EXECUTIVE SUMMARY

This report by the Irish Tourism Industry Confederation (ITIC) aims to both outline the unintended consequences of an over-dependence by Government on tourism accommodation stock, and to set out a number of policy recommendations that should be taken to ameliorate the situation. ITIC fully supports the Government’s humanitarian reaction to the Ukrainian crisis and is ready to assist in devising a balanced strategy. However Ireland’s tourism and hospitality industry cannot be asked to take the primary burden of accommodating Ukrainian refugees and asylum seekers on its own and a more proportionate and creative approach is required from Government.

The extensive, and potentially increasing, reliance on tourism accommodation to provide housing for refugees and asylum seekers is placing a limitation on the country’s carrying capacity to cater for domestic and overseas visitors and is putting Ireland’s tourism recovery at risk. There is an urgent need for a credible pathway – short and medium term – to optimise the contribution that tourism providers can make to Ireland’s response to the current refugee crisis, while minimising the potential constraint and longer term damage to Ireland’s tourism economy.

The Russian invasion of Ukraine on 24 February 2022 has resulted in the largest displacement of Europeans since World War II, with 5 million currently living in Europe under the EU’s Temporary Protection Directive. To-date Ireland has welcomed 57,000 Ukrainians, more per capita than many other member states, this despite a very limited temporary accommodation infrastructure.

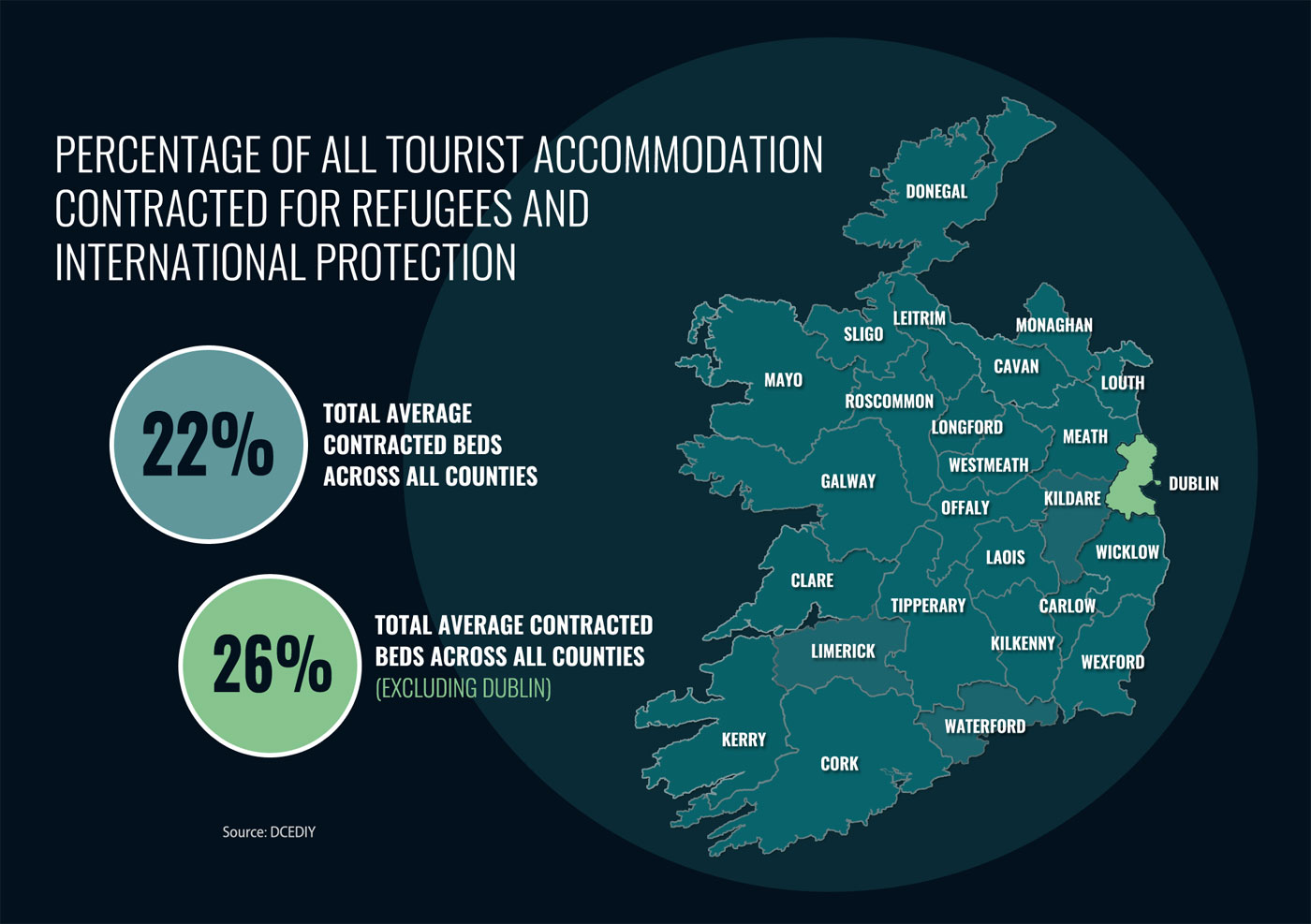

80% of arrivals are reliant on the State for accommodation. Currently 22% of the country’s tourist accommodation capacity, including 15% of hotel rooms, is contracted to provide shelter for those fleeing Ukraine, plus around 5,000 asylum seekers from other countries. At present an estimated 34,000 Ukrainian citizens are living in tourist premises. As refugees continue to arrive, currently at a rate of upwards of 1,000 per week, the State is becoming even more reliant on tourist accommodation as temporary shelter in the absence of other options. While Ireland is not alone in struggling to meet the accommodation needs of refugees, it is an outlier in its over dependence on tourist accommodation to provide temporary shelter.

The outlook is for protracted hostilities in Ukraine with the likelihood in the short term of a new wave of refugees as many of the estimated 7 million displaced persons internally flee war over the harsh winter months. Ireland faces an immediate challenge of providing temporary accommodation for those arriving seeking shelter, together with the need for a transition from temporary to medium term or longer term accommodation and supports. The Government is projecting a short fall in accommodation of 15,000 beds by the end of the year.

Government has announced a number of measures to address the growing crisis but it is difficult to foresee the delivery of accommodation supply at a scale and pace to significantly reduce the over dependence on tourist accommodation in time for the start of the 2023 season.

