INTRODUCTION

With St Patrick’s Day and Easter behind us we are now set for what will hopefully be a busy and prosperous year for Irish tourism. This bulletin by the Irish Tourism Industry Confederation (ITIC) looks at strong global travel demand patterns, Irish tourism prospects for the year ahead, the importance of enhanced connectivity to Ireland, global economic indicators and outlook, as well as a spotlight on some of the key enablers needed for Irish tourism enterprises to overcome the challenges they face.

North America holds best prospects and this is a key market for Irish tourism but other source markets may well be softer. Cost, capacity and competitiveness constraints each are likely to put a handbrake on progress. Compared to last year revenue may grow but a shortage of tourism accommodation allied to a cap at Dublin Airport is likely to stymie inbound volume growth. The Irish Government is due to publish a long-awaited national tourism policy and it must match the responsible ambition of industry.

Strong Global Demand for Travel & Tourism in 2024

International travel has got off to a strong start in 2024. January and February saw solid international passenger growth, with all regions of the globe reporting double digit growth. Current indicators provide good reason to be optimistic about prospect for continued global tourism growth this year.

Global international passenger traffic (RPKs) in February was 26.3% ahead of that same month last year, while January saw 20.8% year on year increase. European airlines reported year on year increases in January and February of 10.5% and 15.9% respectively. Demand over the past two months exceeded 2019 levels, however February data is skewed by an extra day in 2024.

Airports Council Europe reported an 8% year on year increase in international travel in January.

The prospects for long haul travel to Europe in 2024 were found to be predominantly optimistic in key source markets of USA, Canada, Australia, South Korea, China and Brazil. The outlook for travel from the USA to Europe this year was reported to be consistent with the high level of intent as in 2023. (European Travel Commission)

