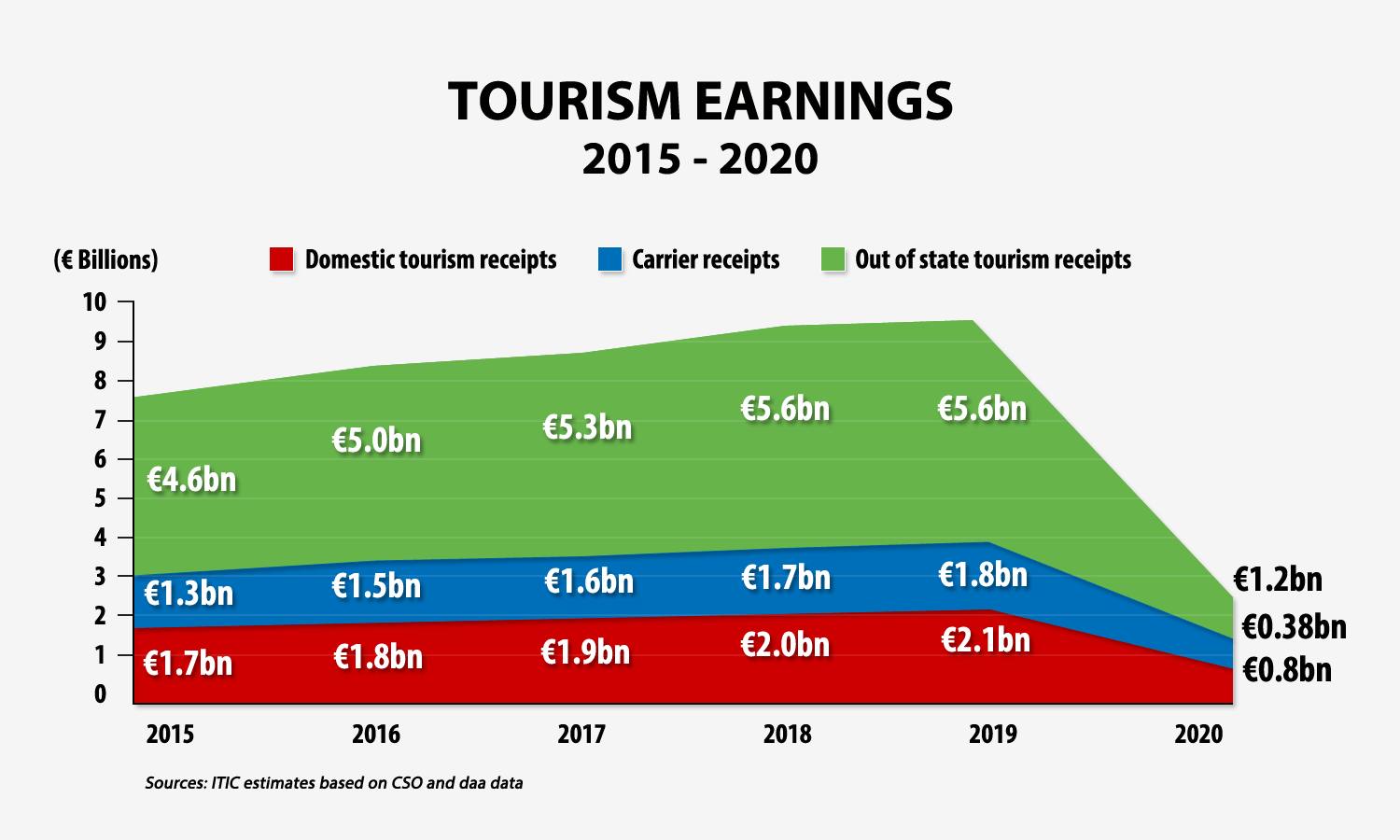

However, tourism made an important contribution to Ireland’s economy recovery as employment in the sector returned to pre-crisis levels by 2014, while overall employment recovery was not achieved until 2018. Government policy supports for the tourism sector, including a reduction in VAT and the suspension of air travel taxes, were proven to be important drivers of the return to work for thousands of people and a boost to regional economic recovery.

3.2 Today’s challenges to business recovery

While the industry anticipates an improved performance in 2021 compared to 2020, the road to recovery is expected to be long and difficult. Pandemic restrictions of varying severity are expected to endure until at least Q3 2021. The first half of 2021 represents a serious challenge to the survival of many businesses. The current resurgence of the virus has forced businesses to recalibrate their sales and budgets expectations for 2021. Cash burn will continue with positive cash flow position for many businesses unlikely before 2022. The risk is that many more businesses will run out of cash before the vaccine boost kicks in. Hence continued ‘life supports’ from Government and banks remain critical to ensure the survival of tourism enterprises.

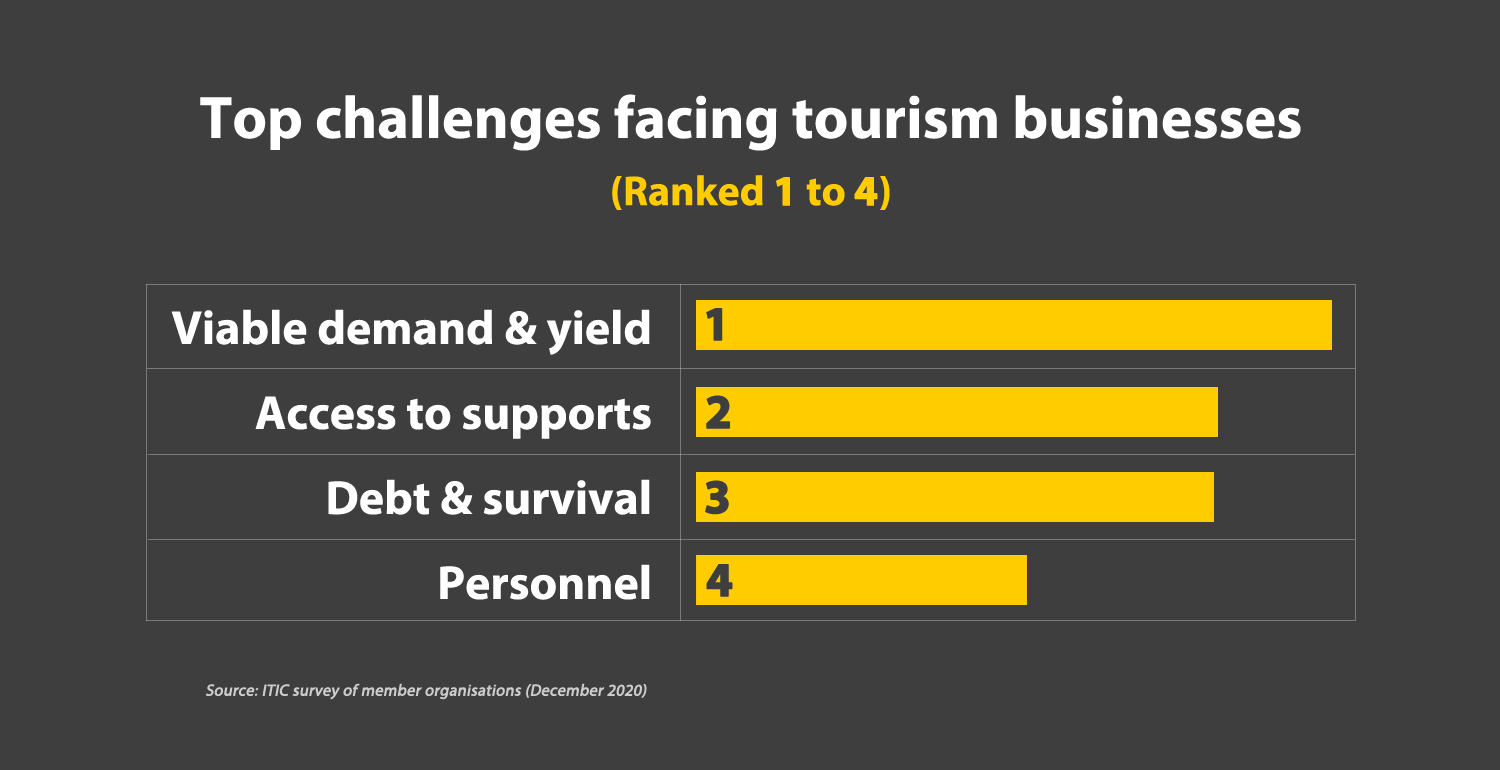

Priorities for tourism businesses

The reopening of markets and resumption of trading is the industry’s top priority and challenge. Businesses are focused on generating revenues to stem cash burn and to speedily achieve a return to levels of business with improving yields. It is widely anticipated that the initial resumption of trading will be focused on generating sales volume rather than yield as in the immediate term liquidity will be key to survival.

Further Government support will be required to save jobs and kick start the recovery. Bridging tourism businesses to the recovery is one of the most important investments that the Government can make in the indigenous economy. It will save jobs and kick-start the recovery in the broader hospitality, arts and entertainment sectors.