The immediate impact of the current situation on tourism is a marked reduction in capacity, higher prices for available accommodation, and a devastating impact on the visitor economy of many popular tourism areas in the country where a sizeable share of tourist accommodation has already pivoted to housing refugees. Such areas include west Clare, County Donegal, Killarney and west Waterford. Downstream businesses in hospitality, retail and other tourism services are suffering from the absence of tourists and consequential job losses.

The outlook for tourism demand in 2023 is unpredictable as the desire to travel remains strong, but rising cost of living and interest rates could dent the volume and value of international and domestic trips. Later booking patterns mean that Ireland’s ability to meet demand will be severely challenged should a signifiant share of its guest accommodation be withdrawn from the market.

The impact on demand versus supply will be felt most keenly at times of peak demand and in the more popular destinations.

ITIC’s projections show that should the over-reliance on tourist accommodation continue into 2023, tourism supply side could be reduced by approximately 30% should the number of Ukrainian refugees reach above 90,000. This would have serious negative impacts on tourist visits, with the loss of up to €1 billion in earnings, the loss of hundreds of jobs in the broader hospitality and supply sectors, threaten the sustainability of many businesses, and seriously damage Ireland’s competitiveness. A lack of available accommodation may also affect carriers who will suffer from frustrated tourist demand in key source markets. The longer term impacts could delay Irish tourism’s recovery by several years, as well as causing structural shifts within the sector.

Research shows that for every €1 a tourist spends on accommodation, €2.50 is spent on other services. In view of the seriousness and urgency of addressing the issue, ITIC is making the following recommendations:

- A Department of Taoiseach-led whole of government approach

- A published 2 year humanitarian plan as to how displaced persons are to be accommodated

- A 12%-15% allocation: in ITIC’s view a proportionate and fair allocation from the tourism industry is between 12% and 15% of available stock to be given over to refugees and asylum seekers.

- A Business Continuity Fund for tourism businesses negatively affected by the impact of Government contracts

- Expedited Local Authority strategies to deal with the crisis

- Focus on fast tracking alternative accommodation solutions

- Encourage integration into the labour force by minimising barriers to entry.

- Quicker transition from Direct Provision

- Extend tourism VAT rate of 9% to 2025

HUMANITARIAN FALLOUT

Humanitarian fall-out from Russia’s invasion of Ukraine

The Russian invasion of Ukraine on 24 February 2022 has resulted in immense societal and economic turbulence, geopolitical tensions and the largest displacement of Europeans since World War II.

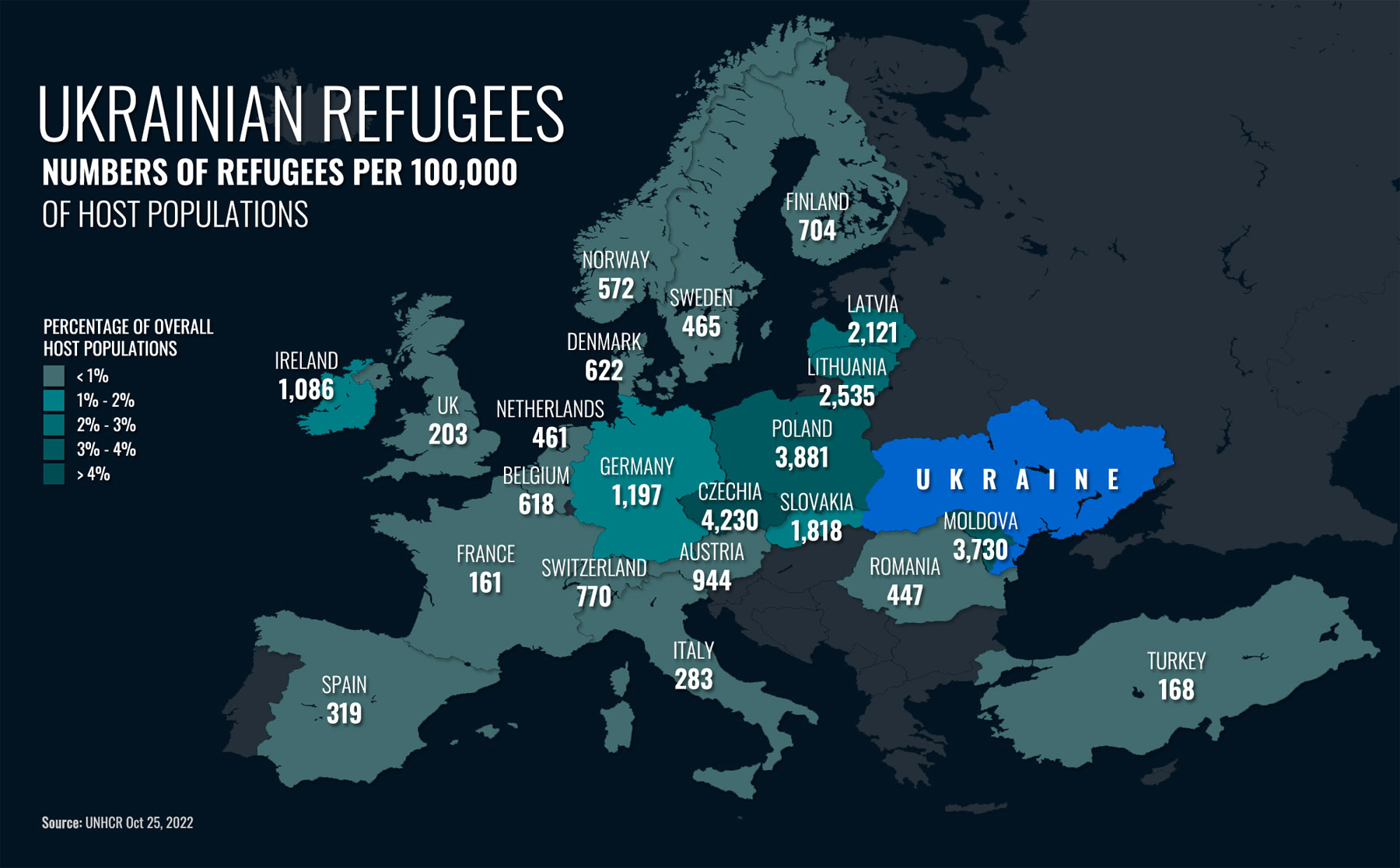

Latest estimates put the number of Ukrainians fleeing the war at just over 5 million across Europe, not counting over 2 million entering Russia. The scale of the unprecedented forced exodus has primarily impacted neighbouring countries in central and eastern Europe, with Poland alone accommodating almost one third of those fleeing Ukraine, while the Czech Republic took in 450,000 refugees, more relative to its population than any other country.