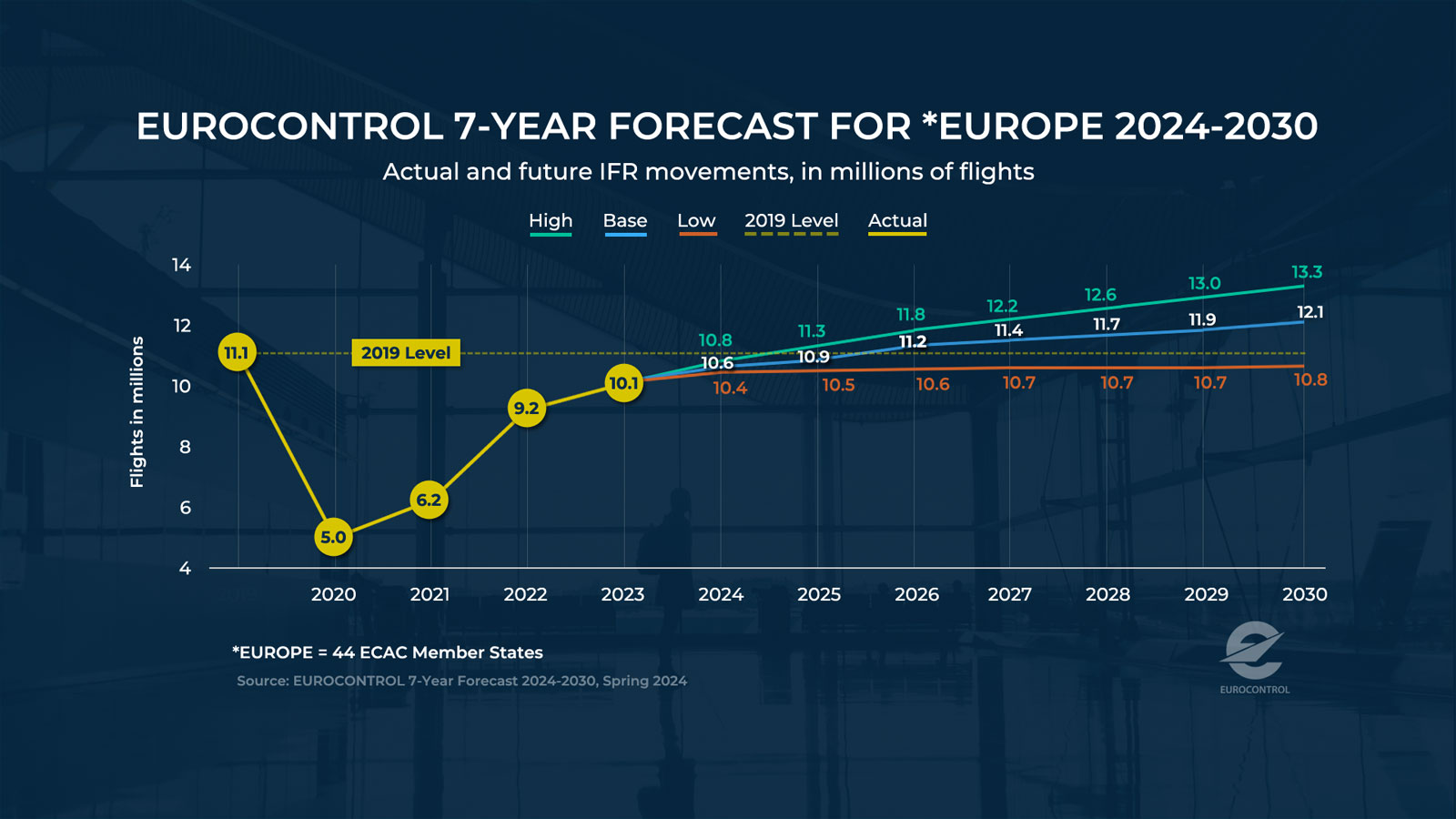

Looking ahead beyond 2024 Eurocontrol has revised marginally downwards its short term forecasts, despite a strong summer in 2023, due to changes in economic outlook and disparities across European markets. The latest forecasts would see a 4.9% year on year increase in the volume of flights in 2024.

Irish Tourism in 2024

An estimated 885,000 tourists visited Ireland over the first two months of the year, out of a total 2.57m passengers departing through air and sea ports. Total passenger traffic through Irish ports in January and February is 5% ahead of the same period last year and 6% ahead of pre-pandemic in 2020.