Bridging for businesses is key for business survival, but may be too late for those with insufficient reserves. Many businesses in the sector face a struggle with debt burden for some years to come although low interest rates may ease the burden somewhat. However, as an industry already significantly leveraged before the current crisis, it is cautious about taking on more debt with supports in the form of grants or tax breaks preferred.

The industry also expects to struggle to maintain experienced employees, having already lost a significant number who have found employment in other sectors. As a service industry, tourism relies on a highly trained and competent management and workforce.

Marketplace challenges facing the tourism sector

The good news is that consumers’ desire to travel remains incredibly resilient, and that pent-up demand bodes well for the travel and tourism industry in the long run. Research over recent months consistently shows that travel remains a key part of consumers’ lifestyles and travellers are keen to indulge their wanderlust again. It is clear that the deployment of vaccines will further boost the nascent recovery and the industry can start to look forward to brighter days ahead.

The roll-out of a coronavirus vaccine will undoubtedly support a return to international travel bookings, as people look forward to the reopening up of destinations. However, the vaccine will not deliver an immediate and universal re-opening of international travel. It is likely that many of the restrictions and behaviour changes will remain in place for some time to come to safely manage infections. For international travel to fully re-open will require that both Ireland and each source market from which we attract visitors will have to have effective vaccination programmes in place, supported by effective test and trace procedures. Ireland is well positioned with Dublin and Cork airports offering comprehensive onsite testing facilities.

The approval and rollout of vaccine(s) has been a game changer as it has boosted consumer sentiment as travellers become more comfortable with the prospect of travelling. This has been evident from the reported web searches and booking surge as experienced by airlines, tour operators and OTAs in recent weeks. Positive consumer sentiment can be expected to improve as vaccine and inoculation rates evolve, supported by effective test and trace procedures.

Travel sentiment is fluid and changes by the day reflecting latest news on the vaccine, infection rates and travel regulations.

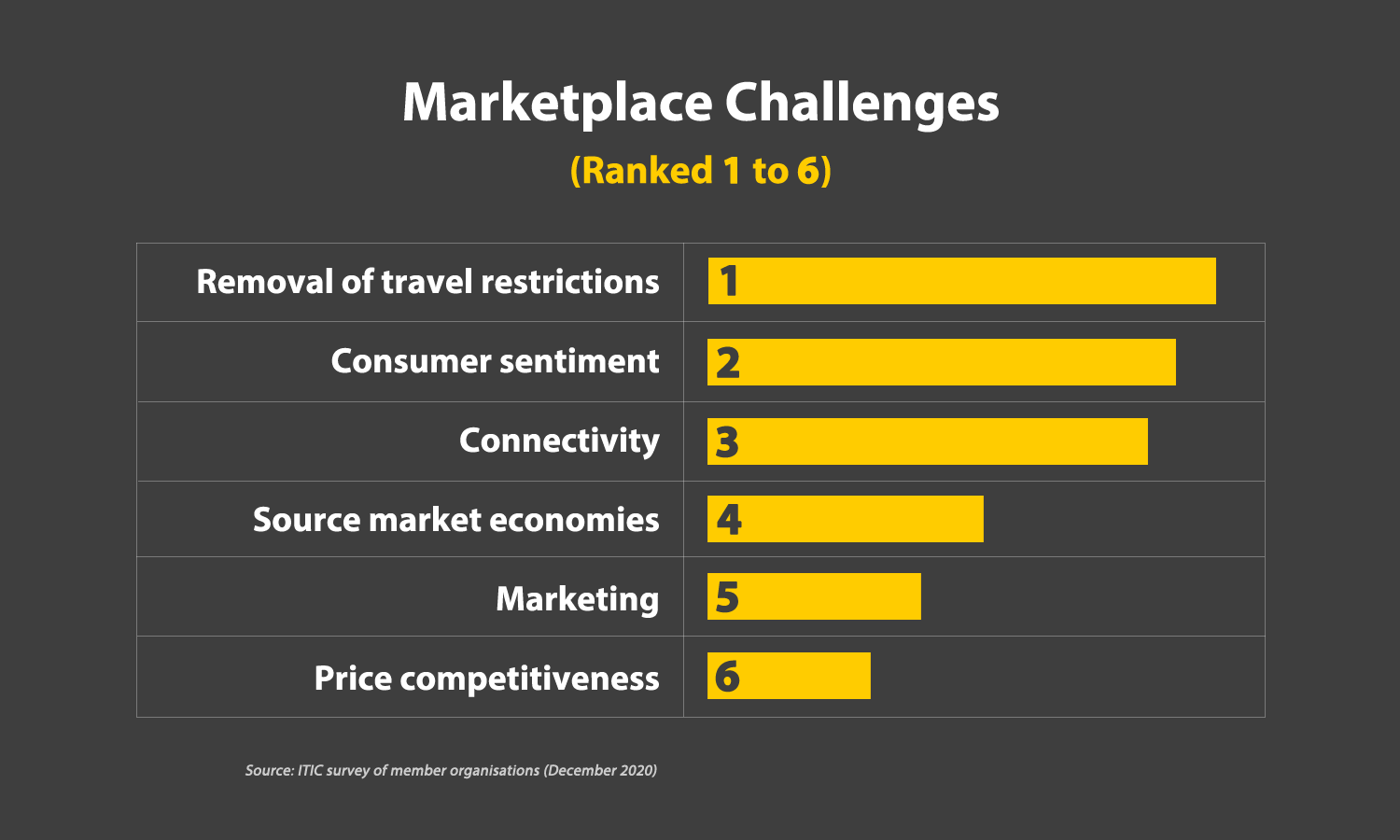

When asked to rank the challenges to the resumption of attracting overseas tourists to Ireland, the unanimous agreement that the removal of travel restrictions was the ‘sine qua non’ to resumption of trade. The re-opening of borders and the abolition of quarantine requirements, under protocols which allow for the safe resumption of international travel, are key to tourism’s future.

Top 2 prerequisites for recovery

4.1 Testing and vaccines

Tourism and the international travel industry require a cost effective, global, and modular solution to safely restart travel. Attempting a “zero risk” approach to eradicating Covid-19 is proving an unrealistic aspiration. As Covid -19 likely to be with us in some form for at least some time to come, the immediate risk-management solution is systematic testing alongside the vaccination roll-out. While the vaccines coming to market hold out hope as the eventual solution, the global inoculation programme will take time – time that many businesses do not have to be saved from closure.

Systematic testing regime urgently needed

Until the vaccine is widely distributed, rigorous testing will remain a key facilitator of international travel, as quarantine regimes have been shown not to be sustainable economic or social policies. Testing is already a requirement by an increasing number of countries as a pre-requisite for entry. Proof of a negative test result provides some level of mitigation of the risk of Covid-19 importation when re-opening borders to travellers. However, there is ongoing debate, and no universal agreement, on the type of test (PCR or antigen), the effectiveness of the measure against the spread of the virus, the cost, and verifiable evidence of test results. Until there is widespread inoculation it is expected that rapid and inexpensive testing will be increasingly available for travellers. Government must engage with rapid testing regimes to facilitate the restoration of aviation. Meanwhile, The Organisation for Economic Co-operation and Development (OECD) is laying the foundation for a global framework to help governments trust testing data based on mutual recognition of testing results.

Vaccine roll-out

The good news on vaccine approvals for use has come at an opportune time as the spread of infection continues. The preliminary approval by health authorities for the use of vaccines – Pfizer/BioMTech, Moderna and AstaZeneca vaccines – together with others in late-stage testing, plus homegrown vaccines in use in China, Russia and India, gives great hope for the reopening of travel at some point in 2021.

The roll-out of vaccination programmes is a significant step but not without challenges. Manufacturing capacities, distribution logistics, and access to supplies, are factors influencing the speed at which mass vaccination can become a reality and allow economies to start to function fully again. Already some supply issues have caused time lines and vaccination targets to slip, particularly across Europe. The USA and UK currently are ahead of the EU on the roll-out, having immunised a higher proportion of their populations.

Current data would suggest that America will exceed its target of 100m immunisations by the end of the first quarter of 2021, and a further 100m by mid-year. In contrast, most countries in the European Union, where vaccine rollouts have moved extremely slowly, are lagging behind other developed countries. Differences in vaccine efficacy could mean evolving dynamics, as will the rate of uptake of the vaccine within populations.