The European Union’s Temporary Protection Directive has greatly facilitated those fleeing the conflict to seek refuge in member states. This provides the right to live, work, receive financial assistance, health care and access to education for up to three years in whichever EU member state they choose to settle. As at end October 4.6 million Ukrainians had registered for temporary protection, with women and children accounting for the vast majority of refugees.

Ireland has welcomed 57,000 Ukrainians over recent months, accommodating more per capita than other European states excluding Germany and countries bordering Ukraine.

All European countries have been challenged to scale up their capacity to receive Ukrainian refugees, with most countries relying on a mix of accommodations. The range includes pre-existing, or newly created, reception centres or other repurposed emergency and temporary accommodations. The latter are designed for use prior to refugees moving to hosted private homes, including the Ukrainian diaspora and other forms of housing facilitated by state incentive programmes. A pan-European survey in June found half of respondents were staying with either local hosts (29%) or with family & friends (20%).

In some countries, where reception centres were insufficient to host Ukrainian refugees, additional accommodation has been found in hotels, hostels, schools and other institutions with some countries turning to emergency solutions, such as cruise ships, tents, and mobile homes. In the majority of cases, these arrangements are intended as short stay transit accommodation.

About one third of Ukrainian refugees 16 and older who fled to the EU have found employment, according to recent surveys conducted by Kantar Public, although the employment rates vary greatly from country to country. In Poland more than half are in employment while in France only about 15% of working age Ukrainians have found jobs. Overall it would appear that employment has been found primarily working in lower wage sectors – logistics, manufacturing, agriculture and construction and hospitality – even though many have higher qualifications.

IRELAND’S RESPONSE

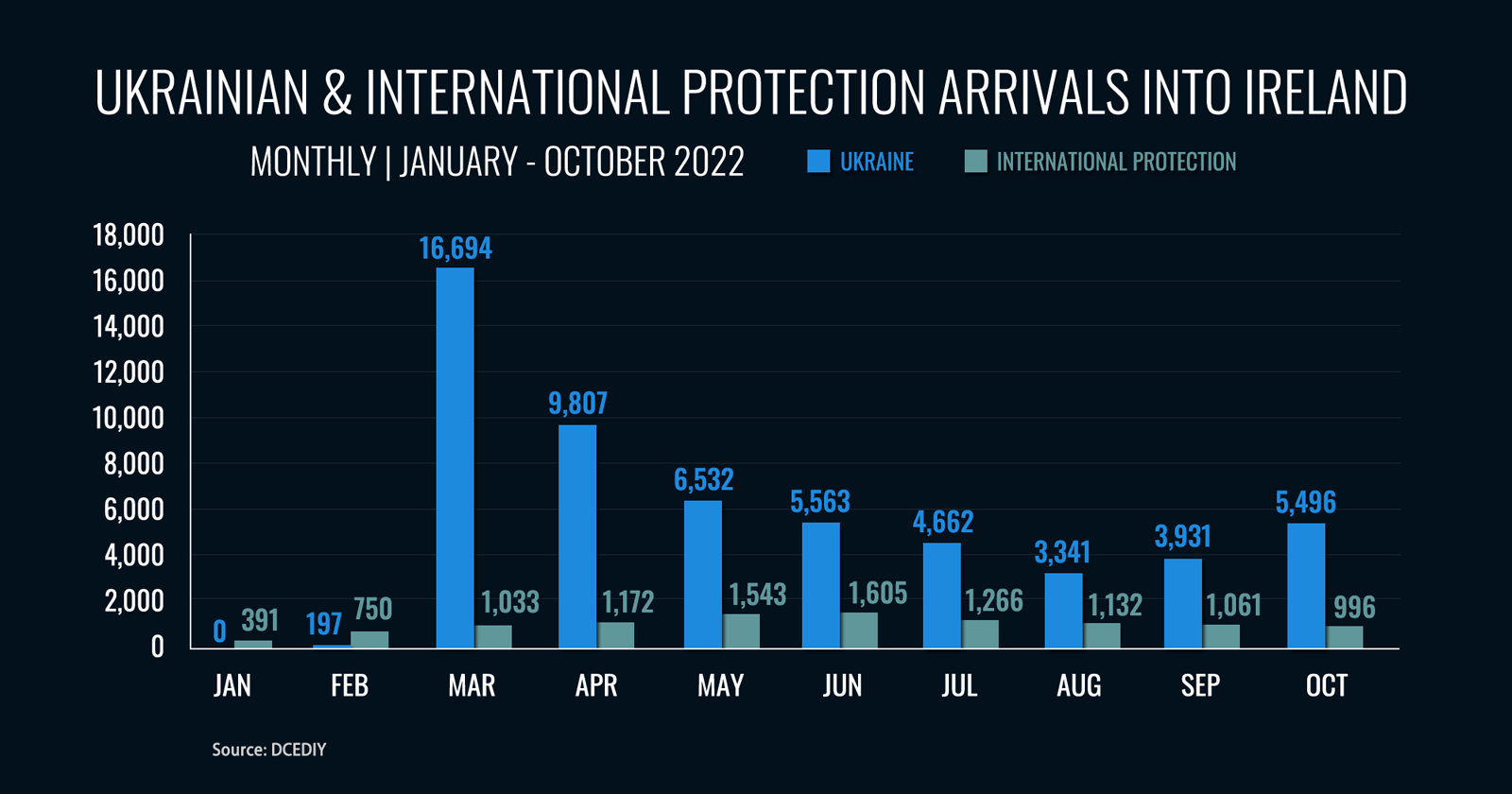

57,000 Ukrainians have found refuge in Ireland since February, in addition to close to 11,000 asylum seekers under the International Protection protocol this year. This compares to 7,500 arrivals in 2021.

Ireland’s response to opening its doors to Ukrainian migrants was immediate and exemplary both at Government and citizen levels. The humanitarian response was well intentioned and welcoming, including up to 21,000 pledges from home owners to provide shelter. The challenges faced by Ireland, in accommodating the influx of refugees from Ukraine, and an increase in asylum seekers from other countries seeking International Protection, has been exacerbated by:

Ukrainian refugees in Ireland

62,425 Personal Public Service Numbers (PPSNs) were issued to Ukrainians under the Temporary Protection Directive, up to end October. This number is not necessarily indicative of how many people are currently resident in Ireland as some people may have subsequently left. Arrivals were predominantly females (46%) and children (34%), reflected in 12,544 children registered in schools, 63% in primary schools, as of November 01.