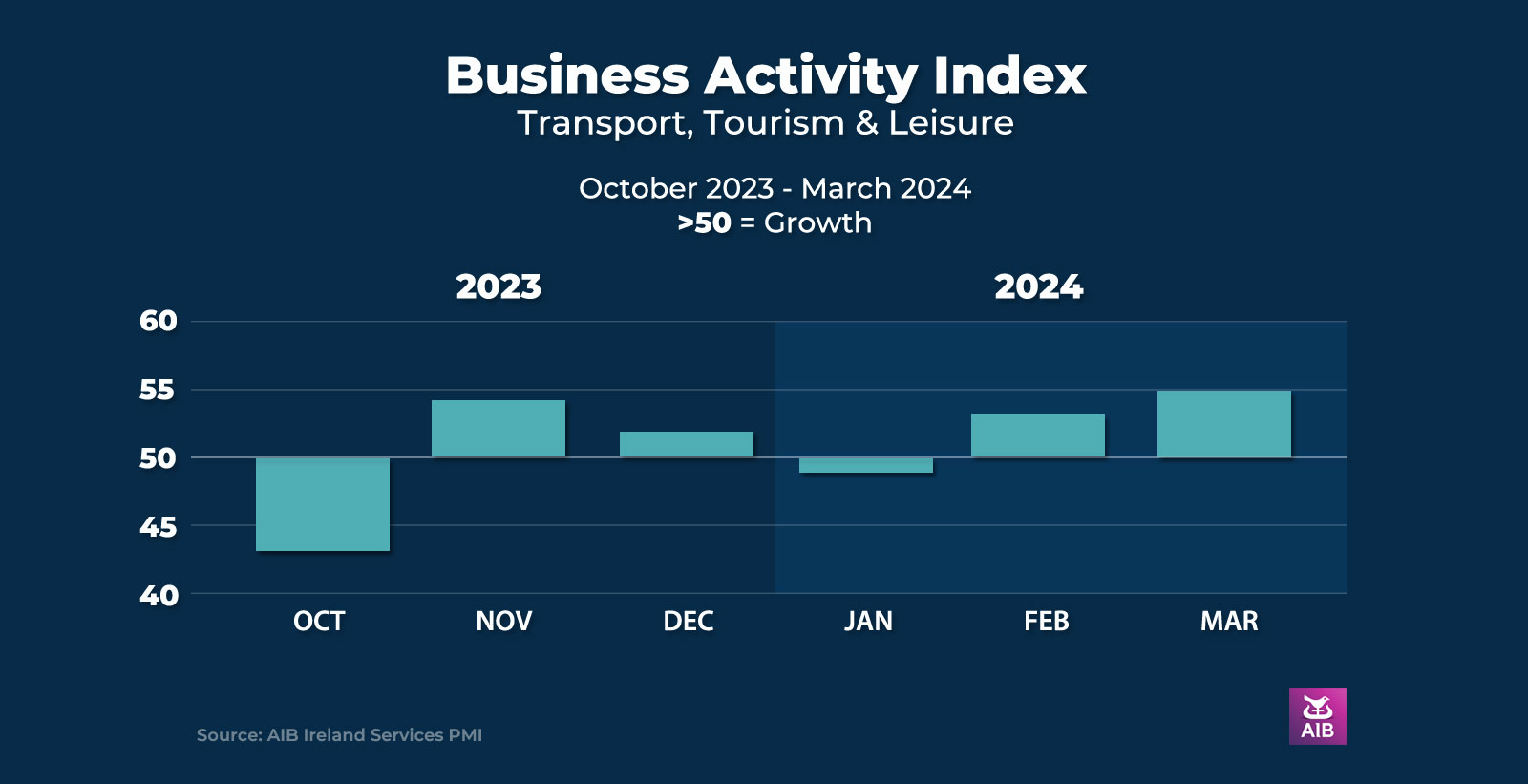

Activity in the transport, tourism & leisure sector in the period January to March rose at the fastest rate in ten months, with employment rising for the second month running although at a slower rate than the pickup in other service sectors of the economy.

The challenge of measuring inbound tourism

Official tourism volume and value estimates are based on sample surveys conducted by the CSO, which were suspended over the duration of the pandemic. A long planned change in sampling methodology and data collection by the CSO, designed to provide the industry with more comprehensive and timely monthly metrics on overseas tourism, was introduced on the resumption of port surveys from April 2023. This month will be the first month that tourism data will be directly comparable to the same month last year as the same methodology will have been used.

A key finding of the new methodology is that outbound Irish resident travel accounts for an increased share of total passenger traffic. The extent of this swing appears at times to be at variance with results from other surveys, industry sentiment and commercial data and ITIC, along with other principal stakeholders, are engaging with the CSO to ensure the methodological model is robust.