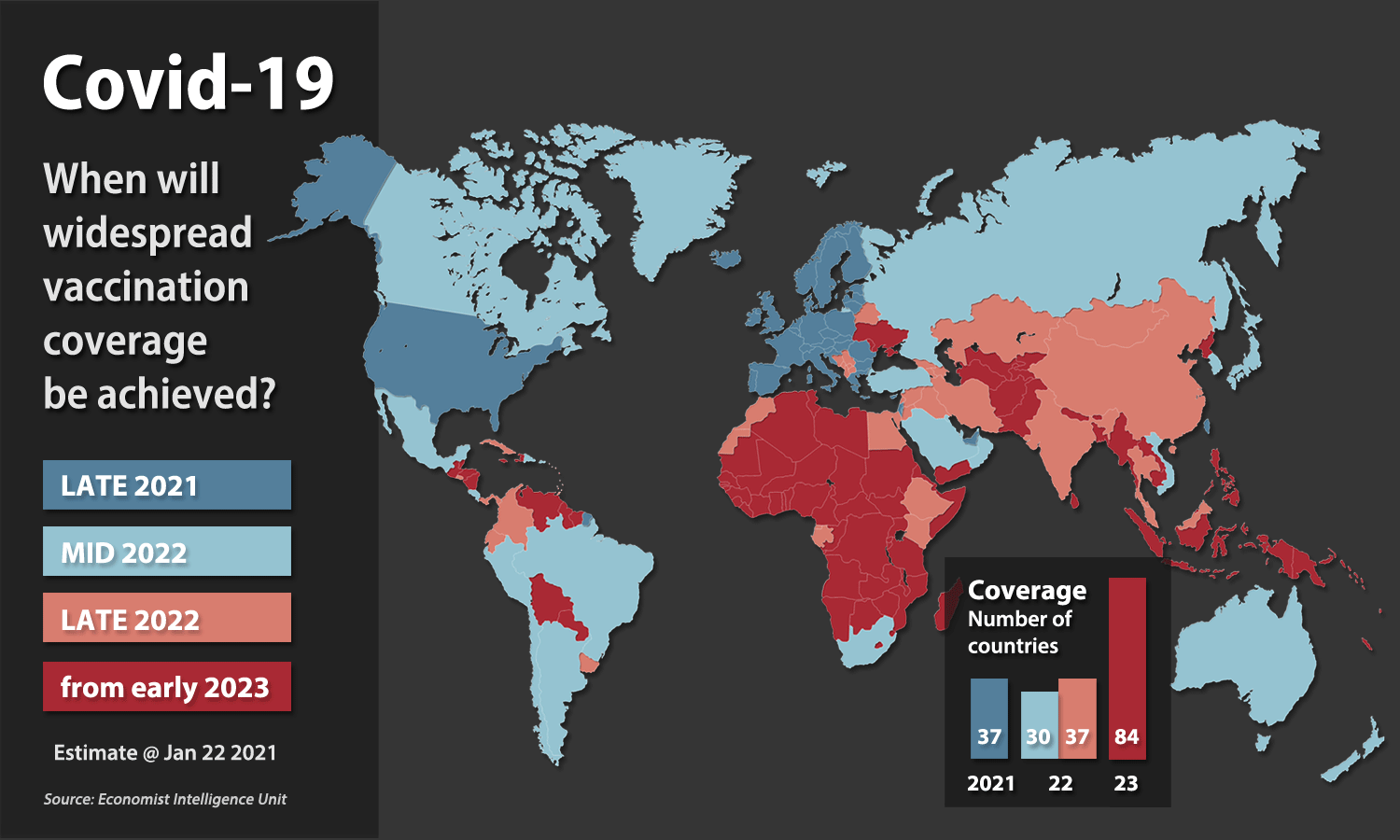

Most developed nations, including Ireland’s main tourism source markets, are expected to have immunised their priority groups (including the elderly, people with underlying health conditions and healthcare workers) by end-March, while the bulk of the population will not be immunised until the latter part of the year. Although the probability of achieving herd immunity by autumn is still the most likely scenario in developed nations, the rise of more contagious mutations and the slower initial vaccine rollout each increases the likelihood of that target being pushed out into early 2022 according to the Economist Intelligence Unit (January 2021).

However, life will not be back to normal even by then, as immunisation programmes for the bulk of the population in advanced economies will continue until mid-2022. Meanwhile, local outbreaks of Covid-19 are likely, which may lead to the reimposition of local or national lockdowns.

Global harmonised approach to biosafety for a safe return to international travel

A common request from people across the industry is for governments to work together to standardise testing and vaccination protocols. Unfortunately the experience of 2020 clearly demonstrated the negative impact of the absence of a coordinated inter-governmental approach, even at European level, which led to a patchwork quilt of confusing, and at times apparently contradictory, regulations and advisories. Without an agreed approach to biosafety at an international level, it will be difficult for international tourism to begin a recovery. Hence the urgent need for the establishment of global standards for vaccination and testing certification.

The International Air Transport Association (IATA) has called on governments to partner with the air transport industry to devise plans to safely re-open international travel as soon as the COVID-19 epidemiological situation permits.

A number of key global standards are already being developed. The World Health Organization (WHO) is leading efforts to build the standards needed to digitally record vaccination information. This Smart Vaccination Certificate will be the digital successor to the long-established “yellow book” used to manage vaccinations such as yellow fever. Similarly, the International Civil Aviation Organization (ICAO) has published standards to create a Digital Travel Certificate or e-passport to securely match travellers to their vaccination and test certificates. Meanwhile, many airlines and some destinations are currently piloting technology solutions to streamline the health documentation process delivering accurate information, secure identification and verified data. The first digital health passports to emerge include apps such as IATA’s Travel Pass, CommonPass, AOKpass, Myine-iProov, and VeriFLY. While these solutions offer the prospect of facilitating international travel there are concerns about security, legal and data protections issues.

Only multilateral policy decisions are absent to enable implementation.

4.2 Restoring Connectivity

Covid-19 has decimated air connectivity

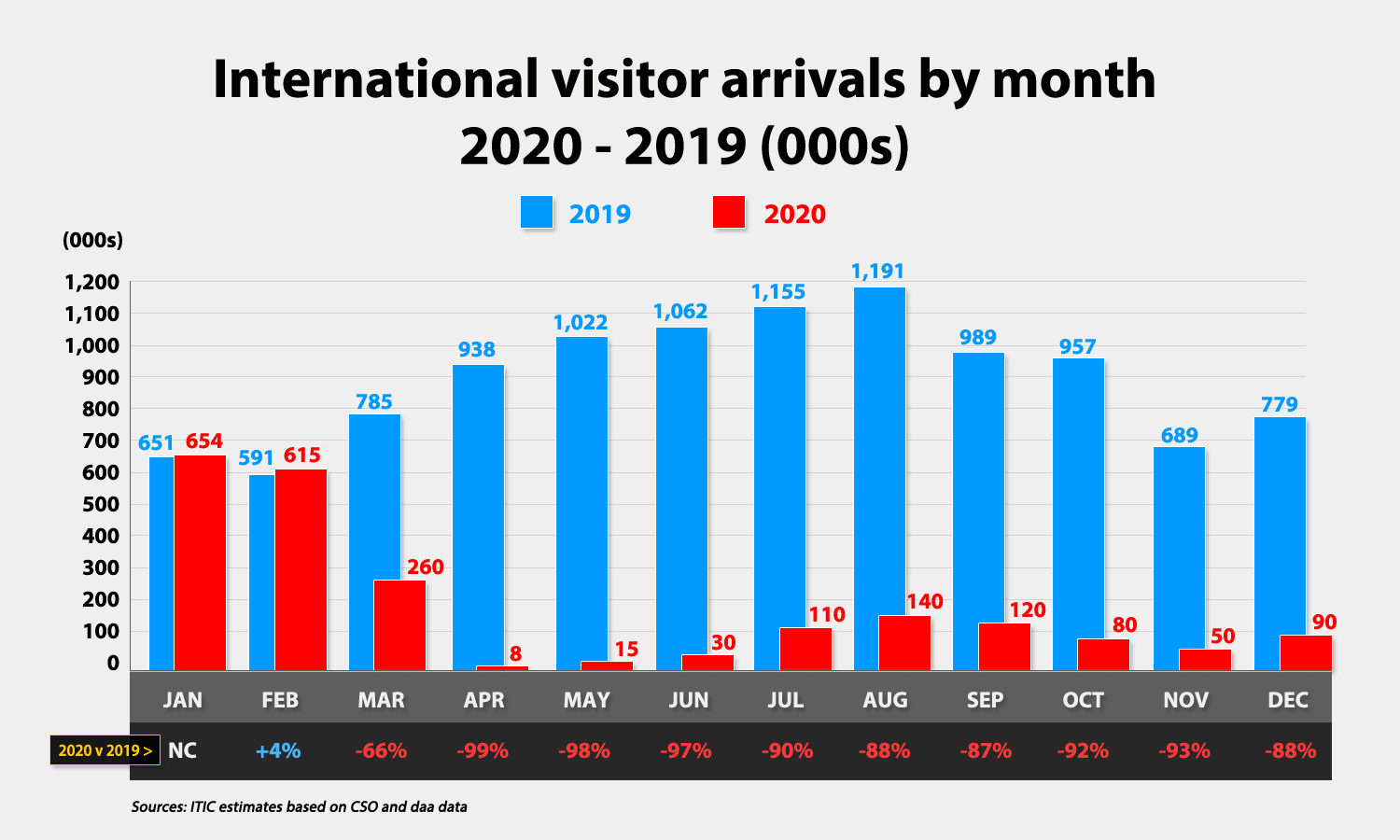

Commercial flight movements at Ireland’s three main airports fell by 58% (Source: IAA release January 11, 2021), as airlines curtailed services and abandoned, at least temporarily, many routes. Ireland’s connectivity has reduced by more than two-thirds. Dublin Airport has lost service to over 100 destinations, while all other airports are experiencing severe reduction in connectivity, including the total withdrawal of international service from regional airports for periods of time.