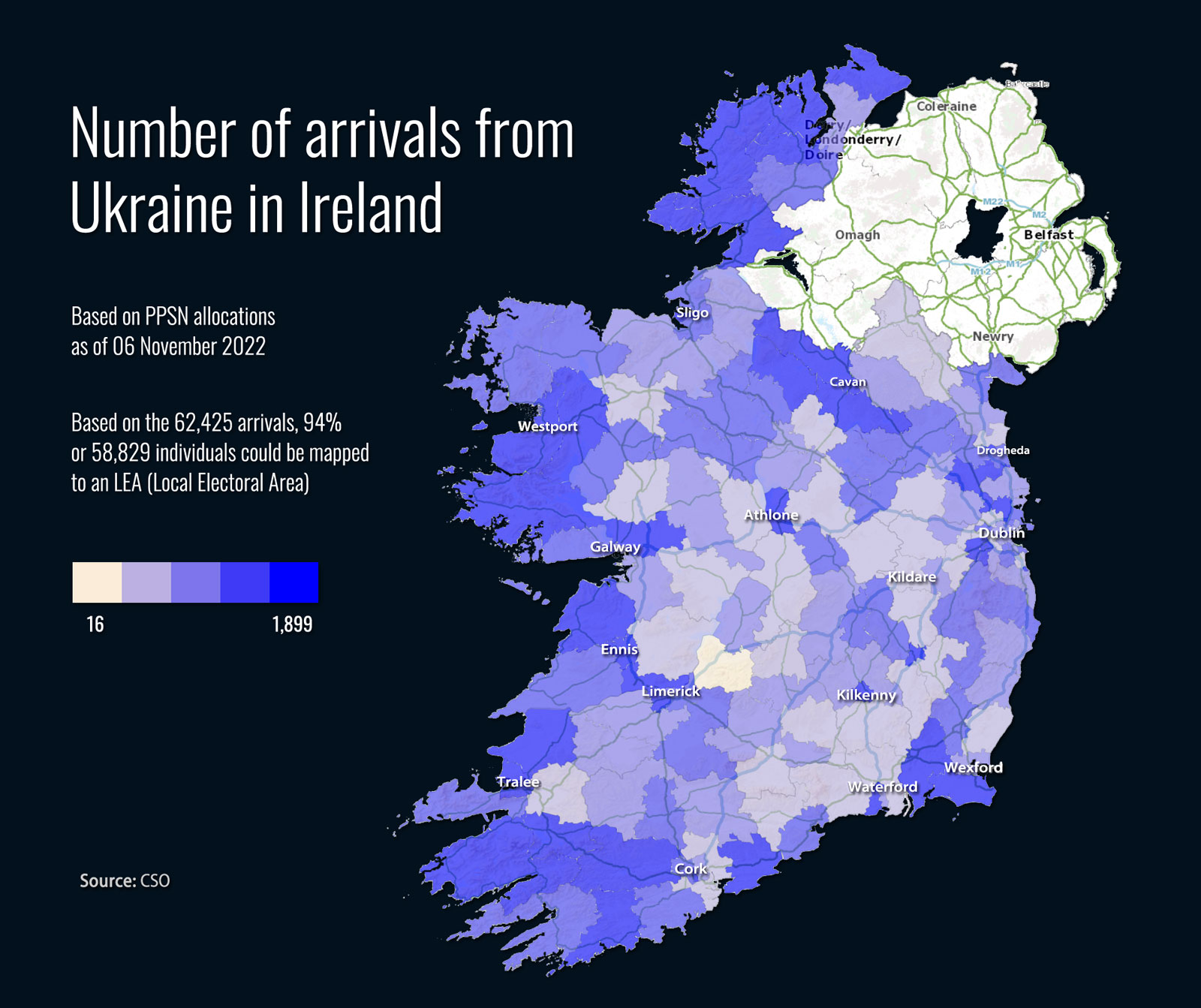

The distribution around the country by Local Elector Area (LEA) shows the rate of Ukrainians per 100 of the population ranges from 0.07% to 8.88%, the highest being in Ennistimon, encompassing Lahinch, Co. Clare, while Dublin’s North Inner City and Killarney are hosting the largest numbers.

9,228 have found employment, just over half (52%) of the jobs are in the Wholesale, Transport and Accommodation sectors, with industry estimate putting the number in the accommodation and hospitality sector at close to 4,000. [CSO ‘Arrivals from Ukraine in Ireland’ Series 7, November 14, 2022].

Accommodation crisis

Despite earlier plans, Ireland has struggled to keep pace with the demand for accommodation from the increasing numbers seeking refuge. This resulted in the Government issuing an advisory that new arrivals could not be guaranteed accommodation as of October 26, 2022, although they are still welcome to come.

A renewed Government response to the accommodation crisis, agreed on October 28, included plans for rapid-build modular homes, the repurposing of vacant buildings, the use of army barracks and the provision of dormitory style accommodations, and a new State-led Vacant Homes call with increased financial incentives for hosts. In addition, the State plans to move to a standard offer of ‘accommodation only’, with beneficiaries of Temporary Protection utilising existing state income supports for food and day to day expenses.

Short to medium term outlook

Most international agencies foresee an increase in the exodus of Ukrainians over the coming winter months as Russia’s renewed bombardment of urban infrastructure has left many thousands homeless and without essential supplies of water and power. With an estimated 6.9 million displaced persons internally and the severity of winter in Ukraine, Europe is preparing for a possible new wave of refugees.

Furthermore, the outlook for a resolution to the conflict appears unlikely in the short term, with the prospect of protracted hostilities. Whenever the conflict ends, there will be a need for significant investment for restructuring before many refugees can return to their homeland.

Ireland faces an immediate challenge of providing temporary accommodation for those arriving seeking shelter, together with the need for a transition from temporary to medium term or longer term accommodation and supports. Combined, these challenges are putting Ireland’s commitment to the test.

