Year End Review 2023

&

Outlook 2024

27 DECEMBER 2023

OVERVIEW

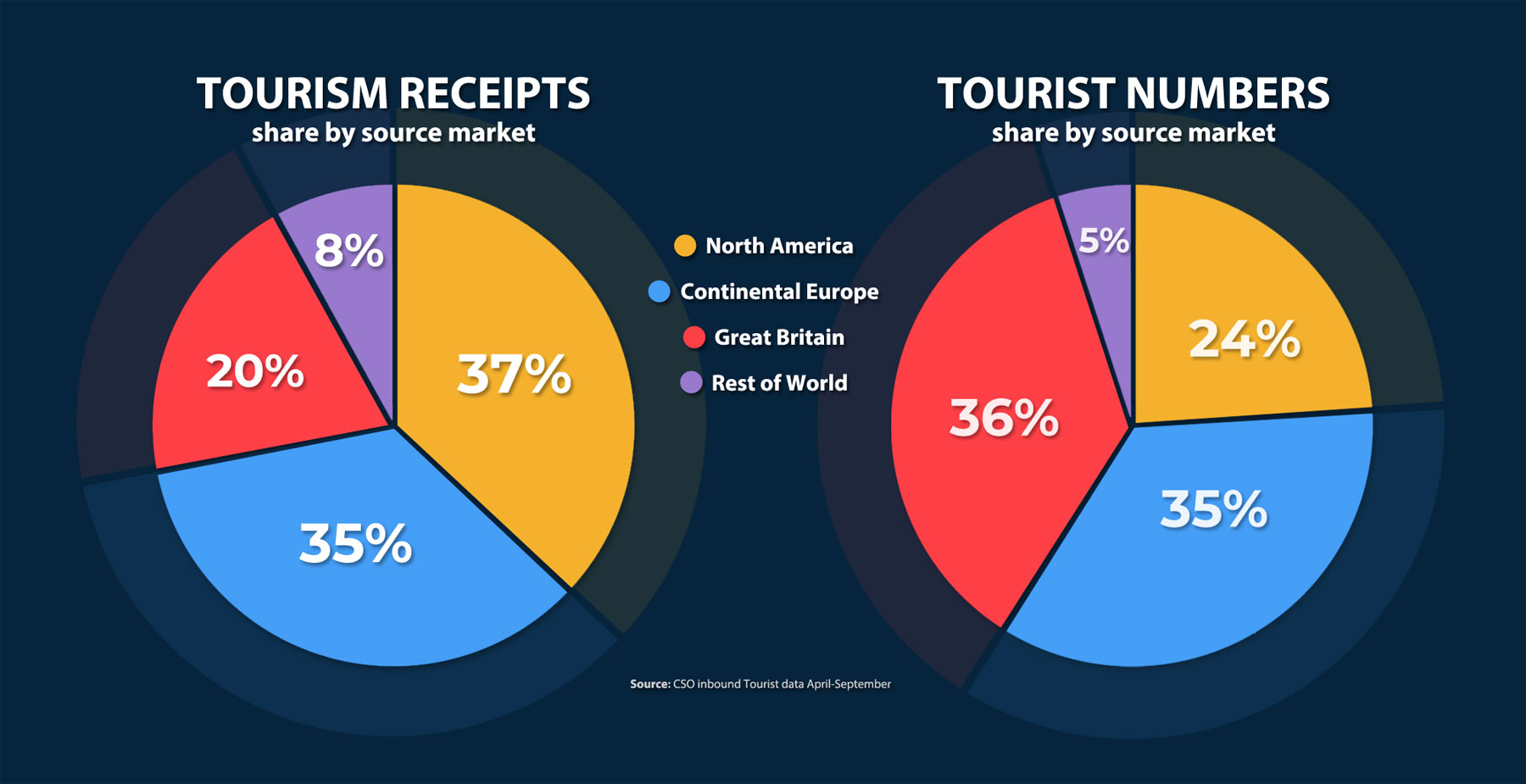

Ireland’s tourism industry demonstrated remarkable resilience this year despite domestic capacity challenges and international geopolitical upheaval. Once again the sector underpinned its role as Ireland’s largest indigenous industry and biggest regional employer with a remarkable 254,000 people working in tourism and hospitality businesses. The Irish Tourism Industry Confederation (ITIC) estimates that €5.3 billion excluding fares was spent by international visitors to the country this year with North America the biggest single source market. Data for the domestic market has not yet been published but sentiment and industry intelligence would suggest that it is marginally down on record 2022 levels.