Passenger numbers at Dublin Airport in 2020 fell by 77% , while traffic at Cork and Shannon was 79% and 78% below the previous year, with regional airports experiencing an even steeper fall in demand. The drop in inbound tourists by air was more marked as outbound Irish traffic provided a boost during the summer window of easing of restrictions.

Airlines and airports have suffered devastating income losses, massive cash burn, and job shedding in a struggle to survive.

Air service connectivity a key driver of inbound tourism

The correlation between air service connectivity and tourism growth is well established, as evident from the impact of air service liberalisation over the past 25 years and the demonstrable impact of the launch of new services on visitor arrivals. Over the past five years, tourist arrivals have grown by 36% in parallel with a similar increase in capacity on air services, which provided Ireland with connectivity on 260 ‘city pair’ routes in 2019.

Inbound visitor traffic has grown at a faster pace than domestic originating demand at both Dublin and Cork in recent years, while North American visitors accounted for two out of every three transatlantic passengers at Shannon. Regional airports, while catering to lower volumes of inbound traffic, are of particular importance to their local economies.

The most demonstrable impact of increased airlift on tourist arrivals in recent years has been the expansion of direct air service to Ireland from the USA, Canada and selected European gateways, while the launch of services via the Middle East, and more recently from China, drove demand from new emerging markets. Visitors from North America have increased by 66% from 2014 on the back of increased airline connectivity.

Outlook for European air services

Prior to the current travel restrictions and vaccination requirement for entry introduced in early January, the daa had forecast up to 16 million passengers in 2021, half of 2019’s all-time high of 32.9 million, with a return to pre-pandemic volumes not expected before 2024. However, forecasts can be expected to be subject to revision due to the ongoing crisis.

Latest projections from Eurocontrol suggest that flight numbers in European airspace would reach 51% of 2019 levels in 2021 and fully recover by 2026. This recovery path “factors in likely progressive vaccine deployment across Europe” during 2021, but not “full coverage” or the “disappearance” of Covid-19 in the next 12 months.

Europe’s leading low-cost carriers (LCCs) have mostly navigated through the crisis in better shape than the leading legacy airline groups. LCCs have distinct advantages over legacy rivals as demand for travel resumes. These airlines focus on short haul, where the recovery is faster, they are less reliant on business travel that is slow to recover, and they have low unit costs and so can operate with lower fares at a time of economic hardship for consumers. Moreover, Ryanair, a market leader, has a strong balance sheet and has outperformed rivals on profitability and more crucially cash with €4.5bn cash in hand at September 30, 2020.

Restoration of connectivity essential for tourism recovery

Ireland is fortunate in having two airlines – Aer Lingus and Ryanair – heavily invested in the market. This provides a distinct competitive advantage for tourism of a more speedy reinstatement of services as soon as the virus in under control and consumer sentiment recovers. Foreign airlines, other than those serving strong hub networks, as is in the past will be slower to reinstate services to/from Ireland.

Ryanair – the market leader in delivering short haul visitors to Ireland

Current services are massively reduced in Q1 with the airline revising downward its forecast for its financial year ending March 2021. A strong balance sheet, together with its lowest cost base, means Ryanair is best positioned amongst European airlines to emerge a winner from the crisis to fund low fares, grow its network, and expand its fleet, including taking delivery of new Boeing 737 aircraft.

The airline is well positioned to gain market share and can be expected to aggressively market its services as market conditions improve. Currently five million seats are on offer on Ireland routes in the airline’s summer schedule, marginally down on 2019. (Source: OAG Schedule Analyser) While four of the carrier’s top volume routes are between Dublin and Britain, the airline is expected to adopt a cautious approach to the reinstatement of some routes with lower demand and yield profiles, which may impact the number of routes served to/from Ireland, with airports outside of Dublin more vulnerable to any reduction in service.

Aer Lingus – Ireland’s top network carrier

Aer Lingus’ year-round services on key European trunk routes and its extensive transatlantic route network are key to the success of inbound tourism. IAG, Aer Lingus’ parent, has boosted its already strong balance sheet by a recent €2.7bn right issues and a UK back-guaranteed loan.

Aer Lingus’ investment strategy of expansion to its transatlantic network, positioned as a ‘value airline’, has delivered increasing revenue and profit in recent years, as well as driving increased numbers of tourists to Ireland. The airline is well positioned to gain first mover advantage on transatlantic services as soon as demand resumes. As US airlines are likely to be slower to restate services on thinner US-Europe routes, Aer Lingus are well positioned to gain a distinct advantage in winning increased market share of both the Ireland inbound and outbound markets as well as attracting greater numbers of transatlantic passengers on routes from North America to Europe via its Dublin hub.

The airline is expected to maintain an extensive network of European services providing high frequency connectivity with all major cities in the UK and mainland Europe as gateways for inbound tourists.

Foreign airlines serving Ireland

European legacy carriers linking Ireland with key hub airports, including BA, Lufthansa, and Air France-KLM, are expected to continue to serve Ireland, with capacity and frequency adjusted to demand patterns. Other carriers and secondary routes currently suspended may take time to re-open, as has been the experience in the past. The focus of recovery can be expected to be on routes with established records to Dublin and Cork.

The major US airlines serving Ireland are undergoing significant fleet reductions by accelerating the retirement of some models and deferring replacements. This will inevitably impact some services to Ireland – a fact already confirmed by the withdrawal of some routes serving Shannon and Dublin. The impact is likely to continue in the short to medium term, reflecting the pattern of previous recoveries.

Connectivity via Middle East hubs is expected to be maintained, while the reinstatement of the short-lived direct services from China and Hong Kong is unlikely in the short term.

Airports – short term outlook

All Irish airports have seen their traffic decimated as a consequence of the measures taken to address the virus in Ireland and across the globe. While the start of the connectivity recovery path, based on past experiences, is likely to see Dublin the preferred gateway for first wave connectivity recovery, Ireland and its gateway airport will be in competition with capital city airports around Europe to attract back services, particularly for long haul. It is expected that a slower rate of re-establishing services will be experienced at other airports.

Dublin Airport, the primary gateway for air travel, has announced an incentive scheme designed to allow airlines a higher level of confidence to commit capacity to Ireland, as market conditions improve, vaccines are rolled out and Government guidelines are further relaxed during 2021. Airlines delivering incremental traffic in any quarter above 50% and 70% of 2019 levels will benefit from graduated rebates. A similar incentive scheme for the rebuild of services is in place at Cork Airport.

Further Government financial supports will be needed to rebuild connectivity. Failure to assist the critical connectivity infrastructure and operators would severely limit the tourism recovery.

The Aviation Task Force report (July 2020), acknowledging that airlines needed to manage financial risk of route restoration, advocated a number of measures to reduce operating costs as an effective catalyst to rebuilding connectivity. The recommendations included “rebates on certain charges and per passenger sums as appropriate… to reduce the financial risk of rebuilding capacity and passenger numbers whilst meeting Government objectives on rebuilding connectivity and capacity.”

Cork, Shannon, Ireland West, Kerry and Donegal airports face a particular challenge having lost many services and incurred significant operating losses. The short-term recovery environment suggests that services to these airports will be slowest to recover, as has happened in the past, and will require specific financial supports from the State for survival. Such an approach would have to be notified to the European Commission for approval. A recent report from the Oireachtas (Issues affecting the aviation industry, December 2020) called upon the Government to engage “with the European Commission to seek derogation from State Aid rules for emergency funding to Irish airports”