“This is going to be a tough winter in Europe….the conflict in Ukraine is being protracted, and the Ukrainians are going to stay longer”

OVER-DEPENDANCE ON TOURISM BEDS

State funded accommodation for refugees

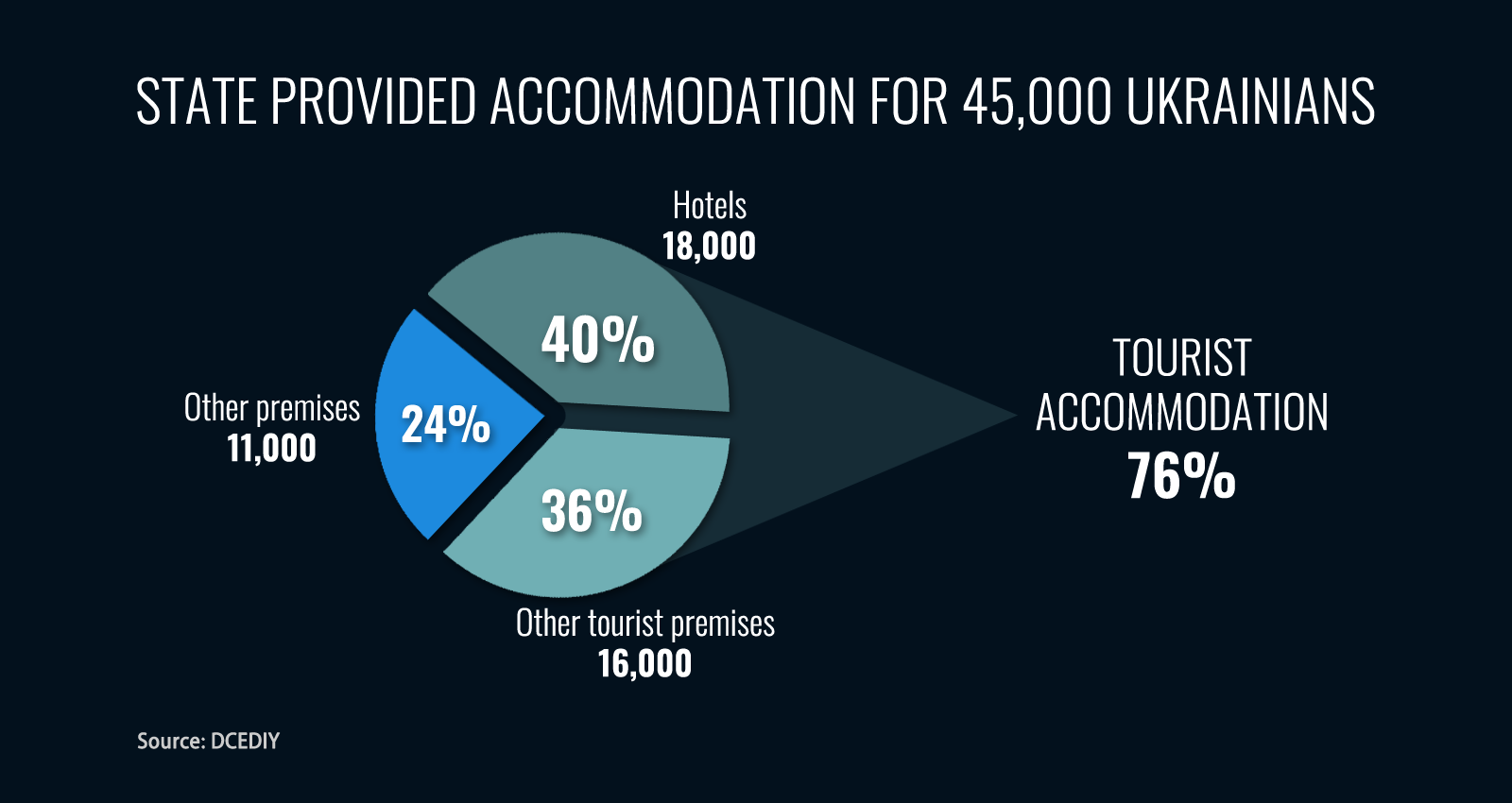

The Department of Children, Equality, Disability, Integration and Youth is now accommodating close to 62,000 people – 45,000 Ukrainians and 17,000 International Protection – compared to 7,500 a year ago.

The cost to the State this year is currently close to €350 million, a sum that is expected to increase to €440 million by year end.

80% of arrivals from Ukraine are accommodated by the State

The majority of Ukrainians are currently reliant on the State for accommodation. Almost 46,000 of the 57,000 arrivals, to end October, are in State funded shelter. Just under 7,000 Ukrainians were being hosted by 3,224 Irish households, based on the Accommodation Recognition Payments scheme, as of November 06 2022, with the remainder staying with family and friends or in independently arranged accommodation. The pattern of arrivals suggests that four out of five new refugees can be expected to be reliant on the State for housing.

Ireland’s reliance on tourist accommodations as temporary shelter

Just short of 40,000 bed spaces in tourist premises are currently contracted by the State to house refugees, of which almost 24,000 are in registered hotels. This represents just over 21% of the country’s tourist accommodation stock (excluding hostels and camp sites) and over 15% of hotel capacity. Almost 600 tourist premises, including over 250 hotels, are currently providing shelter for refugees. In some instances the tourist premises are exclusively providing refugee accommodation while other properties have contracted a share of their capacity while continuing to trade.

34,000 Ukrainians in tourist accommodation

3 out of every 4 Ukrainians dependent on the State for accommodation are now in tourist accommodation. Close to 34,000 beds in tourist accommodation are currently contracted to provide shelter for Ukrainians as Beneficiaries of Temporary Protection (BOTPs), with an estimated 18,000 in hotels and 16,000 in other tourist premises.

In the absence of alternative accommodation options available to the State, reliance on the tourism sector to meet accommodation needs continues to rise with the daily arrivals of new refugees.

International Protection

Close to 11,000 persons seeking asylum from other countries arrived in Ireland so far this year. Currently an estimated 17,000 asylum seekers are in State provided accommodation, including Direct Provision centres and other contracted sites. Tourist accommodation contracted so far this year is estimated at close to 5,000 bed spaces.

Geographic dispersal of tourism accommodations housing refugees

80% of tourist accommodation in use for refugees is outside Dublin, where one quarter of registered and approved tourist bed stock is providing emergency shelter. Just over 12% of tourist accommodation in Dublin is catering to refugees.

The share of tourist accommodation contracted to the State varies considerably from across the regions. Industry sources suggest that many areas have seen upwards of 20% of accommodation stock allocated to providing refugee shelter, including many popular visitor destinations which rely on tourism. It would appear that a significantly higher share of tourist accommodation has been contracted by the State in some high profile tourism destinations, including Youghal, Killarney, west Clare, and Counties Mayo and Donegal.