Looking forward, primarily due to capacity challenges, ITIC estimate that increasing volume may be challenging during peak months but that value growth across 2024 of 5% in real terms is attainable given the right market mix.

As outlined in ITIC’s strategic roadmap for the sector, ‘Vision 2030’ which was published in September, the value of the industry can grow by 50% by the end of the decade whilst meeting its sustainability obligations but this is predicated on pro-tourism and pro-enterprise policies form Government.

2023 REVIEW

Ireland earns €5.3bn from overseas tourists in 2023

Ireland’s tourism industry demonstrated remarkable resilience again in 2023. Despite geopolitical upheaval, economic and social uncertainties, together with capacity constraints, recovery continued, although at a slower pace than in 2022. However, despite increasing numbers of overseas visitors, full recovery to pre-pandemic levels is still some way off.

Expenditure by overseas tourists in the country in 2023 is projected at €5.3 billion, based on CSO data for the period April through October.

2023 was the year which saw airline capacity return to pre-pandemic levels, with some markets exceeding 2019 levels, while airlift from German was 20% down. Ferry services linking Ireland with mainland Europe expanded in 2023. At the same time ‘on the ground’ capacity was further constrained. While the pressure on car rental availability eased, the stock of tourist accommodation was constrained by up to 20% by the Government’s reliance on hotels and other visitor accommodations to provide humanitarian housing from those fleeing Ukraine and increasing numbers seeking International Protection.

Consumers in developed countries prioritised leisure travel in 2023 despite inflation, rising interest rates and pressure on disposable incomes. Latest indicators would suggest that Ireland’s recovery in 2023 lagged that of many other European destinations. The European Travel Commission (ETC) reports tourist numbers back to 97% pre-pandemic levels, with 1 in 3 countries reporting exceeding 2019 levels. The rebound was driven by strong demand for intra-European travel, coupled with demand from North America bouncing past recovery to expansion, helped by a strong US dollar and increased airlift. Visits from North America to the UK were 15% ahead of 2019 levels over the first 9 months of the year.

Due to changes in official data reporting it is not possible to directly compare latest CSO figures with pre-pandemic performance metrics. However, industry sentiment suggests that demand from the USA, the top spending market, was particularly buoyant in 2023, with visitor demand from mainland Europe positive although showing some marked variance between countries, while demand from Britain was less robust.

Domestic demand was less positive than that of a year ago, with a swing towards an increase in outbound leisure travel throughout the year, despite an increase in domestic demand in the first quarter of the year, the latest period for which official data is available.

The year will be remembered as one where businesses struggled with rising input costs, labour challenges, and an increase in VAT. While many businesses may have enjoyed a good trading year, the performance of tourism has been uneven across the country, with shifts in the volume, value and profile of visitors across markets. The strong global growth in tourism underway illustrates the highly competitive trading environment in which the Ireland’s tourism sector operates.

2024 OUTLOOK

Positive outlook for Global tourism

Global tourism spending is expected to hit US$2 trillion record in 2024, with more than 2 billion international trips, 3% above pre-pandemic levels. Europe is forecast to enjoy a positive year, with increasing leisure demand coupled with the Olympic Games in France. However, performance will be shaped by a complex interaction of factors, including the ongoing geopolitical tensions, weak economic growth and escalating sustainability challenges. Most forecasters see international travel and tourism outperforming economic growth.

The global economy is expected to be sluggish in the short to medium term. The subdued growth environment, as economies emerge from the monetary tightening cycle, is likely to bring inflation down in line with central bank targets, thereby allowing interest rates to come down. Amongst developed economies the US is expected to continue to outperform Europe. However, the ongoing conflicts in the Ukraine and the Middle East represent a risk to international travel and tourism.