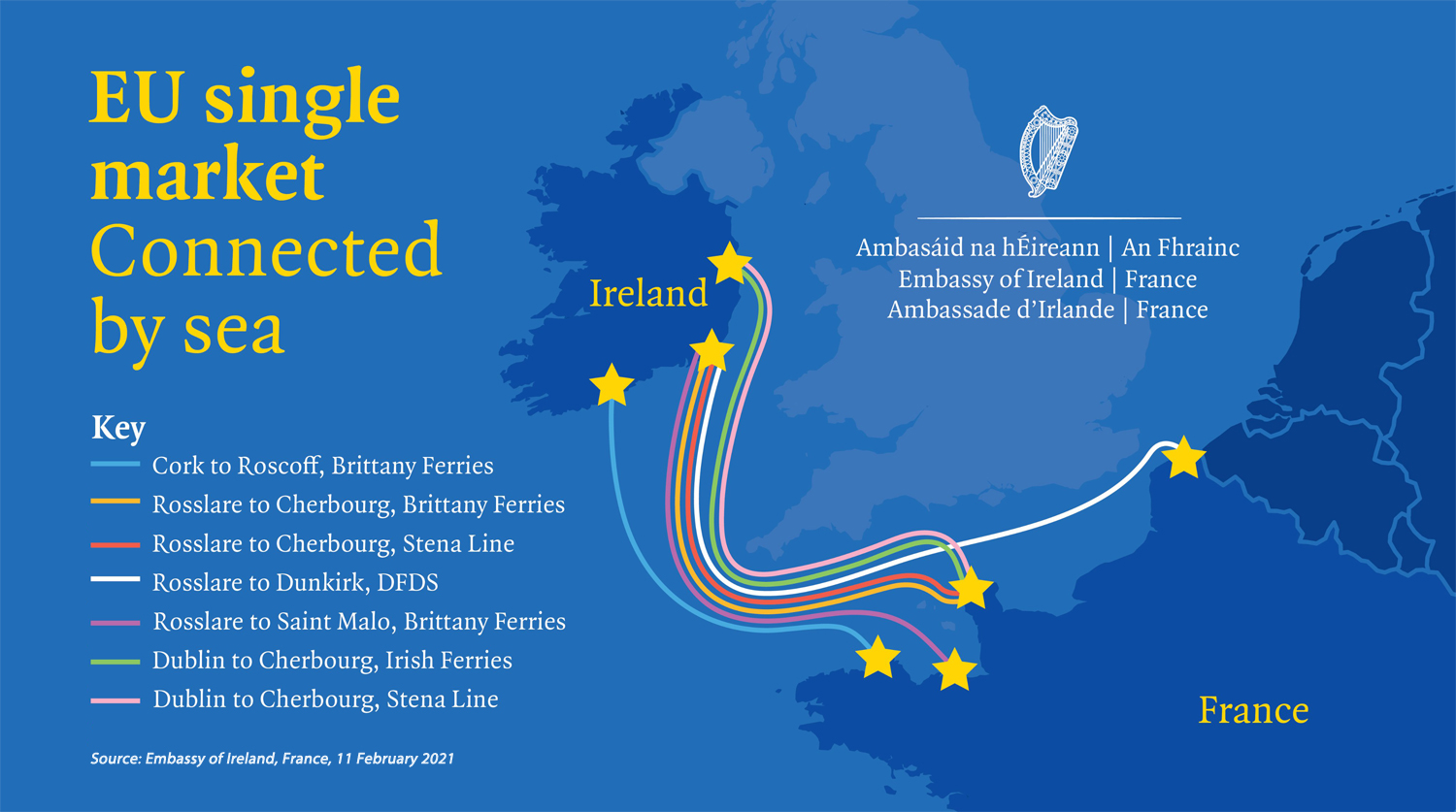

Ferries

While just under one in ten visitors arrive by ferry, the services provide a vital link from Britain and mainland Europe for tourists in cars and coaches. Own-car visitors tend to have a longer stay and higher spend profile than the average holiday visitor. The impact of the pandemic may also result in an increase in interest for travel by ferry, being perceived by some as offering a lesser health risk and a more environmentally friendly travel option.

The ferry operators – Irish Ferries, Stena Line and Britanny Ferries – continue to invest in Ireland routes and are offering increased capacity on routes to mainland Europe as freight demand has increased post Brexit.

Outlook: future scenarios

5.1 The current context

News of successful vaccines in the closing months of 2020 provided a much-needed boost to the industry with the hope that international travel could begin to recover in 2021. However, a massive surge in infections, the emergence of new strains of the virus, and the re-imposition of lockdowns and border closures around the world, has forced a recalibration of expectations for travel in 2021 and lengthens the time line for a recovery to pre-Covid levels.

The immediate short term is looking bleak. It is now more difficult to imagine a transition to the reopening of Ireland to international visitors before the second half of 2021. This timeline could be pushed out by a number of factors including new more infectious strains of the virus, unexpected vaccine safety considerations, manufacturing and supply chain issues, and a shorter than anticipated duration of vaccine-conferred immunity.

Ireland’s tourism businesses face a myriad of challenges in 2021, but by far the most pressing is the question of when will international visitors begin to return in significant numbers. Only when numbers begin to flow again can businesses start to exit survival mode and transition to recovery, generating cash flow, securing jobs and reducing dependency on state supports. Tourism businesses in Ireland had expected to see the start of a reopening of international tourists in 2021, with the majority not expecting to see green shoots before the second half of the year or early in 2022.

5.2 Economic outlook

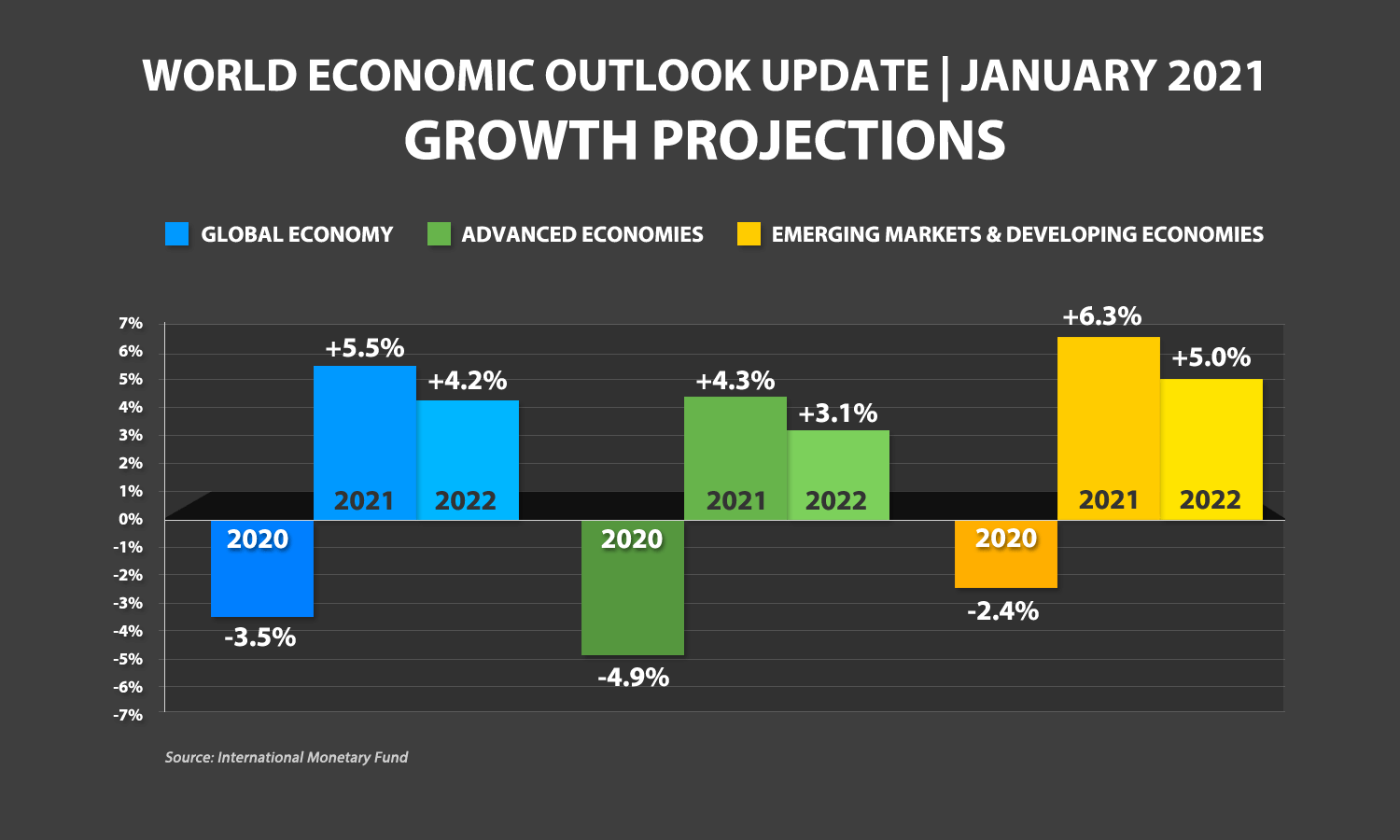

By any measure the global economy has rebounded more quickly than many forecasters initially expected. The extent of fiscal stimulus, including supports for businesses and employment subsidies in many economies, played a key role in offsetting the damage from the pandemic.

Global economy is at a critical juncture, according to the latest report from the IMF. While rollout of vaccines will boost growth, economic recovery will be shaped by the extent of further policy support, the roll-out and effectiveness of vaccines. Renewed waves and new variants of the virus represent the principal threats to a return to economic growth.

Global GDP which contracted by -3.5% in 2020, it is projected to return to growth in 2021 by 5.5%, with more modest 4.2% growth in 2022. While trade rebounds as economic activity picks up, recovery is expected to be uneven and unequal across the globe.

The economic outlook for Ireland’s tourism main source markets is positive, with evidence of increased savings in most developed economies boosting the prospect of a rebound of consumer spending as restrictions are lifted.