Expanding Connectivity for Inbound Tourism

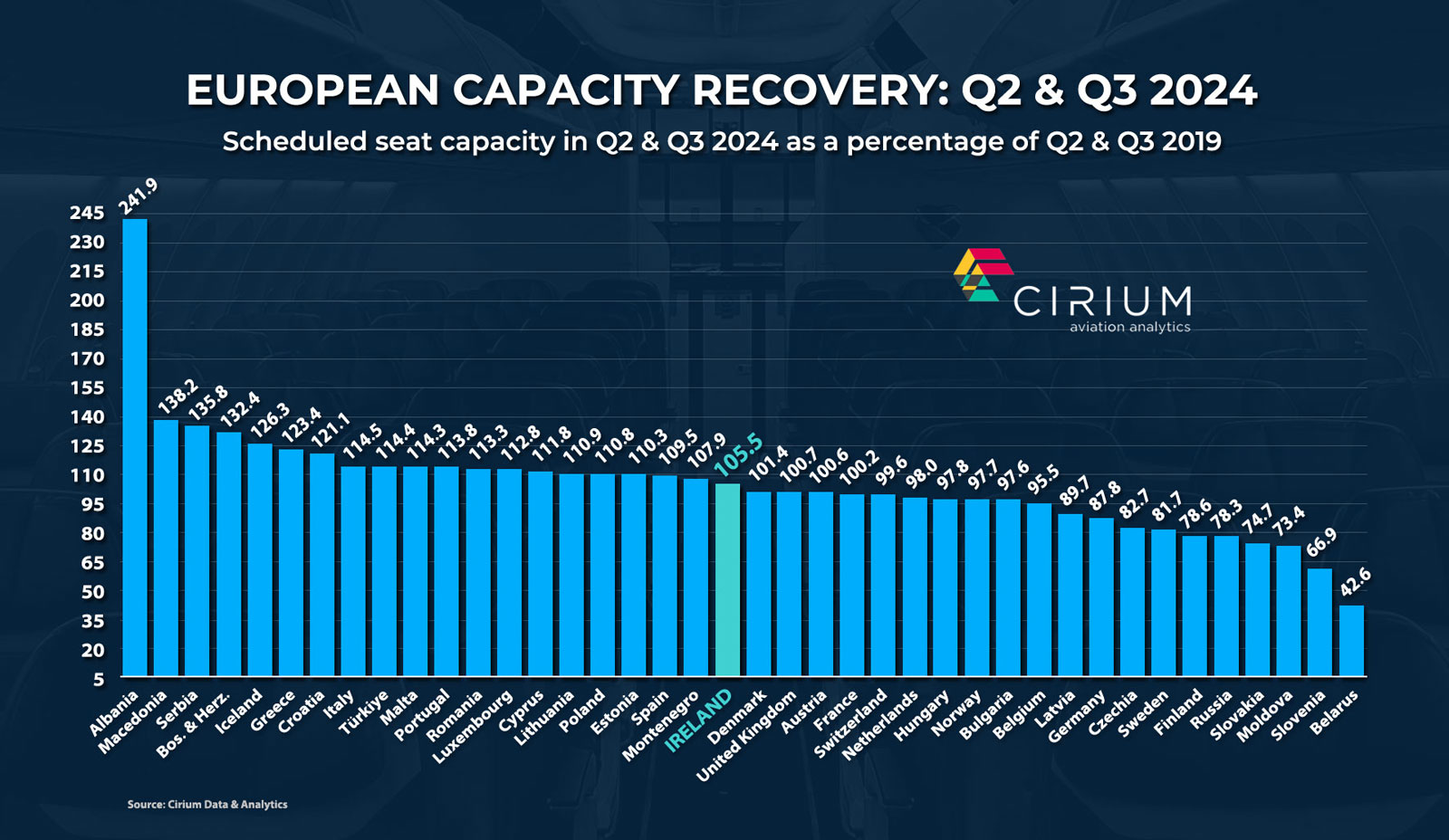

Growth in airline services to/from Ireland continues. Aggregate seat capacity this summer will be 5% higher than back in 2019, following on a full recovery last year. Many new services offer significant opportunities for growth in inbound tourism, particularly from North America.

Ireland’s recovery of connectivity has outpaced most non-sun destinations in western and northern Europe, led primarily by an ambitious restoration and expansion of services by Ryanair and Aer Lingus.

Highlights of the 2024 summer schedule – new and expanded services – with best prospects for growing incoming tourism:

DUBLIN AIRPORT

New & Resuming Routes

Aer Lingus: Denver service (four flights per week)

Delta Air Lines: Minneapolis St Paul to Dublin (daily service)

JetBlue: New York and Boston services (daily)

Aer Lingus: Minneapolis St Paul resuming (four per week)

WestJet: Toronto (daily) and Halifax (four per week).

Increased frequency / capacity

Hainan Airlines: Beijing service up from two to four per week (peak summer period).

Qatar Airways: increased capacity from Doha (larger aircraft)

American Airlines: increased capacity from Dallas Forth Worth (larger aircraft)

Widerøe Airlines: Bergen service (three flights per week)

Finnair: Helsinki service (from daily to 10 flights per week).

Aer Lingus Regional: increased frequency from Edinburgh, Birmingham, Brest & Rennes.