Leisure and VFR (Visiting Friends and Relatives) travel are expected to continue to be the prime drivers of growth, while full recovery of international business travel is more complex. Global trends borne out by research show that consumers will continue to prioritise leisure travel, valuing experiences, time spent with family and friends, and wellness moments. The UK is forecasting a 7% year on year increase in spending on the back of a 5% growth in volume in 2024, to within 3% of 2019 numbers with full recovery in 2025.

Challenges and Risk facing Ireland’s tourism industry

Ireland is facing a number of challenges in the year ahead, which represent a serious risk to competitiveness.

- Accommodation capacity constraints: as the Government continues to rely heavily on tourism properties to house refugees and International Protection applicants. In addition, the Short-Term Tourism Letting Legislation being introduced is expected to further reduce supply.

- Dublin Airport’s 32m passenger cap: maintaining the passenger limit will inevitably have, not only short term, but longer term adverse impact on Ireland’s ability to expand visitor traffic, develop new connections to broaden the industry’s source market footprint.

- Cost competitiveness: higher input and labour costs, together with increased regulatory compliance costs, in an already a high cost economy for businesses, runs the risk of a further loss of competitiveness at a time when consumers are becoming more price and value conscious.

- Labour supply: the sector continues to struggle to recruit, train and retain staff in a tight labour market.

Market Outlook

North America

Expectations are very positive for continued growth in transatlantic travel to Europe in 2024 as airlines increase capacity. Economic conditions see inflation falling, interest rates currently high but stable are expected to fall, while US consumer confidence levels have bounced back in November. Ireland is well positioned in the market to capitalise on winning a share of the expanding travel market.

Exciting new and expanded airline services are planned for 2024:

Aer Lingus: new Denver-Dublin plus reinstated Minneapolis St. Paul – Dublin services

Delta Air Lines: new Minneapolis St. Paul – Dublin & reinstated New York JFK – Shannon services

American Airlines: Dallas Fort Worth – Dublin extended to year-round & Charlotte-Dublin extended together with expanded code-share connectivity with Aer Lingus.

Canada will see reinstatement of WestJet services from Toronto and Halifax, with Air Transat increasing frequency from Toronto.

Mainland Europe

Headline inflation is expected to gradually decline to 2.7% in 2024, with the outlook for economic growth subdued in the short term. The European Central Bank (ECB), at its December meeting, held interest rates steady possibly signalling an end to interest rates hikes. Consumer confidence across the European Union showed a relative improvement in November, a three month high, based on a more positive assessment of household financial situation and general economic conditions. Compared to 12 months ago, consumers in Germany and Spain have shown the greater increases in confidence within Europe, according to the latest Ipsos Consumer Confidence Index.

Ireland is very well served by airline and ferry services, with Ryanair the dominant carrier. New services of interest to inbound tourism in 2024, include Paris and Brussels to Cork and Paris to Shannon.

Britain

Despite inflation falling by more than expected in November, the broader economic picture remains challenging, marred by stagnation and subdued growth prospects. The Bank of England has repeatedly pushed back against significant interest rate cuts in 2024, despite market expectations. Consumer confidence remains firmly in negative territory, as the cost of living crisis continues, according to the latest GfK Index.

The British market is an important volume and short break component of Ireland’s tourism but is likely to continue to prove challenging to recover from the decline in recent years in the leisure and business sectors.

CONCLUDING COMMENTS

Irish tourism has a long history of responding positively to crises including 9/11, Foot and Mouth, and the financial crash. Its recovery from Covid-19, an existential challenge, further supports the reputation of resilience. Tourism showcases the best of Ireland to an international audience and the domestic market – unlike other industries it can’t be outsourced or off-shored. It provides wealth and employment across all parts of Ireland and is primarily an export industry with 75% of Ireland’s tourism economy derived from international visitation.

However the sector cannot be taken for granted. The 40,000 businesses in the sector are predominately SMEs and generally operate with modest profit margins. ITIC has outlined how the sector can grow responsibly in the years ahead but continued support is needed from Government and state agencies to allow businesses to prosper.

The risks internationally are significant in 2024 and Government can do little to influence them. However the challenges affecting the industry domestically do lie in the gift of Government and action on ameliorating cost challenges, addressing capacity concerns and improving competitiveness will all help Ireland’s tourism and hospitality industry to continue on its path to recovery.