5.3 Pent up demand for travel

All research points to the fact that the consumer is eager to return to travelling, but feel restrained. However, the timeline of re-opening international tourism is far from clear. The key metric, identified by research, is the level of comfort consumers have with undertaking a trip. The roll out of vaccines underway in the UK, the US, across EU member states and in other countries, undoubtedly make a significant difference in terms of travel confidence, as will protocols and international travel requirements.

Almost one in three (32%) of Europeans indicated that they intend to take a trip in Q2, 2021, with just over half (52%) planning to travel in the next six months, according to the latest poll from the European Travel Commission (ETC). Both indicators show an improvement on the previous survey in November. The survey shows a strong preference for intra-European travel – the top choice for 40% of respondents. The findings show that strict health and safety protocols build trust and peace of mind and make travel more enjoyable. (Source: ETC: “Monitoring Sentiment for Domestic and Intra-European Travel – Wave 4” survey across 10 European countries in December 2020)

Encouraging findings from Tripadvisor show that nearly half (47%) of travellers surveyed globally said they are planning to travel internationally in 2021, including 45% of US travellers. In fact, one in ten (11%) global respondents had already booked an international trip for 2021, including 14% of respondents in the US. The most eager to venture abroad are German and UK travellers – in the first week of January, 85% of hotel clickers on Tripadvisor in either country were planning international breaks for later this year.

Ireland’s attractiveness as a holiday destination remains unchanged, but the overall comfort levels towards taking a European trip remained low, according to the findings of the most recent research from Tourism Ireland. The key conclusion of the research was that while vaccine brings optimism, consumer sentiment currently doesn’t indicate a speedy return to travel as normal. The main findings included:

- The fundamental desire to travel remained with over half of outbound holidaymakers expected to take of short break or holiday in Europe by end of 2021. Two in five Europeans expected this to be between April and September 2021.

- The majority expected to have vaccine available to them by June 2021. The attitude to vaccine take-up differed by market, with most in Great Britain and the United States keen to take vaccine as soon as it is available, Germans were cautiously positive, while in France fewer than half intended to take the vaccine as soon as it was available to them.

- The majority of holiday makers expected vaccinations to be a mandatory requirement for travel within Europe in future, although support of this isn’t universal. Some form of testing for travel within Europe was also acknowledged by a majority of respondents.

(Source: Research amongst 4,000 experienced travellers in Great Britain, USA, Germany & France conducted 04-17 December 2020)

Visiting friends and relatives (VFR)

An important component of international travel worldwide is the large cohort visiting friends and relatives. In recent years just under 30% of tourists to Ireland fell into this category. While the importance of this segment has been in relative decline, it continues to accounts for just over half of all visitors from Britain.

The continued strength of the segment by source market mirrors inward and outward migration over the years and represent a sizeable opportunity as travel reopens. It is expected that pent up demand for visiting family and friends will be particularly keen to travel as soon as it is feasible, as already witnessed with travel spurts particularly this past Christmas. VFR travel is an especially important year-round market for access carriers. Past experience has shown how responsive this market segment is responsive to staged events, including The Gathering in 2013 in the aftermath of the global financial crisis.

Leisure visits

Holiday or short break visitors accounted for just over half (54%) of all arrivals, and 60% of revenue in 2019. The segment is most susceptible to destination and event marketing and has been the driver of growth in Ireland’s inbound visitor number and, more importantly, revenue in recent years. Mainland Europe is the top source market, ahead of North America and Britain. Significant growth in holiday trips from outside of Europe has provided high value holidaymakers resulting in significant incremental increase in overall receipts.

Ireland’s attractiveness and competitiveness as a holiday destination has not diminished as a result of Covid-19. However, in the short term, demand may be curtailed by a real or perceived perception of any limitation on things to do and see at the destination due to ongoing public health regulations.

Recent indicators would suggest a growing preference for open spaces and less congested locations – factors which have the potential to work in Ireland’s favour. Major tour operators in Germany and the USA report that clients, with booking deferred from 2020, are keen to travel as soon as it is safe to do so and restrictions are lifted. A number of tour operators have programmes on offer for later this year.

Business travel

Historically business travel has made up a significant portion of global travel and tourism revenues, traditionally a high yield segment of the overall market of importance to airlines, hotels, Irish based PCOs/DMCs, restaurants, car rental and meeting venues. Business trips have accounted for 15% of tourists to Ireland in recent years; a segment with a higher than average per diem expenditure, especially conference and incentive travel visits.

When Microsoft co-founder Bill Gates said that “over 50% of business travel and over 30% of days in the office will go away” (Speaking at New York Times’ DealBook conference, November 06, 2020) it may have come with a little personal bias – the owner of Teams videoconferencing platform had a fourfold increase to 115 million daily users in 2020. However, the statement highlighted the question as to the extent to which more extensive use of technology would impact corporate travel. Just how much of a shock Covid-19 has caused to the corporate travel sector is unknown. The incidence of business travel is expected to fall with face-to-face meetings with clients, suppliers and distributors taking precedence over internal corporate meetings. The expectation is that business travel will be slow to recover with annual expenditure unlikely to recover until late 2023 or in 2024.

Despite the success of virtual conferencing over recent months, conferences will come back with a hybrid model gaining in popularity. The market may be slow to re-open, with immediate demand limited to deferred bookings for events with new forward bookings experiencing a lag time of 2 to 3 years.

Cruise tourism

The US Centers for Disease Control and Prevention, while it has lifted its ‘no sail’ order from US ports, continues to advise deferring travel on cruise ships, including river vessels, worldwide. New recommended health and safety protocols require cruise operators to carry out simulation cruises before restarting passenger carrying voyages. Most major cruise lines have postponed re-start dates to at least May 2021, with most cruises sailing at a reduced capacity on limited itineraries of shorter duration.

5.4 Current outlook for international travel recovery

International Air Transport Association (IATA)

IATA’s baseline forecast for 2021 is for a 50.4% improvement on 2020 demand that would bring the industry to 50.6% of 2019 levels. However, currently there is a severe downside risk if more severe travel restrictions in response to new variants persist. Should such a scenario materialise, demand improvement could be limited to just 13% over 2020 levels, leaving the industry at 38% of 2019 levels. (Source: IATA release February 03, 2021)

Eurocontrol

The current ‘most likely’ scenario would see flight traffic returning to 92 per cent of 2019 volumes by 2024, with 2019 levels only reached fully by 2026. The most optimistic scenario, which would see a full recovery by 2024, is not now viewed as likely, while the least likely scenario envisages a much slower return to 2019 by 2029 (Source: Eurocontrol: Think Paper #8, January 01, 2021).

Airports Council International (ACI)

European airports expect very low levels of demand in Q1 & Q2 2021 with some recovery as of Q3 yielding a ‘significant summer peak’ as pent up demand is released. This is based on the assumption of an effective vaccine roll-out and, at least partial, lifting of travel restrictions. This scenario would see Q3 traffic reaching up to 60% of 2019 levels, followed by a slowing down of recovery in Q4 to 55% of 2019 levels. ACI’s pessimistic scenario sees peak traffic in summer 2021 not exceeding 40% of 2019 levels (Source: ACI: Traffic forecast & Financial impacts (Revised 2021 forecasts), January 20,2021).

UN World Tourism Organisation (UNWTO)

The extended scenarios for 2021 to 2024 point to a rebound by the second half of 2021. Nonetheless, a return to 2019 levels in terms of international arrivals could take between two and four years.

World Travel and Tourism Council (WTTC)

The global body’s best case scenario predicts a strong summer of travel ahead for worldwide tourism from late March onwards, based on WTTC’s latest economic forecast. This scenario factors in widespread vaccination programmes and a swift adoption of comprehensive test-and-trace regimes, together with continual, strong international coordination from the private and public sectors (Source: WTTC Release, London January 19, 2021).

HSBC Global Research

Despite the near grounding of aviation in Q1’21, “recovery in H2, while not guaranteed, continues to look quite good”. Vaccination roll-out could see intra-European and transatlantic travel re-open in the second half of the year. An international consensus on health protocols and border regimes will be essential, “without a stable international framework it will be hard for travel to resume” (Source: HSBC Global Research: European Aviation, January 18, 2021).

Visit Britain

Latest forecast for 2021 shows a very small increase in inbound tourism during the early part of the year, followed by a recovery in Q2 as restrictions start to ease, and then a gradual increase throughout the rest of the year. European inbound markets are forecast to recover quicker than long haul markets, with 2021 demand from Europe expected to be in the region of 50 per cent, and long haul at 24 per cent, of 2019 volume levels (Source: Visit Britain: Forecast last updated December 2020, published early January 2021).

5.5 Three recovery scenarios

Foresight v. forecast

With more unknowns than knowns it is likely that the future will not be business as usual and the speed and shape of recovery is unlikely to be universal across Ireland’s source markets. Envisioning possible paths to the re-emergence of tourism demand for Ireland – VFR, leisure and business – is complex and will be largely determined by external factors.