Ryanair: Increased frequency/capacity on selected routes

CORK AIRPORT

New Routes

Ryanair: Brussels Charleroi (three per week)

Increased frequency / capacity

Air France: Paris (CDG) daily service boosted to twice daily (four days per week in July & August)

SHANNON AIRPORT

Delta Air Lines: New York-JFK, daily from May 24.

Aer Lingus: Paris Charles De Gaulle.

Ireland West Airport

Ryanair: increased frequency from Barcelona (Girona)

Aer Lingus: maintains daily Heathrow service providing global connectivity

Kerry Airport

Chalair: Weekly flights from Brest, Caen and Pau (10 – 13 week peak summer season)

Donegal Airport

Loganair: Glasgow service resumes on May 19, with up to 4 per week in the peak.

FERRY SERVICES

Ferry services to/from France & Spain continue to expand with up to 22 sailings per week in each direction over the summer season. Services connect Cherbourg, Roscoff, Dunkirk and Bilbao with Dublin, Rosslare and Cork, operated by Irish Ferries, Stena Line, Brittany Ferries and DFDS Ferries. New ‘Sail & Rail’ fares will be on offer from France on Irish Ferries

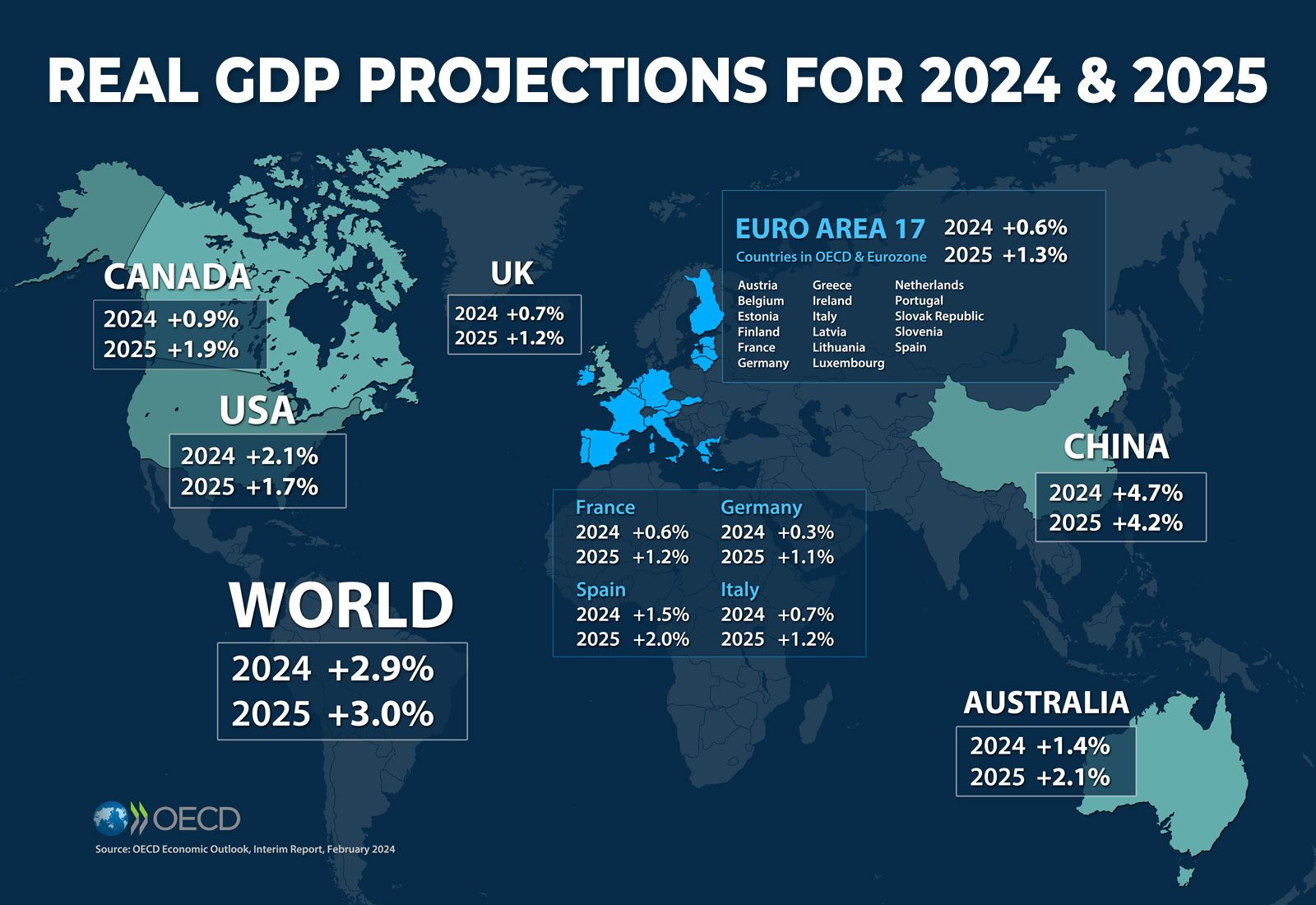

Global Economic Outlook

The overall outlook suggests that GDP growth will be below trend but recession avoided, with the US to continue to outperform other economies. Inflation is expected to fall further allowing central banks to begin to cut interest rates.

United States

Latest news from the FED – America’s central bank – shows economic growth in 2024, 2025 & 2026 to be stronger than previously thought, with no sign of a recession on the horizon. The US economy continues to show remarkable resilience despite interest rates at a 20 year high. The labour market remains robust, with unemployment rate down to 3.8% in March; inflation has fallen significantly; productivity is up, while corporate earnings are robust and the stock market reporting record highs.

The latest forecast would see the economy expand by 2.1% this year and close to 2% in each of the following two years.

Consumer confidence in March jumped to its highest level since July 2021, supported by strong stock market gains, improvements in personal finances, and the expectation that inflation will continue to ease to level off at around 3%. The upcoming November elections may see consumers withholding judgement on the future outlook.

Prospects for international travel remain buoyant boosted by a strong dollar. A record year for Americans tourists is expected to power the recovery in Europe, as it did in 2023. Flights from the USA to Europe will reach a record 600 departures, including 40 new services, on peak days over the summer, up 7.8% on 2023.