Ireland is an outlier in reliance on tourist accommodation for refugees

The use of tourist accommodation is not widespread across Europe. Where governments have contracted accommodation from hotel and other tourist accommodation providers the use is limited, mainly to the provision of emergency shelter. In a recent longitudinal survey of displaced persons, two weeks after having left Ukraine, only 15% reported living in a hotel or hostel.

The use of tourist accommodations is recognised as only suitable for a short stay, especially for families, as they are rarely equipped to be long-term housing solutions and need for businesses to be compensated by the state. For example, the Czech Republic offers hotel stays for up to 90 days, while Canada has a two‑week arrangement with hotels in the event that new arrivals are unable to immediately join sponsors.

One in four Ukrainian refugee respondents to a UNHCR survey in September said they were renting a place of their own. The research showed that the majority of Ukrainian refugees are highly educated and willing to work. While 81% indicated their intent to return home to reunite with families, only 13% planned to do so within 3 months.

Ireland is not the only country struggling to house refugees

Germany’s state support, distributed by the country’s 16 federal states based on a quota system, is struggling to accommodate more than 1.1m new refugees in 2022, mostly from Ukraine but also from other countries including Syria and Afghanistan. Existing migrant reception centres are overcrowded forcing state governments to use convention centres, sports halls, and tent cities as temporary accommodation hubs, while 300 properties made available by the federal Government are already 68% occupied as the country prepares for more refugees from Ukraine. Germany has seen arrivals seeking asylum from other countries increase by 30% on 2021 to an estimated 134,000 by end October.

Estonia has raised concerns about the use of hotel capacity due to the seasonal pattern of tourism demand making it difficult to rely on hotels beyond a short‑term or stop gap solution.

In Britain, more than 100,000 people who have become guests of British families, under the Homes for Ukraine scheme administered by Local Authorities, are coming to the end of their six-month stays and are finding there is limited housing available. The country’s main asylum processing centre at Manston in Kent, intended to house a maximum of 1,600, each for 24 hours, has in recent weeks accommodated 4,000 for extended periods operating outside its legal limits. The authorities are now seeking additional hotel accommodation.

Scotland has welcomed 12,000 Ukrainian refugees with close to 5,000 having found longer term places to stay. The government is accommodating 4,471 in hotels and a further 2,247 on cruise ships docked in Edinburgh and Glasgow.

“Hotels will continue to be a significant part of our offering (to refugees) into the medium term”

RISKS TO IRISH TOURISM

A reduction in Ireland’s tourist capacity

The immediate, and most obvious, impact is a significant reduction in accommodation on offer. This reduces Ireland’s carrying capacity and limits Ireland’s ability to meet demand from domestic and overseas tourists, at least, at times of peak demand. A scarcity of supply, down by almost 25% would have a serious impact on any sector of the economy with constrained supply leading inevitably to price increases and limitation of choice for the purchaser.

The reduction in capacity is primarily concentrated on mid-priced serviced accommodation – mostly 3 star hotel, guesthouses and B&Bs – and self-catering accommodations. All of which are popular mid-range products in high demand, especially from domestic and European source markets. Industry reports indicate some level of frustrated demand over the past summer, with instances where incoming tour operators were unable to fulfil requests from tour groups seeking mid-range hotel accommodation. As the share of accommodation allocated to state funded shelter for refugees and asylum seekers increases it is likely that Ireland’s tourism post-pandemic recovery will be stalled due to a shortage of accommodation in locations of high demand and at peak times.

While it is not possible to predict the level of arrivals to our shores seeking protection over the coming months, it is likely to show an increase on recent months. The Government is estimating a shortfall of 15,000 accommodation places by the end of the year, based on a projected 73,000 Ukrainians being in the country, with over 80% of those requiring accommodation. This shortfall does not take into account demand from further arrivals from other countries seeking International Protection.

Increase in price of tourist accommodation

The impact of limitations on supply has already been amply demonstrated over the summer months with significant price increases for available accommodations at times of high demand. Average daily rate (ADR) in hotels are reported to have been between higher than in August 2019, with average revenue per available room (RevPAR) increasing by a similar level in the majority of properties. While inflation, rising operational costs and staffing challenges have driven price increases it is reasonable to assume that restricted capacity over the summer months was also a contributing factor in the level of price increase achieved.

Hotel prices for short lead time bookings in Dublin attracted much adverse media publicity. However, the average achieved daily room rate in Dublin hotels in September at €202, a 23% increase on the same month in 2019 on an unchanged occupancy of 92% on a decreased supply and occupancy including supply to the state, suggesting a decrease in number of tourists accommodated. Overall, the price competitiveness of Dublin hotels, do not appear to have slipped compared to 2019 compared to Amsterdam, Berlin, Copenhagen, Edinburgh, Lisbon, London and Rome, [STR].

While Ireland has never been an inexpensive destination it has consistently positioned itself as a good value destination. However, at times over recent decades, Ireland’s competitive positioning in the international marketplace has suffered when price increases exceeded those in other destinations leading to a loss of market share and slower recovery from any downturn in overall international travel. Price increases due to the limitation of supply run the risk of damaging Ireland’s competitiveness and prolonging recovery from the pandemic shutdown.

Job losses

The large scale use of tourist accommodation for emergency and temporary accommodation of migrants results in both direct and indirect jobs losses.

The staffing required in premises exclusively providing state funded accommodation for Ukrainian refugees or asylum seekers is less than that necessary to provide full service for tourist guests. Demands on several functions are eliminated or reduced, such as reservations and reception, food & beverage, banqueting, and housekeeping. In premises catering to both refugees and tourists certain economies of staffing inputs can result. For example, a mid range 100 bed room hotel switching from catering to tourists to contracted accommodation for refugees could result in a loss of upwards of 30 jobs.

However, the impact on employment is not limited to the accommodation provision. Indirect and downstream loss of tourist accommodation impacts suppliers, with reduced demand for linens, food and beverages. Jobs in a range of local tourism stakeholders are also put at risk – including those providing transport; local restaurants and pubs, activity and entertainment providers, local retail outlets and tour guides. The ripple effect of reduction in tourist guest accommodation has an immediate impact of the local economy.

Risk to sustainability of accommodation stock

The transitioning of tourist accommodation to exclusively catering to refugees over a prolonged period of time could be expected to lead to a level of attrition in the tourist accommodation sector.