Under these circumstances the approach adopted is one which provides foresight on possible scenarios, and guidance to businesses, rather than the traditional forecasting approach which tends to predict one future.

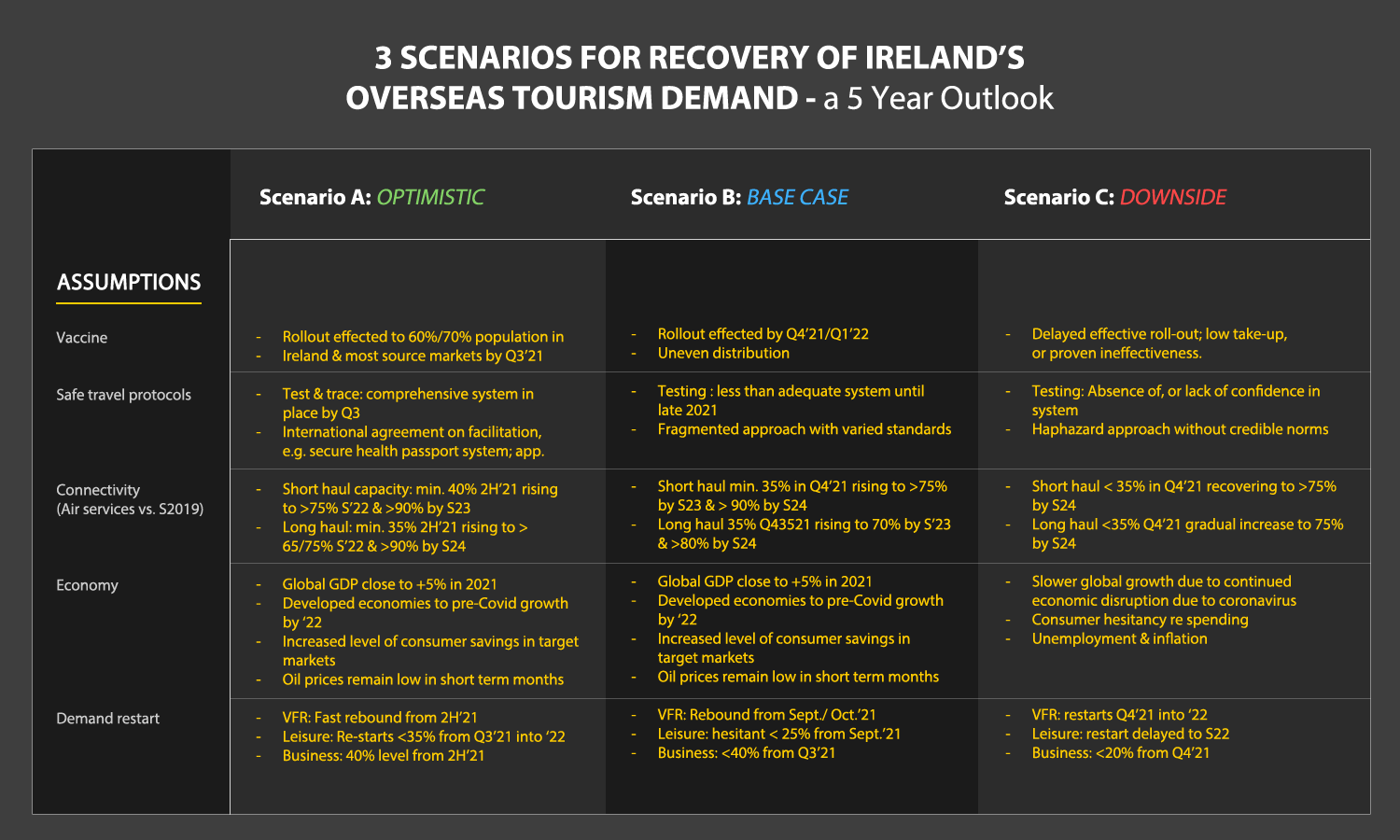

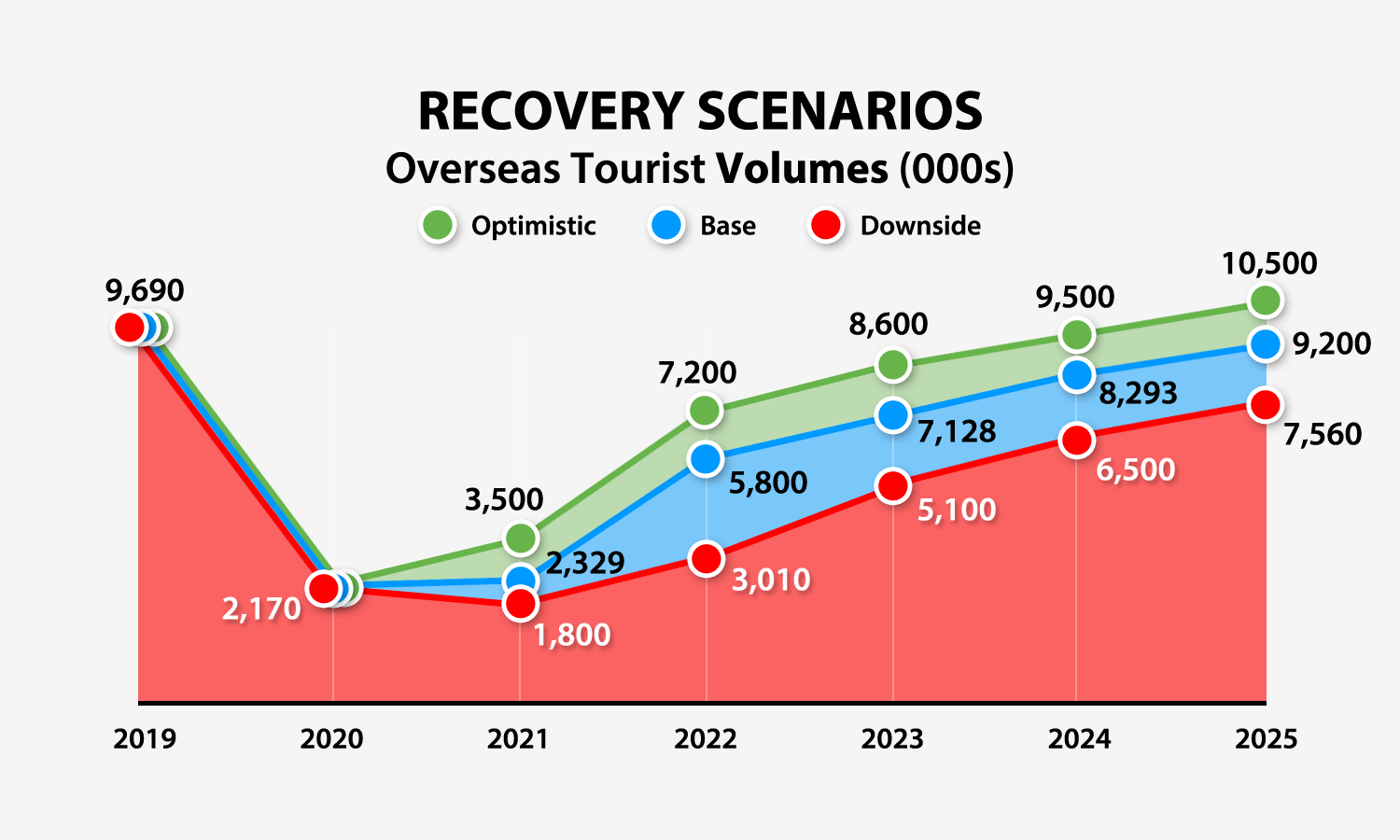

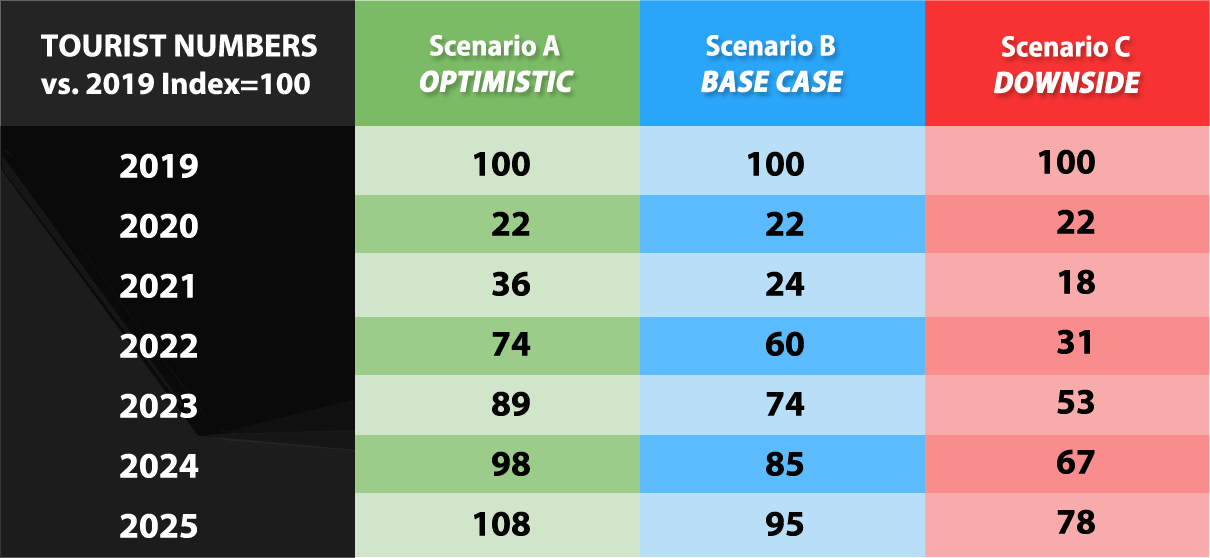

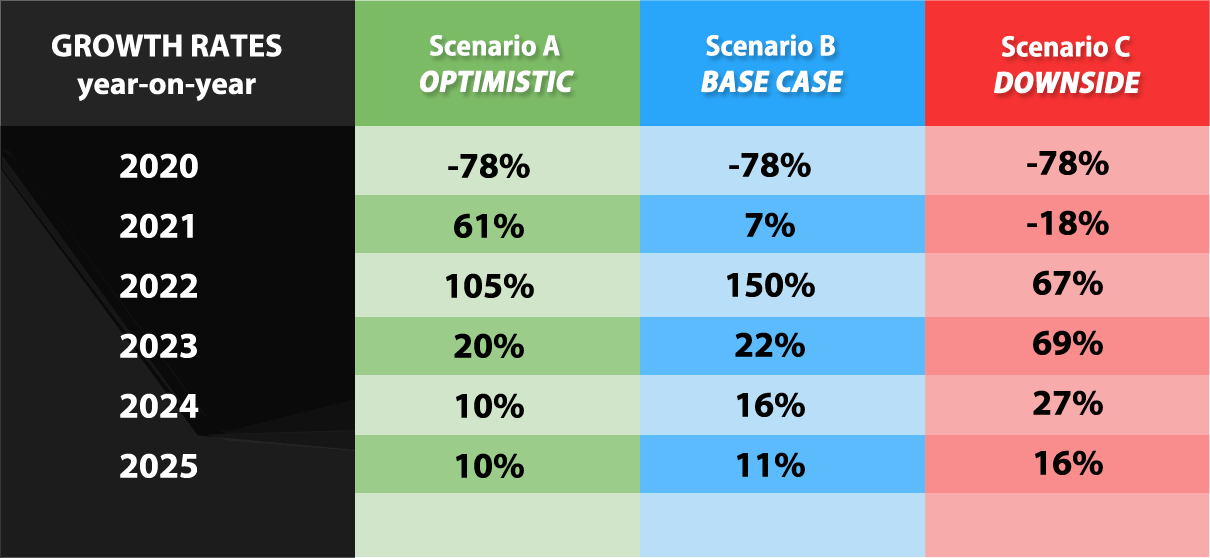

Three scenarios – Optimistic, Base and Downside – present a set of possible or plausible paths to recovery based on current available information, assumptions and risks.

The following dimensions have been taken into account in developing the scenarios:

- Current infectious state of the third wave of the virus, including mutated variants identified, as at end of January 2021.

- Extent and duration of public health and travel restrictions.

- Projected roll-out of vaccine and likely timeline to achievement of herd immunity in the developed world.

- Findings from a compendium of surveys on consumer sentiment and demand for travel.

- Projections for short to medium term recovery paths from international inter-governmental and industry sources.

- Economic outlook in key source markets.

- Inputs from a series of in-depth interviews with key stakeholders in the travel and tourism industry.

Threats / Risks:

- New wave/virus ‘flare-ups’ or re-imposition of restrictions

- Low consumer comfort levels re health & travel

- Stalled connectivity recovery

- Reduction in capacity and attractors due to business closures.

- Threat to quality of experience due to personnel and investment constraints or welcome

- Inadequate or ineffective communications / marketing messaging

Recovery path: uneven restart across markets and segments

- Volume will recover faster than value

- Low yields in early phase of reopening

- Initial reliance on ‘close in’ markets for volume

- Best early recovery prospects: VFR; deferred leisure trips; repeat leisure visitors & experienced travellers; esp. younger age cohorts

- Key to revenue recovery: Long haul markets, esp. USA

- Business travel demand involving interface with clients/suppliers expected to resume faster than corporate visits. Conferences slowest to resume.

Scenario A – OPTIMISTIC: Travel restrictions be removed by July ’21, following effective and on schedule vaccine rollout in Ireland and main source markets, together with coordinated multilateral agreement and implementation of safe travel protocols including testing and vaccination verification.

Scenario B – BASE LINE / MOST LIKELY: Based on current conditions – no international tourist flows before Sept./October ’21 with mixed market response due to uneven vaccination rollouts, and delays in establishing universal safe travel protocols. Effective recovery delayed to 2022.

Scenario C – DOWNSIDE: Further delay to restart due to virus surges or tail-risk fears; vaccine effectiveness compromised by new variants; and/or failure to establish universal safe travel protocols.

Reference sources: IATA; EuroControl; ACI; McKinsey; UNWTO;WTTC; HSBC; Bain & Company; Tourism Economics; OAG. In-depth interviews with 10 top industry executives (mid Dec.’20-mid Jan.’21); ITIC survey of member organisation (mid Dec.’20)

NOTE: As the situation remains very fluid and unpredictable, the scenario projections are apt to change as the pandemic, vaccinations and travel protocols evolve.

The Irish economy and domestic tourism

6.1 The Irish economy

Despite Covid-19 exerting a contradictory impact on Ireland’s domestic economy, most sectors registered a significant recovery in economic output in Q3 2020, as consumption, investment, savings and exports rebounded. GDP is estimated to have grown by over 3% in Q4.