EUROZONE

With wage growth slowing and inflation heading back towards the 2% target level, the ECB is indicating that it may be in a position to reverse interest rate hikes. If data supports the improving conditions, interest rate cuts could be expected by the Bank’s in June, with the prospect of cumulative 1 percentage point reduction in interest rates by year end. However, the Eurozone economic growth continues to be challenged by falling productivity growth.

Consumer confidence continues to edge upwards as expectations for the economy and incomes improve, although still well below long-term average. The latest EU Flash Consumer Confidence Indicator (March 20), shows improvement in consumer confidence across both the EU and Eurozone.

Germany, Europe’s largest economy, struggles to recover economic growth, despite an easing of inflation. Latest forecasts have downgraded growth forecasts for the year, as industrial output and consumer spending continues to falter together with transport sector strikes. Consumers display a lack of optimism for economic recovery any time soon and the absence of a clear economic plan from Government. GDP growth is forecast to lag other major economies in 2024 and 2024.

Short term outlook for outbound international travel appears to remain subdued, with airline capacity still below pre-pandemic levels this summer.

UK

After falling into recession, there are signs that the UK economy is recovering. There are encouraging signs; inflation is falling, down to 3.4% in February, retail sales rose in January following a 10 month decline, while private sector activity is picking up. However the Bank of England has stated it is not moving to cut interest rates at this time.

Real GDP growth in 2024 is projected at below 1% in 2024, improving to 1.2% in 2025, based on latest average from independent forecasters. Rising incomes are expected to boost consumer spending, while investment should also benefit from any lowering of interest rates.

Consumer sentiment dipped marginally in February, but while ahead of a year ago, remains below levels seen over the period from 2013 to 2019, according to the latest Gfk Consumer Confidence Index. Research shows that consumers’ outlook on personal finances over the coming year holds steady, although willingness to spend on big-ticket items softened last month.

Outbound travel from Britain is expected to surpass pre-pandemic levels this year, with sun destinations to the fore.