A significant change in the business model from hospitality to accommodating refugees over a prolonged period may impact planning, licencing, insurance and financial arrangements.

The survival of some traditional tourism destinations is endangered

Currently there are a number of locations where a disproportionately high share of available tourist accommodation is currently committed to meeting the state’s temporary accommodation needs for refugees. If the situation was to continue into 2023 and beyond, there is an imminent risk that some locations would exit the tourism business with the loss of employment, investment and community initiative. As of now, there does not appear to be a clear strategic pathway to release accommodation back into the tourism market for 2023.

Amongst the traditional tourist destinations or resorts at risk are:

- County Kerry: over 40% of tourist accommodation is currently home for over 3,500 Ukrainians and 600 asylum seekers, mostly centred in Killarney – often called the tourism capital of Ireland.

- West Clare: a key destination on the Wild Atlantic Way, has more than one third of its tourism beds currently under contract to the state.

- Youghal: over 80% of the town’s guest accommodation, including two of three hotels, is currently catering to refugees.

- County Donegal: currently half of all tourist accommodation in the county is contracted to the state, including close to a third of all hotel rooms.

- County Leitrim: almost 800 tourist beds, including 98% of the county’s hotel stock, is currently catering to the needs of refugees.

The impact on local tourism economies is already of concern in many communities around the country, including in Killarney and Westport, as is apparent from recent media reports.

CHALLENGES FOR 2023 AND BEYOND

Ireland in common with all other destinations has benefitted from a more rapid recovery in international travel post-Covid than had been anticipated. Current indications suggest that the level of overseas tourists to the country this year will reach between close to 75% of pre-pandemic levels, an estimated 7 million overseas tourists. However due to the absence of official survey sourced data, no information is available on the profile of tourists, their purpose of visit, length of stay, and expenditure. Industry sources point to a strong recovery after a slow start to the year with demand from the US particularly buoyant coupled with good volumes over the summer months from mainland Europe, while demand from Britain lagged recovery from other markets. Tourism’s performance in 2022 benefitted from a rapid reinstatement of connectivity by airlines and deferred pre-booked holidays from 2020 and 2021.

Outlook for tourism in 2023

The outlook for 2023 is broadly characterised as being ‘fragile’ as the desire to travel remains strong in the face of increasing economic and geopolitical headwinds. Ireland is facing a challenging year ahead due to external factors impacting demand but is particularly well positioned by a very significant reinstatement of access capacity to 2019 levels. However, the impact of the continued use of tourist accommodation for temporary housing of refugees and asylum seekers could limit Ireland’s ability to cater for an uptick in international and domestic tourist demand at peak times and in popular locations across the country. In addition, constraints on availability of tourist accommodation to meet market demand would see prices increase. Any increase in price at a rate higher than in competitor destinations would damage Ireland’s competitiveness and its reputation as a ‘good value for money’ destination – each of which would have lasting consequences beyond 2023.

At this point in time, the US market looks set to deliver strong demand in 2023, based on strong consumer interest, a wide range of flight options, and a strong dollar. Visitors from the US are Ireland’s top spending tourists with upwards of 70% using hotel accommodation for their stay – a valuable market for 4 and 5 star properties. Prospects from mainland Europe appear to be mixed, as future travel demand will primarily be shaped by disposable income levels after cost of living increases, including energy, over the coming months. While the main summer holiday is more likely to be protected Ireland could see fewer Europeans coming for short breaks or second or third holidays outside of the summer months. The British market, with is current economic difficulties, is likely to be the most challenging for Irish tourism with its dependence on a high level of discretionary short trips spread over the year. Domestic market demand is most likely to be impacted by a decrease in discretionary spending power as households struggle with inflation and higher interest rates. As a result the incidence of short breaks and travel to events could be expected to show a downturn.

Scenarios for 2023 – use of tourism accommodations for refugees on tourism performance

The greatest risk on the supply side is the increasing dependence by the State on the tourism accommodation sector to provide shelter for Ukrainians and those seeking International Protection. The experience of recent months indicates that there would appear to be a decrease in the number of accommodation options for increasing numbers of arrivals into the country resulting in the State looking more and more to the tourism sector for the provision of shelter.

The decision by owners and operators of tourist accommodations to contract exclusively, or in part, to provide shelter paid for by the State is a business decision. The commercial arrangement is one which may be attractive to some operators over the lean winter months as it guarantees a fixed income over a slow trading period. This has facilitated the State in securing an increasing the number of properties and bed spaces over the past three months when arrivals seeking refuge increased by 10,000 from Ukraine and over 3,000 from other countries. From available data it is apparent that an increasing proportion of arrivals are now accommodated in tourism premises.

An ongoing overreliance on tourist accommodation to provide shelter is not tenable – such accommodation is not designed or suitable for extended stays. The apparent absence of alternative accommodation to provide shelter for new arrivals is of concern and could seriously jeopardise tourism‘s recovery.

Upcoming proposed changes to the commercial arrangement between the State and tourist accommodation businesses with a move to a more standard offer of ‘accommodation only’ with Beneficiaries of Temporary Protection utilising existing state income supports to pay for food and day-to-day expenses. This proposal could make the contract arrangements less attractive to tourist premises, as well as potentially giving rise to challenges in regard to hygiene, safety and insurance arising from food in bedrooms.

The continued use of tourist accommodation for long stay housing of refugees has led to a number of legal challenges in England, including the argument that it is an unacceptable change of use of hotels. The longer term use of tourist premises on an accommodation only basis could lead to planning, health and safety, and insurance issues, amongst others.

The challenge facing the State to accommodate increased numbers of refugees

While it is not possible to predict the level of arrivals to our shores seeking protection over the coming months, it is likely to show an increase on recent months. The Government is estimating a shortfall of 15,000 accommodation places by the end of the year, based on a projected 72,000 Ukrainians being in the country, with over 80% of those requiring accommodation. This shortfall does not take into account demand from further arrivals from other countries seeking International Protection.

The State is increasingly reliant on tourist accommodation as the volume of arrivals increases. The crunch point is likely to occur by March 2023 when many of the current contracts with tourism premises are due to expire.

In anticipation of increasing arrivals, and to lessen the dependency on tourist accommodation, the Government has proposed three initiatives to increase the stock of accommodation for refugees – the expansion of rapid-build accommodation and the refurbishment of existing buildings, including maximising places by allowing for dormitory style accommodation; doubling of Recognition Payment to €800 for hosts; and a new State-led Vacant Homes Call.