The economic impact of Covid-19 showed a marked dichotomy between the performances of the indigenous and the multinational sectors. The strong performance of the tradeable sector, including the multinationals, is in stark contrast to that of the non-tradeable sector (NACE classification) with a negative growth rate of just over 19% in Q2 2020, compared to over 2 per cent expansion in the tradeable sector. The impact of the current crisis was more marked on the non-tradeable sector, including travel and tourism, than in the global financial crisis of 2008 when decline in performance peaked at 10% (Source: CSO).

Unemployment in 2020 reached 30% just two months into the crisis, this compares to peak of 16% over four years of the financial crisis over a decade ago, albeit when emigration was an option.

While the scale of negative shock for most key economic indicators is much more significant than during the previous crisis, the economy is expected to bounce back more rapidly.

Disposable income

Irish households were significantly less leveraged going into the current crisis, with debt to disposable income ratio at half the 2008 level, as the credit gap had closed (Source: ESRI/Central Bank).

Household savings stood at “extraordinary level” in Q3 2019 with gross savings ratio – the proportion of gross disposable income that went unspent – of 21.4%, compared to 14.5% a year earlier. Household disposable income was sustained in spite of the closures of many businesses due to Covid-19. Household disposable income meanwhile was supported by Government intervention (Source: CSO Quarterly Institutional Sector Accounts Non-Financial, 18 December 2020).

2021 Outlook

Assuming a vaccine is successfully rolled out for the latter half of 2021, following the negotiated Brexit trade deal, Irish GDP is set to increase by 4.9% compared to 3.4% in 2020. Personal consumer expenditure is expected to grow by 11.7% following a 9% contraction in 2020.

Unemployment at 5% at the beginning of 2020 finished the year at a level of 20%, is forecast to fall to around 14% in 2021 (Source: Quarterly Economic Commentary Winter 2020, December 2020).

6.2 Domestic tourism

Assuming a lockdown of at least 6 to 8 weeks in Q1 2021 with a vaccine rolled out extensively amongst the general population from Q3 onwards, and the absence of another spike in the infection rates, it is projected the demand from the domestic market could be very significant in the latter half of 2021 – the best case for the outlook for domestic tourism demand. A strong rebound in demand is projected on the back of easing of restrictions and the continuing roll-out of vaccine(s), as households unwind excess savings, as well as substitution for overseas travel.

The domestic market is likely to be a lifeline to many businesses in the sector again in 2021.

The lifting of restrictions during the summer of 2020 saw a spike in demand for domestic holidays in certain parts of the country, which helped to provide much needed cash flow for many tourism businesses securing future viability and employment. All the indications are that as the threat level diminishes and the roll-out of vaccinations get underway that there will be a level of pent-up demand for domestic leisure travel.

Domestic demand for holidays and day trips is an important component of the tourism economy. Most recent data shows that Irish residents spent €2.15bn on 11.6m trips (excluding day trips) in 2019. Spending on holiday and leisure breaks amounted to €1.3bn (Source: CSO Household Travel Survey, September 2020). Domestic demand is critically important to the viability of many businesses in the sector, particularly in providing sustained income year-round. Key to recovery will be the reinstatement of events – culture, sports and entertainment – which drive a significant share of demand for domestic short breaks and day trips.