Ireland

The economy is forecast to grow by 2% per annum on average over the three year period 20024 t0 2026, underpinned by continuing growth in consumer spending and house building, according to Central Bank bulletin published in mid-March. Ireland is expected to out-perform the overall outlook for the Eurozone economy over the period.

Headline inflation is projected to fall to close to 2% this year as external driven price pressures are easing. The labour market is forecast to remain tight, with unemployment levels hovering close to 4%.

Consumer confidence dipped marginally in March even as inflation slowed, while ahead of sentiment 12 months ago it remains depressed compared to long-term average over the past decade. The latest Credit Union consumer sentiment survey suggests that consumers are still cautious and concerned, despite a marked decrease in the rate of inflation, and high employment and wage increases.

Key Enablers for Irish Tourism

1. Labour challenges to continue

Ireland was recently ranked as the having the 4th highest shortage of skilled labour in the Europe, after Germany, Portugal and Greece. Tourism and hospitality, together with construction and healthcare, are the hardest hit sectors in Ireland. An estimated 2.7 million people were in employment in the last quarter of 2023, up 3.4% on the same period a year earlier, the equivalent of 89,600 people at work, including just under 40,000 visas for non-EU workers issued last year.

Employment in the Accommodation and Food Services sector – a traditional proxy for hospitality – was up 6.5% in the final quarter of 2023 compared to the previous year, but remains 6% below the pre-pandemic level (Q3’2019) with 300,000 fewer hours worked per week.

2. Escalating costs of doing business

Ireland is a relatively high cost place to do business, with cost of labour, electricity, and credit historically above the European average. The impact on tourism and hospitality businesses is more marked than other sectors due to its reliance on labour, investment and energy. Recent legislative changes are further driving labour costs which when fully implemented inevitably will be reflected in higher consumer prices further threatening competitiveness and the sustainability of businesses.

A new €70m package of supports for businesses is reported to be on its way. While the details are yet to be announced, measures under considerations include lower rate of employer PRSI and deferment of increase in statutory sick leave. An announcement is expected next month. ITIC has called for a restoration of the 9% Vat rate for tourism and hospitality enterprises, Employer PRSI reform to ease the burden on businesses, and an annual enterprise support package to back vulnerable sectors such as tourism.

3. New regulations of short term rental accommodation expected to add to Ireland’s supply side constraints.

All properties offering short term rental accommodation for tourists will be expected to register their properties annually with Failte Ireland. The new requirement is expected to be rolled out this summer is predicted to put further pressure on tourist accommodation supply, already severely limited with over 20% of tourist accommodations under contract to the Government for humanitarian purposes.

Irish Self-Catering Federation (ISCF) has warned of the adverse impact on supply, especially in rural areas popular with visitors, and has called for the establishment of clear planning guidelines around the development of short stay rental accommodations, a fast growing demand segment favoured by many international visitors.

Demand for short term rental in Ireland grew by 14%, to 6.3m guest nights in 2023, via Airbnb, Booking.com, Expedia Group or TripAdvisor, according to the latest data from Eurostat. 75% of the demand over the peak summer months was for accommodation outside the Dublin, Eastern & Midlands region.

4. A new policy to reduce over-reliance of State on tourism accommodation.

It is estimated at this point that 20% of all tourism beds are contracted by Government for Ukrainian refugees or international asylum seekers. This is set to have a profoundly destabilizing impact on the broader tourism sector with Fáilte Ireland estimating that it will cost downstream tourism businesses as much as €1.1 billion over an annualised period. Government needs to urgently develop an alternative plan as to how refugees and asylum seeker are to be housed and lessen their over-dependency on hotels, guesthouses and B&Bs.

5. Increasing the cap at Dublin Airport and maximising the utilisation of regional airports.

With 75% of the Irish tourism economy based on international visitation it is of significant concern that Dublin Airport, the main gateway to the island, has reached its cap of passenger numbers. Cork and Shannon airports must be supported to maximise their potential but it is vital that Dublin is allowed expand in a responsible and prudent way. This is of critical importance to tourism as well as the broader Irish economy and must be prioritised and expedited by Fingal County Council who are reviewing DAA’s application for the cap to be increased to 40 million passengers annually.