Recent public announcements indicate that 5 sites have been prioritised for modular homes with a target of 200/250 units coming on stream by ‘early 2023’ with a further 200/250 by March. In addition, work is expected to begin shortly on refurbishment of institutional premises. Assuming each modular unit will provide accommodation for up to 4 people, it could provide up to 2,000 new beds by the start of Q2 2023, if delivered on schedule. While additional places are expected to come on stream as a result of the Government’s new initiatives, it is difficult to foresee additional capacity of the scale and pace necessary to meet the projected incremental increase in demand or to significantly lessen the reliance on tourist accommodation before the start of the tourist season in Spring 2023.

The stock of registered and approved visitor accommodation in the country is expected to show only marginal net change in 2023. Meanwhile the tightening of regulation governing the provision of short stay guest accommodation is expected to reduce visitor options and effectively lessen the overall tourist carrying capacity.

The urgent need to provide accommodation for refugees is apparent based on projections of potential demand without any significant shift away from tourist accommodation providing the majority of bed spaces. A 30% increase in arrivals in early 2023, up from the expected 70,000 by end December, could see the State looking to the tourist sector to provide up to 20,000 additional beds, representing just under 30% of tourist accommodation.

The scale of the risks to tourism performance

Given the high occupancy achieved by hotels and other tourist accommodations in peak 2022, which included the accommodation of some refugees, limits Ireland’s ability recover to 2019 levels of tourist arrivals over the peak months, assuming broadly consistent domestic summer demand. The issue of supply and demand will be more acute in a number of specific locations if current accommodation capacity remains contracted into Q3 2023.

The downside on the volume of overseas tourist is likely to impact short haul markets and is likely to lead to frustration of demand for short lead time bookings at peak times and events. Demand from the US market is least likely to be impacted.

The economic impact will most likely be felt within local communities where tourist carrying capacity is reduced as accommodation is allocated for non-tourism purposes. Typically 30% of expenditure by overseas visitors is accounted for by the cost of accommodation, with the balance being spent on food, drink, shopping, transport, and other services. The loss of tourist accommodation will have a significant knock-on impact on all other stakeholders in the local community catering to the visitor market.

Any further tightening of tourist accommodation supply in Dublin, the gateway for the majority of visitors and top event destination, would impact the level of visitor flows to the regions.

For every 1,000 European visitors deterred by a lack of accommodation capacity next year it could represent a loss of up to €600,000 in foregone revenue to tourism businesses; a loss of €138,000 to the Exchequer; and putting up to 20 jobs at risk.

RECOMMENDATIONS

A Department of Taoiseach-led whole of government approach: The recent belated formation of an across government committee of senior civil servants and a dedicated Cabinet Sub-committee to address the challenges is welcome. In ITIC’s view this needs to be led by the Department of Taoiseach, and tourism – as a key sector within this crisis – needs to be represented in all planning and decision making processes, to ensure a coordinated approach to minimising the negative impacts on a prime economic sector. Furthermore the tourism industry, with its particular expertise in accommodation and transport logistics in catering for large volumes of people, is in a position to contribute to strategies and implementation programmes. ITIC thus proposes the establishment of a tourism interface group, comprised of senior executives from the sector, to assist Government in dealing with the accommodation crisis.

A published 2 year plan: ITIC’s view is that this crisis will last for at least 2 years and the Irish Government has to have a transparent plan in place. With fighting intensifying in the Ukraine and no sign of peace talks it would seem that the conflict will continue for some time. Furthermore the damage wrought by the war makes parts of Ukraine uninhabitable even if refugees were able to return home. Thus a 2 year plan as to how Ukrainian refugees and asylum seekers will be looked after needs to be devised and published with clear metrics and milestones. The likely level of tourism accommodation to be used over that period should be outlined so that the tourism industry can plan accordingly in terms of reduced capacity levels and impact on recovery performance.

The 12% to 15% allocation: In ITIC’s view a proportionate and fair allocation from the tourism industry in 2023 is between 12% and 15% of available stock. As of today this would represent between 10,000 and 12,400 bedrooms (or between 27,861 and 34,877 bed spaces) taken out of the tourism economy. This level of withdrawn capacity will have a significant detrimental effect on the tourism economy but is a statement that the tourism industry is willing to play its proportionate role in alleviating this crisis. In November 2022 over 22% of tourism accommodation has been taken with Government contracts and thus this needs to reduce over the coming months in time for the 2023 tourism season from March onwards.

A Business Continuity Fund for affected tourism businesses: smaller tourism destinations risk being seriously damaged as a result of the lack of accommodation available to the domestic market and international visitor. Hotels themselves can rely on payment for Government contracted rooms but downstream tourism businesses in the locality including attractions, restaurants, activity providers, pubs and coach operators risk seeing their livelihoods seriously jeopardised. In that context ITIC propose that Government establish a Business Continuity Fund for affected enterprises that can show turnover impaired. This could follow a similar style to Covid-related business continuity funds or indeed Minister Martin’s recently announced Night-Time Economy Support Scheme or Minister Humphrey’s €50 million Community Fund.

Expedited Local Authority strategies to deal with the crisis: Local authorities have been asked to source vacant community halls, sports facilities, convents, and old Garda stations as part of State efforts to find accommodation for refugees arriving from Ukraine. This situation needs to be expedited urgently.

Fast tracked accommodation solutions: It is noted that Government as at the end of October identified the need to work on medium- to long-term accommodation options such as modular housing and the refurbishment of existing buildings to cater for refugees and asylum seekers. This needs to be given the utmost urgency and emergency planning measures brought into effect where necessary.

Encourage integration in to the labour force: Government should minimise barriers and actively promote integration of refugees in to the labour market, including assisting to meet the shortages within the hospitality sector. It is noted that over 3,500 Ukrainians are already in the tourism economy.

Transition from Direct Provision: Delays in processing asylum claims must be circumvented and priority must be given to the implementation of recommendations contained in previous reports including Oireachtas Justice Committee, the Catherine Day Advisory Group, the Government While Paper and the Irish Refugee Council (IPO Workshop, September 2022)

Extend tourism Vat rate of 9% to 2025: with the tourism industry yet again hit by an external factor not of its own making that will depress demand and retard recovery, the tourism and hospitality Vat rate of 9%, due to expire in February 2023, should be extended until 2025 and reviewed at that point. Adding cost to the tourism industry at this time is counterproductive and damages international competitiveness.